Irs Heat Pump Water Heater Tax Credit Web 29 Dez 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

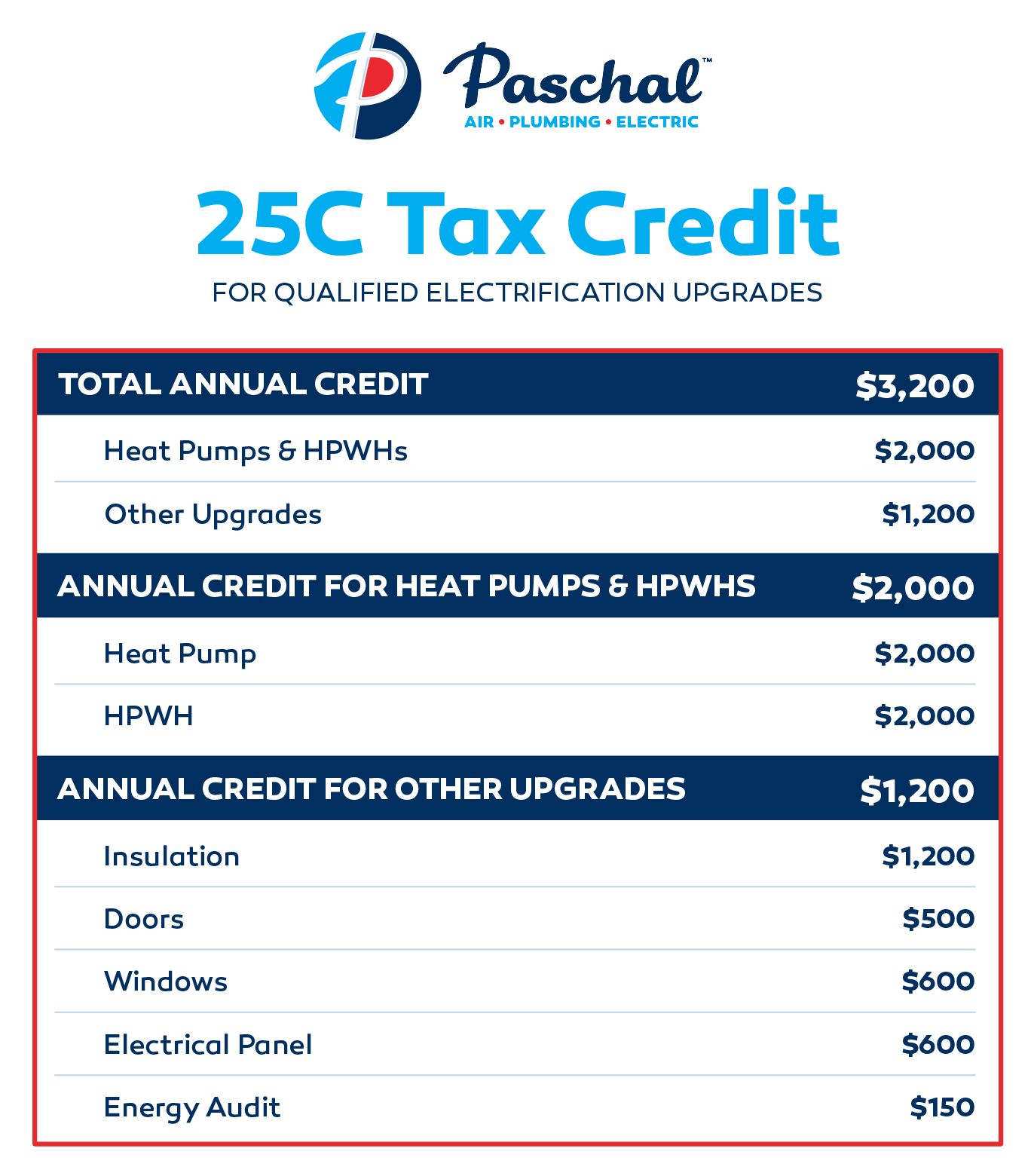

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel Web Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000

Irs Heat Pump Water Heater Tax Credit

Irs Heat Pump Water Heater Tax Credit

http://www.raysplumbinginc.com/wp-content/uploads/water-heater-tax-credit-2016.png

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

https://www.supertechhvac.com/wp-content/uploads/2021/03/Form-5695-for-Heat-Pump-Central-Air1.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white.png

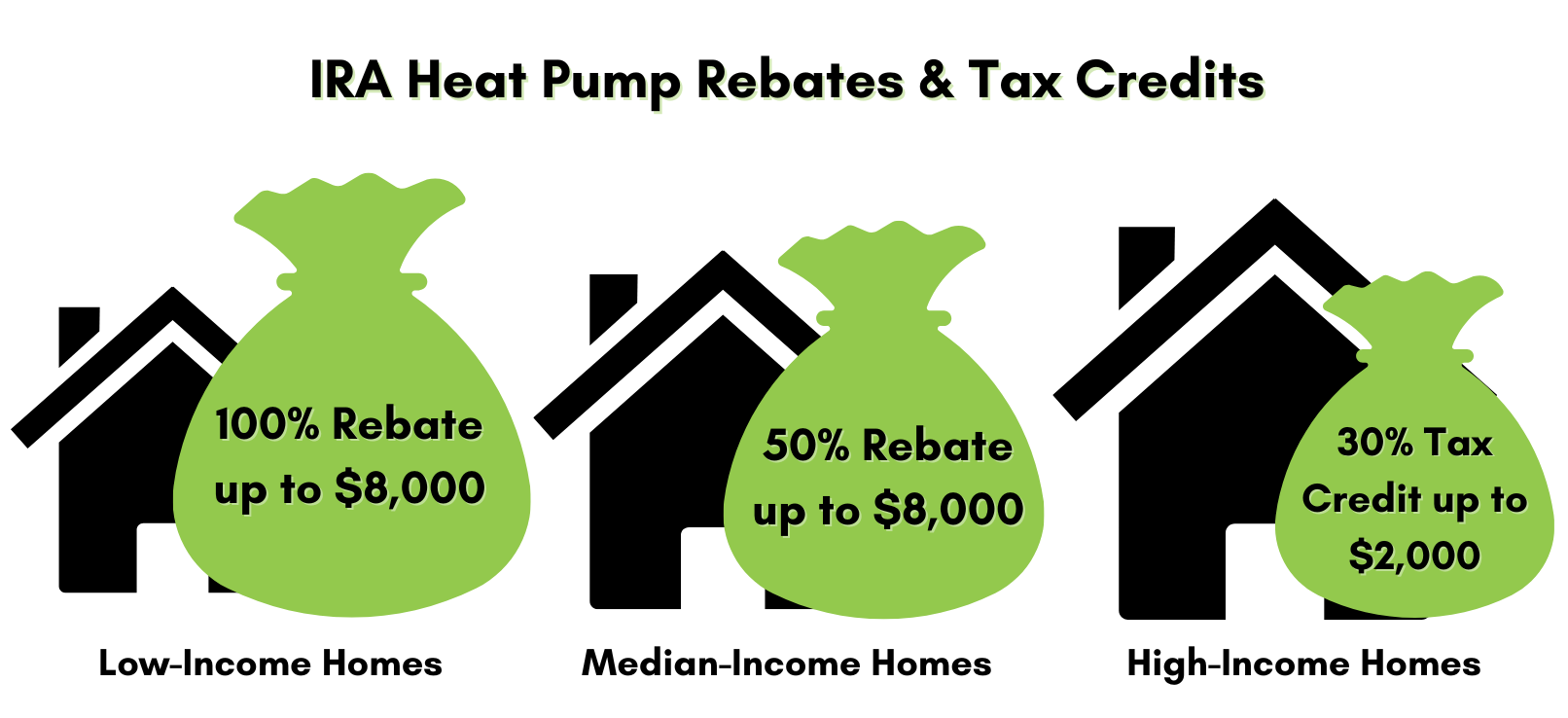

Web 27 Apr 2021 nbsp 0183 32 Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property Web 30 Dez 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

Web 28 Aug 2023 nbsp 0183 32 Clean energy property must meet the following standards to qualify for the residential clean energy credit Solar water heaters must be certified by the Solar Rating Certification Corporation or a comparable entity endorsed by your state Geothermal heat pumps must meet Energy Star requirements in effect at the time of purchase Web 22 Dez 2022 nbsp 0183 32 central air conditioners natural gas propane or oil water heaters natural gas propane or oil furnaces or hot water boilers electric or natural gas heat pumps electric or natural gas heat pump water heaters biomass stoves or biomass boilers and improvements to panelboards sub panelboards branch circuits or feeders the home

Download Irs Heat Pump Water Heater Tax Credit

More picture related to Irs Heat Pump Water Heater Tax Credit

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

https://www.symbiontairconditioning.com/wp-content/uploads/2020/06/money-ac-graphic-2.png

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

https://www.supertechhvac.com/wp-content/uploads/2021/03/AHRI-Certificate.jpg

Federal Tax Credits On ENERGY STAR Certified Water Heaters Water

https://static.globalimageserver.com/media/uploads/iat/sites/36/2022/12/Tax_Credits_Blog-2.jpg

Web Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit Web 30 Dez 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat pumps heat pump water heaters insulation doors and windows as well as electrical panel upgrades home energy audits and more are

Web Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water heaters Biomass Stoves Geothermal heat pumps 30 of cost Solar water heating Efficient air conditioners 300 30 of cost up to 600 Efficient heating equipment Efficient water heating equipment 150 30 of cost up to 600 Other Web 31 Dez 2022 nbsp 0183 32 Electric Heat Pump Water Heater Most ENERGY STAR certified water heaters meet the requirements of this tax credit Water heaters account for 12 of the energy consumed in your home Tax Credit Amount 300 Requirements Uniform Energy Factor UEF gt 2 2 More Information How to apply

Tax Credits For Heat Pumps 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebate-form-northern-wasco-county-peoples-utility-district-31.png?w=530&ssl=1

Water Heater Upgrades Guide To Rebates And Tax Credits

https://lirp.cdn-website.com/67bbbf18/dms3rep/multi/opt/Water+Heater+Upgrades+Guide+to+Rebates+and+Tax+Credits-1920w.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 29 Dez 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

https://www.irs.gov/instructions/i5695

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel

2023 Residential Clean Energy Credit Guide ReVision Energy

Tax Credits For Heat Pumps 2022 PumpRebate

Heat Pump Tax Credits Get Rewarded For Sustainable Heating And Cooling

Tax Credits Offered For Heat Pump Installation YouTube

Inflation Reduction Act Summary What It Means For New HVAC Systems

Available Tax Credits For Geothermal Heat Pumps In 2023 HVAC

Available Tax Credits For Geothermal Heat Pumps In 2023 HVAC

25C Residential Energy Efficiency Tax Credit Paschal Air Plumbing

25C Tax Credits Reinstated For High Efficiency Water Heaters

2021 Form MI MI 1040CR 7 Fill Online Printable Fillable Blank

Irs Heat Pump Water Heater Tax Credit - Web 27 Apr 2021 nbsp 0183 32 Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property