Irs Interest Calculator On Late Tax Payments 42 rowsWith our free online IRS Interest Calculator you are able to calculate how much

Use the eFile Late Filing and or Late Payment Calculator PENALTYuctor tool below to calculate any penalties or interest you might owe the IRS due to a missed Of the two charges you could face interest is the more straightforward to calculate The IRS interest rate is determined by the federal short term rate plus 3 Since the

Irs Interest Calculator On Late Tax Payments

Irs Interest Calculator On Late Tax Payments

https://2020taxresolution.com/wp-content/uploads/2022/01/IRS-Penalties-Interest-media.jpg

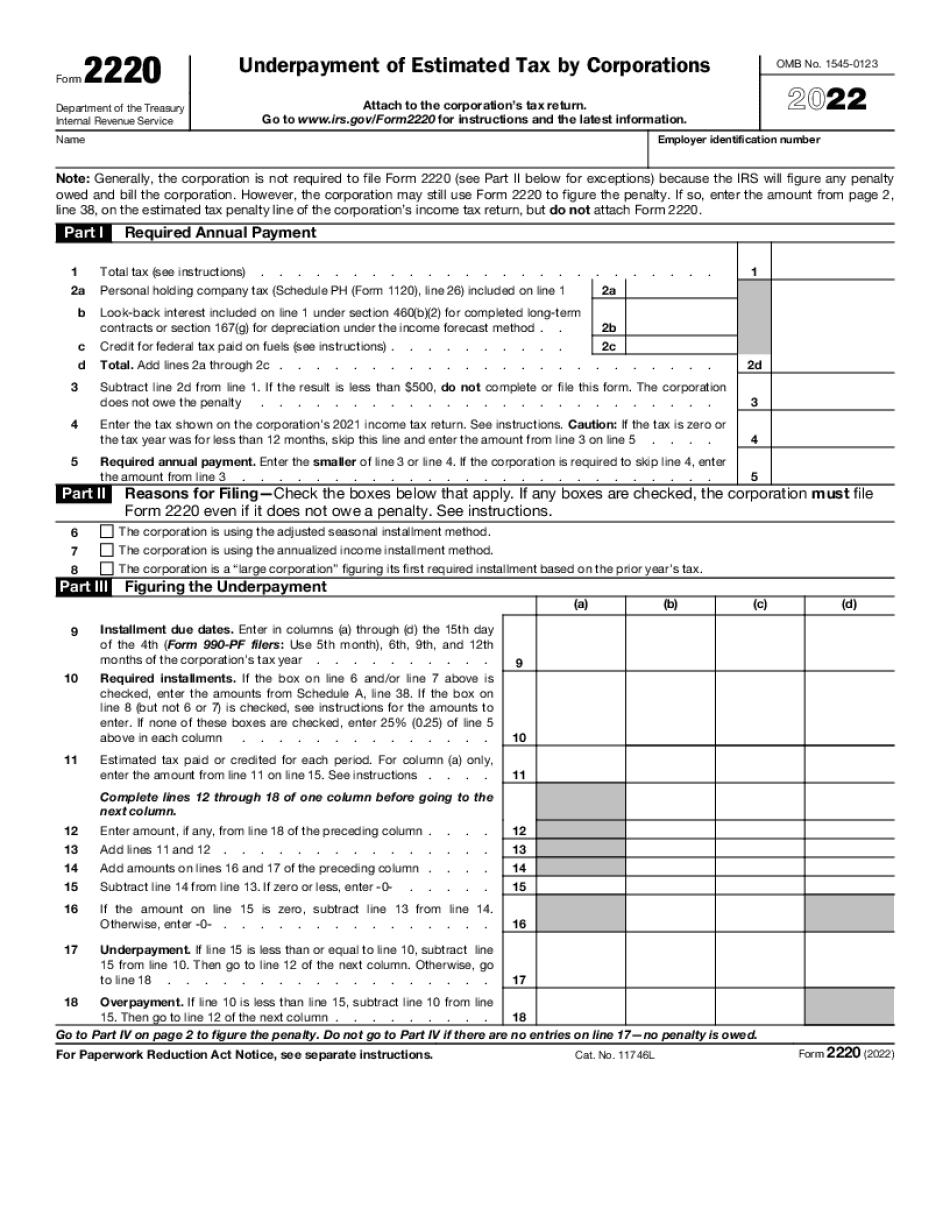

Irs Underpayment Penalty Calculator MacRuvarashe

https://2020taxresolution.com/wp-content/uploads/2022/01/tax-penalty-with-pen-calculator-tax-report-sign-1024x621.jpg

IRS Interest Calculator 2023

https://www.zrivo.com/wp-content/uploads/2023/02/IRS-Interest-Calculator-1024x576.jpg

When does the IRS pay interest Stop and start dates for overpayment interest In general we pay interest on the amount you overpay starting from the later of the Tax return The IRS Interest Calculator is a tool used to estimate the amount of interest that may be owed to the Internal Revenue Service IRS for late payment or underpayment of taxes It helps individuals or businesses calculate the

The IRS interest rate on unpaid taxes and tax refunds for individuals is 8 for all of 2024 and 7 for the first quarter of 2025 the rate is adjusted on a quarterly basis The IRS generally charges interest on unpaid IRS interest calculator online will make the life of taxpayers who need to compute the interest on outstanding tax very quickly the IRS adds interest every time it calculates

Download Irs Interest Calculator On Late Tax Payments

More picture related to Irs Interest Calculator On Late Tax Payments

IRS To Pay Interest On Late Tax Returns DSJ CPA

https://dsjcpa.com/wp-content/uploads/2022/06/IRS-to-pay-interest-on-late-returns-1152x768.jpg

The Rate Of Late Tax Payments Interest Rates Continues To Rise Clay

https://www.clayshawthomas.com/wp-content/uploads/2022/10/The-rate-of-late-tax-payments-interest-rates-continues-to-rise.jpg

General FAQs On Late Payment Late Tax Filing Penalties By

https://miro.medium.com/max/3200/1*6Rj-sVDarxHKMA2lO1x6pw.jpeg

Easily calculate IRS state interest online with results that refresh while you type This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax debt The

Calculate the late deposit penalty and interest with this failure to deposit penalty calculator We may charge interest on a penalty if you don t pay it in full We charge some penalties every month until you pay the full amount you owe Understand the different types of

IRS Penalty Calculator Breaking Down Your IRS Late Fees Fees And

https://i.pinimg.com/originals/cb/0c/6a/cb0c6af10102b5353396201b7384bd82.jpg

IRS Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

https://2020taxresolution.com/wp-content/uploads/2022/01/desktop-reports-notepads-calculator-cash-yellow-sticker-tax-penalty-business-concept-1024x639.jpg

https://goodcalculators.com › irs-interest-calculator

42 rowsWith our free online IRS Interest Calculator you are able to calculate how much

https://www.efile.com › late-tax-filing-penalty-calculator

Use the eFile Late Filing and or Late Payment Calculator PENALTYuctor tool below to calculate any penalties or interest you might owe the IRS due to a missed

Government Increases Interest Rate On Late Tax Payments Clay Shaw Thomas

IRS Penalty Calculator Breaking Down Your IRS Late Fees Fees And

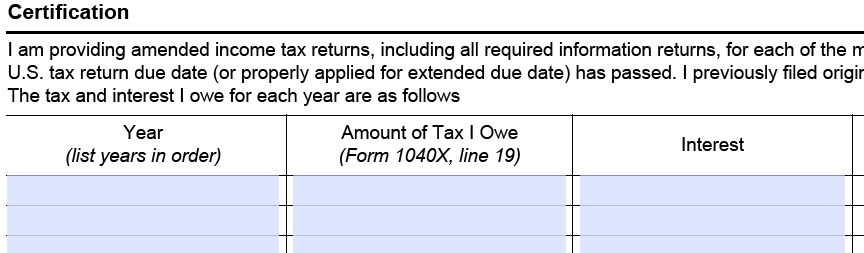

Form 14654 Form 14653 Interest Calculator

Irs Interest Rates For Underpayment Of Taxes 2022 2023 Fill Online

Payments And Interest Calculate In Excel Excel Tutorial Advance

IRS Late Payment Penalty Calculator Https www irstaxapp irs

IRS Late Payment Penalty Calculator Https www irstaxapp irs

Irs Interest Calculator ElanorLiyana

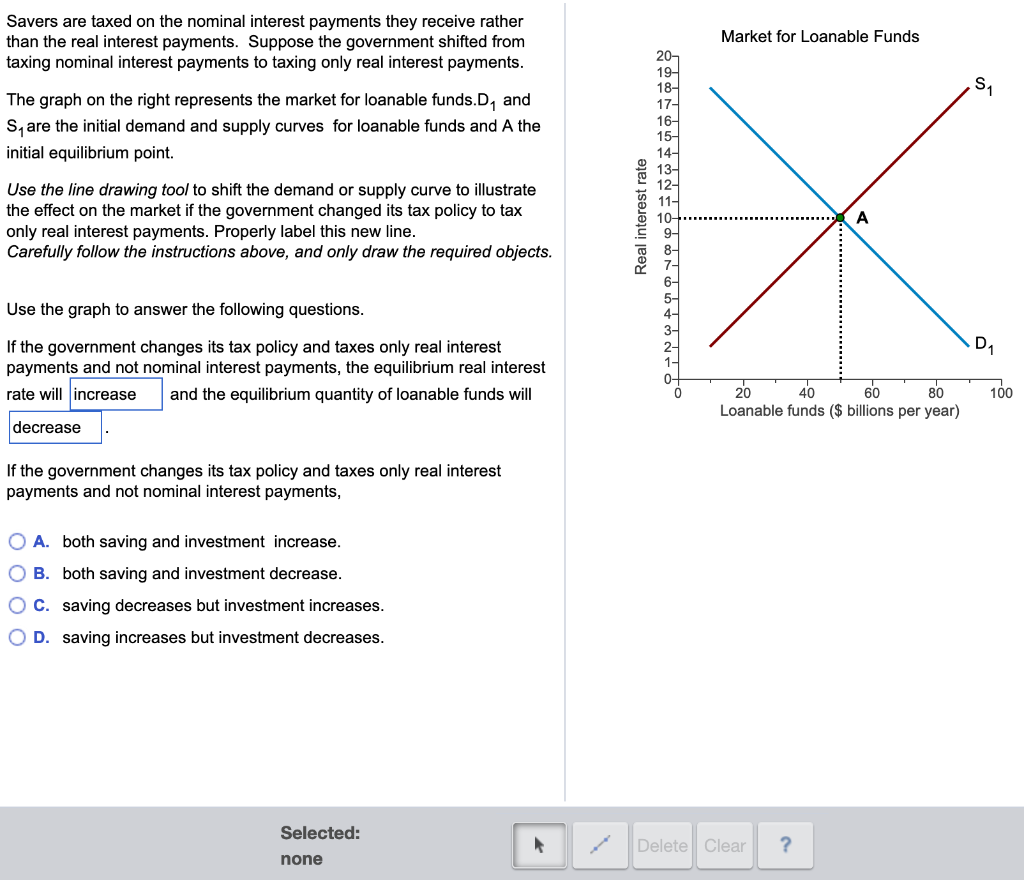

Solved Savers Are Taxed On The Nominal Interest Payments Chegg

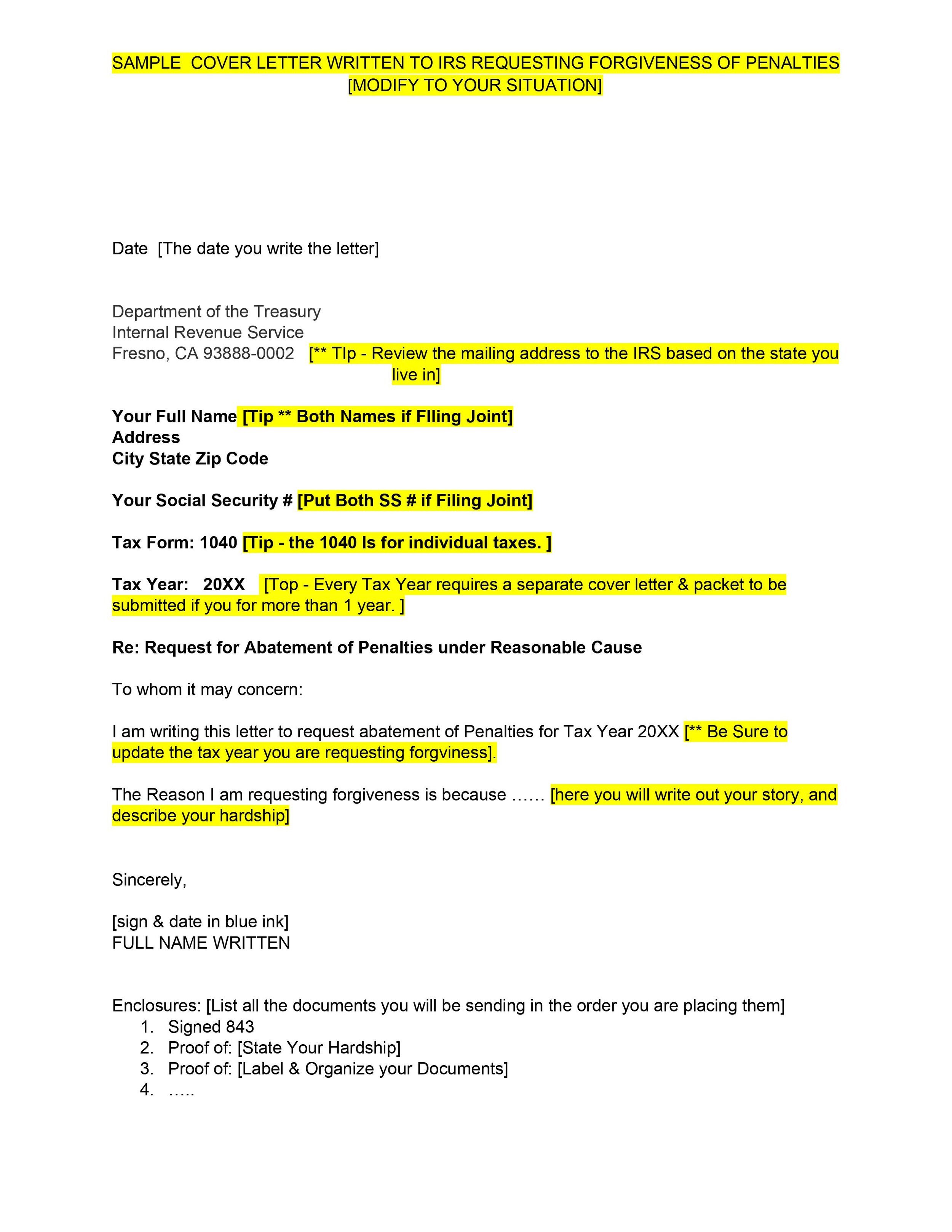

Sample Irs Letters

Irs Interest Calculator On Late Tax Payments - The IRS Interest Calculator is a tool used to estimate the amount of interest that may be owed to the Internal Revenue Service IRS for late payment or underpayment of taxes It helps individuals or businesses calculate the