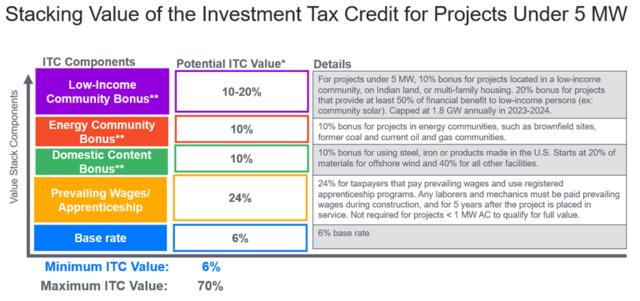

Irs Investment Tax Credit Renewable Energy The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released guidance on the Investment Tax Credit ITC under Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin

Irs Investment Tax Credit Renewable Energy

Irs Investment Tax Credit Renewable Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Investment Tax Credit ITC How It Works Qualifications Benefits

https://www.carboncollective.co/hubfs/Investment_Tax_Credit.png#keepProtocol

Get Tax Credits For Energy Efficient Upgrades With The Residential

https://thewealthywill.files.wordpress.com/2023/06/ff_detailed_energy_a.png

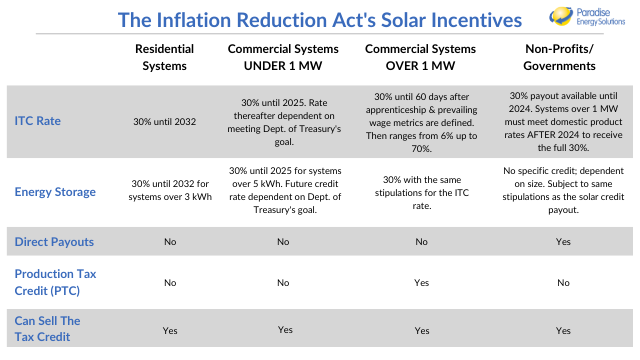

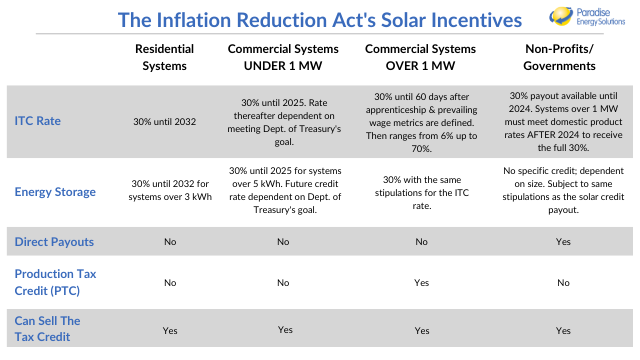

President Biden signed the Inflation Reduction Act into law expanding the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released proposed guidance on the Clean Electricity

In prior IRS notices the Treasury Department and the IRS established the Continuity Safe Harbor that allows an eligible renewable energy project to be deemed The US Internal Revenue Service IRS and US Department of the Treasury Treasury released proposed regulations on November 17 2023 addressing the

Download Irs Investment Tax Credit Renewable Energy

More picture related to Irs Investment Tax Credit Renewable Energy

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

https://uploads.edisonenergy.com/2022/08/25153840/Picture1-2-640x301.png

IRS Clarifies Clean Energy Tax Credit Direct Pay Transferability

https://www.energy-storage.news/wp-content/uploads/2023/06/800px-Home_of_the_Internal_Revenue_Service.jpeg

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

https://phantom-marca.unidadeditorial.es/ac74621e18bc098b394c3393658acfb3/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/17/16739726135614.jpg

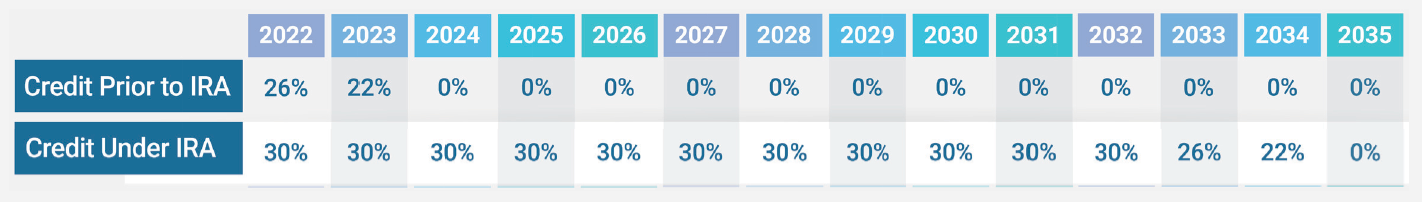

Through at least 2025 the Inflation Reduction Act extends the Investment Tax Credit ITC of 30 and Production Tax Credit PTC of 0 0275 kWh 2023 value as The IRS and Treasury finalized proposed rules issued last June over how eligible taxpayers can effectively buy or sell certain energy tax credits and clarify who is

Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin construction The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage

How Does The Federal Solar Tax Credit Work

https://www.paradisesolarenergy.com/hs-fs/hubfs/Inflation Reduction Ac Solar Tax Incentive Overview.png?width=960&name=Inflation Reduction Ac Solar Tax Incentive Overview.png

The Residential Renewable Energy Tax Credit Is A Little known

https://i.pinimg.com/originals/39/9e/55/399e5509105983b931911f5b36afce98.jpg

https://home.treasury.gov › news › press-releases

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind

https://home.treasury.gov › news › press-releases

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released guidance on the Investment Tax Credit ITC under

Worry For Solar Projects After End Of Tax Credits Published 2015

How Does The Federal Solar Tax Credit Work

What Are Clean Energy Tax Credits And How Do They Work Evergreen Action

The Inflation Reduction Act An Overview Of Clean Energy Provisions And

View RPoL Delta Green Cell L Federal Agencies Treasury By Cell

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

Let Them Eat ITCs Buttondown

The Inflation Reduction Act An Overview Of Clean Energy Provisions And

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Irs Investment Tax Credit Renewable Energy - In prior IRS notices the Treasury Department and the IRS established the Continuity Safe Harbor that allows an eligible renewable energy project to be deemed