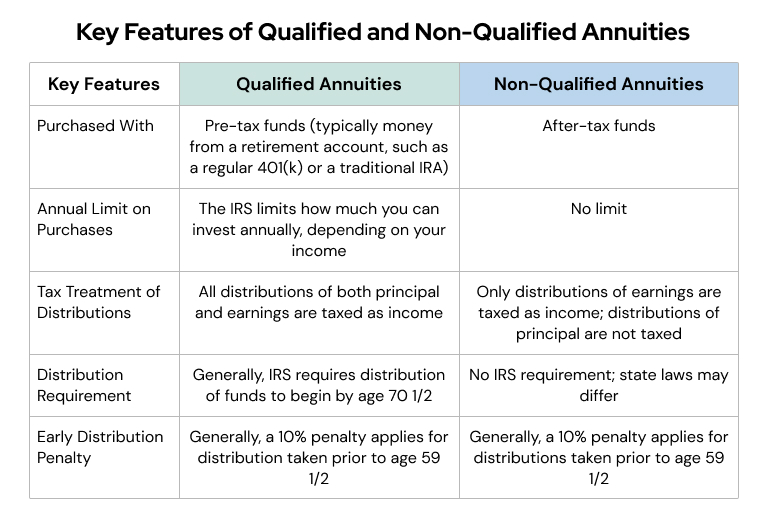

Irs List Of Qualified Electric Vehicles If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The Act introduces a 4 000 tax credit for the purchase of used electric vehicles EVs and updates the 7 500 credit for new ones with a major change There are now caps on the price of new vehicles based on

Irs List Of Qualified Electric Vehicles

Irs List Of Qualified Electric Vehicles

https://s2.studylib.net/store/data/025639602_1-6e450d0d0d3e4ece3562ec2485f6d9df-768x994.png

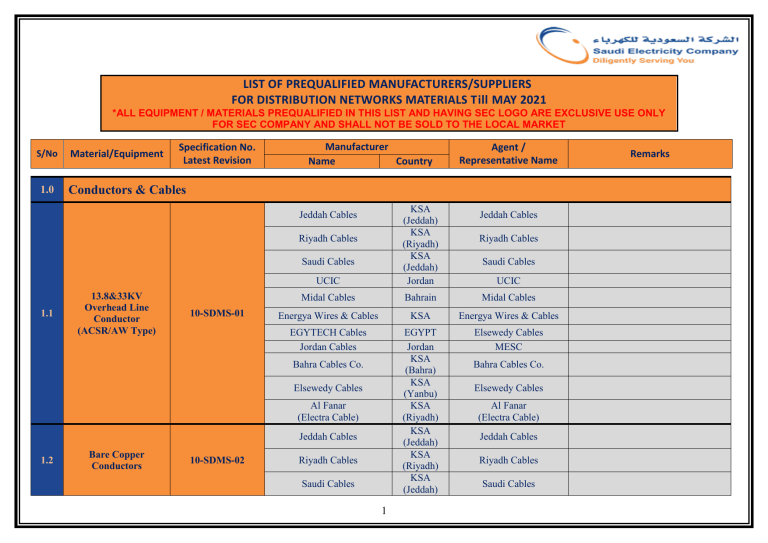

Qualified Vs Non Qualified Annuities Taxes Distribution

https://www.retireguide.com/wp-content/uploads/qualified-vs-non-qualified-annuities-1.jpg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

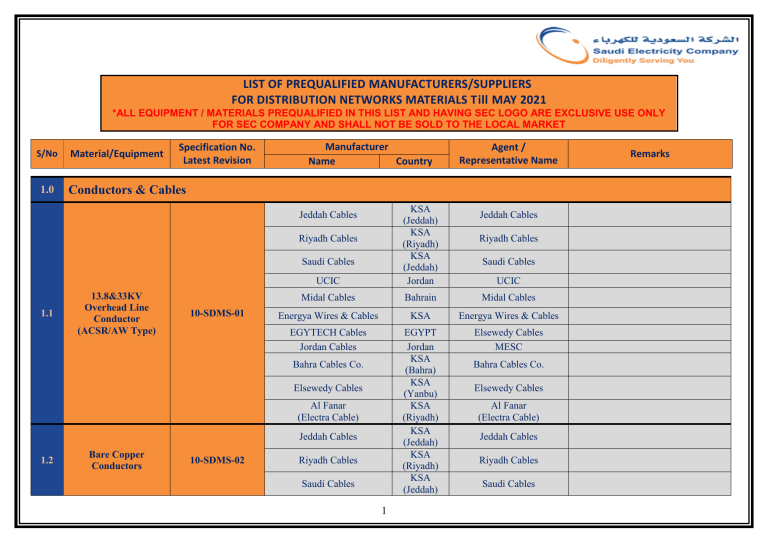

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The IRS maintains and updates a list of new vehicles that qualify for tax credits of up to 7 500 As new rules take effect and manufacturers adapt to changing conditions in the clean vehicle market it is likely that the list of eligible vehicles will change

For up to date information on eligibility requirements for the Clean Vehicle Credit or for additional detail see the information from the IRS For a list of incentives by vehicle see Federal Tax Credits on FuelEconomy gov For a summary of the credit see Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit The Internal Revenue Service IRS has released its list of vehicles that qualify for a clean vehicle tax credit The list is available on the IRS website with the tax

Download Irs List Of Qualified Electric Vehicles

More picture related to Irs List Of Qualified Electric Vehicles

GM To Lead IRS List Of EVs Eligible For Full Tax Incentive This Year

https://www.freep.com/gcdn/presto/2023/04/17/PDTF/83259879-d409-411b-b86f-20a178fa4f73-2023-chevrolet-bolt-ev-003.jpg?crop=5699,3206,x0,y289&width=3200&height=1801&format=pjpg&auto=webp

The IRS Is Making It Way Too Confusing To Buy An EV With Tax Credits

https://images-stag.jazelc.com/uploads/theautopian-m2en/irs_detector-1536x864.jpg

Section 179 Vehicles For 2024 Balboa Capital

https://cdn5.balboacapital.com/uploads/2021/01/28224423/section-179-vehicle-types.jpg

Several electric plug in hybrid and fuel cell electric vehicles are eligible for a federal income tax credit starting with purchases this year 2023 Battery Electric Vehicles BEVs Plug in Hybrid Electric Vehicles PHEVs that currently qualify Find out where an EV is assembled using its VIN Our complete breakdown of state tax

According to the Internal Revenue Service 22 EVs now qualify for IRC Section 30D tax credits down from 41 Of these 14 qualify for the full 7 500 credit and 8 for 3 750 A manufacturer as defined in IRC 30D d 3 that manufactures vehicles meeting the requirements in the following code sections may submit a request to become a qualified manufacturer New electric vehicles under IRC 30D Used electric vehicles under IRC 25E Commercial clean vehicles under IRC 45W

IRS Changes EV Tax Credit Vehicle Classifications Here s The New List

https://www.carscoops.com/wp-content/uploads/2023/02/khjglfghj-1024x576.jpg

Irs Lump Sum Pension Calculation JadonAlissa

https://www.annuity.org/wp-content/uploads/key-features-of-qualifies-and-non-qualified-annuities-640x0-c-default.jpg

https://www.irs.gov/businesses/irc-30d-new...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

FSA Eligible Expense List Flexbene

IRS Changes EV Tax Credit Vehicle Classifications Here s The New List

What s The Difference Between An Unqualified And A Qualified Electric

IRS Adds Vehicles To Section 30D Qualified Electric Vehicle List

Matt Smith On Twitter So Here s The IRS List Of Cars That Qualify

Solved Match The IR Picture With The Compound Please Help Chegg

Solved Match The IR Picture With The Compound Please Help Chegg

Free Printable 1040 Forms Free Printable Templates

Kendriya Vidyalaya Admission 2023 Class 1 Registration Open Apply Now

IRS Tax Forms 1040EZ 1040A More E file

Irs List Of Qualified Electric Vehicles - The Internal Revenue Service IRS has released its list of vehicles that qualify for a clean vehicle tax credit The list is available on the IRS website with the tax