Irs Rebate 2024 Eligibility If you do not have qualifying children 600 If you have a qualifying child 3 995 If you have two qualifying children 6 604 If you have three or more qualifying children 7 430 READ ALSO

When tax filing season opens on January 29 some taxpayers will have the option of filing their 2023 federal tax returns with a brand new government run system Known as Direct File the free On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Irs Rebate 2024 Eligibility

Irs Rebate 2024 Eligibility

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Where S My Rebate Irs Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/where-s-my-rebate-irs.jpg

Irs Rebate Checks 2023 RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/fourth-stimulus-checks-tax-return-irs-stimulusprotalk.jpeg

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Starting on Jan 1 2024 eligible buyers can choose between getting an instant EV tax rebate to use as a down payment on qualified new or used vehicles at the time of purchase at a registered dealership under new rules established by the IRS or they can claim the credit on their tax return Before this change people only had the option of claiming the credit on their tax returns the If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

Download Irs Rebate 2024 Eligibility

More picture related to Irs Rebate 2024 Eligibility

Est mulos Econ micos EN VIVO Tax Rebate Estimated Tax Payments IRS Rebate Program

https://e00-us-marca.uecdn.es/assets/multimedia/imagenes/2022/08/29/16617838062771.jpg

Fast IRS Payroll Tax Rebate For SMBs Non Profits Free Eligibility Check 2022 The DailyMoss

https://www.dailymoss.com/wp-content/uploads/2022/08/fast-irs-payroll-tax-rebate-for-smbs-amp-non-profits-free-eligibility-check-2022-62f4300d560db.jpeg

IRS Penalty Relief 2024 Benefits And Eligibility Criteria SarkariResult SarkariResult

https://www.sarkariexam.com/wp-content/uploads/2023/12/IRSPenaltyRelief2024_BenefitsandEligibilityCriteria.jpg

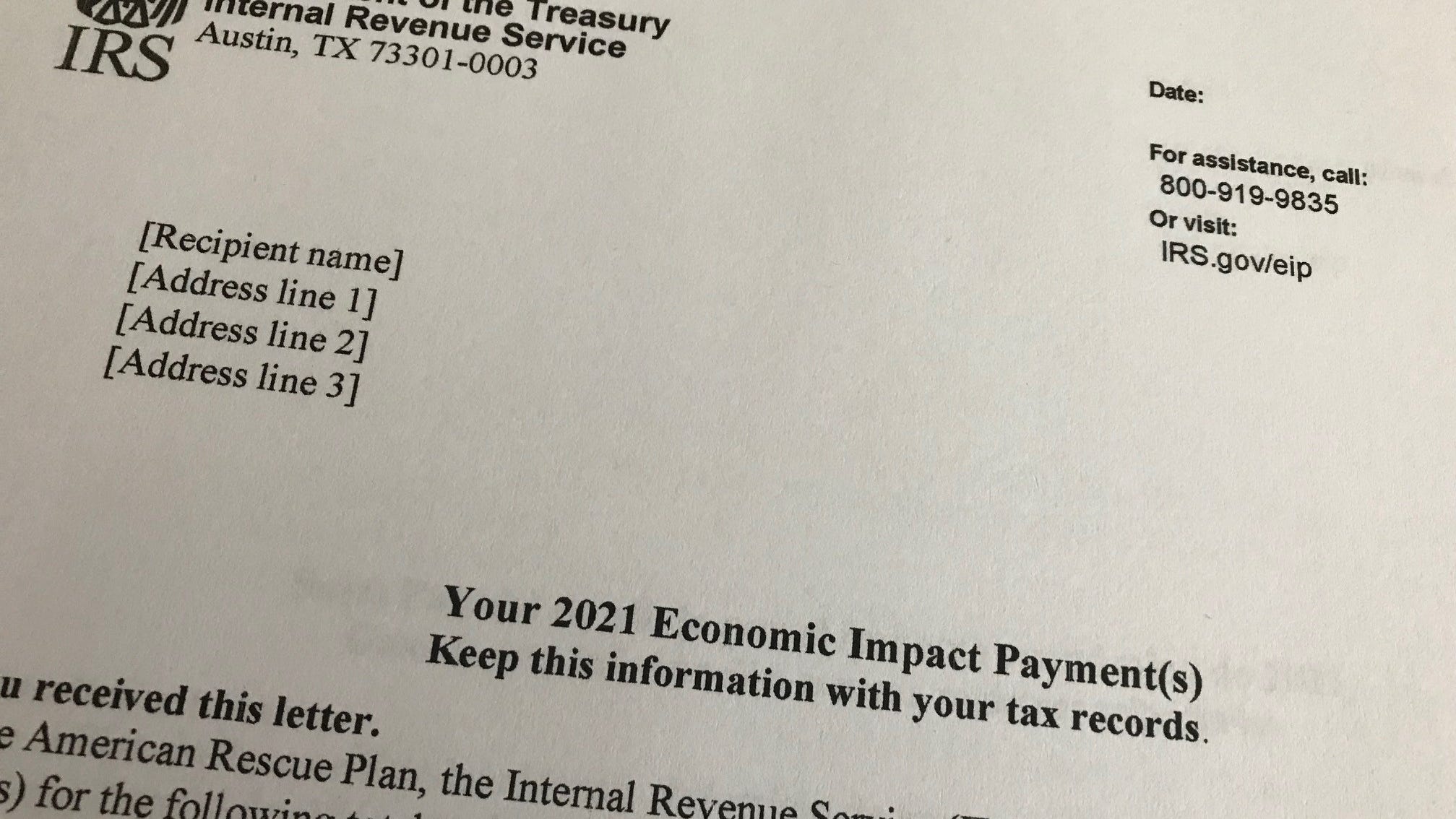

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Starting in 2024 eligibility will be determined based on the individual vehicle not by model Automakers will submit the vehicle identification numbers VINs of eligible vehicles to the Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors

Calam o Accountant ERTC IRS Rebate Qualifications 2022 Free Eligibility Assessment

https://p.calameoassets.com/220722093928-416516852605027e29442f2d9bf07046/p1.jpg

Calam o This ERTC Rebate Application Free Eligibility Test Help Non Profits Claim Max IRS

https://p.calameoassets.com/230429080705-e14ba57b7114f9eede8f5b3236200cba/p1.jpg

https://www.msn.com/en-us/money/taxes/7430-payment-for-the-irs-requirements-and-who-is-eligible-to-receive-the-refund/ar-BB1h8Z71

If you do not have qualifying children 600 If you have a qualifying child 3 995 If you have two qualifying children 6 604 If you have three or more qualifying children 7 430 READ ALSO

https://www.cnn.com/2024/01/25/politics/irs-direct-file-pilot/index.html

When tax filing season opens on January 29 some taxpayers will have the option of filing their 2023 federal tax returns with a brand new government run system Known as Direct File the free

The IRS Abandons Its Lawless Effort To Deny Prisoners Their Rebate Payments The National Interest

Calam o Accountant ERTC IRS Rebate Qualifications 2022 Free Eligibility Assessment

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

IRS Letters Due To The 2020 Recovery Rebate Credit Financial Symmetry Inc

2023 Tax Refund Schedule Chart Printable Forms Free Online

What Is The IRS Recovery Rebate Credit MidSouth Community Federal Credit Union

What Is The IRS Recovery Rebate Credit MidSouth Community Federal Credit Union

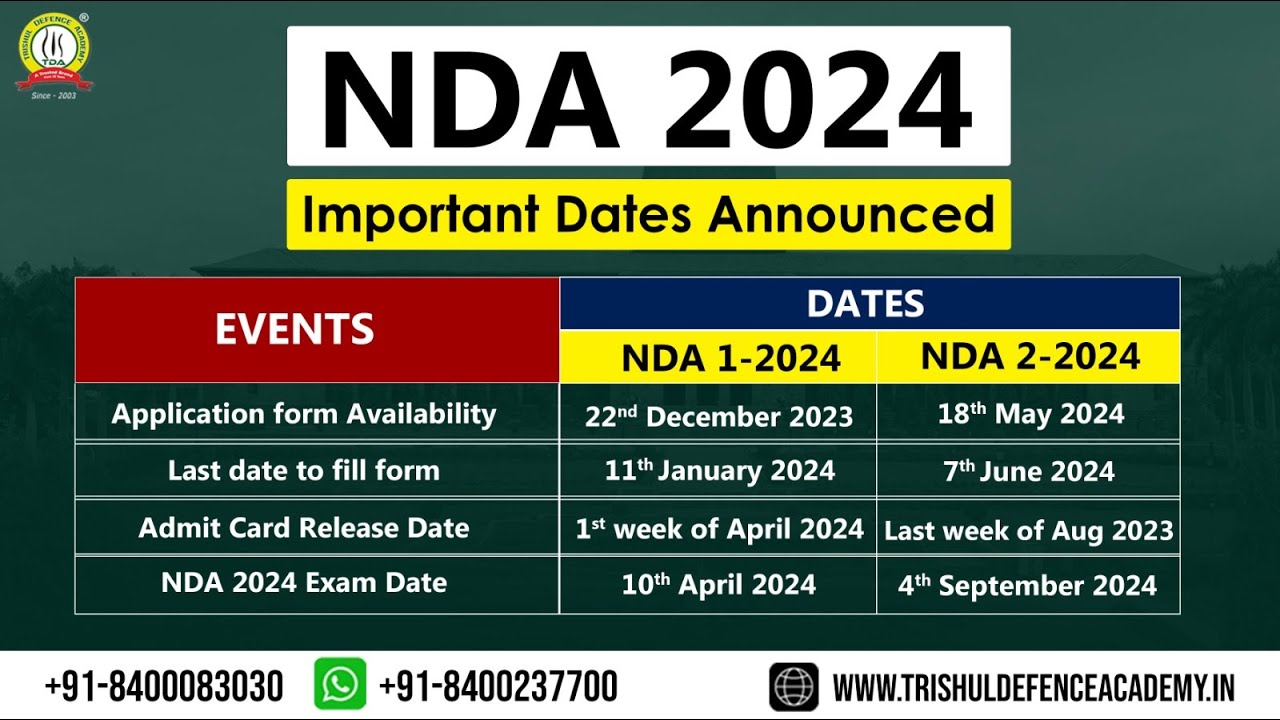

UPSC NDA 2024 Calendar Announced NDA 2024 Exam Date NDA 2023 Age Limit Best NDA Coaching

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Irs Rebate 2024 Eligibility - Starting on Jan 1 2024 eligible buyers can choose between getting an instant EV tax rebate to use as a down payment on qualified new or used vehicles at the time of purchase at a registered dealership under new rules established by the IRS or they can claim the credit on their tax return Before this change people only had the option of claiming the credit on their tax returns the