Irs Rebate Credit 2023 Web 12 juil 2023 nbsp 0183 32 Stimulus 2023 Updates To Know Now Although the IRS has issued all third round Economic Impact Payments EIPs and all plus up payments as of Dec 31 2021

Web 18 oct 2022 nbsp 0183 32 The tax year 2023 maximum Earned Income Tax Credit amount is 7 430 for qualifying taxpayers who have three or more qualifying children up from 6 935 for tax Web 20 juin 2023 nbsp 0183 32 Calendrier 2023 de remboursement des cr 233 dits d imp 244 t Versement de l acompte de cr 233 dit d imp 244 t en janvier pour qui Solidarit 233 frais de garde nounou aide

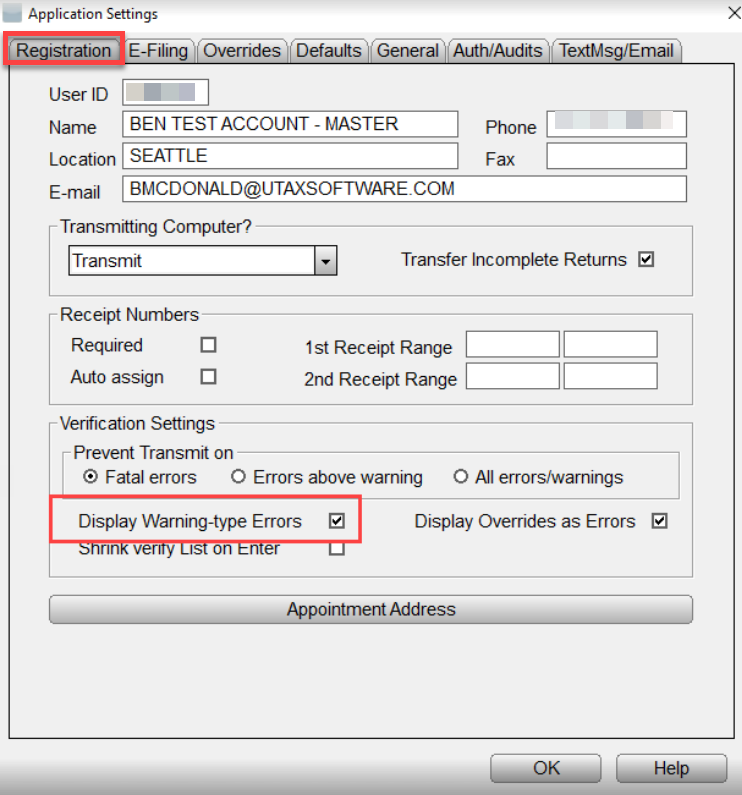

Irs Rebate Credit 2023

Irs Rebate Credit 2023

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

Recovery Rebate Credit 2023 Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/2023-new-hsa-limits-claremont-insurance-services.jpg

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 1 mars 2023 nbsp 0183 32 La loi de finances pour 2023 a r 233 activ 233 le cr 233 dit d imp 244 t pour les d 233 penses de r 233 novation 233 nerg 233 tique des b 226 timents 224 usage tertiaire engag 233 es par les PME entre le Web To claim it you must file a tax return even if you otherwise are not required to file a tax return Your Recovery Rebate Credit will be included in your tax refund If you re eligible

Download Irs Rebate Credit 2023

More picture related to Irs Rebate Credit 2023

2023 Recovery Rebate Credi Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-5.jpg

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

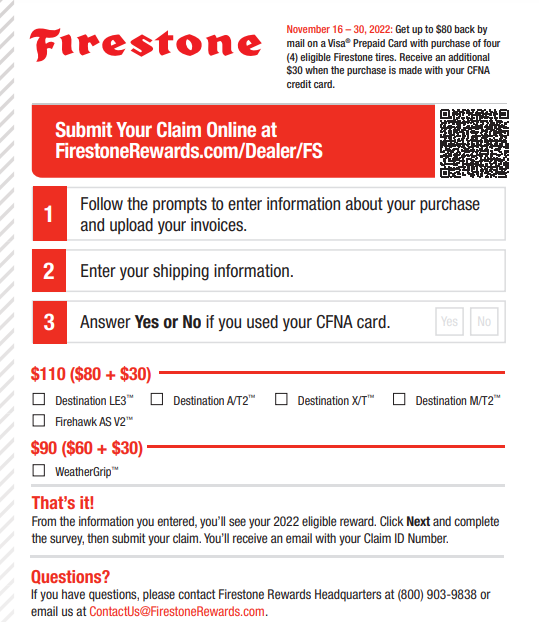

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Web The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing Web 4 mai 2023 nbsp 0183 32 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

Recovery Rebate Credit Worksheet 2022 Irs Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-2022-federal-tax-credits-taxuni.jpg

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-eligibility-calculator-how-to-claim-6.jpg?resize=768%2C596&ssl=1

https://finance.yahoo.com/news/stimulus-collect-1-400-2023-152206003.ht…

Web 12 juil 2023 nbsp 0183 32 Stimulus 2023 Updates To Know Now Although the IRS has issued all third round Economic Impact Payments EIPs and all plus up payments as of Dec 31 2021

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments...

Web 18 oct 2022 nbsp 0183 32 The tax year 2023 maximum Earned Income Tax Credit amount is 7 430 for qualifying taxpayers who have three or more qualifying children up from 6 935 for tax

Recovery Rebate Credit Irs Form Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Irs Recovery Rebate

2023 Recovery Rebate Credit Instructions Recovery Rebate

Recovery Rebate Credit IRS Error Letters Are Not Scam And You Can Get

Does Arizona Have A Renters Tax Credit Printable Rebate Form

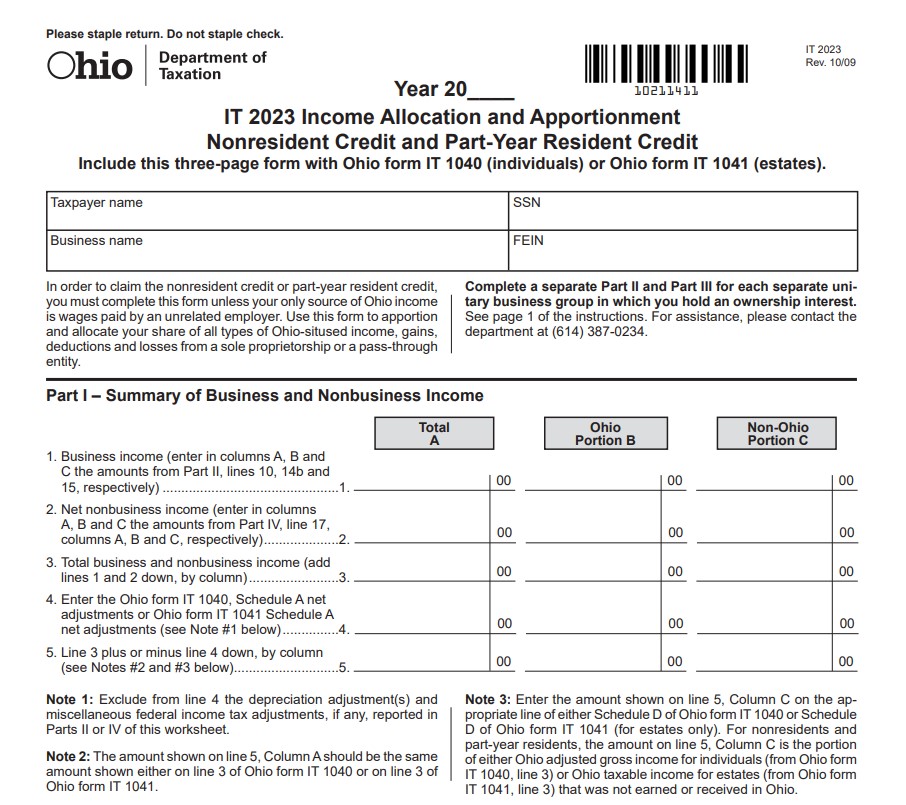

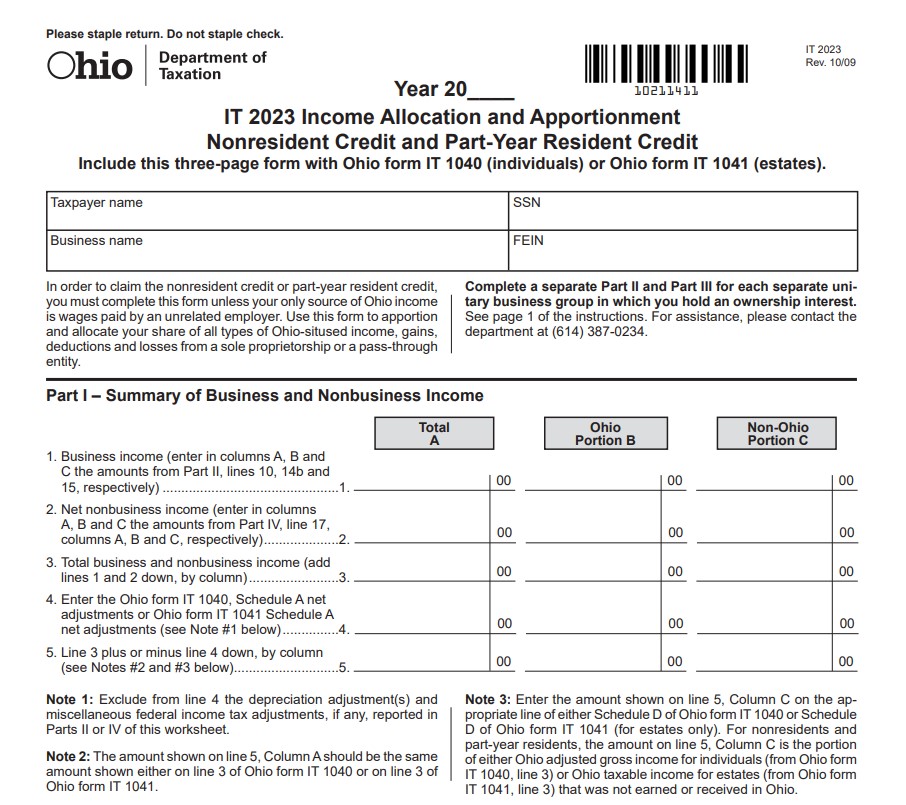

Aep Ohio Rebates 2023 Printable Rebate Form

Aep Ohio Rebates 2023 Printable Rebate Form

What If I Did Not Receive Eip Or Rrc Detailed Information

Recovery Rebate Credit Married In 2023 Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Irs Rebate Credit 2023 - Web 1 mars 2023 nbsp 0183 32 La loi de finances pour 2023 a r 233 activ 233 le cr 233 dit d imp 244 t pour les d 233 penses de r 233 novation 233 nerg 233 tique des b 226 timents 224 usage tertiaire engag 233 es par les PME entre le