Irs Rebate Credit Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Irs Rebate Credit

Irs Rebate Credit

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

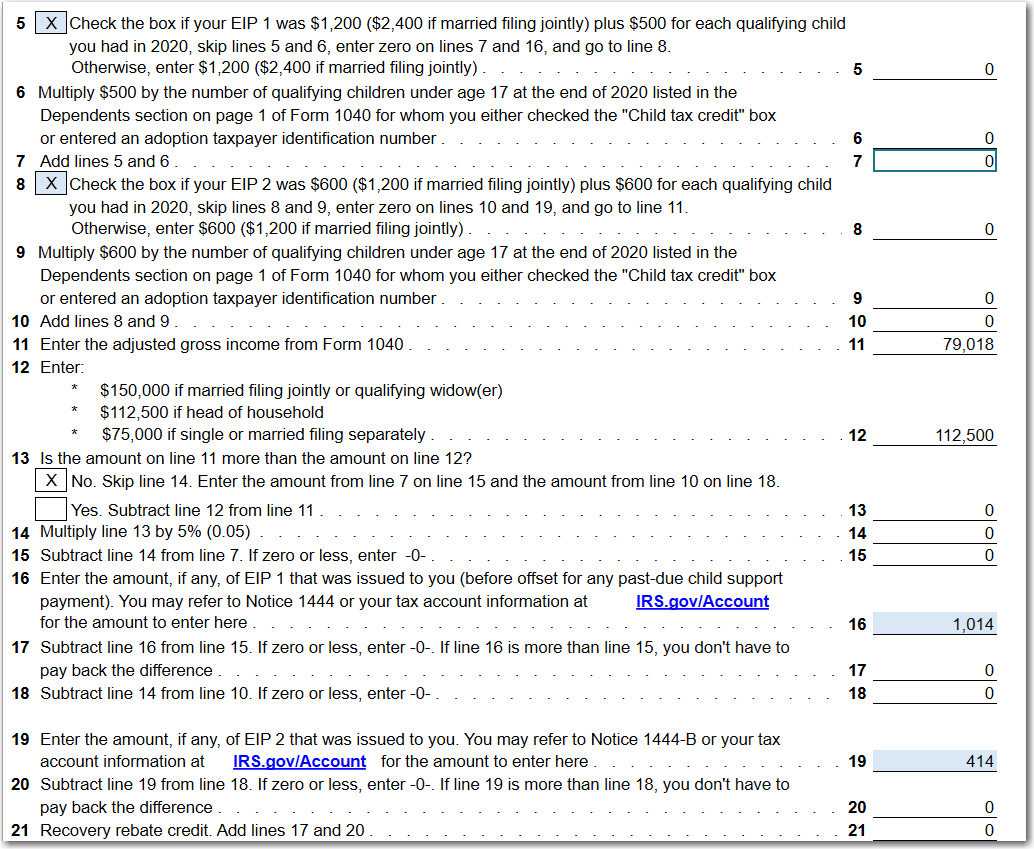

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

What If I Did Not Receive Eip Or Rrc Detailed Information

https://stimulusmag.com/wp-content/uploads/2022/12/what-is-the-irs-recovery-rebate-credit.jpg

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840

Web Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year Web 3 mars 2022 nbsp 0183 32 If eligible you can claim the Recovery Rebate Credit when you file your 2020 tax return Form 1040 or Form 1040 SR Your Recovery Rebate Credit amount will

Download Irs Rebate Credit

More picture related to Irs Rebate Credit

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 17 ao 251 t 2022 nbsp 0183 32 The IRS issued more than 5 million math error notices to taxpayers regarding claims of a Recovery Rebate Credit but failed to inform recipients that they had just 60 days to respond to the notice Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing season

Web 27 avr 2023 nbsp 0183 32 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Web 15 avr 2021 nbsp 0183 32 IRS gov has a special section Correcting Recovery Rebate Credit issues after the 2020 tax return is filed that provides additional information explaining what

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

1040 Rebate Recovery Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-103.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Federal Recovery Rebate Credit Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

How Do I Claim The Recovery Rebate Credit On My Ta

What Is The Recovery Rebate Credit CD Tax Financial

Irs Rebate Credit - Web 9 avr 2021 nbsp 0183 32 That s the 1 400 payment made possible by the American Rescue Plan Act of 2021 aka the Biden stimulus bill If you qualify for a plus up payment you will receive