Irs Rebate For Solar Panels Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web Part I Residential Clean Energy Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2021 1 Qualified solar

Irs Rebate For Solar Panels

Irs Rebate For Solar Panels

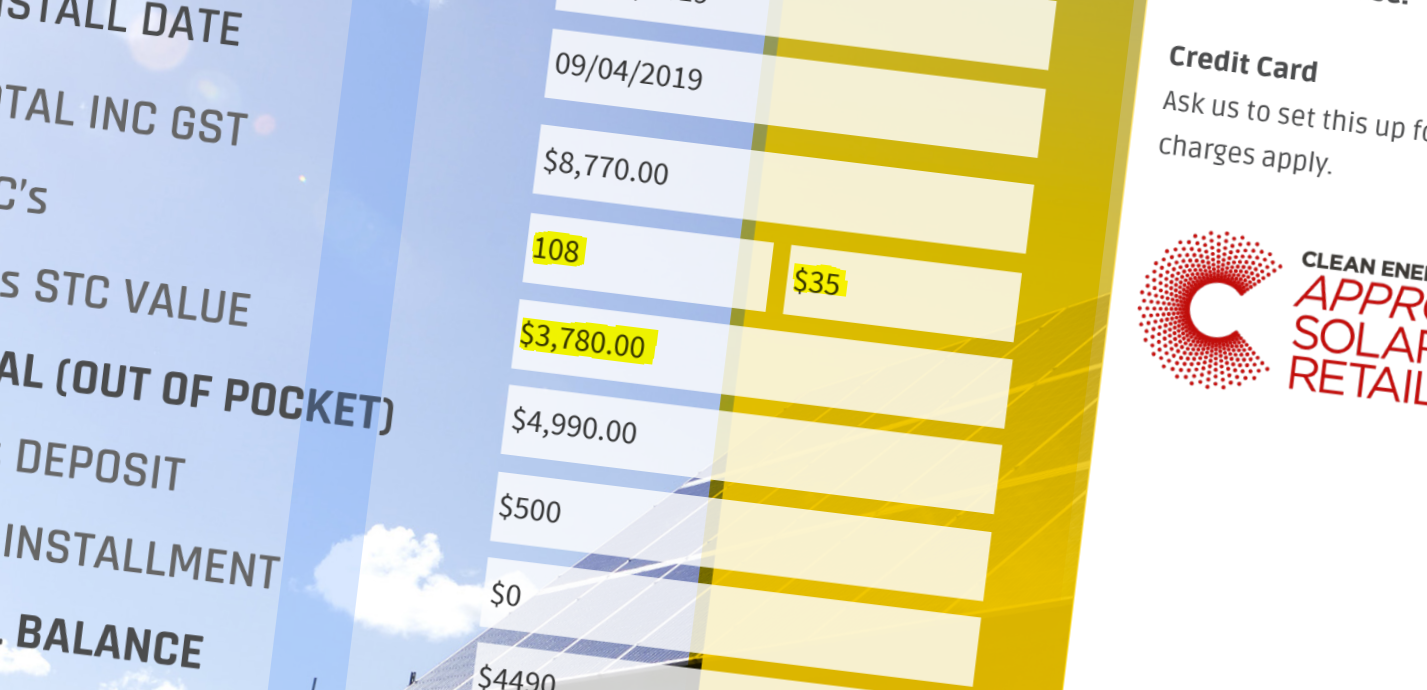

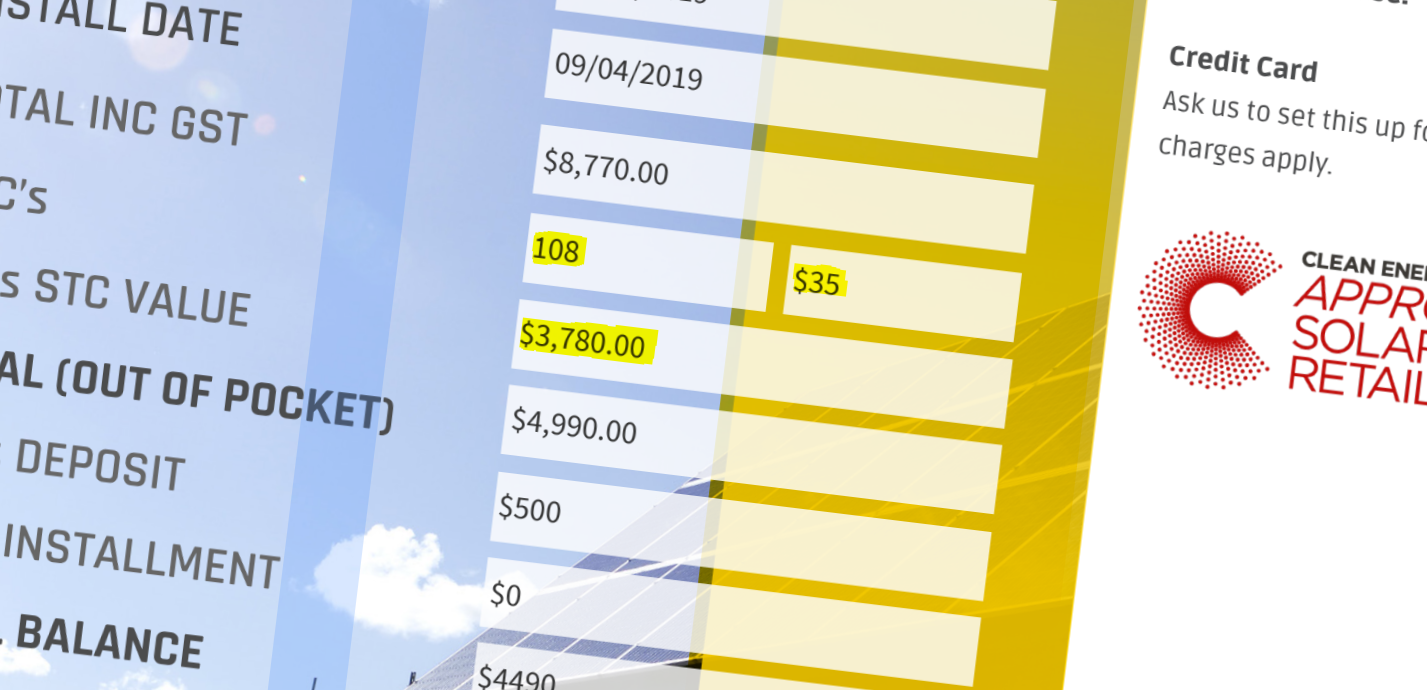

https://perthsolarwarehouse.com.au/wp-content/uploads/2019/04/Solar-Panels-Perth-WA-Rebate-PSW.png

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

Solar Panel Rebate How It Works And How To Get It

https://www.solarquotes.com.au/wp-content/uploads/2020/07/solar-rebate-1.jpg

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web 27 avr 2021 nbsp 0183 32 Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December

Web The credit rate for property placed in service in 2022 through 2032 is 30 Energy efficient home improvement credit The nonbusiness energy property credit is now the Web 1 janv 2023 nbsp 0183 32 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per

Download Irs Rebate For Solar Panels

More picture related to Irs Rebate For Solar Panels

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

https://www.solarreviews.com/content/images/blog/irs_form2021.png

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar-1080x566.jpg

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

Web Are roofing expenditures that were necessary for the installation of solar panels eligible for the Residential Clean Energy Property Credit added December 22 2022 A2 In Web 16 mars 2023 nbsp 0183 32 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to

Web 1 ao 251 t 2023 nbsp 0183 32 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 for the tax year 2023 through 2032 Web 5 avr 2023 nbsp 0183 32 Q I got a rebate from my utility company for my solar panels Do I calculate the 30 tax credit before or after the reduction from the rebate A We get this question

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

https://i.pinimg.com/originals/23/b0/e8/23b0e83deb727576a8231415ea1cb2a0.png

The Victorian Solar Homes Rebate Explained Half Price Solar Starting Now

https://www.solarquotes.com.au/blog/wp-content/uploads/2018/08/victoria-solar-rebate.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

How To File The Federal Solar Tax Credit A Step By Step Guide Solar

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

The Federal Solar Tax Credit Explained Sunshine Plus Solar

2020 Guide To Iowa Solar Panels For Homeowners Solar Panel Incentives

Claiming The Solar ITC IRS Form 5695 Instructions Understand Solar

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Solar Panel Rebate Victoria How It Works How To Claim

Check Solar Panels Rebate Get Free Quote Do Solar Is Clean Flickr

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

Irs Rebate For Solar Panels - Web 8 sept 2022 nbsp 0183 32 President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the