Irs Rebate Solar Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

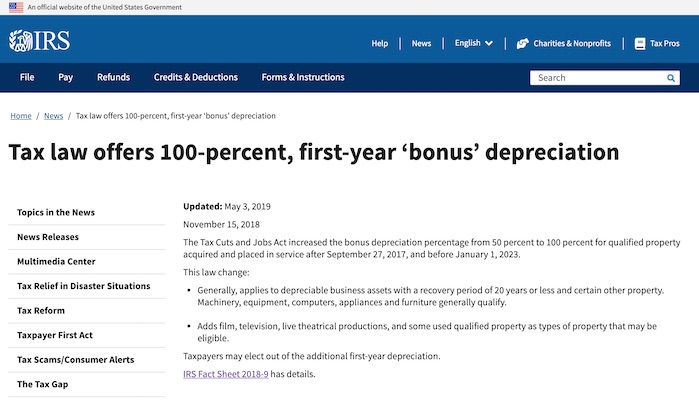

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web 8 sept 2022 nbsp 0183 32 President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also

Irs Rebate Solar

Irs Rebate Solar

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

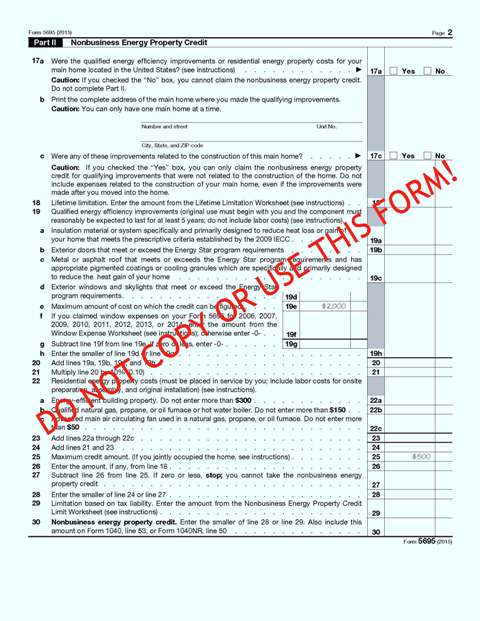

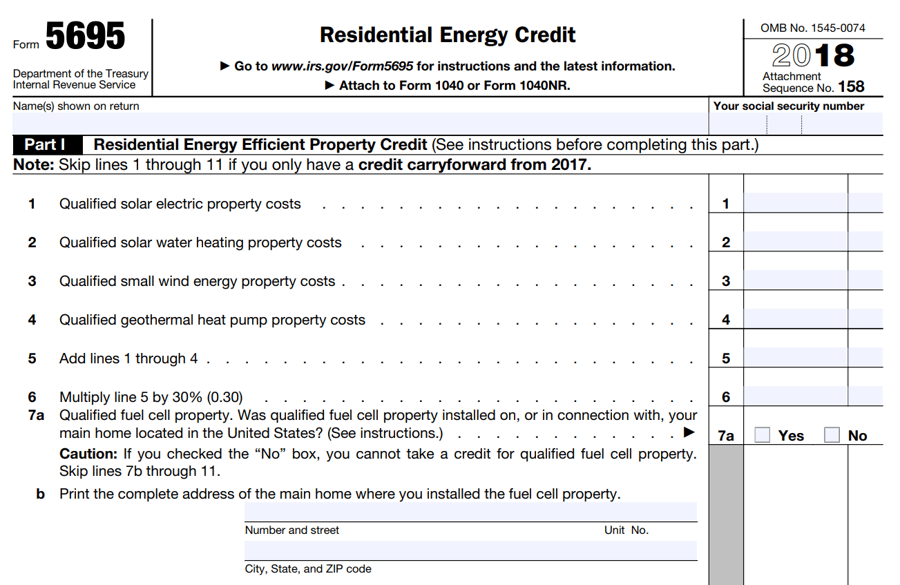

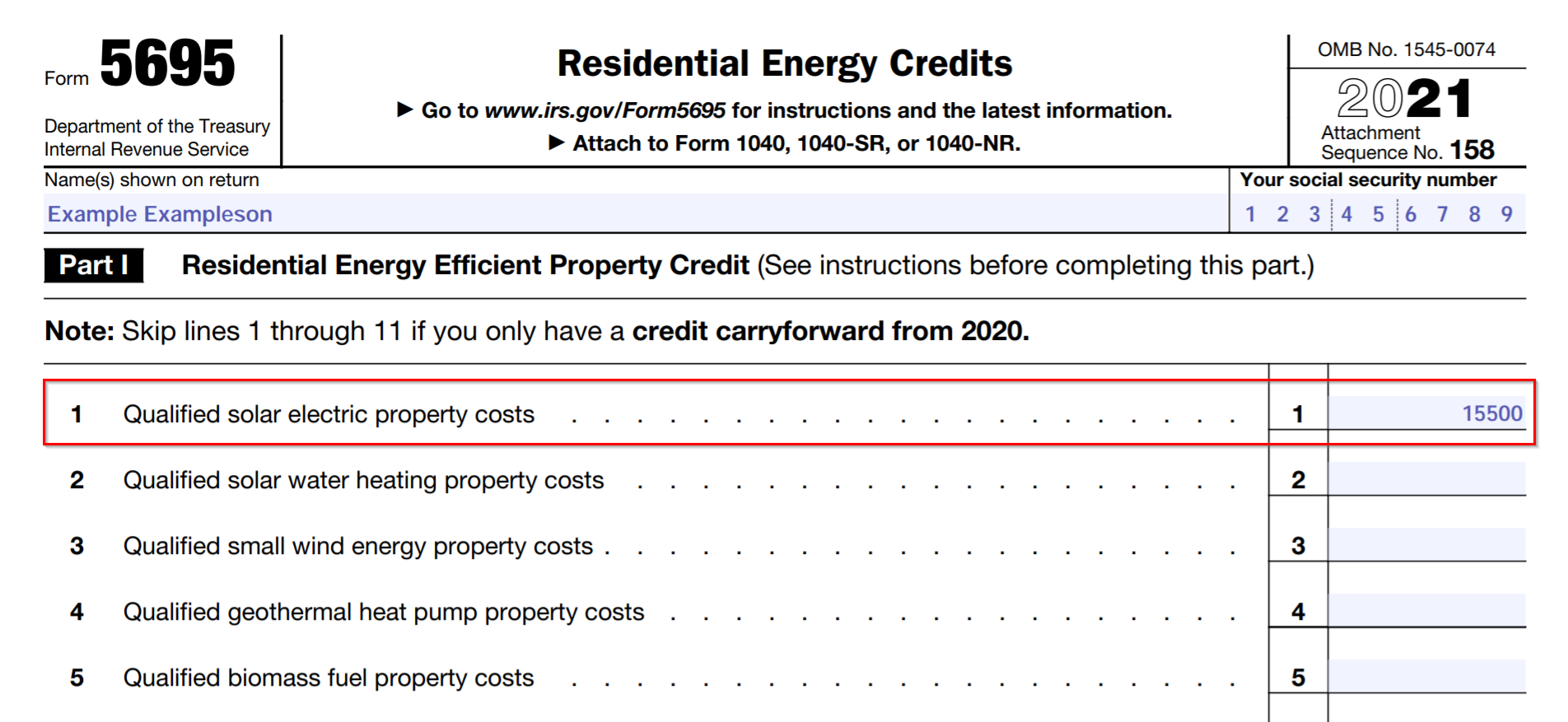

How To Claim The Solar Tax Credit Using IRS Form 5695

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Solar Tax Credit And Your Boat Updated Blog

https://coastalclimatecontrol.com/images/solar/IRS_Form_5695_2015_Pg_2.jpg

Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

Download Irs Rebate Solar

More picture related to Irs Rebate Solar

Solar Tax Credit And Your Boat Updated Blog

https://www.coastalclimatecontrol.com/images/solar/IRS_Form_5695_2015_Pg_1.jpg

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

Lower Commercial Solar Costs For Business With Rebates Forme Solar

https://formesolar.com/wp-content/uploads/2021/02/irs-depreciation-100-solar-tax.jpg

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040

Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal solar tax credit The federal Web 3 janv 2023 nbsp 0183 32 The investment tax credit ITC also known as the federal solar tax credit allows you to apply 30 percent of your solar energy system s cost as a credit to your

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

How To File The Federal Solar Tax Credit A Step By Step Guide

https://blog.pickmysolar.com/hs-fs/hubfs/solar-form-5695.png?width=900&name=solar-form-5695.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

The Truth About The Solar Rebate SAE Group

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Fill Out

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

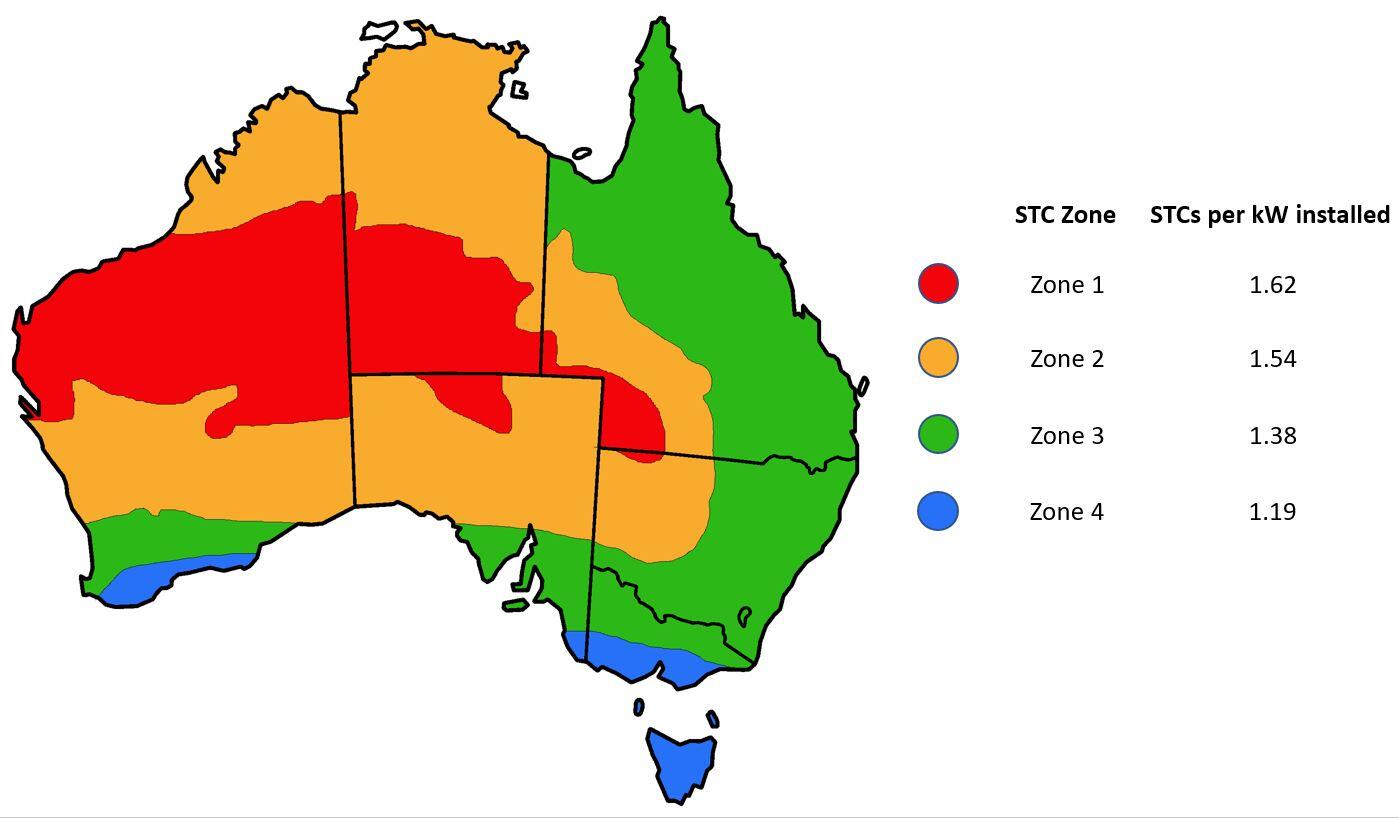

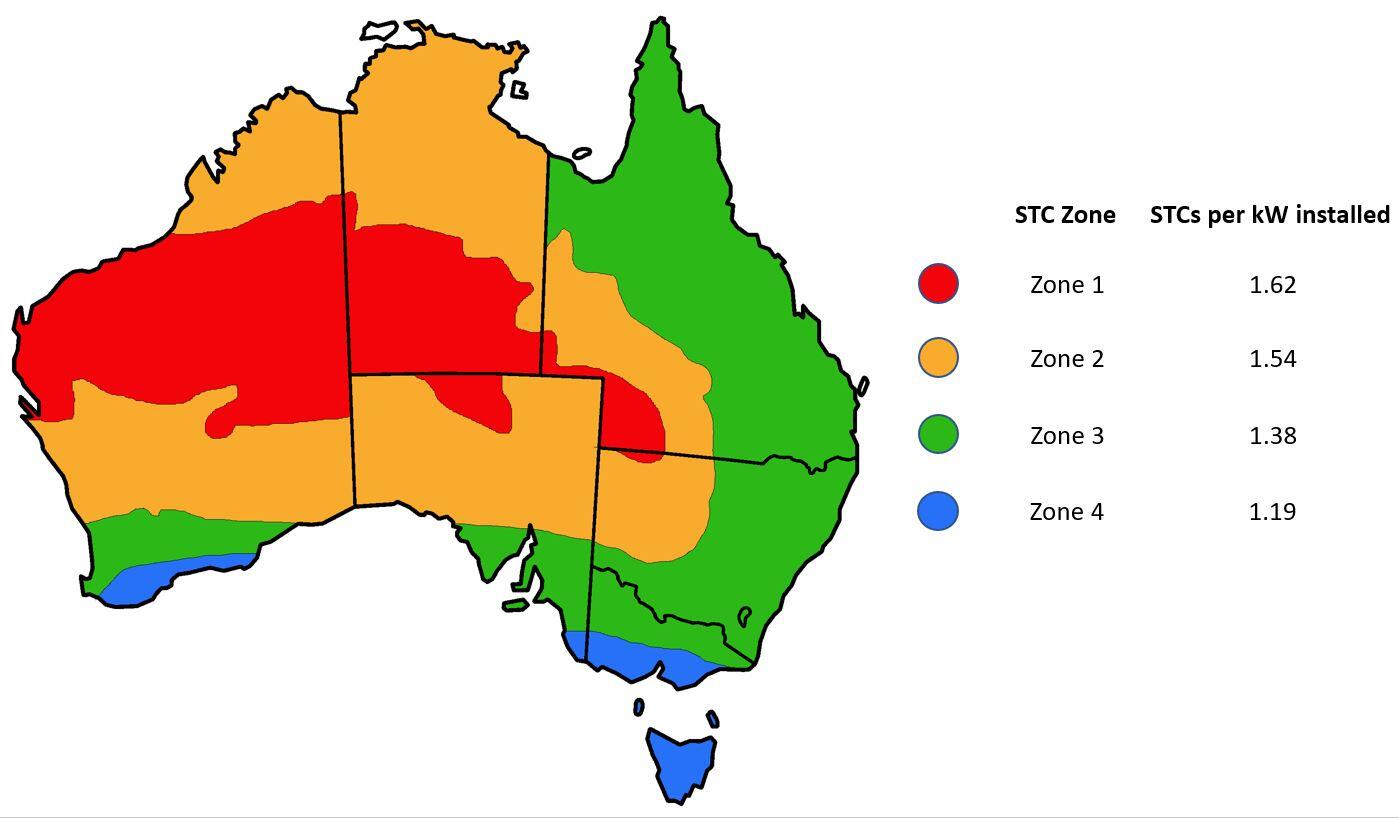

Government Solar Rebate Solar Power Incentives Solar Choice

Government Solar Rebate Solar Power Incentives Solar Choice

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

The Federal Solar Tax Credit Extension Can We Win If We Lose

Irs Rebate Solar - Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system