Irs Rebates For Energy Efficiency 2024 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

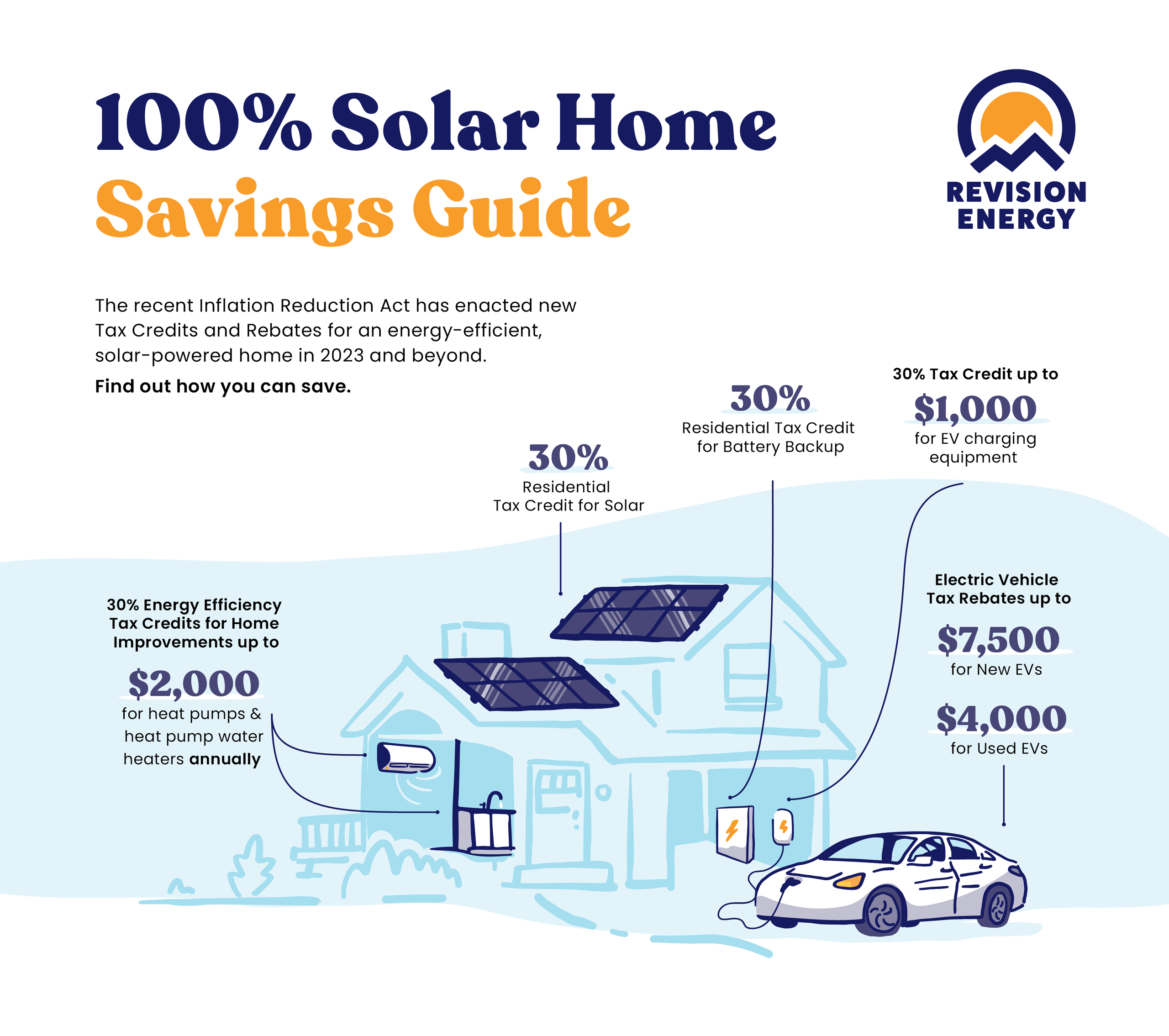

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways

Irs Rebates For Energy Efficiency 2024

Irs Rebates For Energy Efficiency 2024

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

New Tax Changes In 2023 Bring IRS Rebates And 401 k Plan Hikes For Americans

https://www.tododisca.com/en/wp-content/uploads/2022/11/IRS-and-Tax-Identity-Theft.jpg

Calam o This ERTC Rebate Application Free Eligibility Test Help Non Profits Claim Max IRS

https://p.calameoassets.com/230429080705-e14ba57b7114f9eede8f5b3236200cba/p1.jpg

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 New Energy Eficient Homes Credit 45L Energy Eficient Commercial Buildings Deduction 179D Provides a tax credit for construction of new energy eficient homes Credit Amount 2 500 for new homes meeting Energy Star standards 5 000 for certified zeroenergy ready homes

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is available

Download Irs Rebates For Energy Efficiency 2024

More picture related to Irs Rebates For Energy Efficiency 2024

PSE G Energy Efficiency Rebates Incentives 2022 2023 Ciel Power LLC Insulation Contractor

http://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/55c793f6e4b017e133090c7a/632205487403dd6847738eea/1663175777899/PSE%26G+Incentive+Programs.jpg?format=1500w

Energy Efficiency Rebates HomeSelfe

https://www.homeselfe.com/wp-content/uploads/2022/03/Energy-Efficiency-Rebates.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Air Source Heat Pumps Heat Pump Water Heaters Biomass Stoves or Boilers Save Up to 1 200 on Energy Efficiency Home Improvements Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home The actual amount of the credit depends on eligibility requirements such as the type of home the home s energy efficiency and the date when someone buys or leases the home

Excellent Get Free Estimates In connection with the Production Tax Credit the Inflation Reduction Act Provides a bonus credit of 10 percent for qualifying clean energy production in energy communities

Energy Efficiency Rebates Tax Credits Corning Natural Gas Corporation

https://www.corninggas.com/files/2020/05/Efficiency_AdobeStock_194821250.jpeg?w=1440&h=1080&a=t

Rebates Abound With WeatherGard Consumers Energy WeatherGard

https://weathergard.com/blog/energy-efficiency/consumers-rebates/consumers-hq.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

The IRS May Be Taxing Rebates Points And Rewards And Sending Out 1099s

Energy Efficiency Rebates Tax Credits Corning Natural Gas Corporation

Energy Optimization Department Coldwater MI

The IRS Could Speed Up Coronavirus Rebates By Opening Secure Phone Lines

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

A Business Owner s Guide To Energy Efficiency Rebates CET

Property Manager Energy Efficiency Rebates With SRP YouTube

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

Irs Rebates For Energy Efficiency 2024 - On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates