Irs Rebates For Energy Efficiency Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web 28 ao 251 t 2023 nbsp 0183 32 Many states label energy efficiency incentives as rebates even though they don t qualify under that definition Those incentives could be included in your gross

Irs Rebates For Energy Efficiency

Irs Rebates For Energy Efficiency

https://www.barriersciences.com/user_files/upload/Picture1.png

2023 Standard Mileage Rates Released By IRS

https://www.hrmorning.com/wp-content/uploads/2023/01/2023MileageRates.png

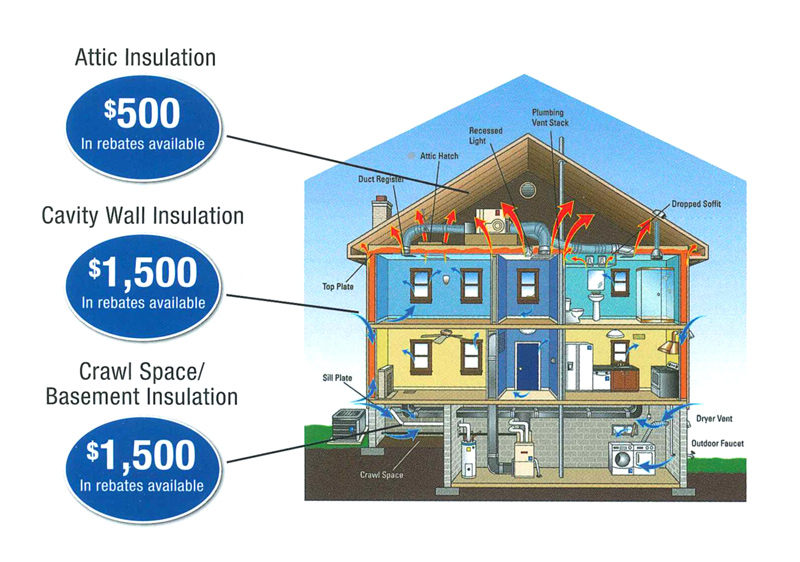

Home Energy Rebates NRGwise Home Energy Assessments Ontario

https://nrgwise.ca/wp-content/uploads/2021/07/NRGwise-Rebate-Flyer-July-2021-1.jpg

Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll

Web the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1 2023 the amount Web The U S Department of Energy DOE estimates that these rebates will save households up to a 1 billion on energy bills each year and support over 50 000 U S jobs This

Download Irs Rebates For Energy Efficiency

More picture related to Irs Rebates For Energy Efficiency

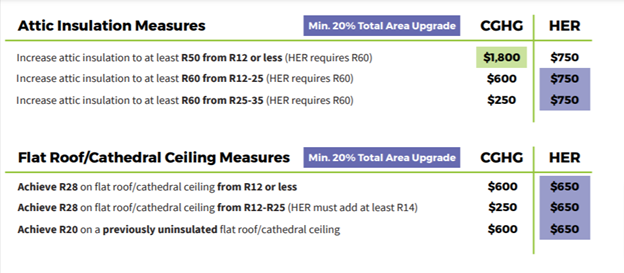

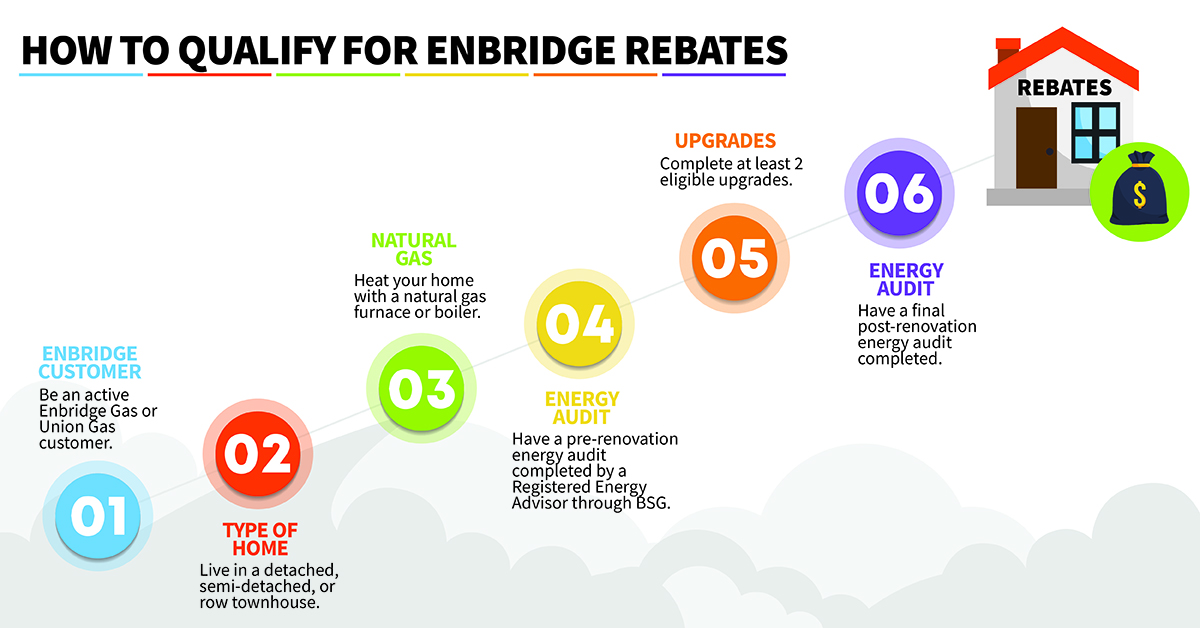

What Are The Enbridge Rebates Home Efficiency Rebates

https://www.barriersciences.com/user_files/upload/how-to-qualify-for-enbridge-rebates.jpg

Energy Efficient Rebates Tax Incentives For MA Homeowners

http://www.myenergymonster.com/ma/wp-content/uploads/sites/2/2012/08/energy-efficient-rebates-ma.png

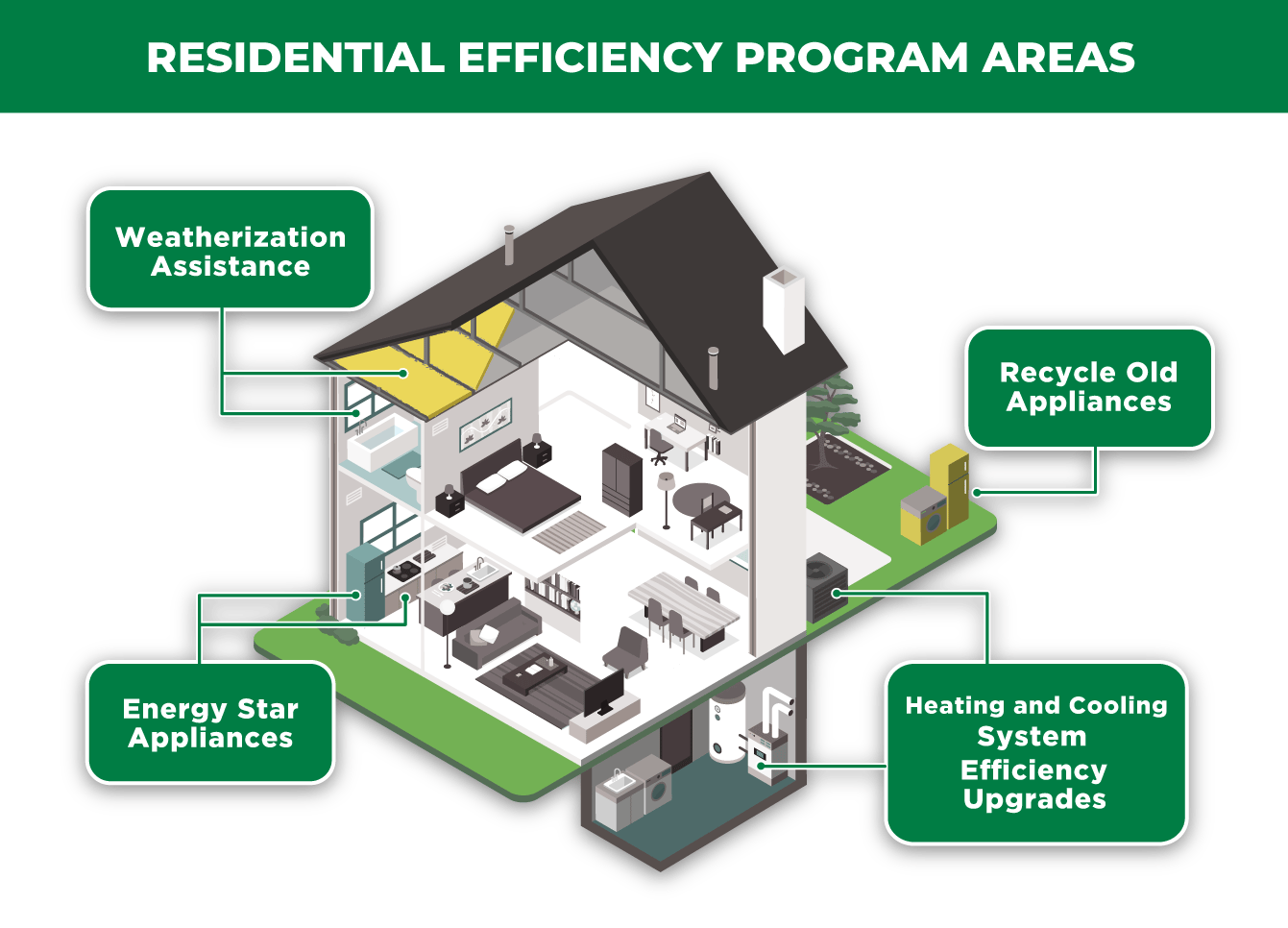

Energy Efficiency Rebates UPPCO

https://www.uppco.com/wp-content/uploads/2019/01/infographic-residential-efficiency-program-areas.png

Web 22 d 233 c 2022 nbsp 0183 32 The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Web The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Web 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual Web 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME

Union Gas Home Reno Rebate Program Great Northern Insulation

https://www.gni.ca/user_files/upload/images/download-soe-pdf.jpg

Everything You Need To Know About Home Energy Rebates In Ontario GNI

https://www.gni.ca/pictures/blog/2015/12/insulation-rebates.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

https://www.irs.gov/newsroom/energy-incentives-for-individuals...

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Alberta Energy Efficiency Rebate Program Details Energy Efficiency

Union Gas Home Reno Rebate Program Great Northern Insulation

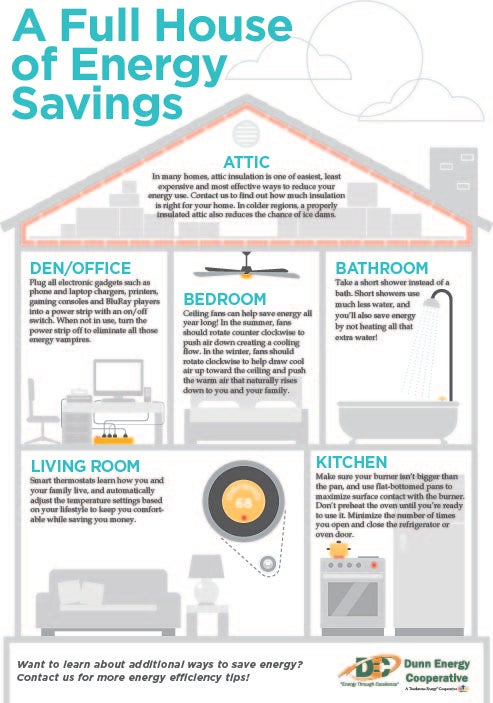

Home Performance Rebates Dunn Energy Cooperative

Empowering Businesses With Rebates For Energy Efficiency

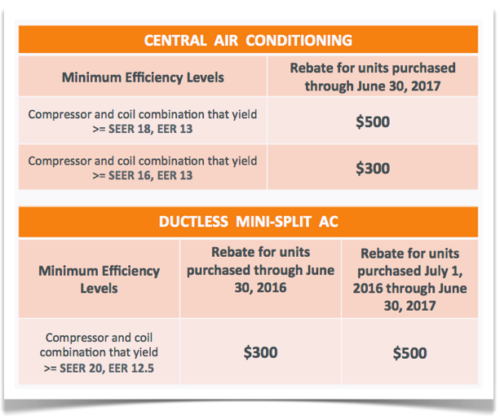

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

How To Claim Your 50 Energy Star Refrigerator Rebate Solar Appliance

Efficiency Vermont Energy Efficiency Rebate Program

Stacking Energy Efficiency Rebates

Irs Rebates For Energy Efficiency - Web 8 sept 2023 nbsp 0183 32 This guidance will ensure homebuilders are meeting the most up to date energy efficiency standards so that new homes are not only good for the climate but