Irs Recovery Rebate Credit 2024 The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

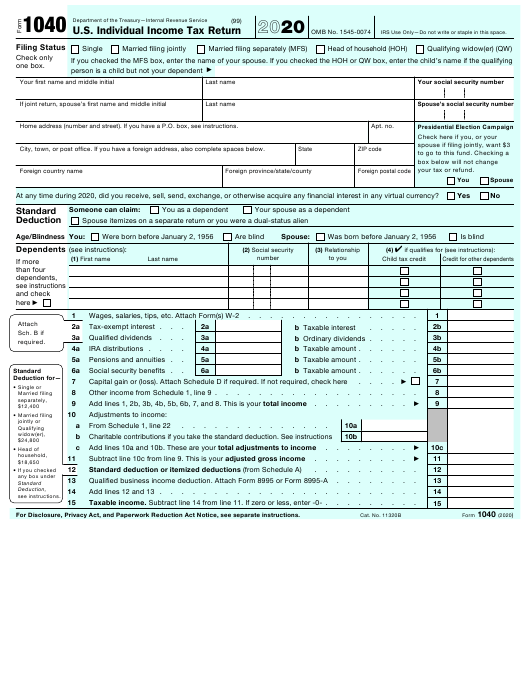

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Irs Recovery Rebate Credit 2024

Irs Recovery Rebate Credit 2024

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

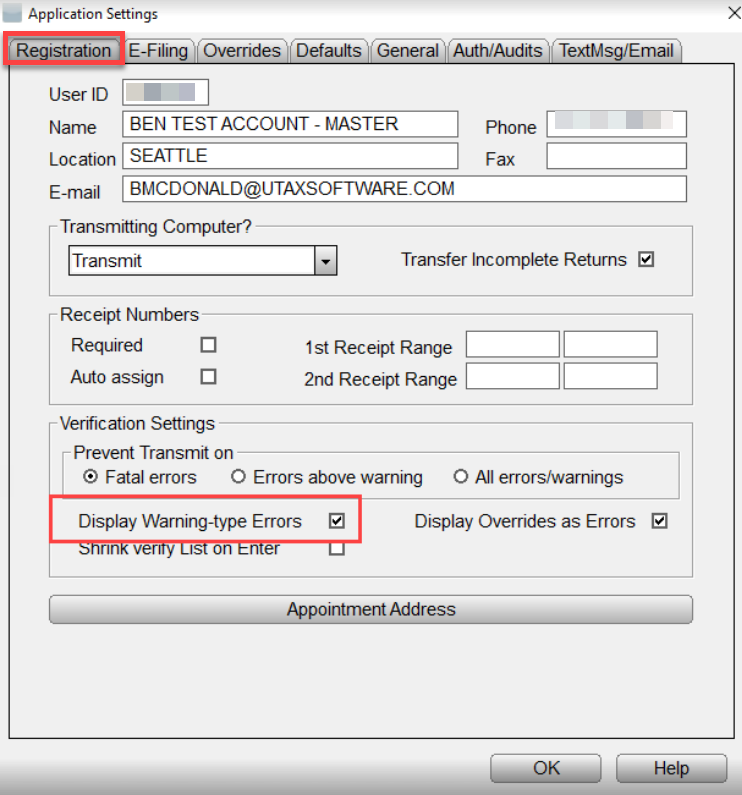

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-federal-tax-credits-taxuni.jpg?resize=1024%2C576&ssl=1

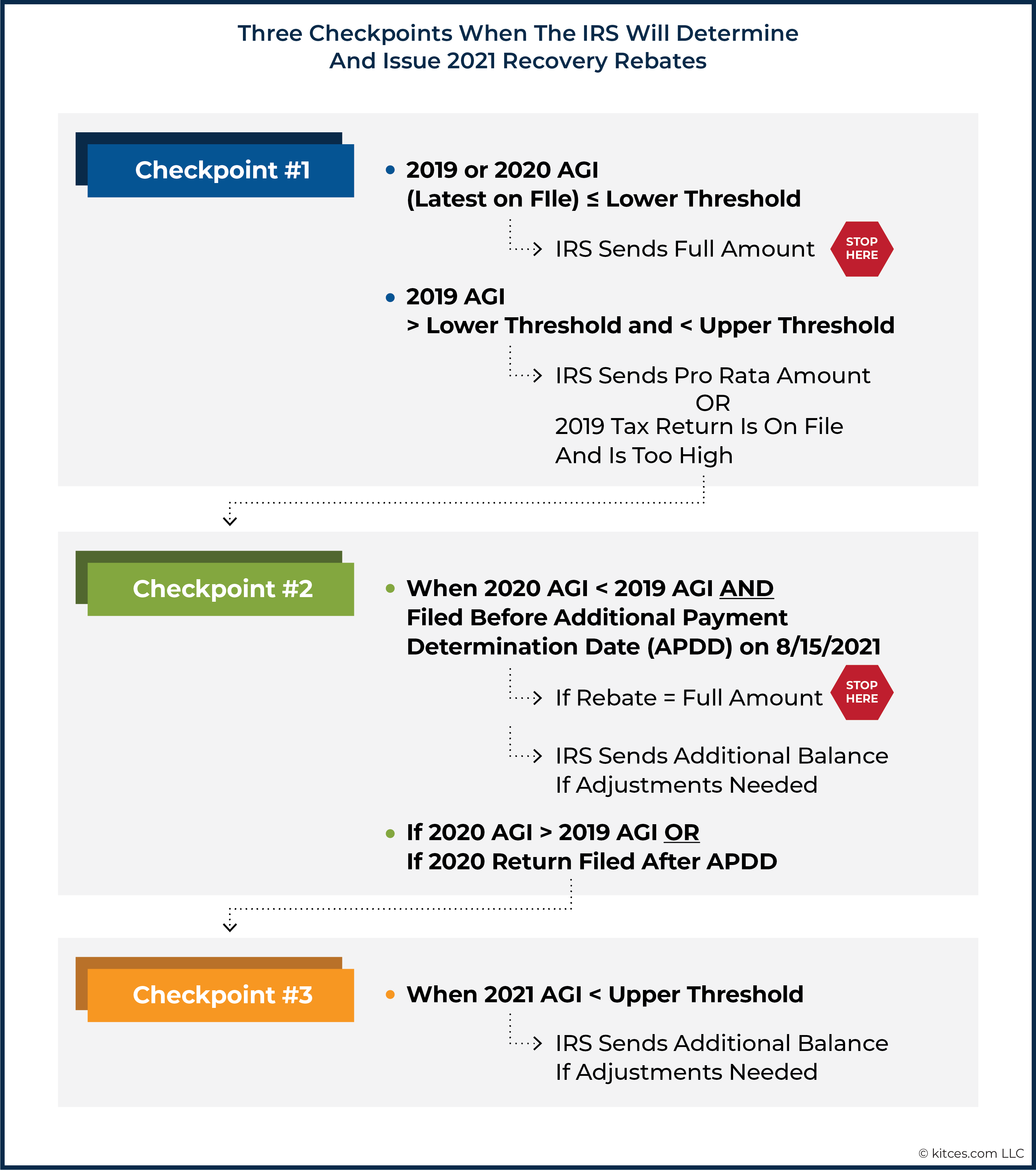

A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs Topic B Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit on your tax return you will need to know the amount of any third Economic Impact Payments you received You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments For 2023 taxes filed in 2024 the

The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or Your EIP 1 was less than 1 200 2 400 if married filing jointly plus IR 2024 21 Jan 25 2024 The Internal Revenue Service renewed calls today for businesses to review their eligibility for the Employee Retention Credit as the agency s law enforcement arm Criminal Investigation CI begins a series of educational sessions for tax professionals

Download Irs Recovery Rebate Credit 2024

More picture related to Irs Recovery Rebate Credit 2024

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-for-college-students-irsuka.jpg?fit=1920%2C1080&ssl=1

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

This means you can file your return and receive your Recovery Rebate Credit through April 15 2024 Steber says 2020 returns are being used to calculate the value of the monthly child tax The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline I know what you re thinking

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

https://www.abercpa.com/wp-content/uploads/2022/01/irs-updates-info-on-recovery-rebate-credit-and-pandemic-response.jpg

Irs Recovery Rebates Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-2.png

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

https://www.irs.gov/pub/irs-pdf/p5486a.pdf

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Do Dependents Get Recovery Rebate Credit Leia Aqui Why Did I Get A Letter From The IRS About

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

Why Did Irs Change My Recovery Rebate Credit Useful Tips

IRS Letters Due To The 2020 Recovery Rebate Credit Financial Symmetry Inc

Irs Recovery Rebate Credit Number IRSYAQU

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

1040 Line 30 Recovery Rebate Credit Recovery Rebate

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

Irs Recovery Rebate Credit 2024 - A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs Topic B Claiming the Recovery Rebate Credit if you aren t required to file a tax return To figure the credit on your tax return you will need to know the amount of any third Economic Impact Payments you received