Irs Recovery Rebate Credit Error 2023 Web 24 ao 251 t 2023 nbsp 0183 32 payment or Recovery Rebate Credit potentially erroneous Recovery Rebate Credit What TIGTA Found The IRS correctly calculated the allowable

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 23 mai 2022 nbsp 0183 32 Although the recovery rebate credit error rate was low TIGTA found that more than 355 000 individuals had received recovery rebate credits totaling 603 million

Irs Recovery Rebate Credit Error 2023

Irs Recovery Rebate Credit Error 2023

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-pdf-20.jpg

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

Web 24 f 233 vr 2023 nbsp 0183 32 SOLVED by TurboTax 690 Updated February 24 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or Web 11 avr 2022 nbsp 0183 32 People who claimed the wrong amount of the recovery rebate credit don t need to file an amended return The IRS will correct their return and send a notice that

Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the Web 22 oct 2022 nbsp 0183 32 There are many possible reasons why your recovery rebate might not be processed as scheduled One of the most common is the mistake made when claiming

Download Irs Recovery Rebate Credit Error 2023

More picture related to Irs Recovery Rebate Credit Error 2023

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

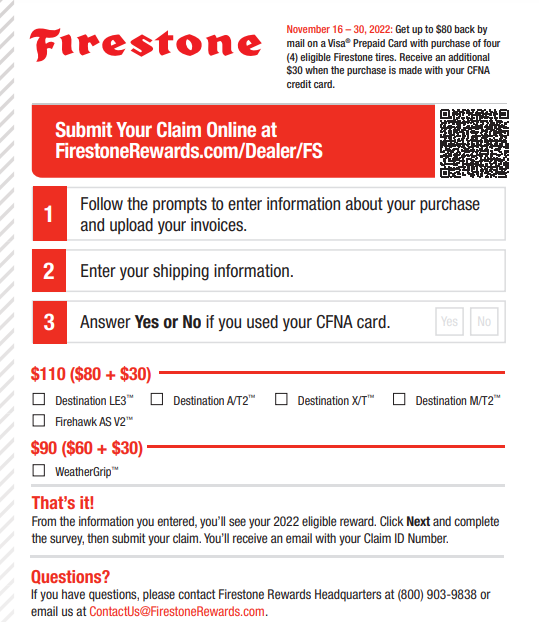

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Web 22 mai 2023 nbsp 0183 32 The IRS will send a letter to you in the event that the credit has not been properly applied The Recovery Rebate is available for federal income tax returns Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 28 juin 2023 nbsp 0183 32 vous avez b 233 n 233 fici 233 d une avance de r 233 duction ou de cr 233 dit d imp 244 t trop importante en janvier 2023 Web 13 avr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

Why Did Irs Change My Recovery Rebate Credit Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/why-did-irs-change-my-recovery-rebate-credit-768x304.png

What Is Recovery Rebate Credit 2023 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/what-is-recovery-rebate-credit-and-how-to-claim-it-in-2022-3.jpg

https://www.tigta.gov/sites/default/files/reports/2023-08/2023…

Web 24 ao 251 t 2023 nbsp 0183 32 payment or Recovery Rebate Credit potentially erroneous Recovery Rebate Credit What TIGTA Found The IRS correctly calculated the allowable

https://www.irs.gov/pub/taxpros/fs-2022-27.pdf

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

What If I Did Not Receive Eip Or Rrc Detailed Information

Why Did Irs Change My Recovery Rebate Credit Useful Tips

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

2023 Recovery Rebate Credi Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

Recovery Rebate Credit Married In 2023 Recovery Rebate

Council Tax Rebate Form 2023 Printable Rebate Form Recovery Rebate

Irs Recovery Rebate Credit Error 2023 - Web 23 mai 2022 nbsp 0183 32 Tax IRS sent over 800M in potentially improper recovery rebate payments By Michael Cohn May 23 2022 4 19 p m EDT 4 Min Read The Internal Revenue