Irs Renewable Energy Tax Credit 2023 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get Residential Clean Energy Credit Part I If you made energy saving improvements to more than one home that you used as a residence during 2023 enter the total of those costs

Irs Renewable Energy Tax Credit 2023

Irs Renewable Energy Tax Credit 2023

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Tax Credits Extended For Renewable Energy Urban Solar

https://urbansolar.com/wp-content/uploads/2015/12/tax-credits-extended-for-renewable-energy.jpg

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

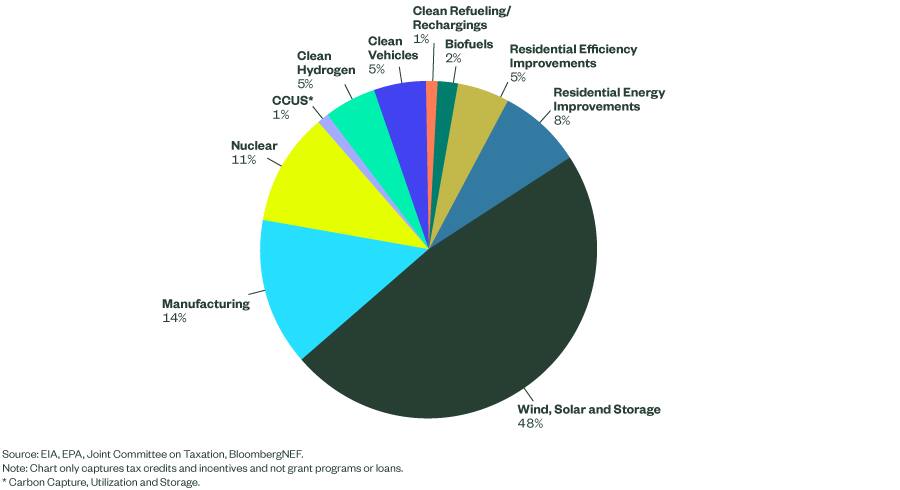

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q

Download Irs Renewable Energy Tax Credit 2023

More picture related to Irs Renewable Energy Tax Credit 2023

The Residential Renewable Energy Tax Credit Is Back Kroger Gardis

https://www.kgrlaw.com/wp-content/uploads/2018/02/Renewable-Energy-1024x682.jpg

IRS Form 5695 Residential Energy Tax Credits Step by Step Guide

https://i.ytimg.com/vi/jPnkaZv4M1g/maxresdefault.jpg

Clean Energy Tax Credit In Canada A1 SolarStore

https://a1solarstore.com/images/solar_blog_page/74/c64107325989b5c7fb937c11345990f3.png

Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin The US Internal Revenue Service IRS and US Department of the Treasury Treasury released proposed regulations on November 17 2023 addressing the

August 4 2023 Home energy audits may qualify for an Energy Efficient Home Improvement Credit August 7 2023 IRS Builders of qualified new energy The IRS has released proposed rules REG 101610 23 on transferring renewable energy credits The Inflation Reduction Act added IRC Section 6418 which allows an eligible

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

https://uploads.edisonenergy.com/2022/08/25153840/Picture1-2-640x301.png

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

https://phantom-marca.unidadeditorial.es/ac74621e18bc098b394c3393658acfb3/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/17/16739726135614.jpg

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get

Get Tax Credits For Energy Efficient Upgrades With The Residential

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

Inflation Reduction Act Impact On Energy Transition

The Residential Renewable Energy Tax Credit Is A Little known

IRS Treasury Propose Rules For Renewable Energy Tax Credits KM M CPAs

IRS Treasury Propose Rules For Renewable Energy Tax Credits KM M CPAs

Renewable Energy Tax Credits Iowa Utilities Board

IRS Updates On Residential Energy Credits Key Insights

Save Money With The Renewable Energy Tax Credit Raleigh NC Durham

Irs Renewable Energy Tax Credit 2023 - One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of