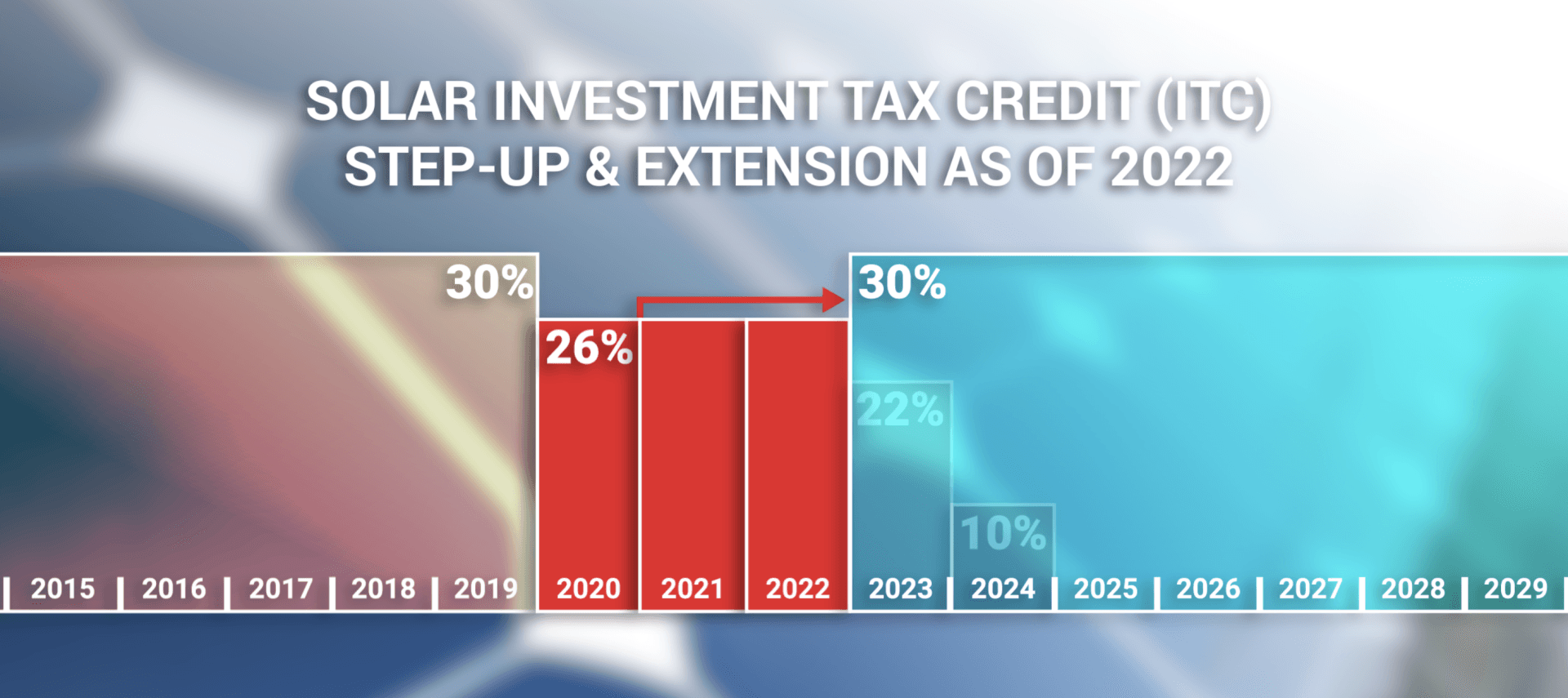

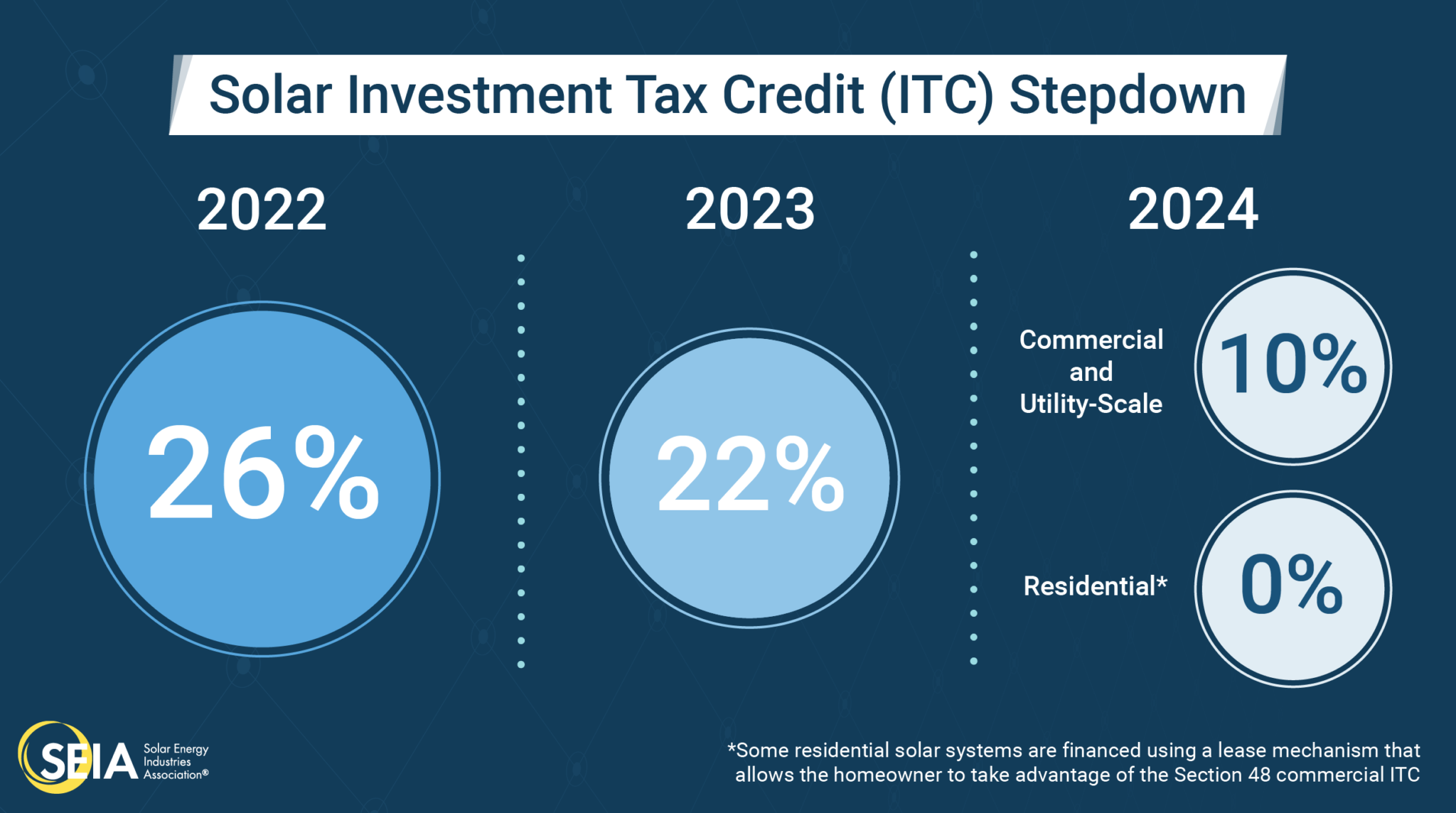

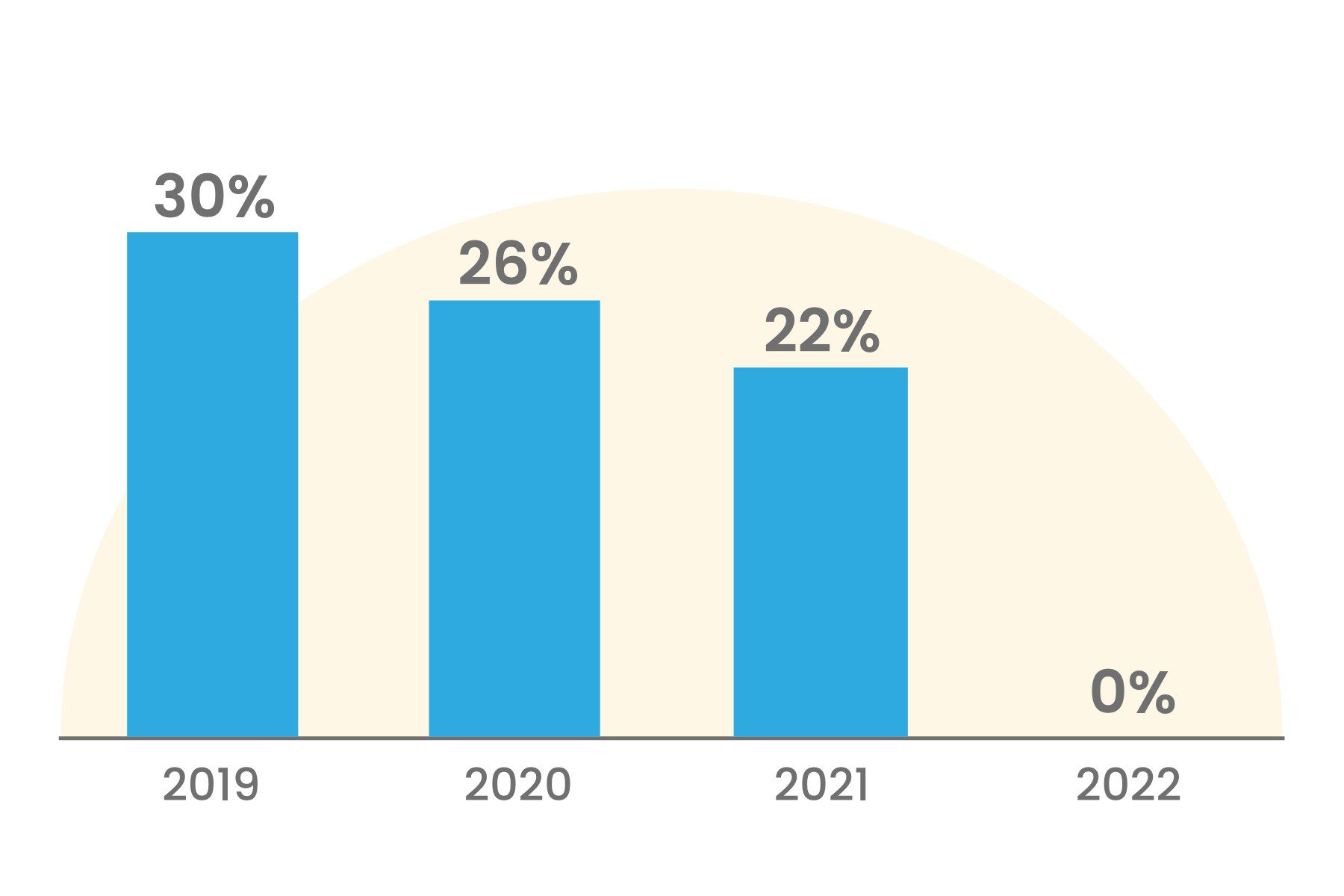

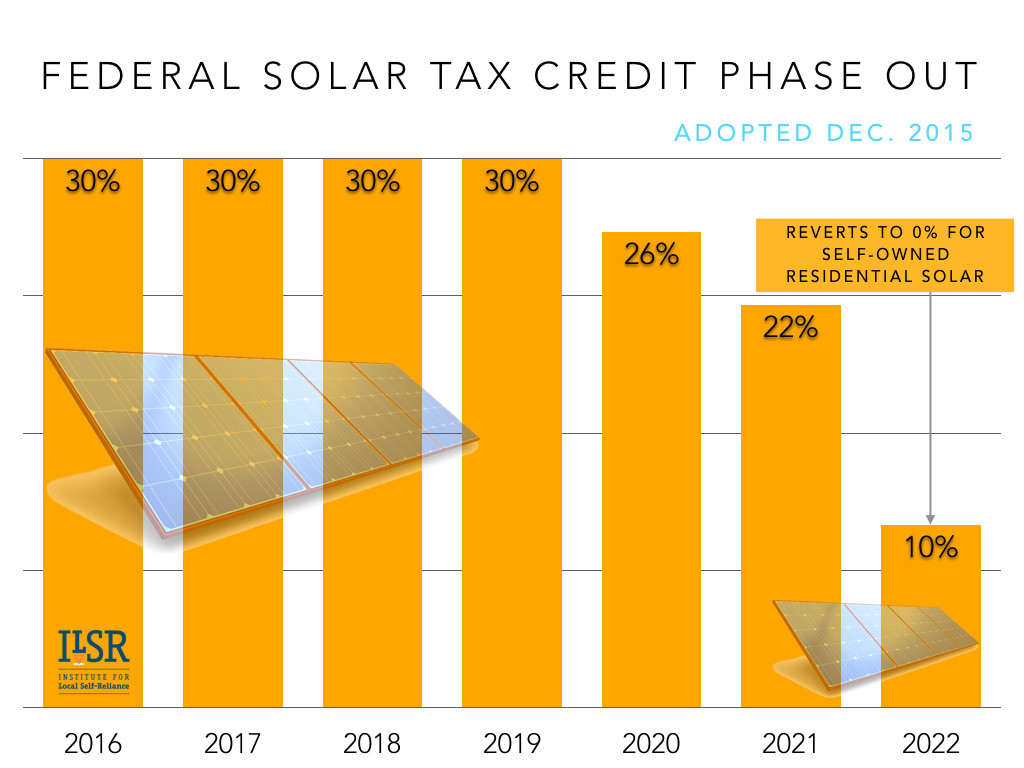

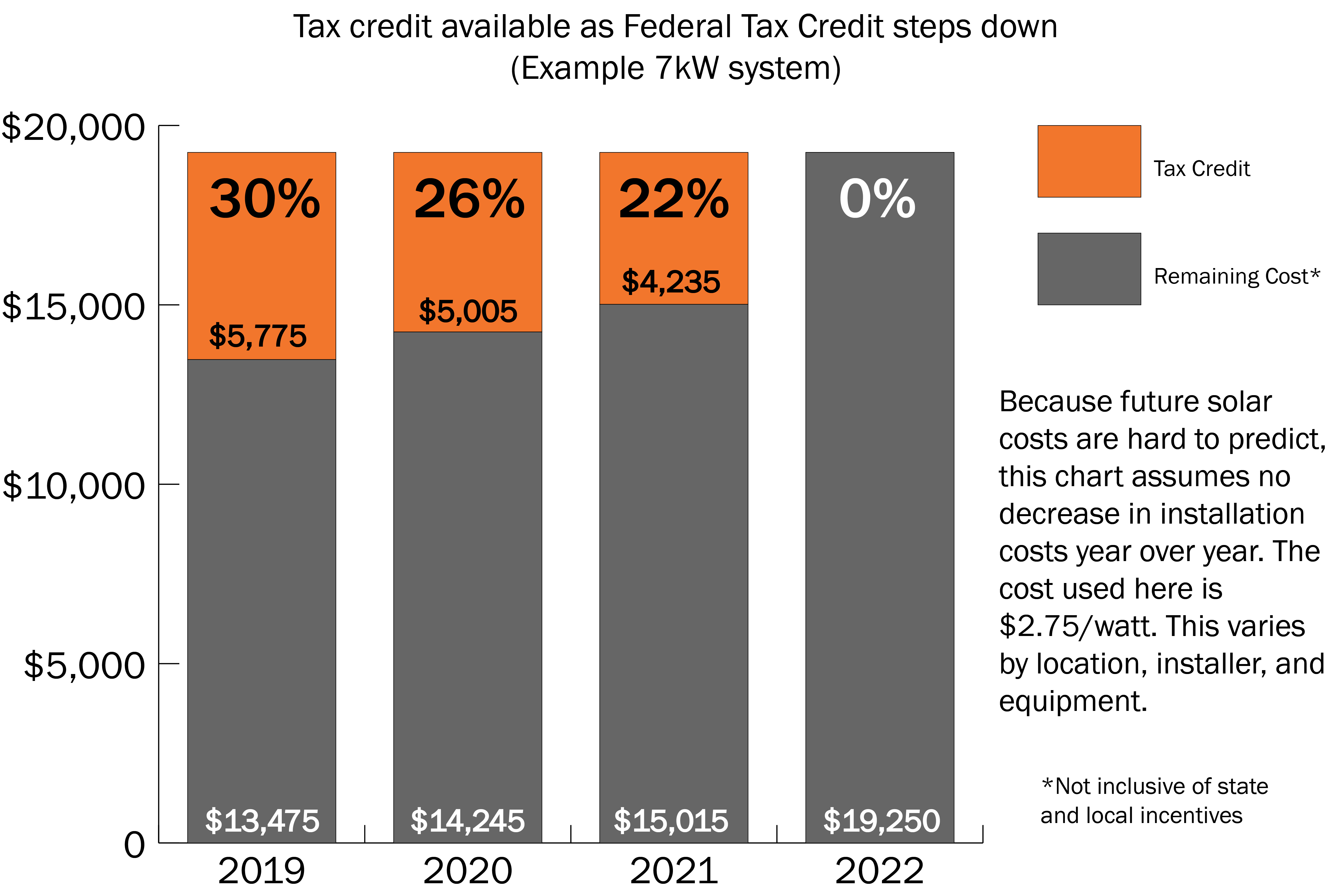

Irs Rules On Solar Tax Credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property Step 1 Check eligibility Make sure the property on which you are installing the energy property is eligible Located in the United States A new or existing home Make sure you are installing qualified energy property Solar electric panels Solar water heaters certified by the Solar Rating Certification Corporation or a comparable entity

Irs Rules On Solar Tax Credit

Irs Rules On Solar Tax Credit

https://pv-magazine-usa.com/wp-content/uploads/sites/2/2022/05/61c317382fb30420ae671c03_Group-238-p-1080.jpeg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

How To Claim The Solar Tax Credit IRS Form 5695

https://optiononesolar.com/wp-content/uploads/2021/10/ClaimingSolarITC.jpg

A1 The following residential clean energy expenditures are eligible for a Residential Clean Energy Property Credit of 30 of the cost solar electric property expenditures solar panels solar water heating property expenditures solar water heaters fuel cell property expenditures small wind energy property expenditures wind The answer depends heavily on your specific circumstances The IRS states in Questions 25 and 26 in its Q A on Tax Credits13 that off site solar panels or solar panels that are not directly on the taxpayer s home could still qualify for the residential federal solar tax credit under some circumstances

Installing solar panels or making other home improvements may qualify taxpayers for home energy credits Internal Revenue Service IRS Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home energy tax Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Download Irs Rules On Solar Tax Credit

More picture related to Irs Rules On Solar Tax Credit

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLD0u4VMgupTPJWuWOaZRVksaroCPw

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date Home energy tax credits Internal Revenue Service If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Solar Tax Benefits Guide Learn With Valur

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Solar Tax Credit Guide And Calculator

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The Federal Solar Tax Credit Increased Extended Solaria

The Federal Solar Tax Credit Increased Extended Solaria

Congress Gets Renewable Tax Credit Extension Right Institute For

Solar Tax Credit Graph without Header Solar United Neighbors

How The Solar Tax Credit Works

Irs Rules On Solar Tax Credit - A1 The following residential clean energy expenditures are eligible for a Residential Clean Energy Property Credit of 30 of the cost solar electric property expenditures solar panels solar water heating property expenditures solar water heaters fuel cell property expenditures small wind energy property expenditures wind