Irs Solar Rebate Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Irs Solar Rebate

Irs Solar Rebate

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

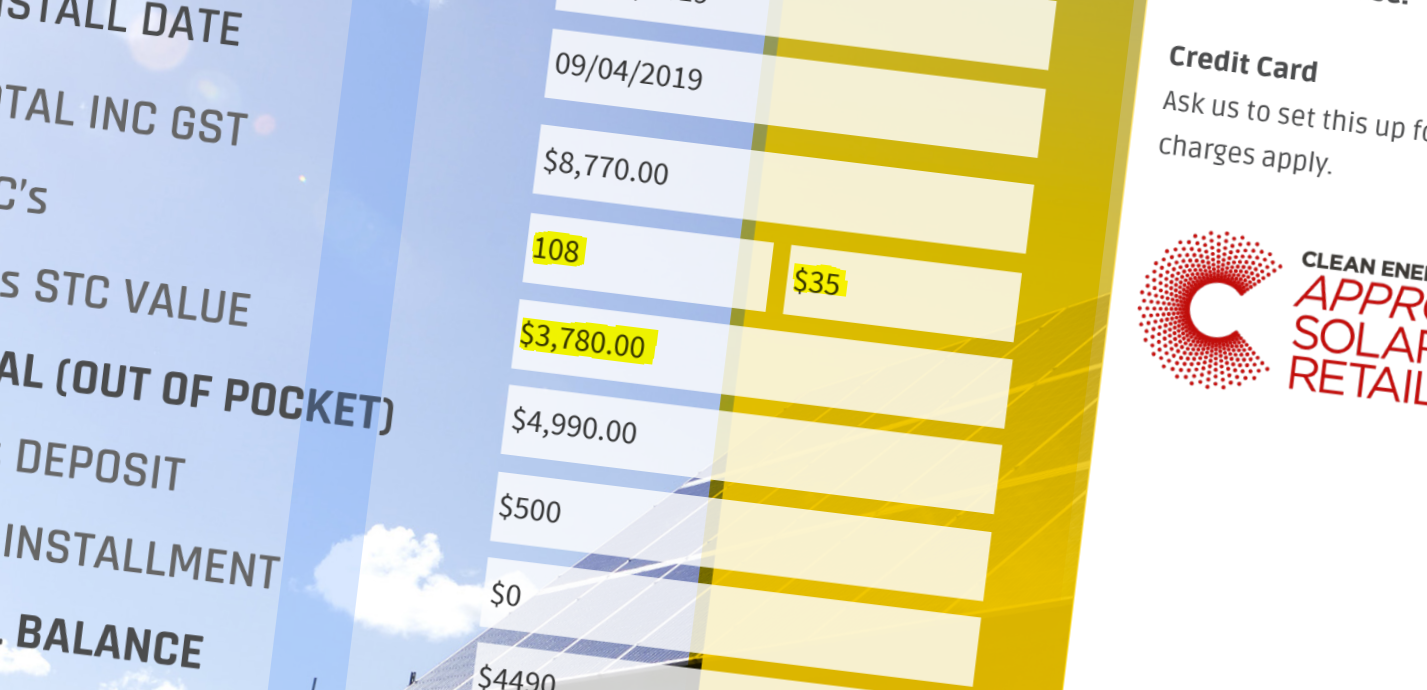

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

https://perthsolarwarehouse.com.au/wp-content/uploads/2019/04/Solar-Panels-Perth-WA-Rebate-PSW.png

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Web 27 avr 2021 nbsp 0183 32 Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date

Web Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040 1040 SR or 1040 NR OMB No 1545 0074 2022 Attachment Sequence No 158 Name s shown on return Your social security number Part I Residential Clean Energy Credit Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Download Irs Solar Rebate

More picture related to Irs Solar Rebate

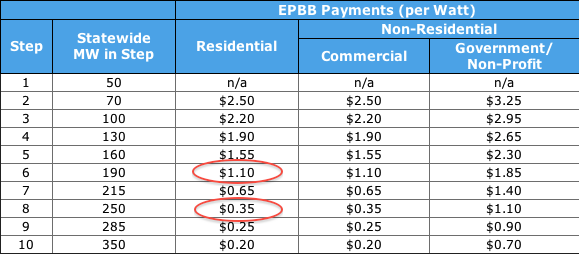

SoCal Edison Still Offers The Best Solar Rebate In California Here s Why

http://www.solar-california.org/wp-content/uploads/sites/2/2011/03/california-solar-rebate-levels-sce-03a93c2c.png

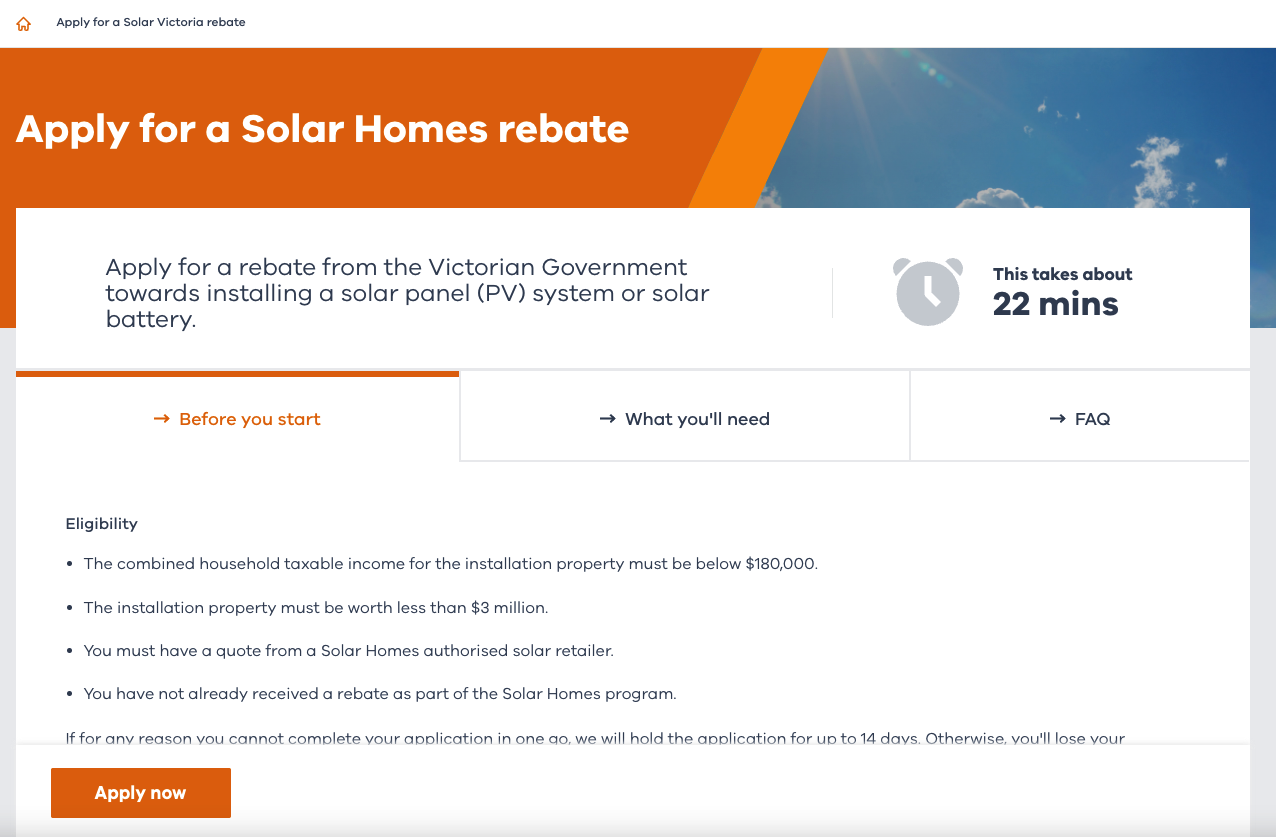

Solar Panel Rebate Victoria How It Works How To Claim

https://cyanergy.com.au/wp-content/uploads/2020/06/Solar-Panel-Rebate-by-Cyanergy.jpeg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Web 1 ao 251 t 2023 nbsp 0183 32 It will remain at 30 for the tax year 2023 through 2032 How does the solar tax credit work The solar tax credit allows you to use a part of the cost of a solar power system to reduce the Web 30 d 233 c 2022 nbsp 0183 32 See tax credits for 2022 and previous years The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 30 for property placed in service after December 31 2021 and before January 1 2033

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web The IRS has ruled the ITC can be claimed by U S corporations citizens or partnerships that own solar in U S territories however companies and individuals are not eligible to receive the tax benefits if they do not pay federal income tax which means most Puerto Ricans and Puerto Rican companies are ineligible Therefore solar assets in U

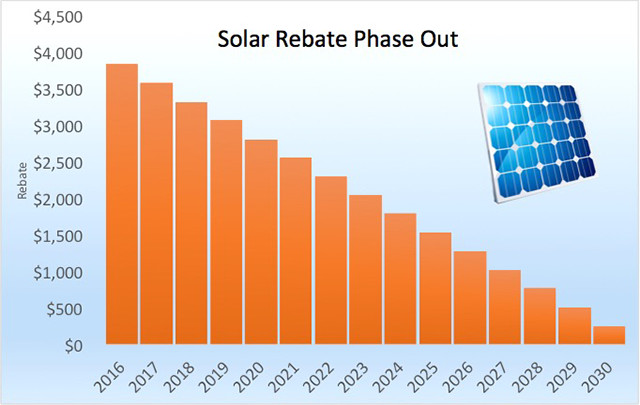

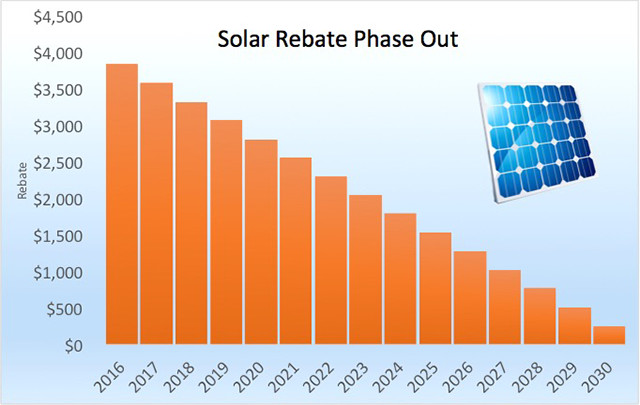

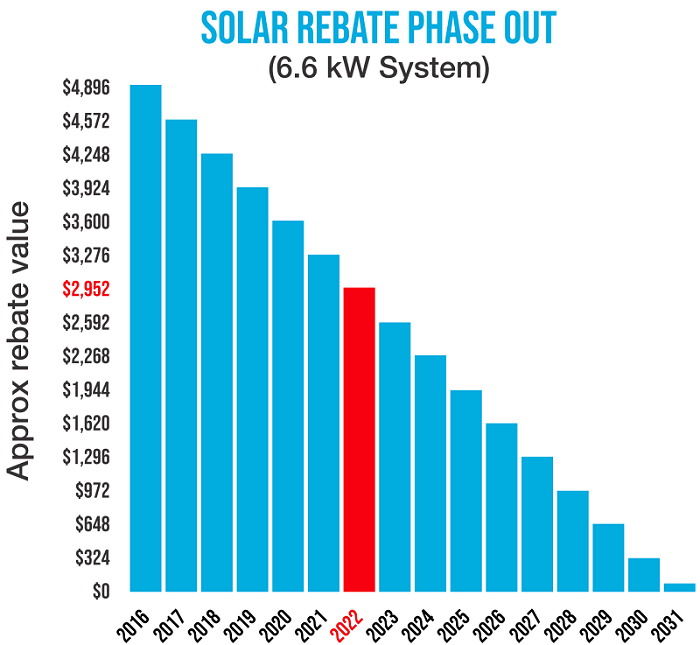

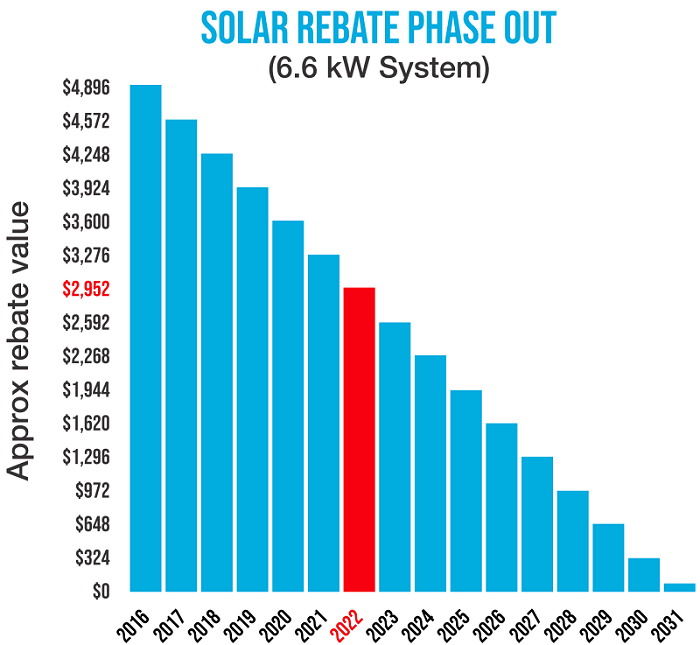

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

https://www.solarquotes.com.au/blog/wp-content/uploads/2016/05/solar-rebate-phase-out.jpg

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows

The Solar Rebate Is Not Ending Don t Be Fooled By Misleading Ads

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

Lower Commercial Solar Costs For Business With Rebates Forme Solar

Solar Rebate Victoria 2022 Printable Rebate Form

The Solar Rebates Ending Make The Most Of It While You Can

Solar 101 A Guide To Buying Solar Power Systems

Solar 101 A Guide To Buying Solar Power Systems

Minnesota Solar Power For Your House Rebates Tax Credits Savings

The Truth About The Solar Rebate SAE Group

Solar Rebate Vs Feed In Tariff Explainer Solar Quotes Blog

Irs Solar Rebate - Web 16 mars 2023 nbsp 0183 32 When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset your income tax liability dollar for dollar but any excess credit won t be refunded