Irs Solar Tax Credit 2022 For Business Federal Solar Tax Credits for Businesses This webpage was updated August 2023 Disclaimer This webpage provides an overview of the federal investment and production tax credits for businesses nonprofits and

The Inflation Reduction Act of 2022 IRA makes several clean energy tax credits available IRS gov CleanEnergy Tax Provision to businesses Description New Energy Updated Aug 1 2023 7 min read The best solar incentive is the federal investment tax credit ITC This is true for both home and business owners By crediting your taxes

Irs Solar Tax Credit 2022 For Business

Irs Solar Tax Credit 2022 For Business

https://powur.solar-energy-quote.com/wp-content/uploads/2022/02/2022-Solar-Tax-Credit-Explained-scaled.jpg

How To Claim Solar Tax Credit A Step by Step Guide

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

IRS Releases Guidance On Low income Solar Tax Credit Booster Pv

https://pv-magazine-usa.com/wp-content/uploads/sites/2/2022/05/61c317382fb30420ae671c03_Group-238-p-1080.jpeg

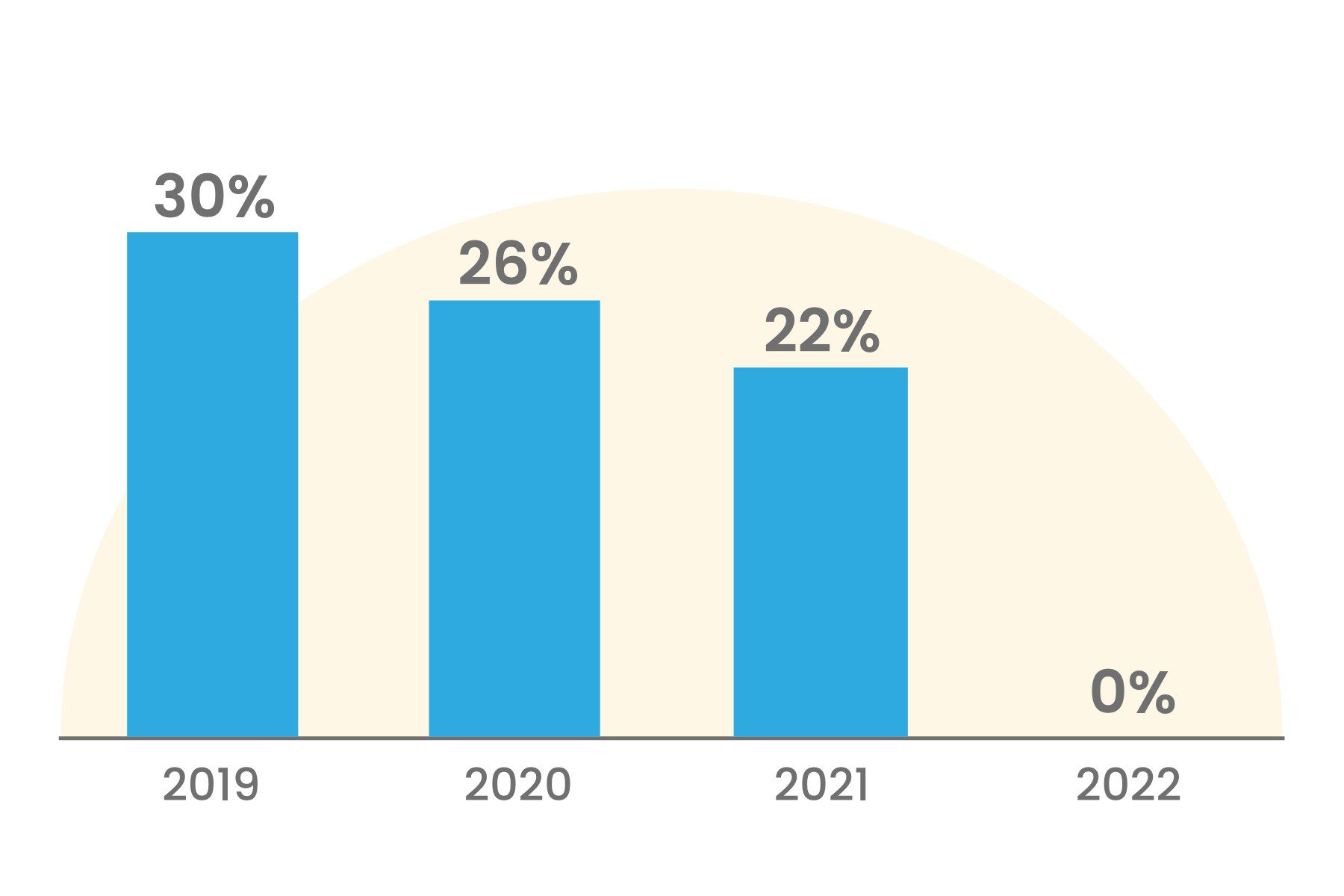

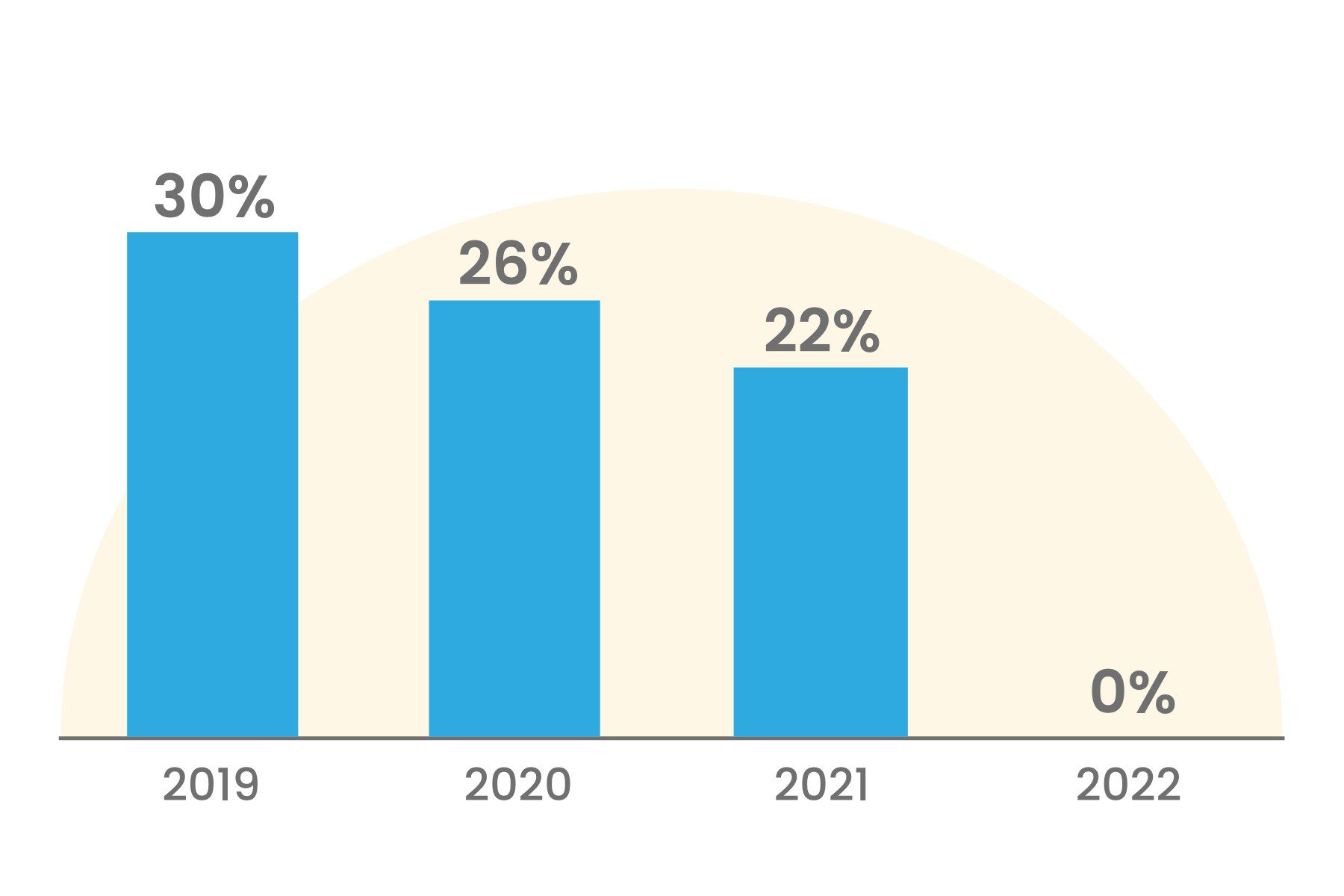

Overview The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems see the Homeowner s

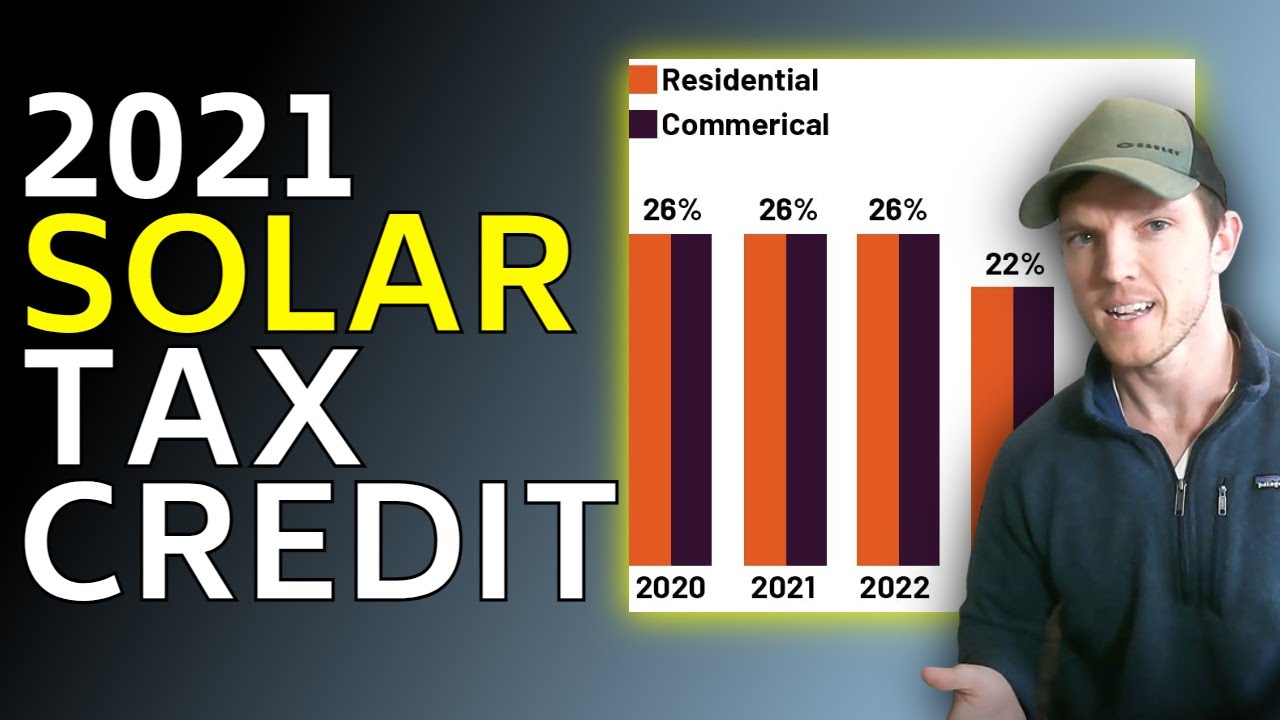

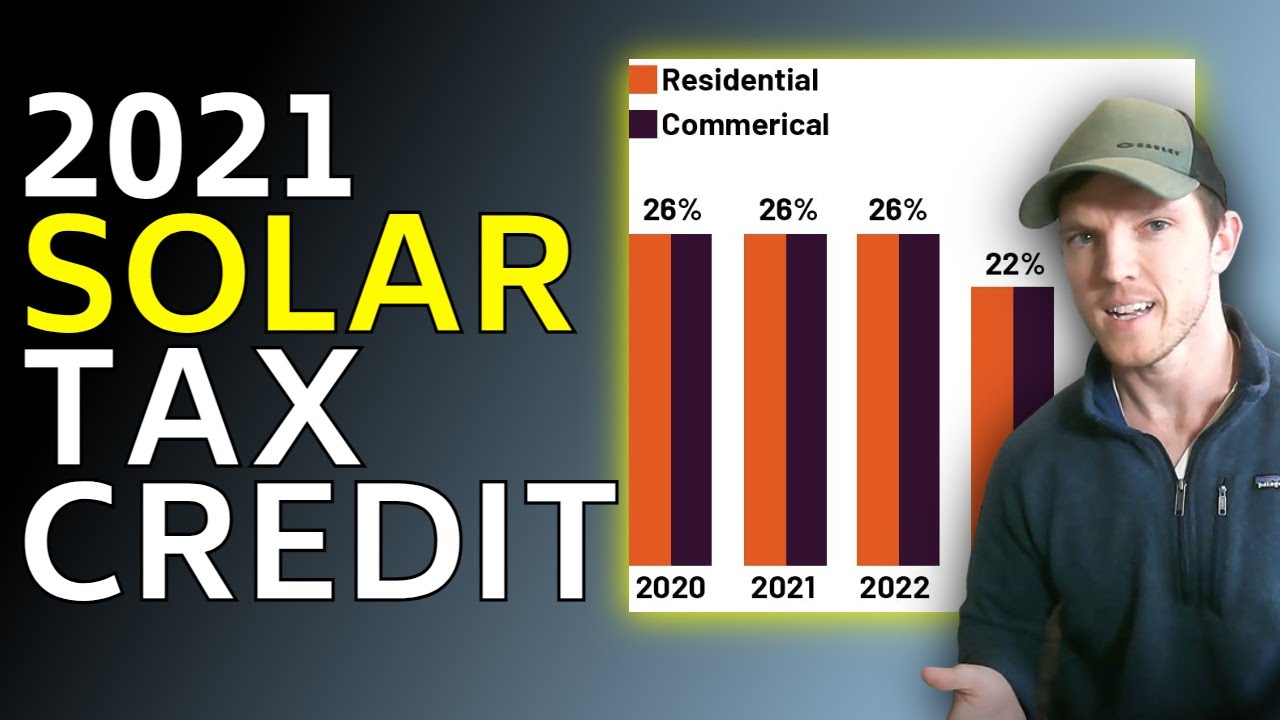

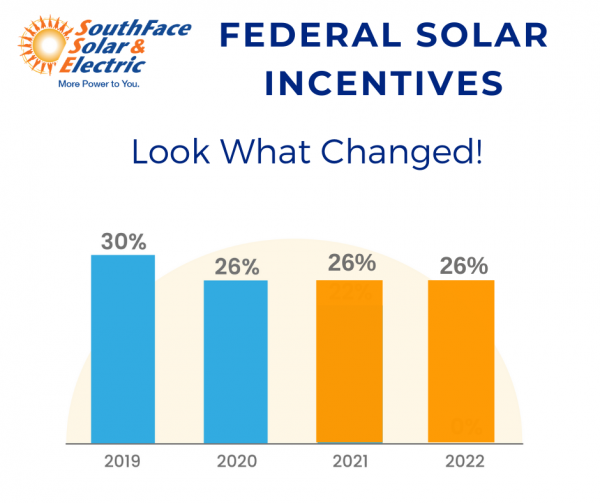

MOUNTAIN VIEW Calif BUSINESS WIRE Wallbox NYSE WBX a leading provider of electric vehicle EV charging solutions today announced that it has been 26 in 2020 2022 22 in 2023 10 in 2024 or later 0 for fiber optic solar energy property The credit automatically drops to 10 if your business doesn t

Download Irs Solar Tax Credit 2022 For Business

More picture related to Irs Solar Tax Credit 2022 For Business

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

https://i.ytimg.com/vi/X1SvVe3_JzA/maxresdefault.jpg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

5695 form energy irs credits renewable line solar claim credit if file purchase only How to file irs form 5695 to claim your renewable energy creditsCms For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales

The solar ITC in 2022 offers system owners a tax credit worth 26 of the total solar installation cost including all parts and labor So if you purchased a solar The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

https://i.ytimg.com/vi/u143Lcm-QG4/maxresdefault.jpg

IRS Solar Tax Credit Reroofing And Roof Repairs Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2023/05/Does-Solar-Tax-Credit-Cover-Reroof-or-Roof-Repairs-1-1080x675.webp

https://www.energy.gov/eere/solar/federal-solar...

Federal Solar Tax Credits for Businesses This webpage was updated August 2023 Disclaimer This webpage provides an overview of the federal investment and production tax credits for businesses nonprofits and

https://www.irs.gov/pub/irs-pdf/p5886.pdf

The Inflation Reduction Act of 2022 IRA makes several clean energy tax credits available IRS gov CleanEnergy Tax Provision to businesses Description New Energy

California Solar Tax Credit LA Solar Group

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

30 Solar Tax Credit The New 2022 Law YOU MIGHT NOT BE ELIGIBLE

Federal Solar Tax Credit BenefitsFinder

Solar Tax Credit Guide And Calculator

Solar Tax Credit Guide And Calculator

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

The Federal Solar Tax Credit What You Need To Know 2022

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 For Business - MOUNTAIN VIEW Calif BUSINESS WIRE Wallbox NYSE WBX a leading provider of electric vehicle EV charging solutions today announced that it has been