Irs Tax Charity Search The Tax Exempt Organization Search Tool You can check an organization s Eligibility to receive tax deductible charitable contributions Review information about the

Tax Exempt Organization Search Tax Exempt Organization Search Select Database Search All Pub 78 Data Auto Revocation List Determination Letters Form 990 N e Doing some research can help ensure donations go to legitimate and qualified charities and help donors avoid scams The IRS s Tax Exempt Organization

Irs Tax Charity Search

Irs Tax Charity Search

https://i.ytimg.com/vi/_iKc9dh4wbY/maxresdefault.jpg

Don t Panic The Government Shutdown Won t Hurt Your Tax Deduction

https://www.donateforcharity.com/wp-content/uploads/2013/10/irs-car-donation-tax-deduction-e1381639923844.jpg

CoinStats Researchers Propose New IRS Tax Framework For

https://cryptodailycdn.ams3.cdn.digitaloceanspaces.com/crypto-tax-h.jpg

Find tax information for charitable organizations including exemption requirements the application for recognition of exemption required filings and more Look up nonprofits and identify prospects with Candid s GuideStar Candid s GuideStar provides information on nonprofits to help you compile IRS nonprofit organization lists and verify 501 c 3 status for potential

Learn more about the benefits limitations and expectations of tax exempt organizations by attending 10 courses at the online Small to Mid Size Tax Exempt Easily search 1 8 million IRS recognized tax exempt organizations and thousands of faith based nonprofits Gather insights on financials people leadership mission and more Quality Authoritative data

Download Irs Tax Charity Search

More picture related to Irs Tax Charity Search

Success Story 300 Total IRS Solution Tax Law Offices Business Tax

https://www.stopirsproblem.com/wp-content/uploads/2022/03/Success-Story-300-IRS-Solution-Tax-Law-Offices-Tax-Lawyer-Naperville-IL.jpg

Offer In Compromise How This IRS Tax Settlement Program Works

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64be714b96697a59a9fd099b_BenchBlog_TaxTips_OfferinCompromise.png

Tips For Removing An IRS Tax Lien From Public Records

https://www.moneysolver.org/wp-content/uploads/2022/10/irs-tax-lien.webp

Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return Form W 4 Employee s Withholding Certificate The Exempt Organizations Business Master File Extract or EO BMF provides information about an organization from the Internal Revenue Service s Business Master File This is

Candid s 990 Finder provides the most recent publicly available 990s from the IRS and the IRS is significantly delayed in processing nonprofit filings so documents available here Since 2013 the IRS has released data culled from millions of nonprofit tax filings Use this database to find organizations and see details like their executive

IRS Plans To Collect Millions Of Dollars In Back Taxes

https://ktar.com/wp-content/uploads/2023/09/IRS_Millionaire_Crackdown_25879-scaled.jpg

Are You Behind On Your Payroll Tax Filings Or Payments IRS Solutions

https://secureservercdn.net/198.71.233.52/03y.6ac.myftpupload.com/wp-content/uploads/2022/01/IRS-Solutions-Kix-01-01-2-1.png

https://www.irs.gov/charities-non-profits/search...

The Tax Exempt Organization Search Tool You can check an organization s Eligibility to receive tax deductible charitable contributions Review information about the

https://apps.irs.gov/app/eos

Tax Exempt Organization Search Tax Exempt Organization Search Select Database Search All Pub 78 Data Auto Revocation List Determination Letters Form 990 N e

Qualified Charitable Distributions Are Great Options For Making Tax

IRS Plans To Collect Millions Of Dollars In Back Taxes

What Assets Can The IRS Seize Optima Tax Relief

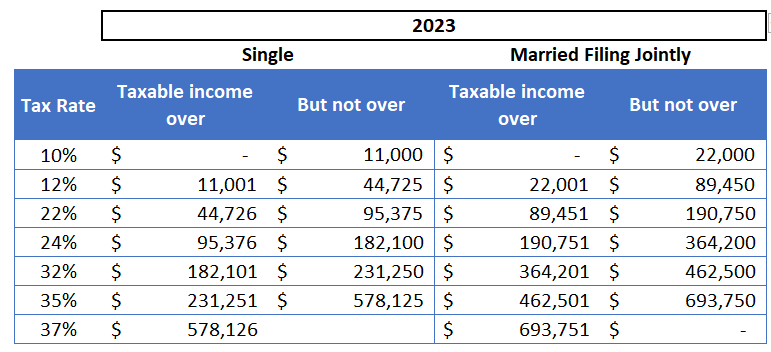

2023 IRS Contribution Limits And Tax Rates

IRS Tax Criteria For Charitable Organizations

IRS To Pay Attorneys Fees The Qualified Qualified Offer

IRS To Pay Attorneys Fees The Qualified Qualified Offer

Freelance Accounting Personal Tax Services

15M Study To Have IRS File Your Taxes RealClearInvestigations

Extended Tax Returns Are Due By October 15th Last Chance To Avoid

Irs Tax Charity Search - Look up nonprofits and identify prospects with Candid s GuideStar Candid s GuideStar provides information on nonprofits to help you compile IRS nonprofit organization lists and verify 501 c 3 status for potential