Irs Tax Credit For Hvac 2023 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

Irs Tax Credit For Hvac 2023

Irs Tax Credit For Hvac 2023

https://www.thecooldown.com/wp-content/uploads/2023/03/WXeB-gLf-YYifeLczQZHnsPc2zoidhRrVucmCLcQzrM.jpeg

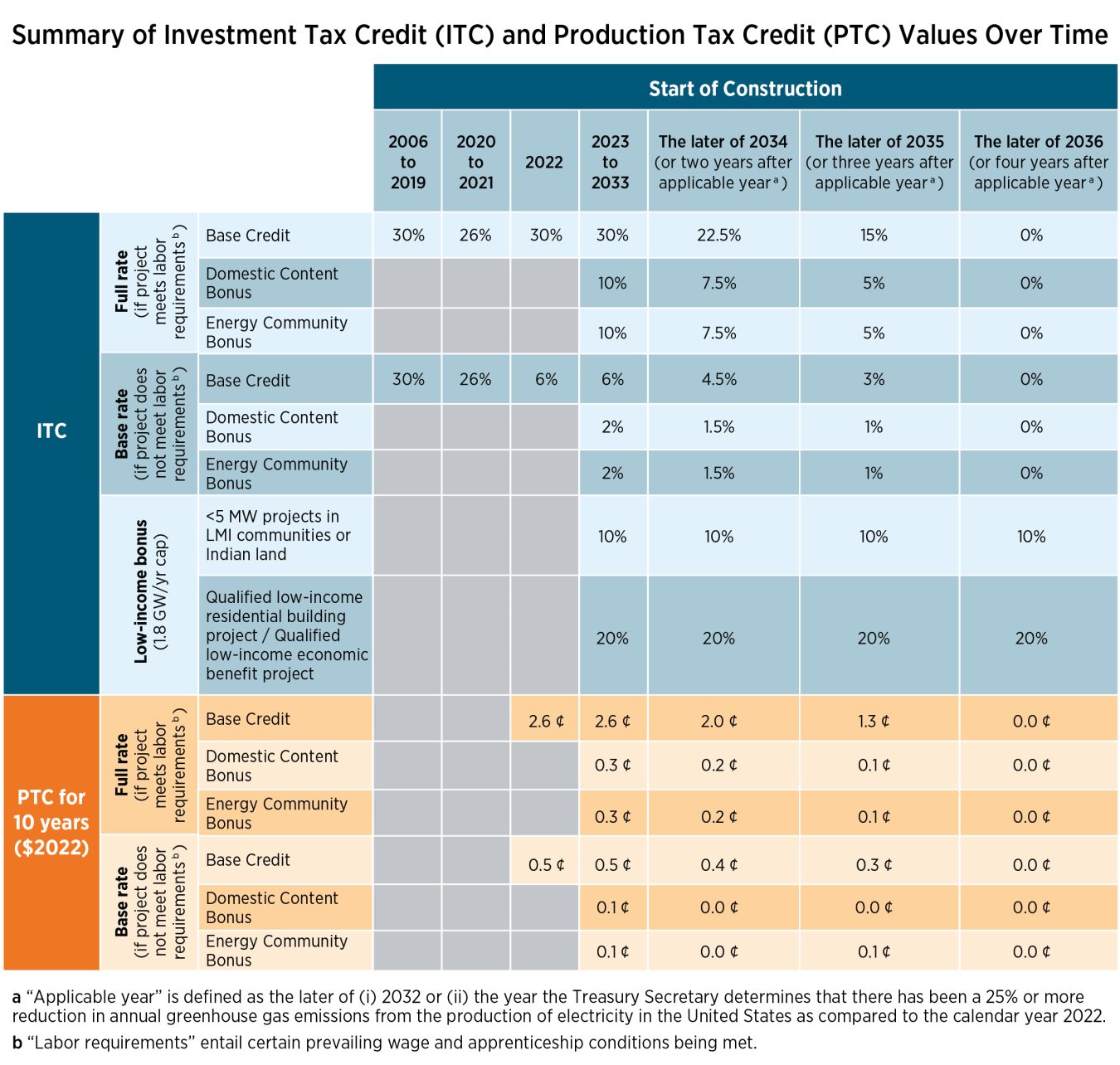

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation The dollar limit that this credit

Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download Irs Tax Credit For Hvac 2023

More picture related to Irs Tax Credit For Hvac 2023

2 000 Tax Credit For Heat Pumps Air Conditioners Installed 2023

https://airconditioningarizona.com/wp-content/uploads/2023/02/[email protected]

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

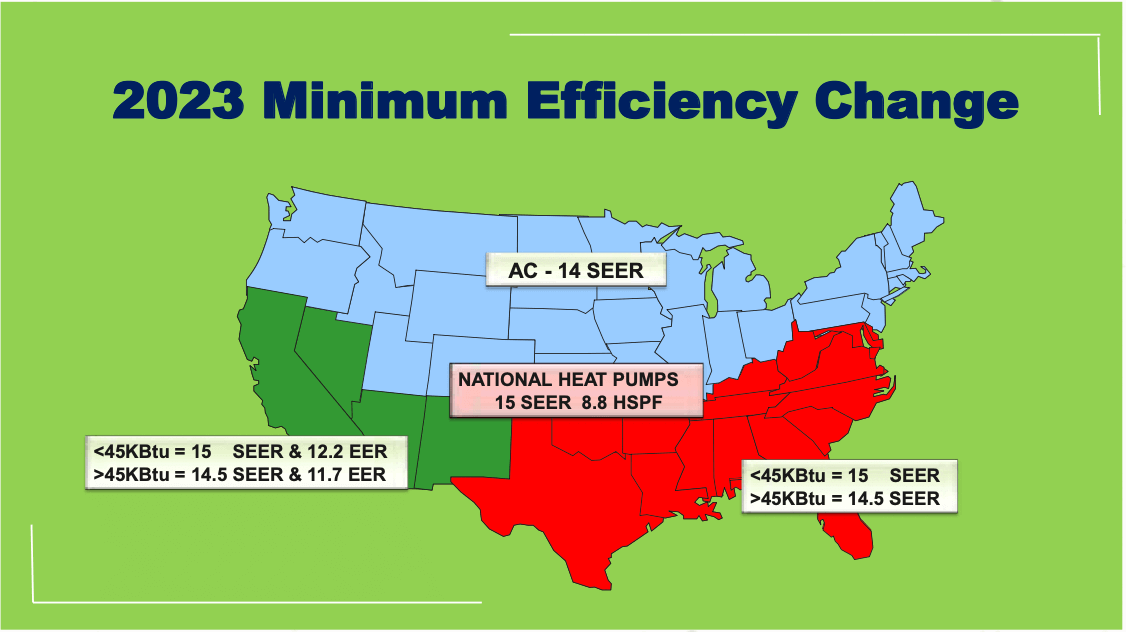

What You Need To Know About HVAC Changes In 2023 Derr Heating And Cooling

https://derrheating.com/wp-content/uploads/2022/12/2023-minimum-efficiency-change.png

The Inflation Reduction Act extended certain energy related tax breaks and indexed for inflation the energy efficient commercial buildings deduction beginning with The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Purchase a qualifying HVAC system Install the system into your home labor costs qualify for tax credit Fill out the IRS Form 5695 during tax preparation Submit Form 5695 with your tax return 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy efficient building property The residential energy property credit is

Insulation Tax Credit For 2023 Insulwise

https://www.insulwise.com/wp-content/uploads/2023/06/Insulwise-insulation-tax-credit-2023-1024x512.jpg

Pakistan HVACR Society 28th Expo Conference 2023 Pakistan HVACR

https://hvacr.org.pk/wp-content/uploads/2023/01/301138177_10159537236749300_225744375688791285_n.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the

https://www.irs.gov/newsroom/irs-going-green-could...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

Insulation Tax Credit For 2023 Insulwise

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

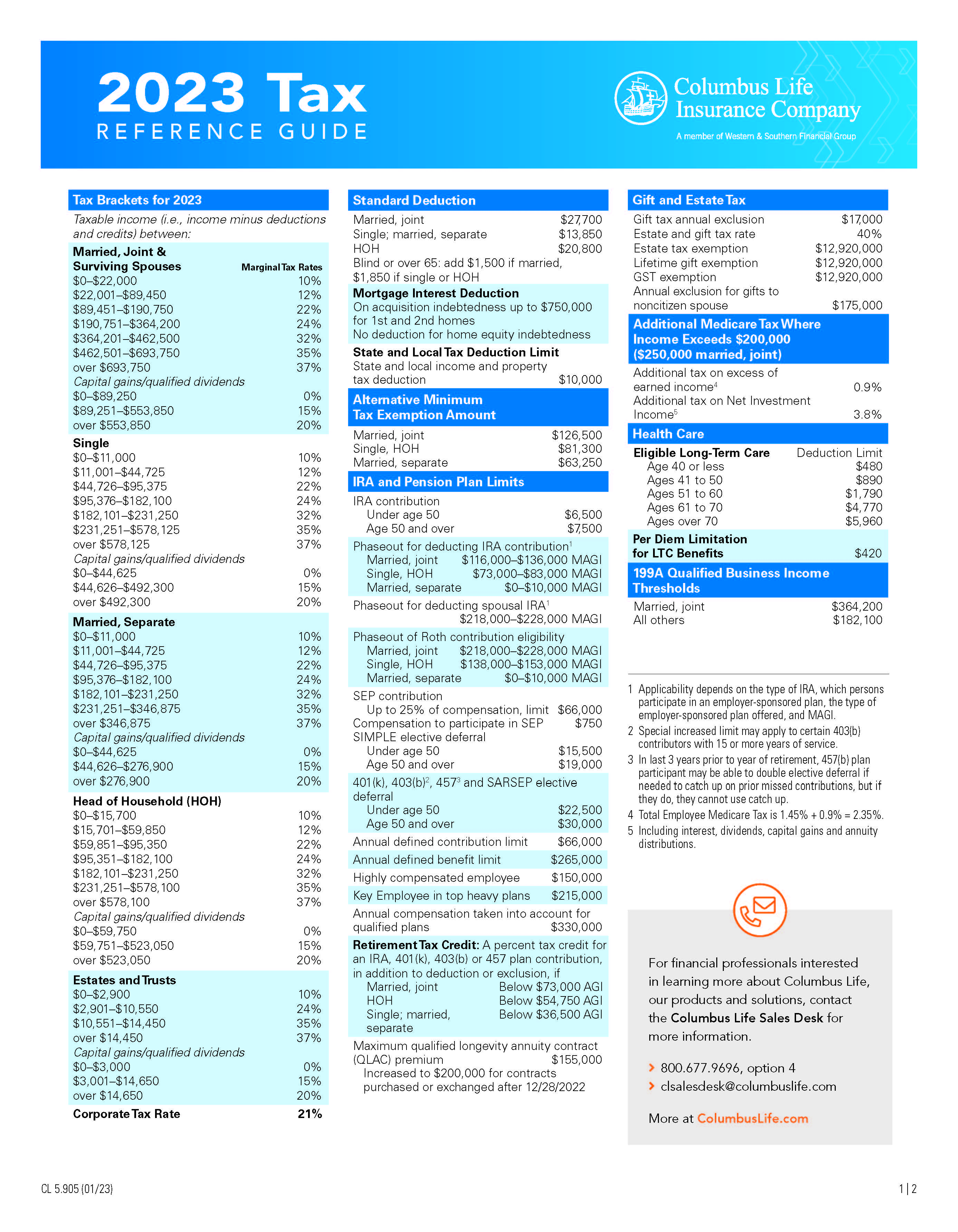

2023 Taxes Clarus Wealth

AZ HVAC Tax Credit Save Money With HVAC Purchase Mark Daniels Air

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

2023 Home Energy Federal Tax Credits Rebates Explained

HVAC Tax Credit For Jackson TN Residents 2023 Cagle Service Heating

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Irs Tax Credit For Hvac 2023 - Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be