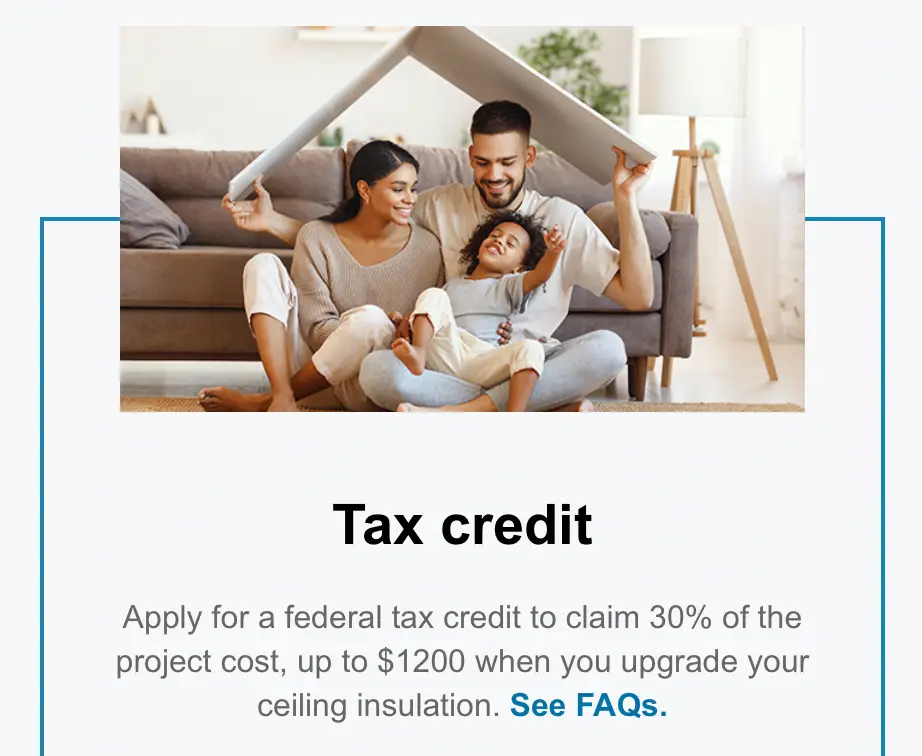

Irs Tax Credit Insulation 2023 This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Claim the credits using the IRS Form 5695

The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 We ll help you compare the credits and decide whether they apply to expenses you ve already paid or will apply to Enter the total of the preceding credit s adjustment s only if allowed and taken on your 2023 income tax return Not all credits adjustments are available for all years nor for all filers See

Irs Tax Credit Insulation 2023

Irs Tax Credit Insulation 2023

https://yellowbluetech.com/wp-content/uploads/2023-insulation-tax-credit.jpg

Everything About Log Home Insulation Loghouses au

https://loghouses.com.au/wp-content/uploads/2019/07/ceilinginsulation.jpg

Insulation Boards

https://www.kingspan.com/content/dam/kingspan/kil/products/therma-tr26-mena/kingspan-therma-tr26-product-render-board.png/jcr:content/renditions/cq5dam.web.1280.1280.png

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products TAX CREDIT AVAILABLE FOR 2023 2032 TAX YEARS Home Clean Electricity Products Solar electricity 30 of cost Insulation materials 30 of cost Windows including skylights 30 of cost up to 600 What

The Renewable Energy tax credits have also been extended and now will be available through the end of 2023 These include incentives for Geothermal Heat Pumps The federal legislation includes a long list of tax credits to help homeowners afford everything from new insulation to electric appliances

Download Irs Tax Credit Insulation 2023

More picture related to Irs Tax Credit Insulation 2023

OG Insulation Patrickswell Limerick

http://www.sfb.ie/filedepot/logos/OG INSULATION BANNER.jpg

Roof Insulation Board

https://www.kingspan.com/content/dam/kingspan/kil/products/therma-tr22-mena/kingspan-therma-tr22-product-render-board.png/jcr:content/renditions/cq5dam.web.1280.1280.png

Insulation Boards

https://www.kingspan.com/content/dam/kingspan/kil/products/greenguard-mena/kingspan-greenguard-product-render-board.png/jcr:content/renditions/cq5dam.web.1280.1280.png

As part of President Biden s Investing in America agenda American families can lower their energy costs by upgrading home appliances insulating their homes and making energy efficient improvements thanks to a For qualifying property placed in service after 2022 the nonbusiness energy property credit has been expanded and renamed as the energy efficient home improvement credit

If you checked the No box for line 21a or 21b you cannot claim the credit for your residential energy property costs Skip lines 22 through 25 and line 29 For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime

What Does R 5 Insulation Mean Storables

https://storables.com/wp-content/uploads/2023/11/what-does-r-5-insulation-mean-1699467826.jpg

Tips For Removing An IRS Tax Lien From Public Records

https://www.moneysolver.org/wp-content/uploads/2022/10/irs-tax-lien.webp

https://www.energystar.gov/about/federal …

This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Claim the credits using the IRS Form 5695

https://www.irs.gov/.../home-energy-tax-cr…

The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 We ll help you compare the credits and decide whether they apply to expenses you ve already paid or will apply to

AWS Q2 Earnings Report 2023

What Does R 5 Insulation Mean Storables

What Insulation For 2X6 Walls Storables

Assured Insulation Solutions LLC

Are You Behind On Your Payroll Tax Filings Or Payments IRS Solutions

IRS Tax Credit Spray Foam Insulators

IRS Tax Credit Spray Foam Insulators

FPL Insulation Rebate And IRS Tax Credit Program Spray Foam

What Assets Can The IRS Seize Optima Tax Relief

IRS Tax Notice Could Be Error IRS CP14 Letter

Irs Tax Credit Insulation 2023 - The federal legislation includes a long list of tax credits to help homeowners afford everything from new insulation to electric appliances