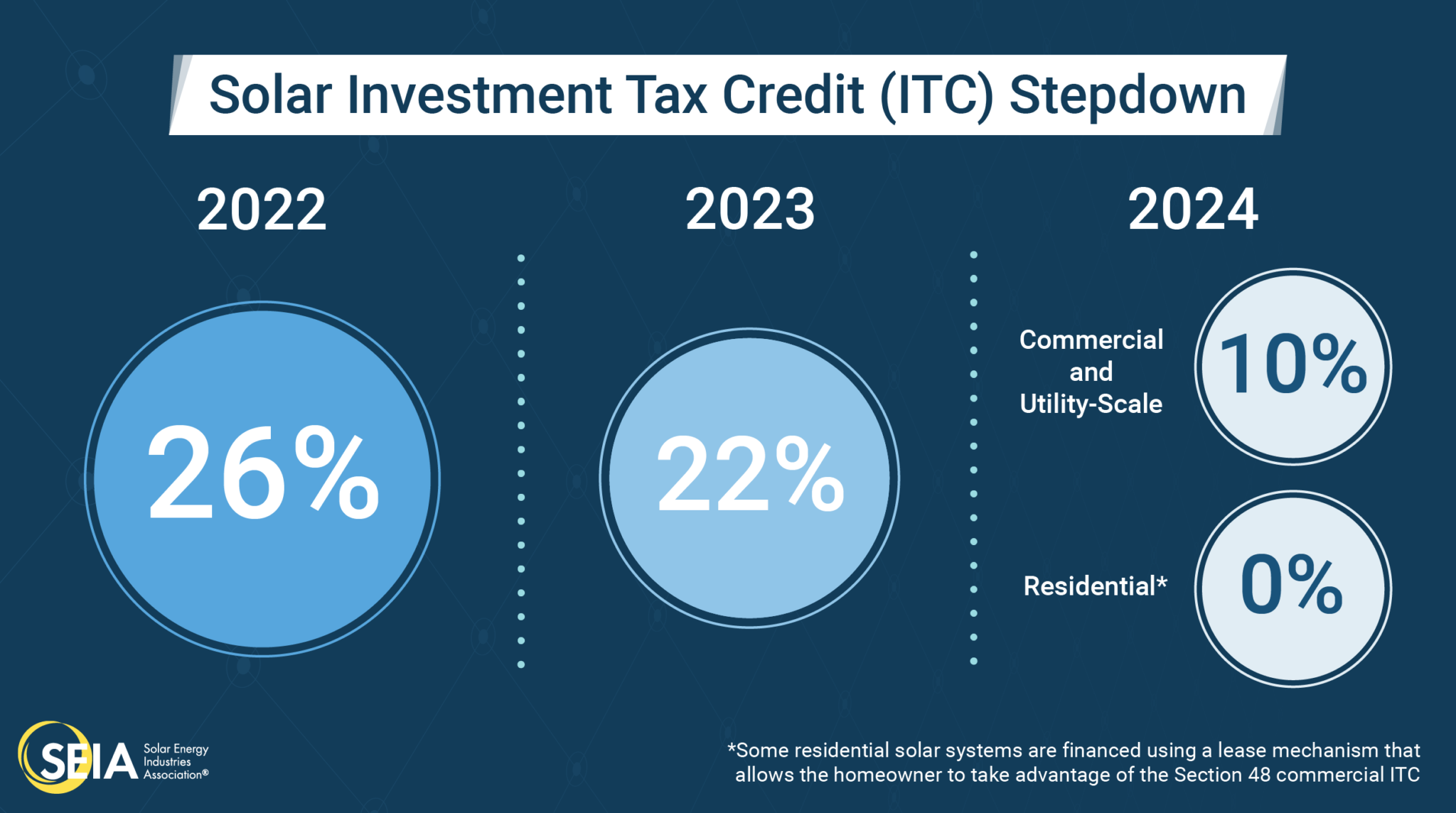

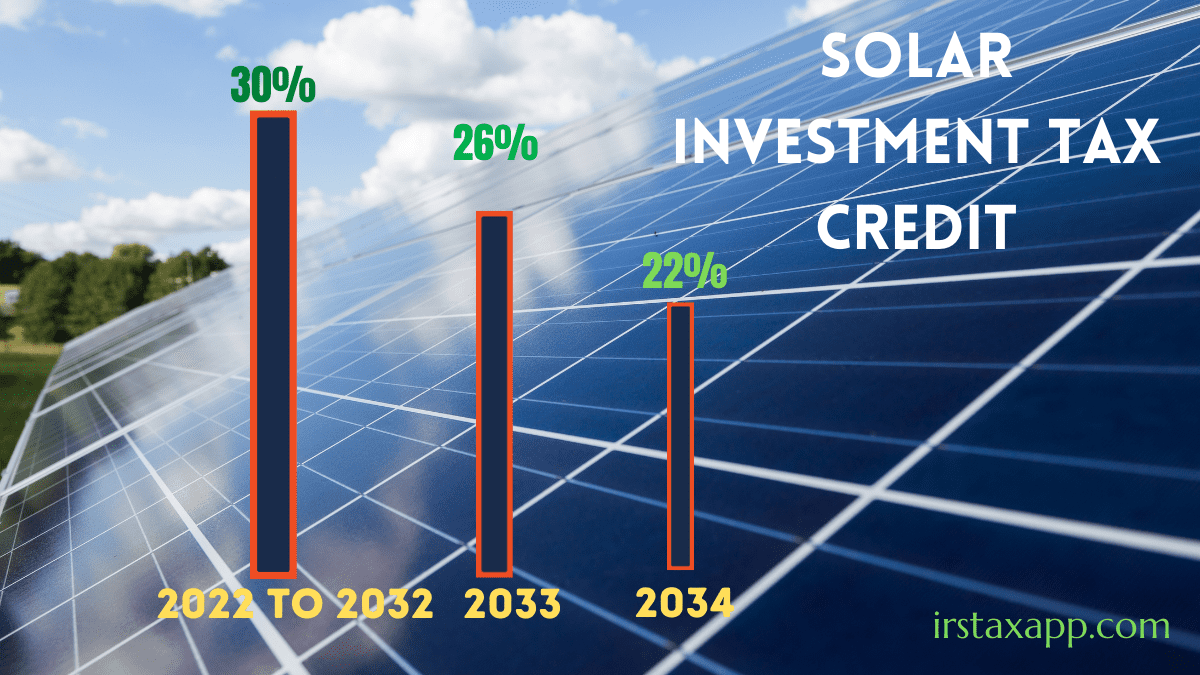

Irs Tax Credit On Solar Panels Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed

These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a

Irs Tax Credit On Solar Panels

Irs Tax Credit On Solar Panels

https://njsolarpower.com/wp-content/uploads/2022/03/iStock-1321546707.jpg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Federal Tax Credit On Solar Installation Resnick Roofing

https://cmsplatform.blob.core.windows.net/wwwresnickroofcom/offers/images/large/1d39721a-394d-4033-9794-39ee8150ab2e.jpg

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump ahead

To claim the solar tax credit you ll need all the receipts from your solar installation as well as IRS form 1040 and form 5695 and instructions for both of those forms We ve included an example below of how to fill out the tax The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction

Download Irs Tax Credit On Solar Panels

More picture related to Irs Tax Credit On Solar Panels

Does A New Roof Qualify For The Solar Investment Tax Credit Florida

https://djh4x3uvkdok.cloudfront.net/resources/20210618205145/Solar-Panels-On-A-Roof-Get-A-Tax-Credit.jpg

Is Solar Power Really Worth The Investment Hot Solar Solutions

https://www.hotsolarsolutions.com/wp-content/uploads/2020/04/88570932_l.jpg

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Adding solar panels to your home can save you money not only on your utility bills but also at tax time That s because installing solar panels is one of the The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your Here are key details What Is the Solar Tax Credit If you install solar energy equipment in your residence any time this year through the end of 2032 you are

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

https://www. energy.gov /eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed

https://www. irs.gov /newsroom/irs-releases...

These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Federal Solar Tax Credits For Businesses Department Of Energy

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

What Happens When You Pay Off Your Solar Panels Energy Theory

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Residential Clean Energy Credit Guide ReVision Energy

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Irs Tax Credit On Solar Panels - How to claim the solar tax credit IRS Form 5695 instructions By Ben Zientara Updated 02 12 2024 Note The information below can be used if filing taxes