Irs Tax Credit Solar Panels The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy

Irs Tax Credit Solar Panels

Irs Tax Credit Solar Panels

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

U S Solar Shares Rise On Hopes For Tax Credit Extension Solar Solar

https://i.pinimg.com/originals/e2/01/d7/e201d7a1c257b184141158e57d10b661.jpg

How Solar Panels Can Earn You A Big Tax Credit CNET

https://www.cnet.com/a/img/resize/4ded0ed813a5e958493599572031b603bb9a4d61/hub/2022/02/17/21bac0be-4b9a-4652-b864-ef0320c496b2/gettyimages-172263059.jpg?auto=webp&width=1200

What is the federal solar tax credit a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar

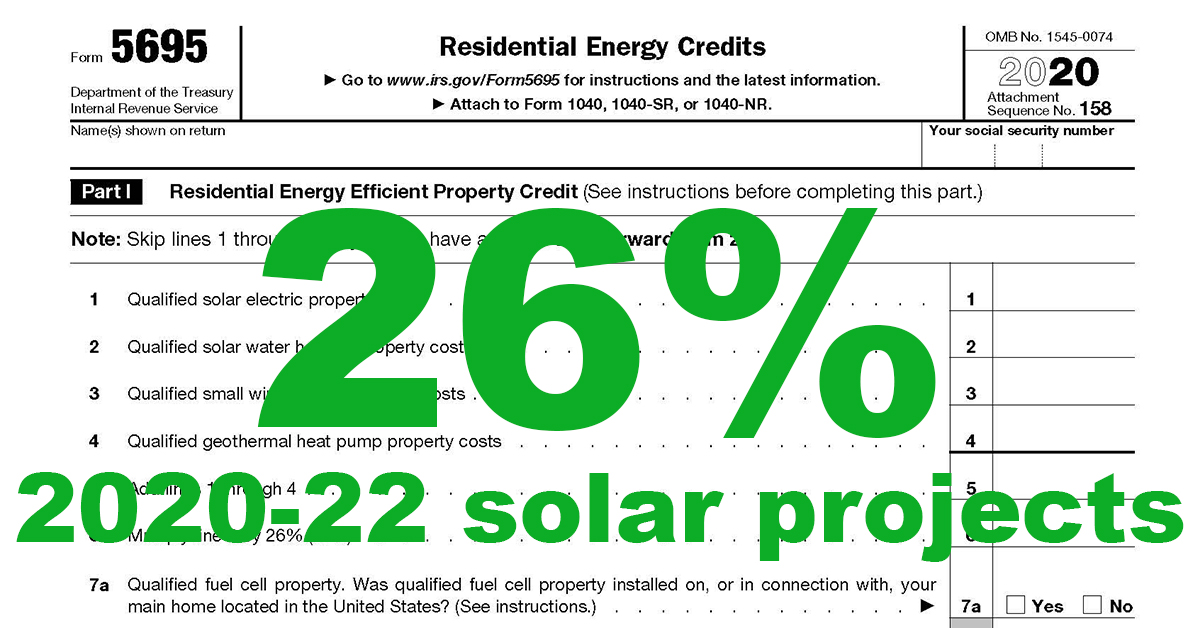

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

Download Irs Tax Credit Solar Panels

More picture related to Irs Tax Credit Solar Panels

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy Credit to lower your tax bill Here are the steps to claim the solar tax credit Fill out IRS Form 5695 and include it in your tax return In Part I calculate the amount of the tax credit

Under the ITC the Internal Revenue Service IRS provides nonrefundable tax credits for energy improvement upgrades to your home or rental property such as installing a How can I use federal tax credits to get solar panels Homeowners can take advantage of the Residential Solar Investment Tax Credit ITC and Energy Storage ITC From

Utah State Solar Tax Credit Lanette Huber

https://i.pinimg.com/originals/08/f8/7e/08f87e7239d73ae06d9a37a65f1a1c7b.jpg

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

https://geoscapesolar.com/wp-content/uploads/2021/10/ITC-Infographic-768x520-1.jpg

https://www.energy.gov/eere/solar/hom…

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

https://www.irs.gov/newsroom/installing-solar...

Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home

Irs Solar Tax Credit 2022 Form

Utah State Solar Tax Credit Lanette Huber

The 30 Solar Tax Credit Has Been Extended Through 2032

Irs Solar Tax Credit 2022 Form

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

Puget Sound Solar LLC

Puget Sound Solar LLC

Colorado Government Solar Tax Credit Big History Blogger Photography

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

FOUR SQUARE CONSTRUCTION Everything You Need To Know About Solar

Irs Tax Credit Solar Panels - For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs