Irs Tax Credits For Heat Pumps Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75 qualify for a credit Qualified improvements include new Electric or natural In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Irs Tax Credits For Heat Pumps

Irs Tax Credits For Heat Pumps

http://climatecontrolinc.com/wp-content/uploads/AC-repair-8_9-1-scaled-e1665694734965.jpg

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/iStock-1444118278.jpg

New Tax Credits Increase Appeal Of Heat Pumps For Homeowners

https://hvparent.com/_content/articles/tax-credits-and-heat-pumps-40021.JPG

Thus the taxpayer can claim a 2 000 tax credit for the cost of the heat pump alone and the taxpayer s total Energy Efficient Home Improvement Credit is There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas

Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat Equipment type Tax Credit Available for 2022 Tax Year Home Clean Electricity Products Solar electricity Fuel Cells Wind Turbine Battery Storage

Download Irs Tax Credits For Heat Pumps

More picture related to Irs Tax Credits For Heat Pumps

Heat Pumps Can Help Oregonians Achieve Clean Cooling Oregon Capital

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/Heat-hot-weather-Getty-Images.jpg

IRS Notice 2021 21 Relief From Certain Taxpayer Deadlines Due To

https://www.ssgmi.com/cm/dpl/images/articles/472/IRS_Tax_Credits_for_Covid_19_Image_compressed.jpeg

Heat Pump Cost Archives WeLoveHeatPumps

https://weloveheatpumps.com/wp-content/uploads/2024/02/thermostat.png

May 10 2024 Through tax credits and rebates President Biden s Inflation Reduction Act IRA provides new opportunities to homeowners and renters to make energy efficient Tax credits are applied to the tax year you install the heat pump For example if your heat pump is deployed in 2023 you can redeem your credit when you

Total Annual Limit The 2 000 heat pump credit can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Effective Date Products purchased About ENERGY STAR Federal Tax Credits For Energy Efficiency Tax Credit Information 2022 Tax Credit Information Information updated 12 30 2022 The

How To Leverage Inflation Reduction Act Tax Credits For Energy Savings

https://cwpower.com/sites/default/files/images/news/IRA BLOG Photo.jpg

Heat Pumps How Federal Tax Credits Can Help You Get One

https://environmentamerica.org/center/wp-content/uploads/2022/12/51322503903_6b8b80baa4_o-scaled.jpg

https://www.energystar.gov/.../air-source-heat-pumps

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

https://www.irs.gov/credits-deductions/how-to...

Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75 qualify for a credit Qualified improvements include new Electric or natural

25C Tax Credit What s Is It And How Can You Get It

How To Leverage Inflation Reduction Act Tax Credits For Energy Savings

When Are Tax Credits Ending How To Apply For Universal Credit

Lucrative Tax Credits Pledged For Heat Pumps REMI Network

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Energy Tax Credits For 2023 One Source Home Service

Energy Tax Credits For 2023 One Source Home Service

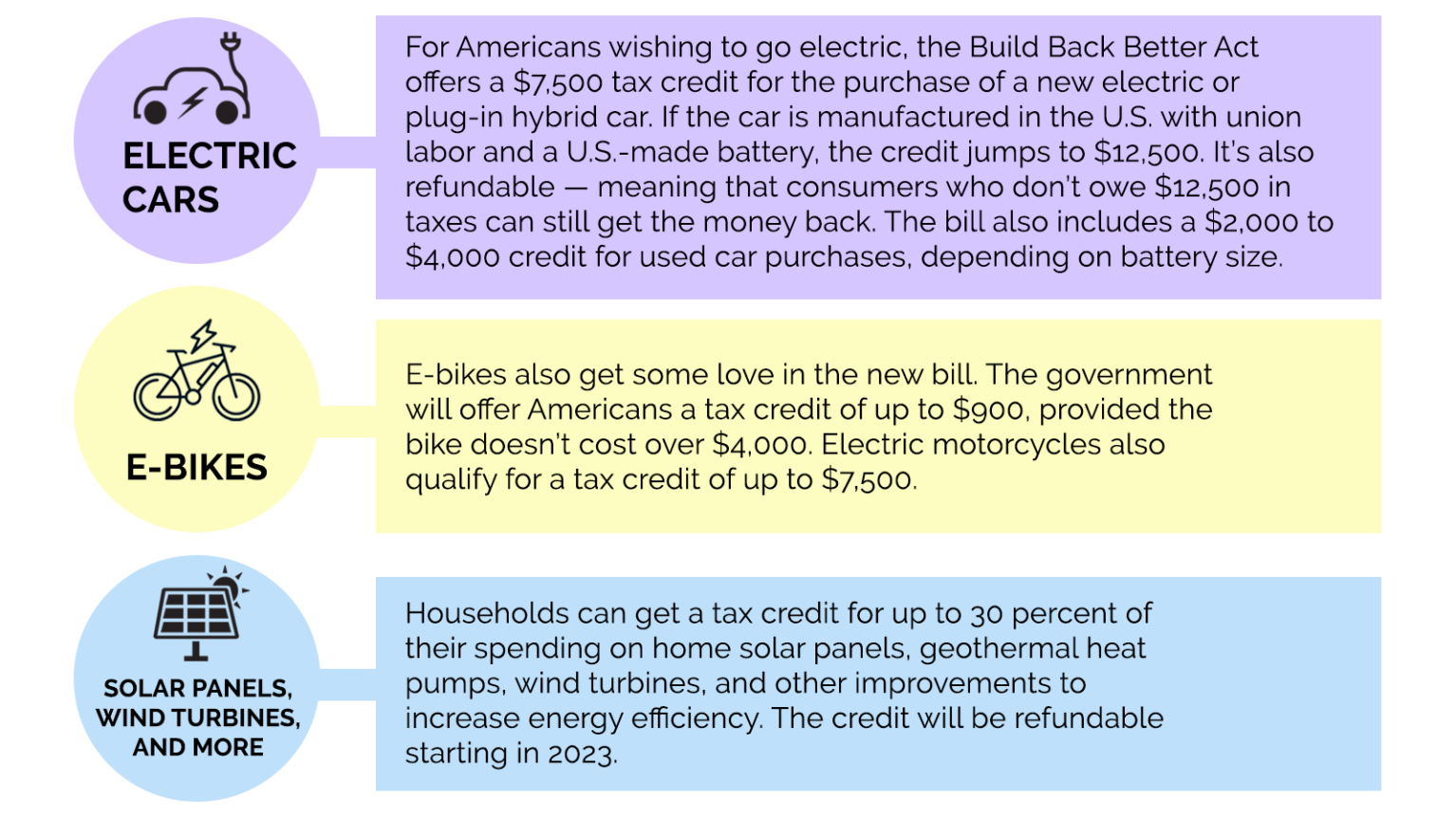

Green Incentives Usually Help The Rich Here s How The Build Back

Clarion H R Block Tax Tips Claiming Energy Tax Credits For 2022 And

Georgia Tax Credits For Workers And Families

Irs Tax Credits For Heat Pumps - Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to equipment installed on January 1 2023 or