Irs Tax Depreciation Tables Verkko Chapter 4 Figuring Depreciation Under MACRS Which Depreciation System GDS or ADS Applies Which Property Class Applies Under GDS What Is the Placed in

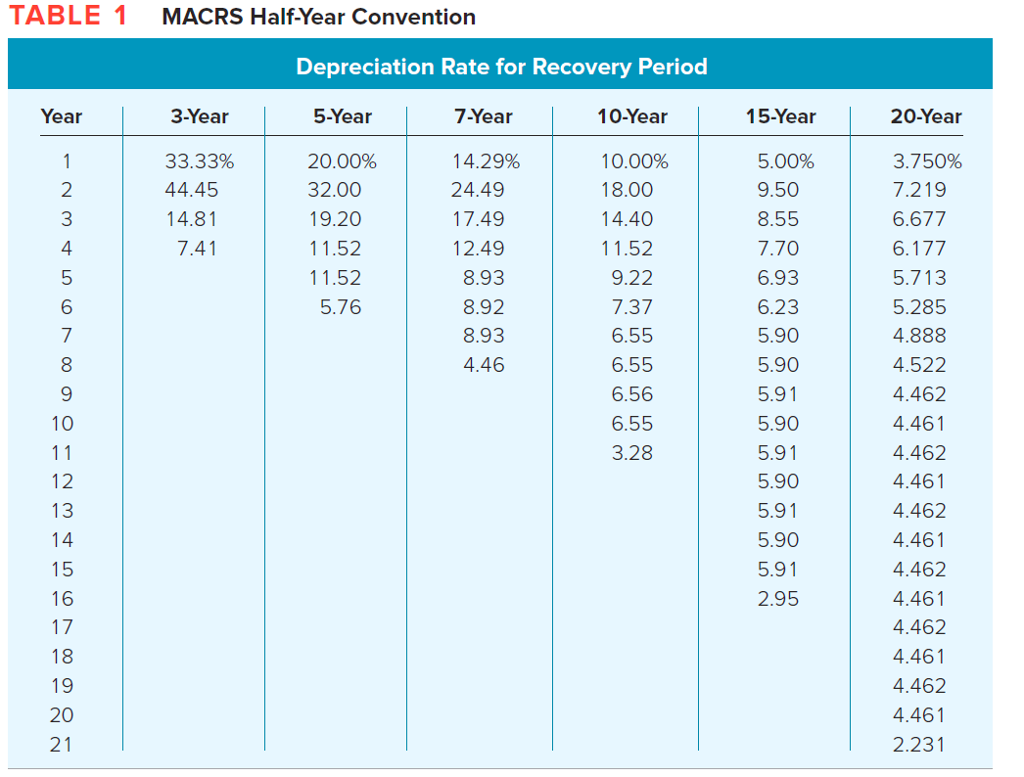

Verkko Using Table 2 2d you find that the depreciation percentage for property placed in service in February of Year 1 is 3 182 That year s Verkko 18 syysk 2023 nbsp 0183 32 Page Last Reviewed or Updated 18 Sep 2023 Publication 946 explains how you can recover the cost of business or income producing property

Irs Tax Depreciation Tables

Irs Tax Depreciation Tables

https://www.irs.gov/pub/xml_bc/13081f18.gif

Macrs Depreciation Table 2017 39 Year Awesome Home

https://www.irs.gov/pub/xml_bc/13081f45.gif

Irs Macrs Depreciation Table Excel Review Home Decor

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f4562_part3.jpg

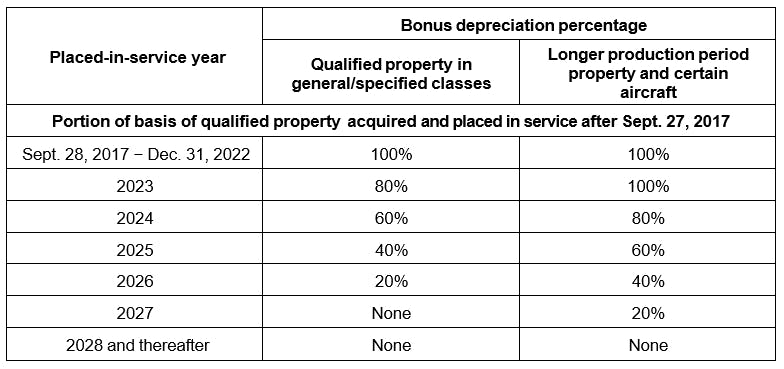

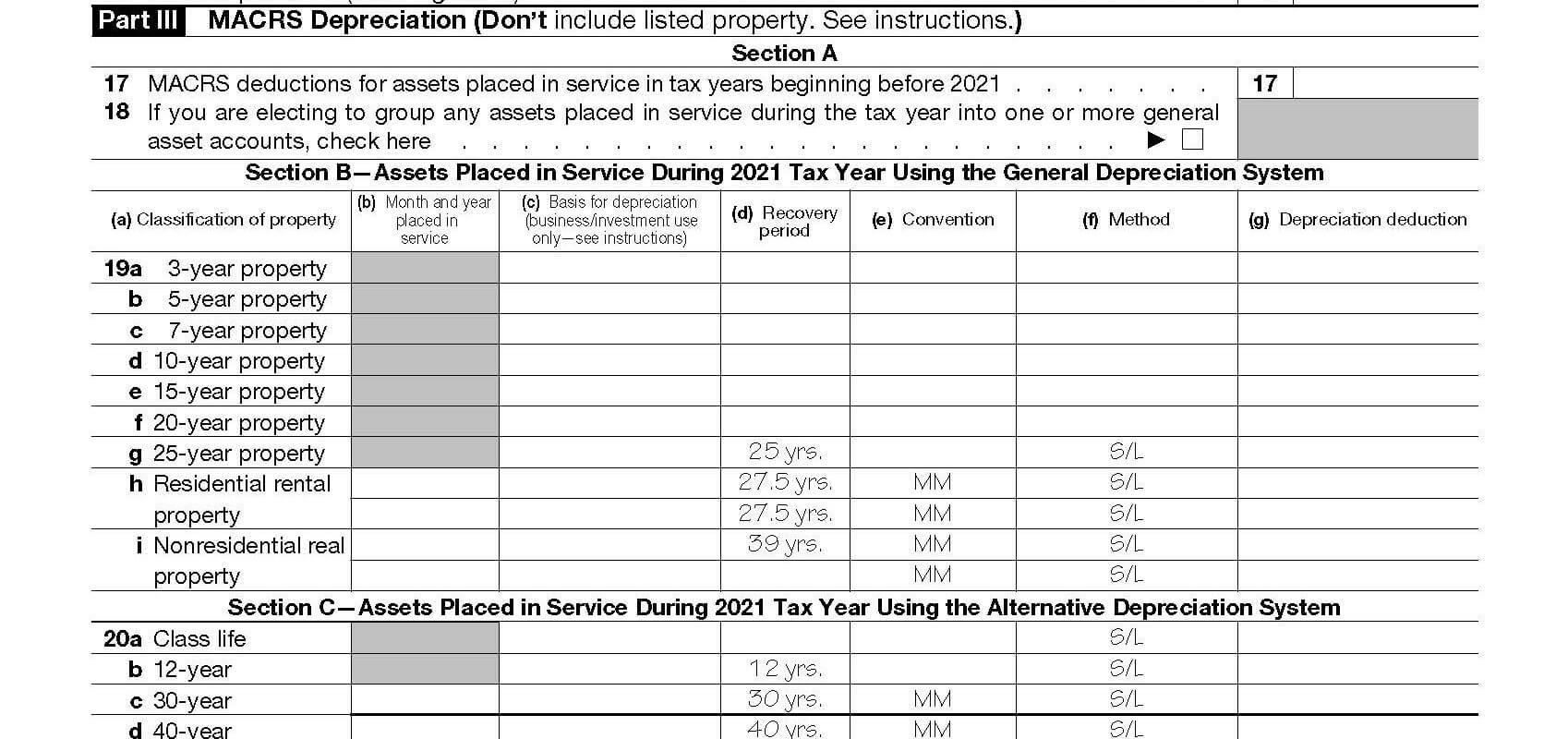

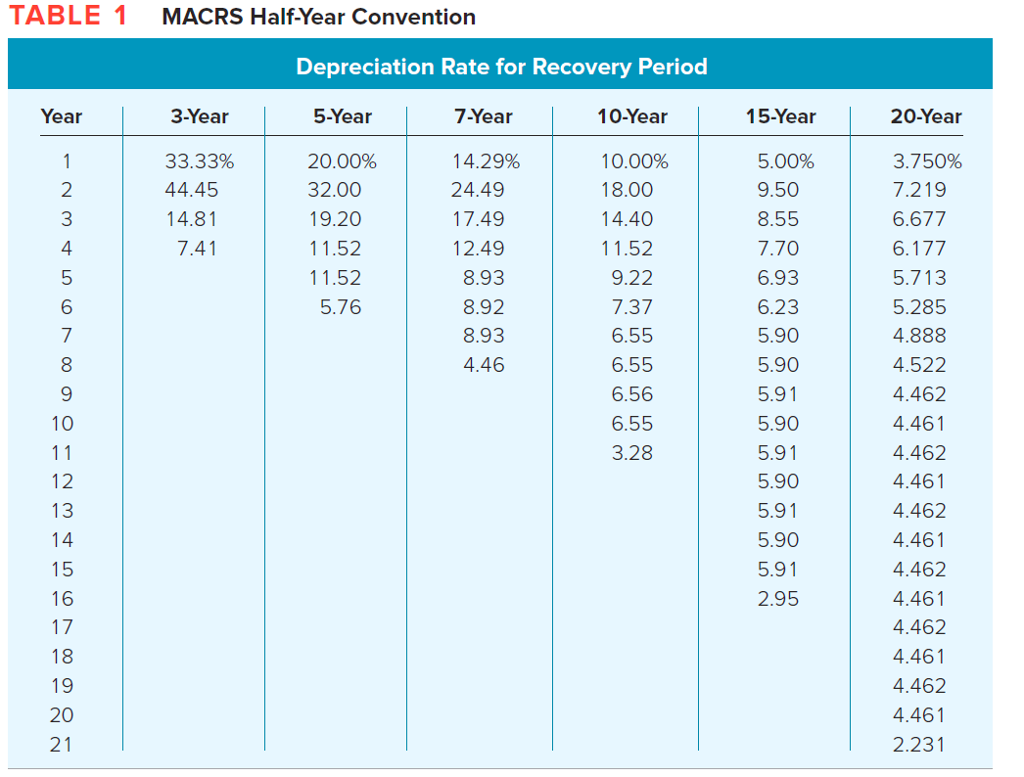

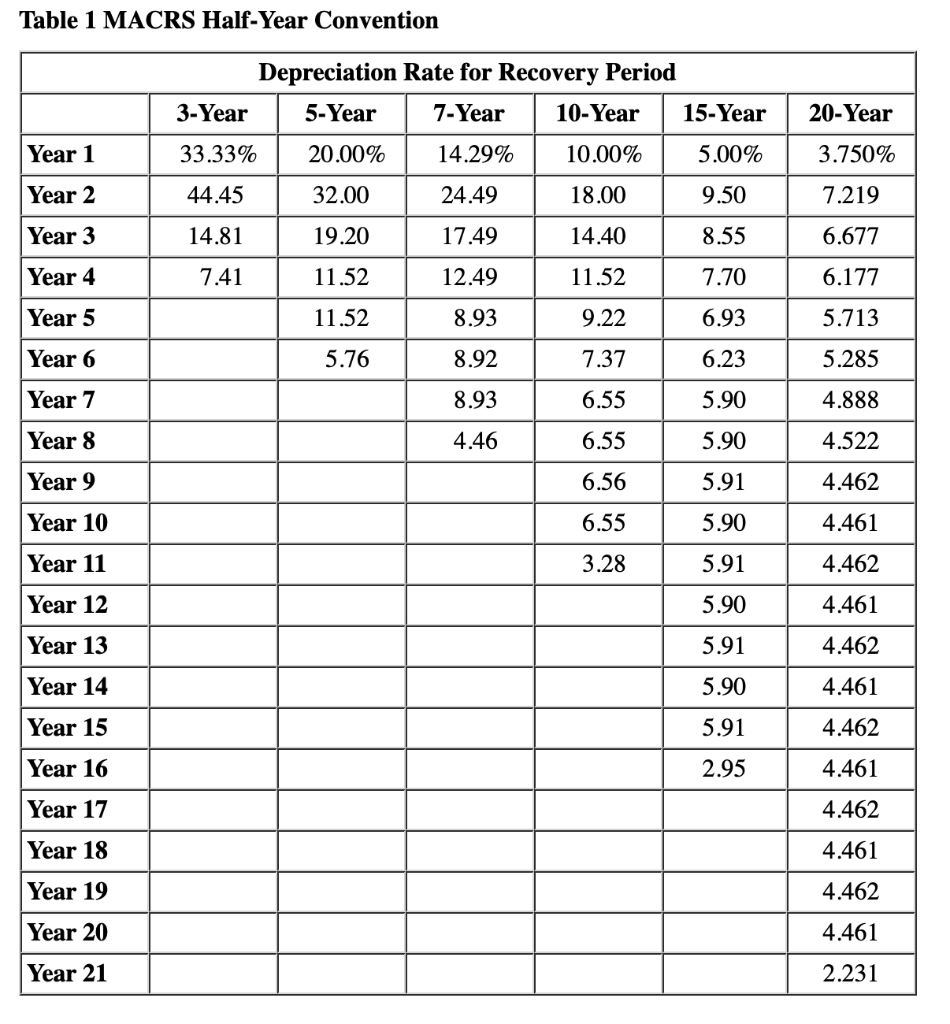

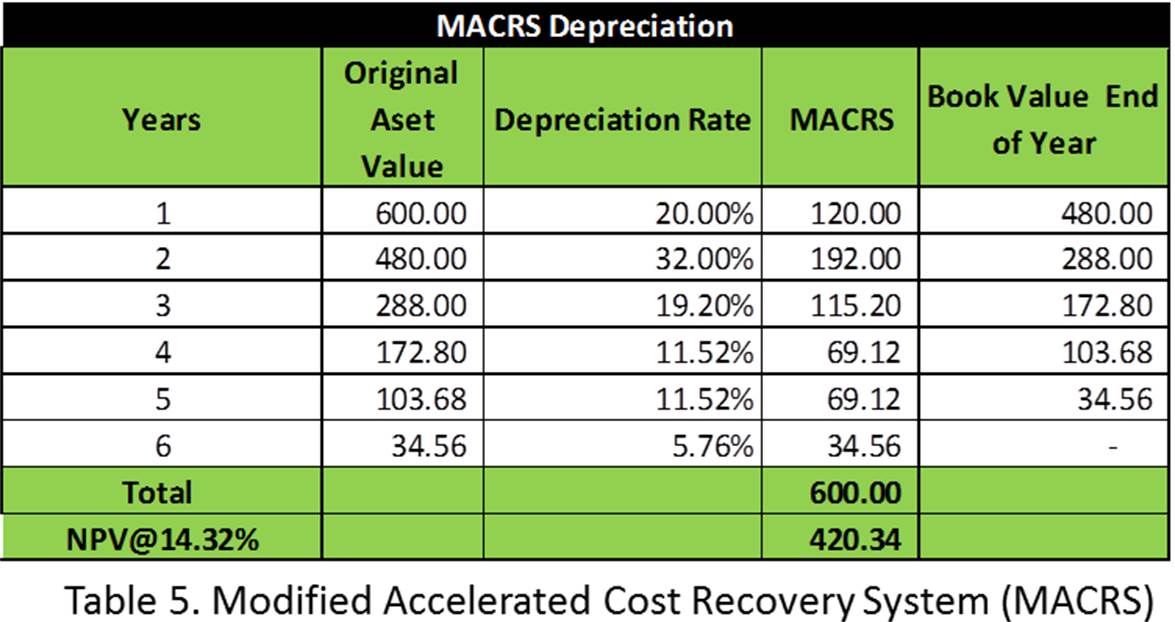

Verkko 2 helmik 2022 nbsp 0183 32 The depreciation tables spell out exactly how much you can deduct each year for different classes of business property At first glance the tables make Verkko The Internal Revenue Service IRS publishes detailed tables of lives by classes of assets The deduction for depreciation is computed under one of two methods

Verkko The IRS provides a slew of depreciation tables to be used in different situations the MACRS table Table A 1 using the half year convention and the 200 percent Verkko 1 maalisk 2022 nbsp 0183 32 The IRS offers three tables in Pub 946 to help you figure out the depreciation rate to employ The following are the three tables Table of MACRS

Download Irs Tax Depreciation Tables

More picture related to Irs Tax Depreciation Tables

Irs Depreciation Tables In Excel Awesome Home

https://i1.wp.com/cdn.vertex42.com/Calculators/Images/depreciation-calculator.png?resize=550%2C493&is-pending-load=1#038;ssl=1

How To Calculate Depreciation Expense Irs Haiper

https://www.calt.iastate.edu/system/files/images-premium-article/macrs_2.png

Macrs Depreciation Table 2017 Cabinets Matttroy

https://images.prismic.io/baker-tilly-www/a6ba0058-9f6e-4512-bd60-1b570ceb9fd5_Table+1.PNG?auto=compress,format

Verkko To determine the classification of property being depreciated whether it is 3 year property 5 year property etc refer to IRS Instructions for Form 4562 Depreciation Verkko Numerous quick reference tables and charts providing easy access to key information including easy to read depreciation tables for MACRS with or without bonus depreciation ADS AMT and ACRS Real life

Verkko 1 jouluk 2023 nbsp 0183 32 The expected salvage value is 10 000 and the company expects to use the van for five years By using the formula for the straight line method the annual Verkko The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the IRC or the alternative

Irs Depreciation Tables 2018 Brokeasshome

https://media.cheggcdn.com/media/5f1/5f137676-da5d-4a19-8c65-45dc0c642462/phpG2HEEE.png

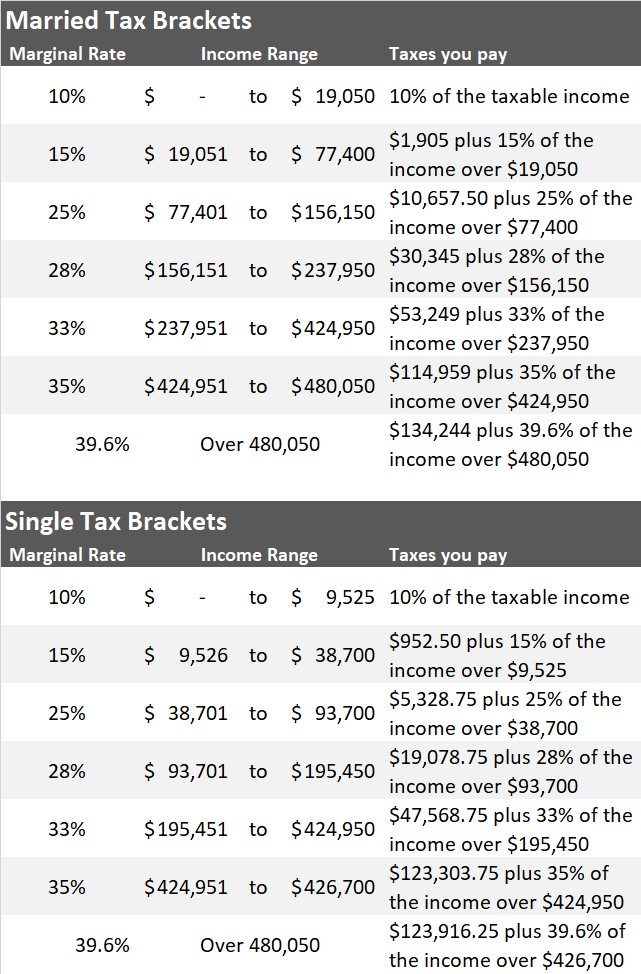

2018 Federal Tax Tables Irs Gov Tutorial Pics

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/1508861962592-KIG66TODG5ZZR0TLPSSC/2018+Tax+Brackets.jpg

https://www.irs.gov/pub/irs-pdf/p946.pdf

Verkko Chapter 4 Figuring Depreciation Under MACRS Which Depreciation System GDS or ADS Applies Which Property Class Applies Under GDS What Is the Placed in

https://www.irs.gov/publications/p527

Verkko Using Table 2 2d you find that the depreciation percentage for property placed in service in February of Year 1 is 3 182 That year s

Irs Depreciation Tables In Excel Cabinets Matttroy

Irs Depreciation Tables 2018 Brokeasshome

Irs Depreciation Tables Brokeasshome

Depreciation Tables ITeachAccounting

A Using MACRS What Is Javier s Depreciation Chegg

Irs Macrs Depreciation Table Excel Review Home Decor

Irs Macrs Depreciation Table Excel Review Home Decor

Tax Depreciation Tables Brokeasshome

Irs Home Depreciation Calculator Atikkmasroaniati

How To Calculate Depreciation Cost Of Machinery Haiper

Irs Tax Depreciation Tables - Verkko 1 maalisk 2022 nbsp 0183 32 The IRS offers three tables in Pub 946 to help you figure out the depreciation rate to employ The following are the three tables Table of MACRS