Irs Tax Extension Online Free E file Your Extension Form for Free Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension Filing this form gives you until October 15 to file a return If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day

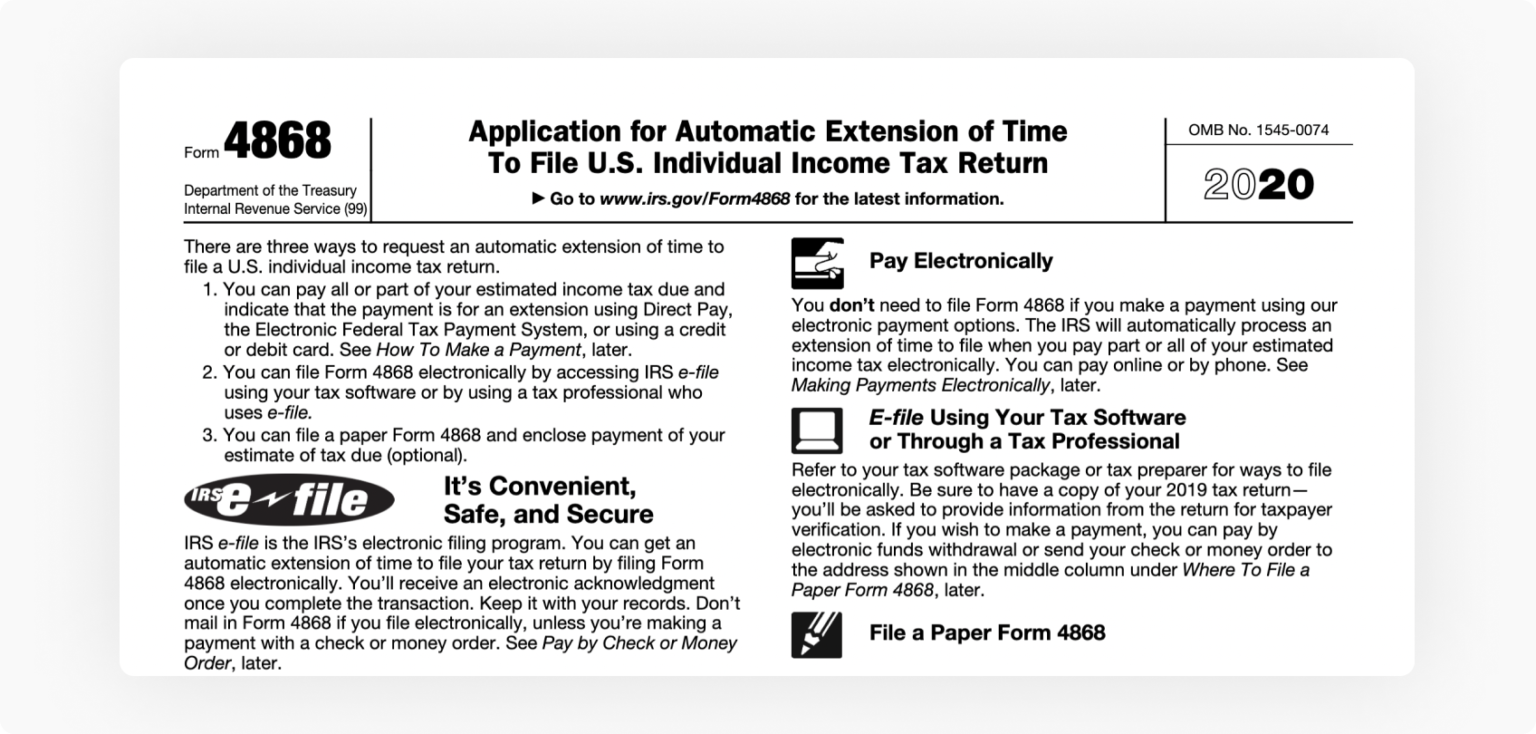

Use IRS Free File to electronically request an automatic tax filing extension Request an extension by mail 1 File Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return You can file by mail online with an IRS e filing partner or through a tax professional 2 Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension The fastest and easiest way to get an extension is through IRS Free File on IRS gov Taxpayers can electronically request an extension on Form 4868 PDF

Irs Tax Extension Online Free

Irs Tax Extension Online Free

https://www.pdffiller.com/preview/574/501/574501425/big.png

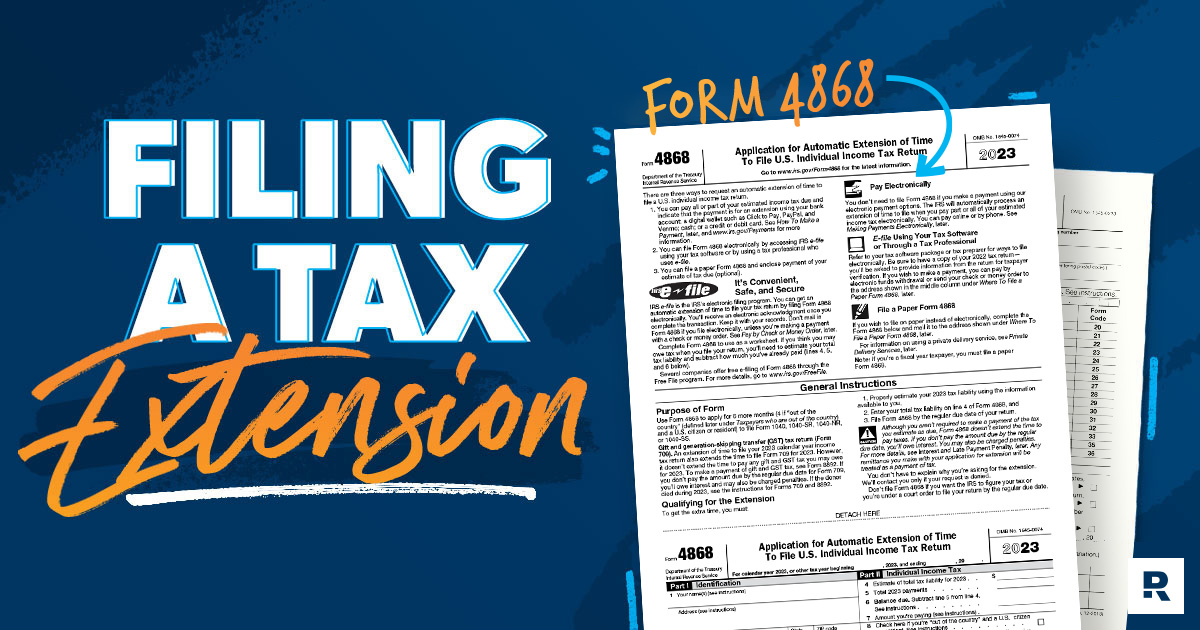

Tax Extension Form 2023 Printable Forms Free Online

https://m.foolcdn.com/media/affiliates/images/Business_Tax_Extension_-_02_-_Form_7004_Part_O.width-750.png

Irs form 4868 application for automatic extension of time to file

https://blog.pdffiller.com/app/uploads/2021/12/irs-form-4868-application-for-automatic-extension-of-time-to-file-individual-income-tax-return-1536x734.png

File with an IRS Free File partner IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software It s safe easy and no cost to you Those who don t qualify can still use Free File Fillable Forms File an extension No matter your income you can file an extension with a An easy way to file an extension is through IRS Free File on IRS gov All individual filers can use the program software to request an extension on Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return regardless of income

Use IRS Free File to get an extension online A quick and easy way to get an extension is through IRS Free File on IRS gov All individual tax filers regardless of income can electronically request an extension on Form 4868 PDF by using the IRS Free File program partner software on IRS gov Easily file an IRS tax extension for free File by midnight on April 15 2024 Important reminder an extension to file is not an extension to pay When you e file IRS Form 4868 and receive confirmation you ll have until October 15 2024 to finish and file your 2023 tax return

Download Irs Tax Extension Online Free

More picture related to Irs Tax Extension Online Free

How To File A Tax Extension ZenLedger

https://uploads-ssl.webflow.com/5f9a1900790900e2b7f25ba1/6254776336f3f437f693e6db_62547502a2486c6ddefbf6e3_personalTaxExtension.png

File Irs Tax Extension Online To Get More Time To File The Return By

https://image.isu.pub/140314120212-f7b0ea986746946b546772cc730e3429/jpg/page_1.jpg

Tax Extension Form 2023 Online Printable Forms Free Online

https://cdn.ramseysolutions.net/media/blog/taxes/tax-basics/tax-extension.jpg

TurboTax Personal Taxes Easy Extension Free federal tax extension is now available File now File an extension by April 15 2024 and have until October 15 2024 to finish your taxes Avoid penalties and get a little extra time to file your return Learn more about penalties Easily complete your IRS tax extension from a brand Pay Electronically You don t need to file Form 4868 if you make a payment using our electronic payment options The IRS will automatically process an extension of time to file when you pay part or all of your estimated income tax electronically You can pay online or by phone See Making Payments Electronically later

Published January 6 2022 Last Updated October 24 2023 Extensions of Time to File Tax day might be circled in red on your calendar but circumstances may keep you from filing on time Fortunately you can request extra time to file by asking for an extension Filing IRS Form 4868 gives you an automatic six month extension to file your tax return You can request an extension for free but you still need to pay taxes owed by Tax Day By

How To File A Tax Extension With The IRS In 2016 CBS News

https://cbsnews1.cbsistatic.com/hub/i/2016/04/14/c1ff031c-5d7c-446b-90ab-4a58bc69f64d/istock000085543149medium.jpg

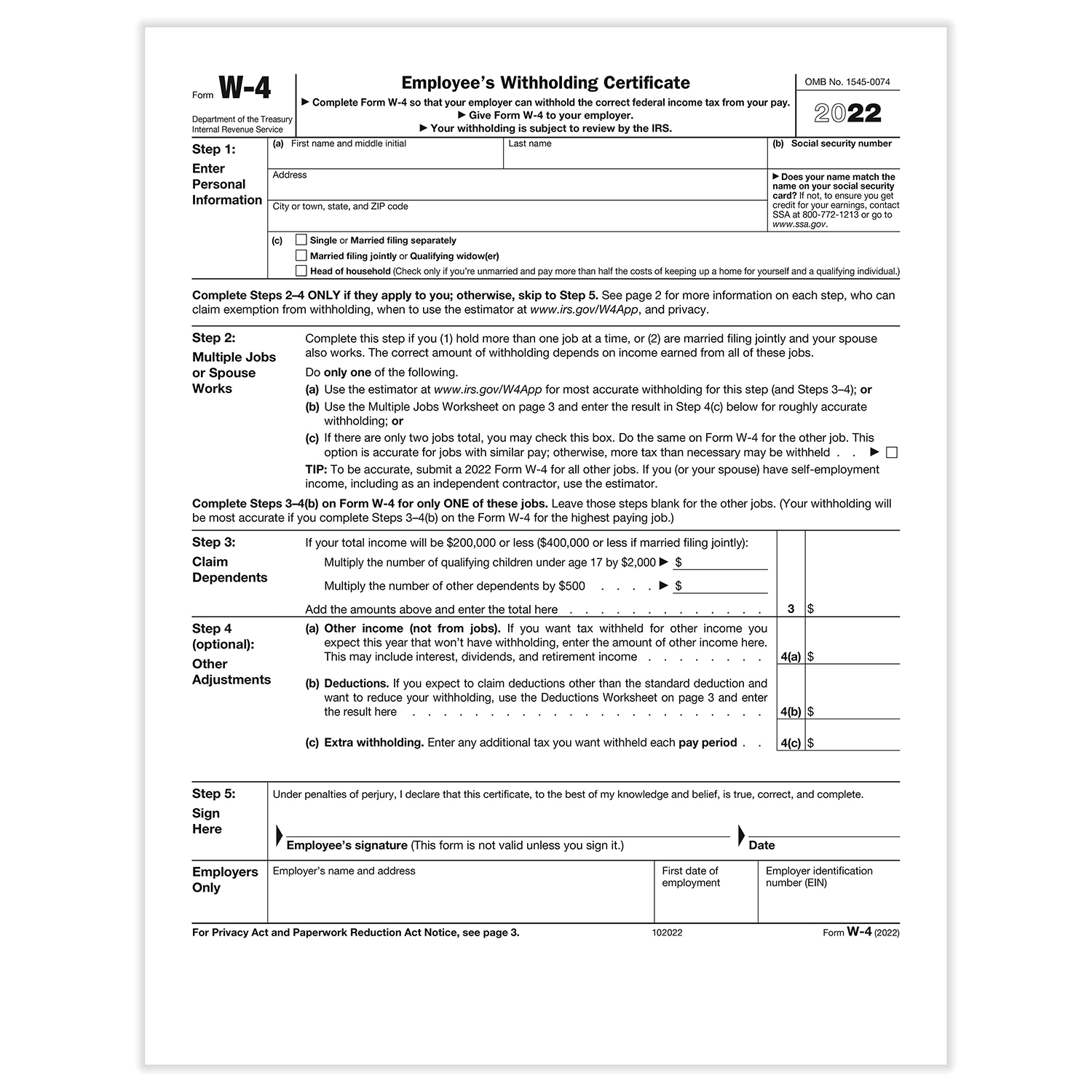

Fillable Forms Office 20232023 Fillable Form 2024

https://fillableforms.net/wp-content/uploads/2022/10/2023-irs-w-4-form-hrdirect.jpg

https://www.irs.gov/forms-pubs/extension-of-time...

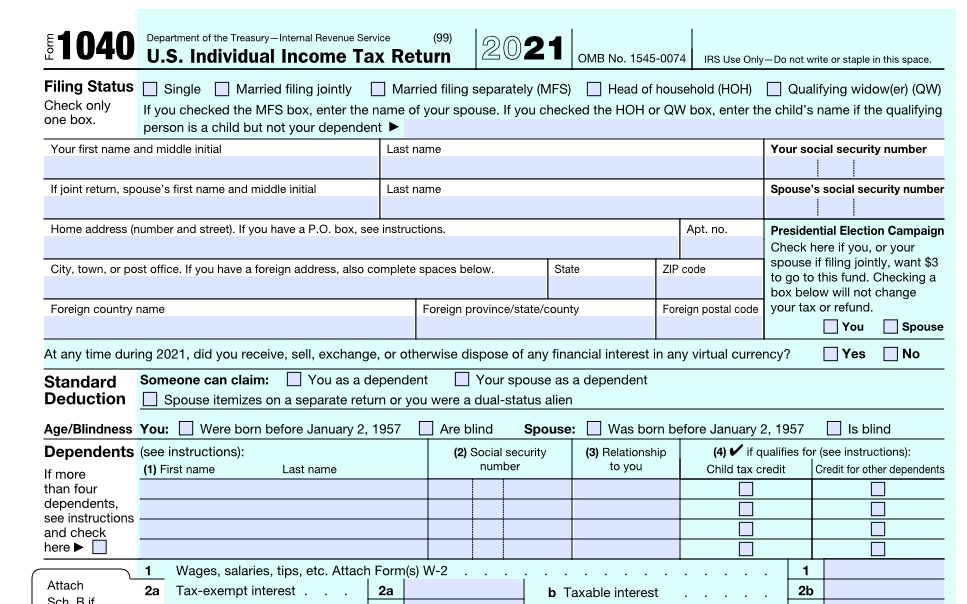

E file Your Extension Form for Free Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension Filing this form gives you until October 15 to file a return If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day

https://www.irs.gov/filing/get-an-extension-to-file-your-tax-return

Use IRS Free File to electronically request an automatic tax filing extension Request an extension by mail 1 File Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return You can file by mail online with an IRS e filing partner or through a tax professional 2

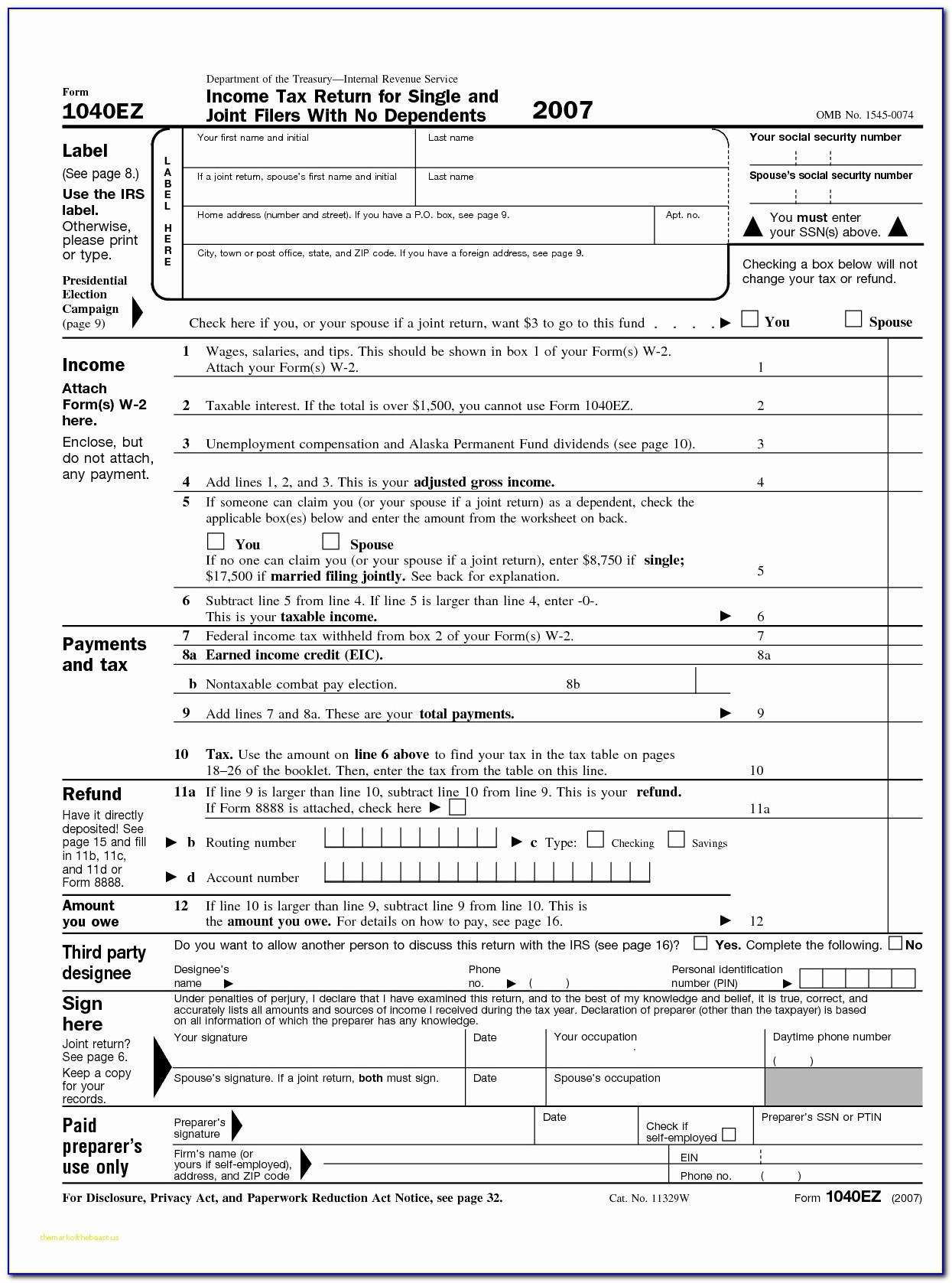

IRS Tax Forms Picture Free Photograph Photos Public Domain

How To File A Tax Extension With The IRS In 2016 CBS News

Taxpayers Should Take These Steps Before Filing Income Taxes CPA

Printable 1099 S Form

Irs File Extension Mgmthohpa

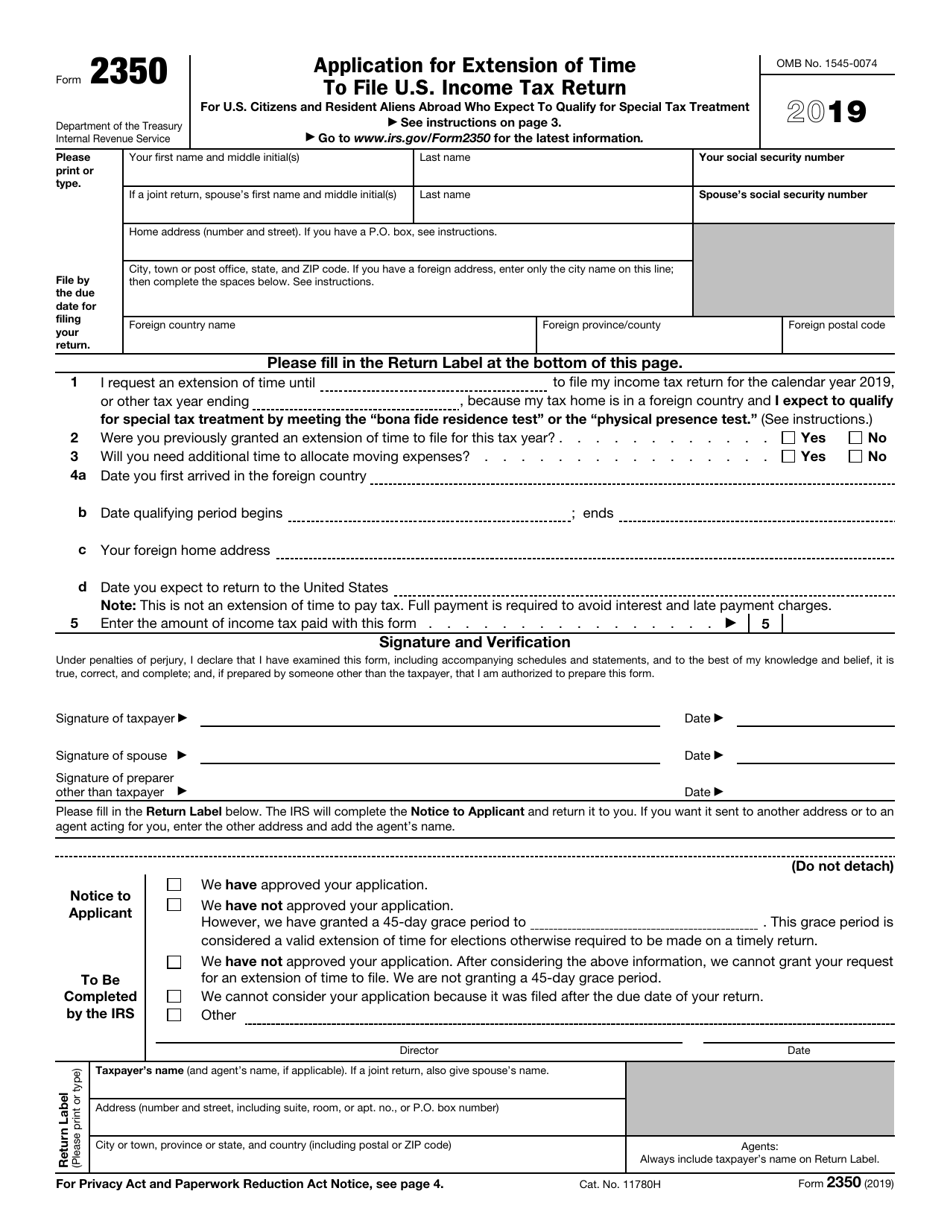

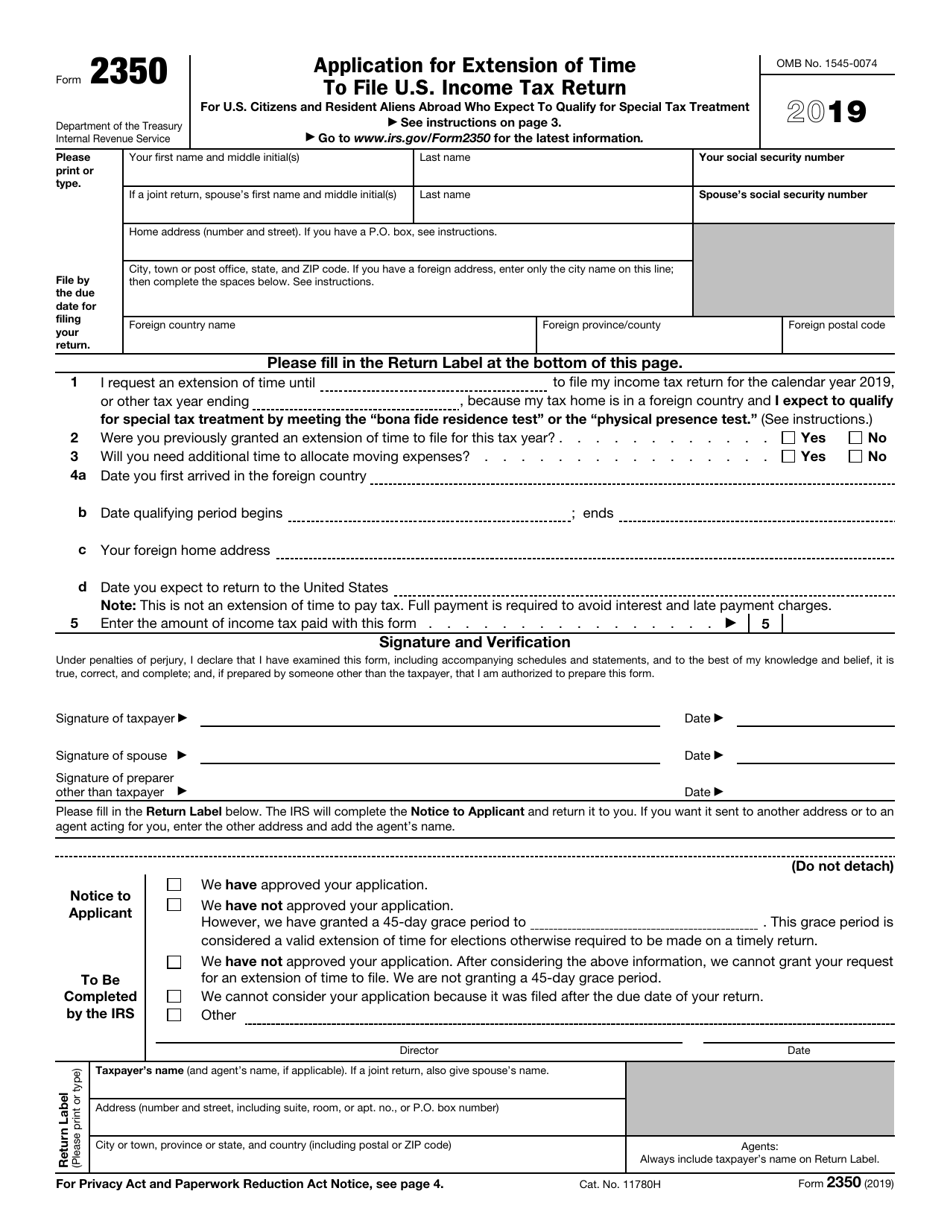

IRS Form 2350 2019 Fill Out Sign Online And Download Fillable PDF

IRS Form 2350 2019 Fill Out Sign Online And Download Fillable PDF

Tax Form 1040 Fillable Printable Forms Free Online

How To File An IRS Tax Extension YouTube

Tax Extension IRS Automatically Give Without Filing Form 4868 If You Do

Irs Tax Extension Online Free - An easy way to file an extension is through IRS Free File on IRS gov All individual filers can use the program software to request an extension on Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return regardless of income