Irs Tax Income Limit Generally you need to file if Your income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent There are seven federal tax brackets for tax year 2024 They are 10 12 22 24 32 35 and 37 The highest earners fall into the 37 range while those who earn the least are in

Irs Tax Income Limit

Irs Tax Income Limit

https://www.taxdefensenetwork.com/wp-content/uploads/2018/08/How-to-Make-IRS-Payments-for-Your-Taxes_Credit-Cards.jpg

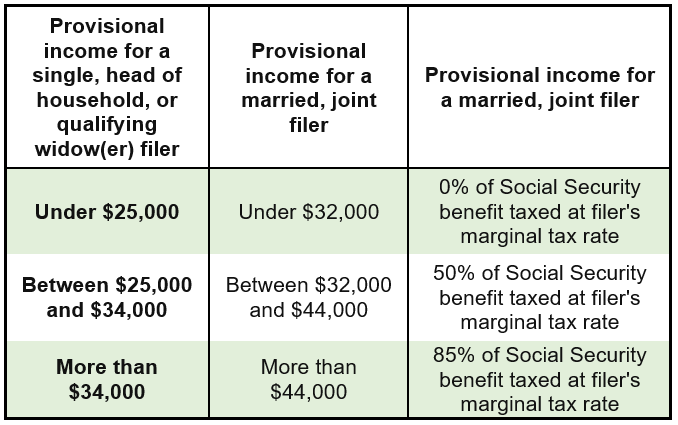

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

IRS Tax Liability The IRS Reports On Its Use Of Debt Collectors

https://www.fedortax.com/hubfs/bigstock--148904384-1.jpg#keepProtocol

The seven federal income tax brackets for 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1

The IRS uses 7 brackets to calculate your tax bill based on your income and filing status As your income rises it can push you into a higher tax bracket and may Generally most U S citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year Taxpayers

Download Irs Tax Income Limit

More picture related to Irs Tax Income Limit

Erc Worksheet 2021 Excel Printable Word Searches

http://www.worksheeto.com/postpic/2009/12/irs-earned-income-credit-worksheet_560796.png

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

Income Tax Practitioner Dhaka

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100042218395359

2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are Minimum income requirements for filing taxes You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer

2024 Federal Income Tax Brackets and Rates In 2024 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 The IRS is introducing new income limits for its seven tax brackets adjusting the thresholds to account for the impact of inflation That could provide a break to some

Taxpros Ptin Irs Gov Printable PDF Sample

https://i.pinimg.com/originals/a1/f1/18/a1f1185145d99d8984d6ebd91b92a309.png

Calculating Social Security Taxable Income TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

https://www.irs.gov/individuals/check-if-you-need-to-file-a-tax-return

Generally you need to file if Your income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent

https://taxfoundation.org/data/all/federal/2021-tax-brackets

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent

IRS Ups Standard Deductions Tax Brackets Due To Inflation

Taxpros Ptin Irs Gov Printable PDF Sample

2024 HSA HDHP Limits

Non resident Tax Information

Earned Income Credit Table 2017 Cabinets Matttroy

See The EIC Earned Income Credit Table Income Tax Return Income

See The EIC Earned Income Credit Table Income Tax Return Income

Free Printable Irs Tax Forms

Maximize Your Paycheck Understanding FICA Tax In 2024

Simulador De Taxes 2023 Irs 401k IMAGESEE

Irs Tax Income Limit - The seven federal income tax brackets for 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status