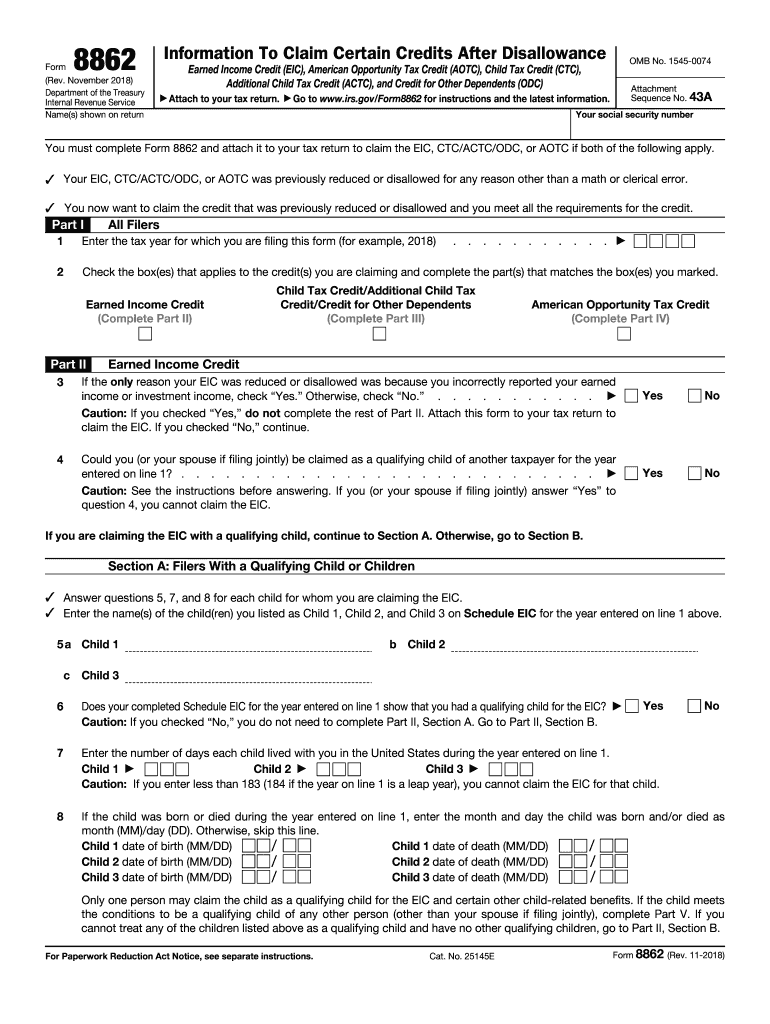

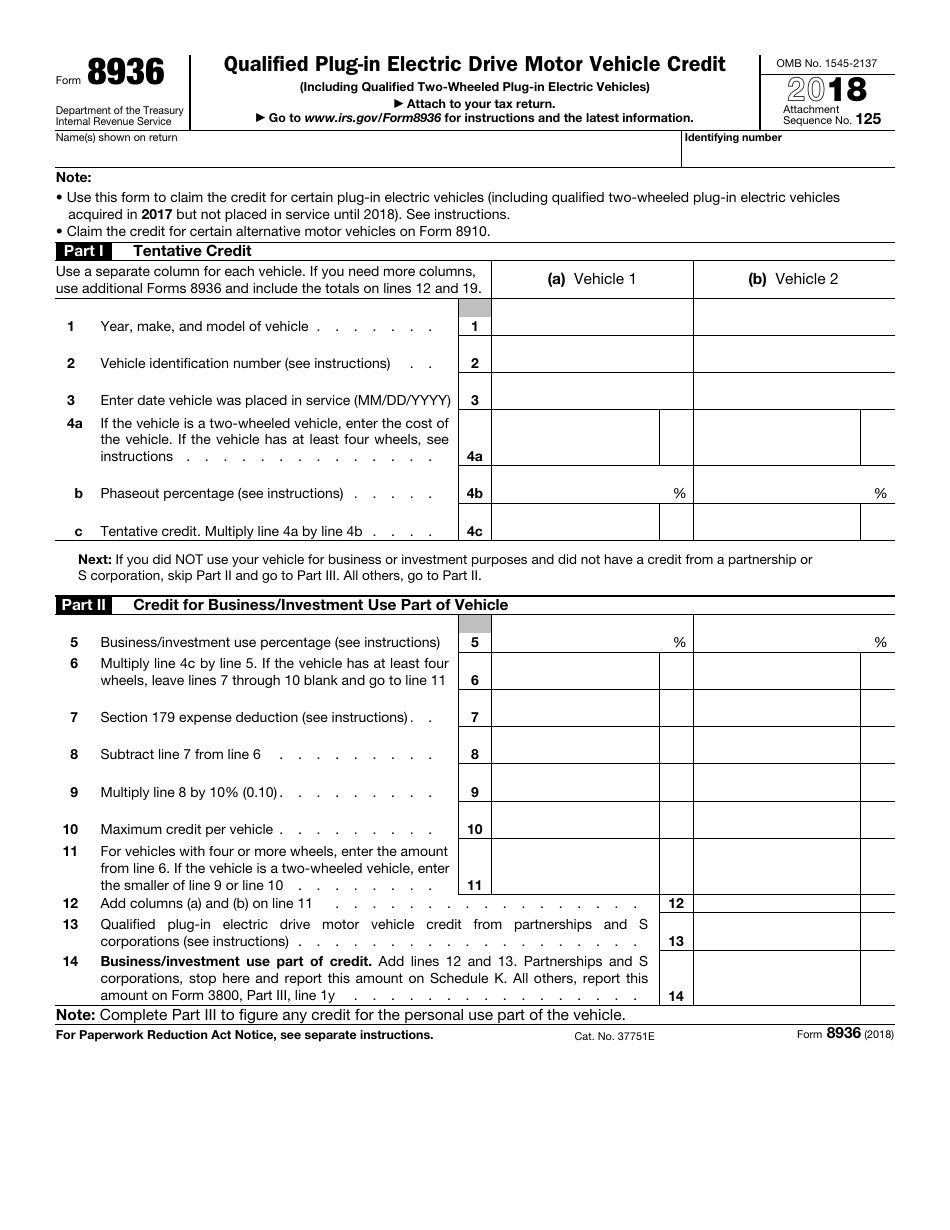

Irs Tax Rebate Electric Vehicle Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Irs Tax Rebate Electric Vehicle

Irs Tax Rebate Electric Vehicle

https://funnyinterestingcool.com/download/file.php?id=435

Audi MINI Toyota Prius Models Added To IRS Electric Vehicle Tax

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026bde930365200c-800wi

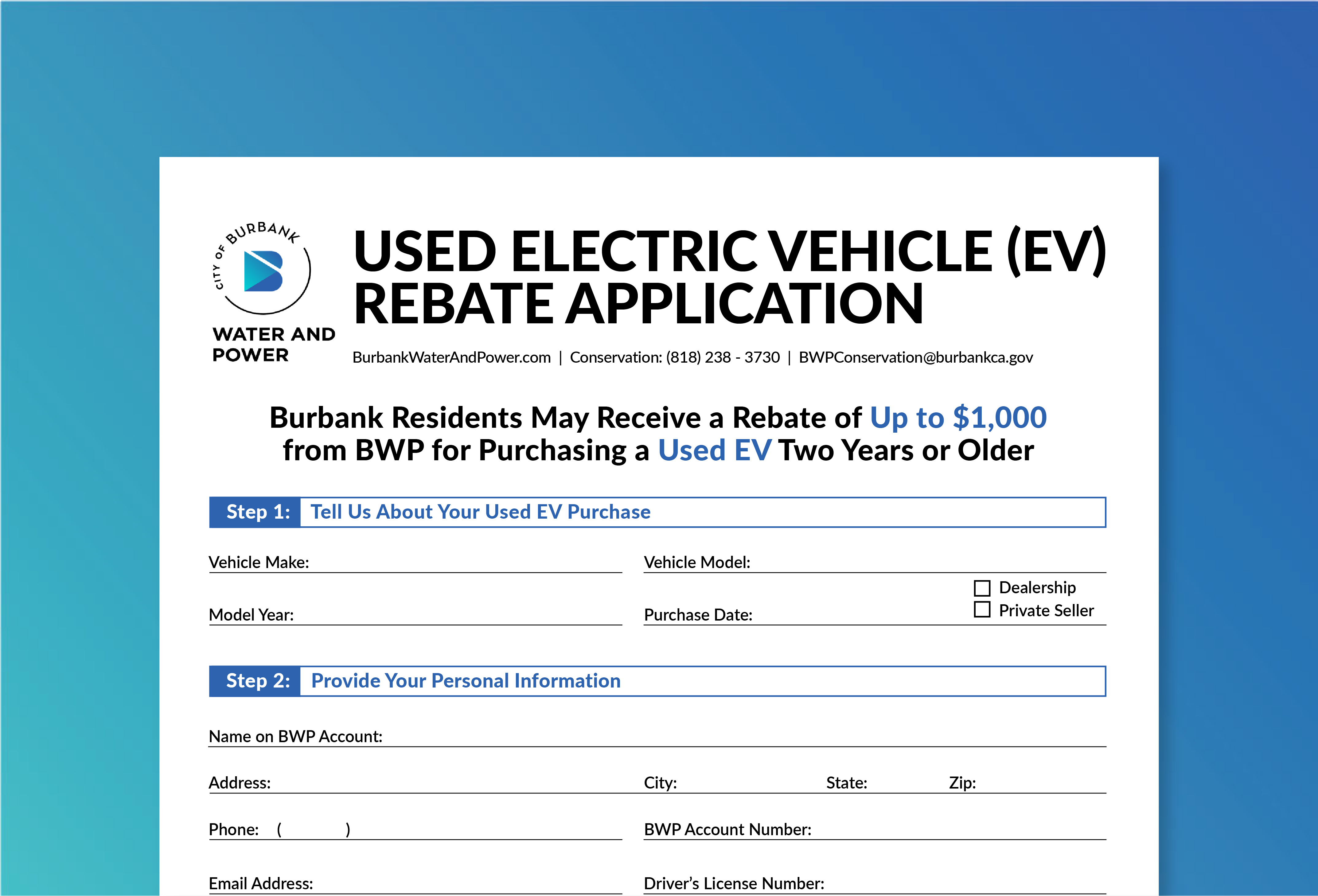

Used Electric Vehicle Rebate

https://www.burbankwaterandpower.com/images/2020/11/03/usedev_application_images-01.jpg

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell Web Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for

Download Irs Tax Rebate Electric Vehicle

More picture related to Irs Tax Rebate Electric Vehicle

Have A New Electric Car Don t Forget To Claim Your Tax Credit Turbo Tax

https://turbo-tax.org/wp-content/uploads/2021/03/image-RW69h4fSoBX1wYeD.jpeg

Used Electric Vehicle Rebate

https://www.burbankwaterandpower.com/images/2020/02/11/used-ev_application_image.jpg

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web Background The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in Web 16 ao 251 t 2022 nbsp 0183 32 Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for Web 17 avr 2023 nbsp 0183 32 Release Date 4 19 2023 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

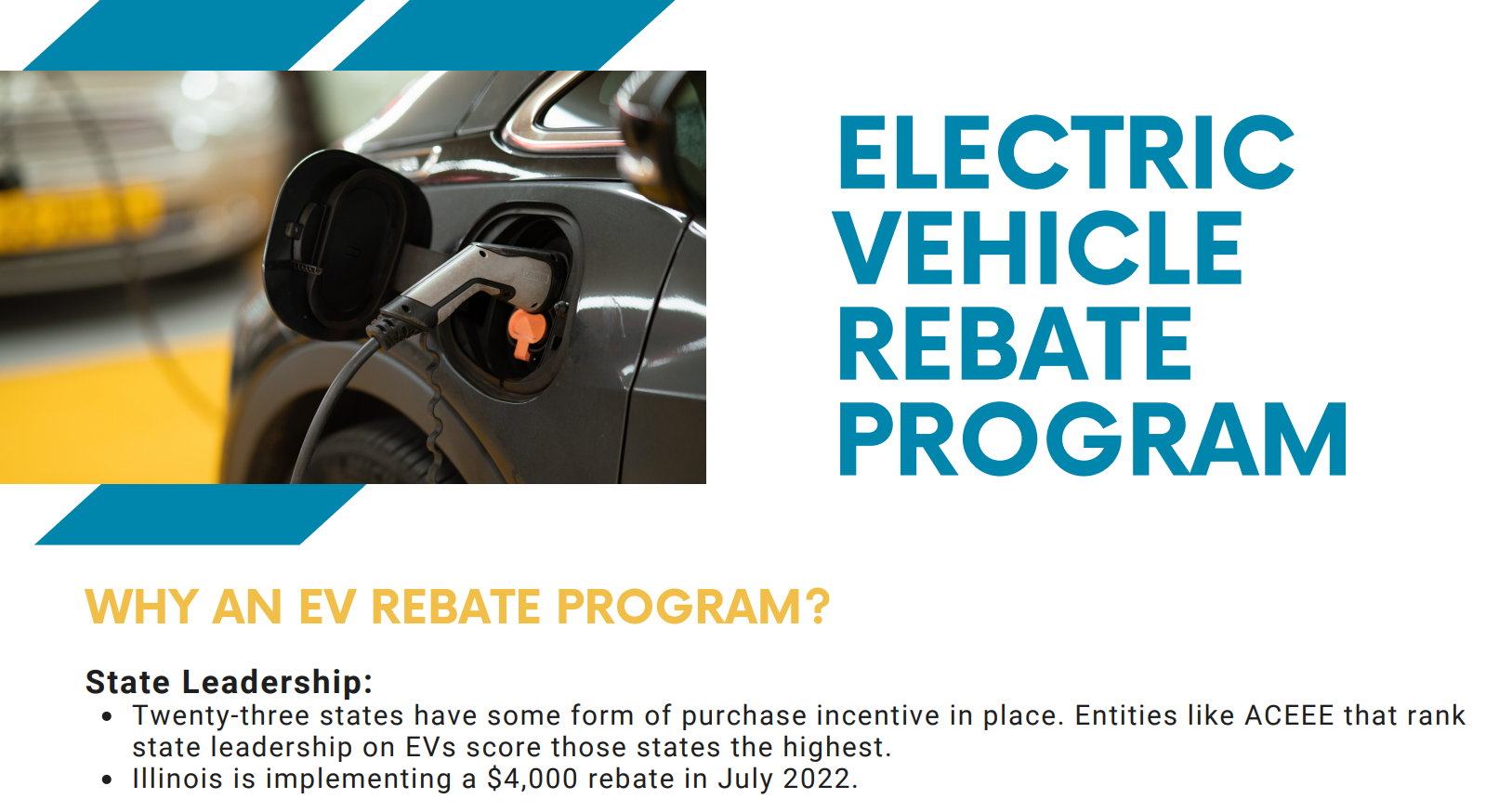

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

https://funnyinterestingcool.com/download/file.php?id=418

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

https://www.irs.gov/clean-vehicle-tax-credits

Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for

The Florida Hybrid Car Rebate Save Money And Help The Environment

Federal Tax Rebates Electric Vehicles ElectricRebate

Tax Rebates For Electric Cars Michigan 2022 Carrebate

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug In

Electric Vehicle Rebate Program Clean Fuels Michigan

Electric Vehicles Canada Rebate

Electric Vehicles Canada Rebate

Electric Vehicle Rebate 2019 VPPSA

IRS Electric Car Tax Credits Reporting Discrepancies Remain

How Does The Electric Car Tax Credit Work TaxProAdvice

Irs Tax Rebate Electric Vehicle - Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under