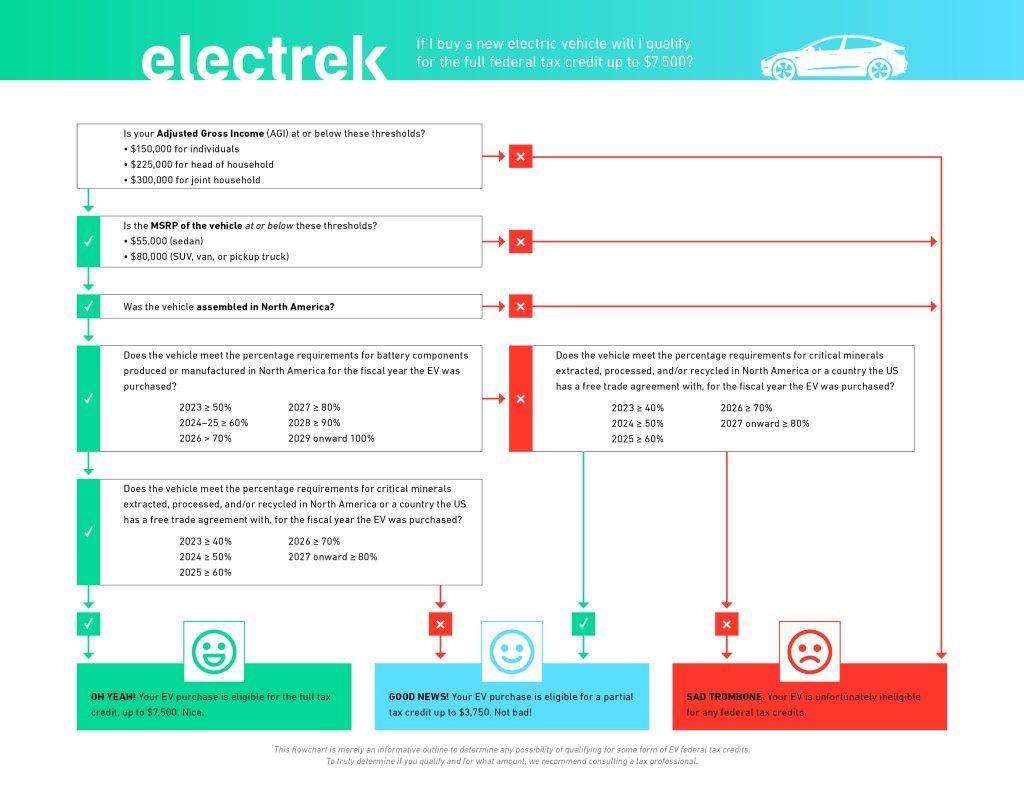

Irs Tax Rebate Ev Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Irs Tax Rebate Ev

Irs Tax Rebate Ev

https://cleantechnica.com/files/2018/07/IRS-Federal-EV-tax-credit-form-8936.png

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Used Electric Vehicle Rebate

https://www.burbankwaterandpower.com/images/2020/02/11/used-ev_application_image.jpg

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Web 7 janv 2023 nbsp 0183 32 Not every electric vehicle qualifies for the credit Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

Web 3 ao 251 t 2023 nbsp 0183 32 The IRA remedies this Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Web 16 ao 251 t 2022 nbsp 0183 32 WASHINGTON Following President Biden s signing the Inflation Reduction Act into law today the U S Department of the Treasury and Internal Revenue Service

Download Irs Tax Rebate Ev

More picture related to Irs Tax Rebate Ev

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

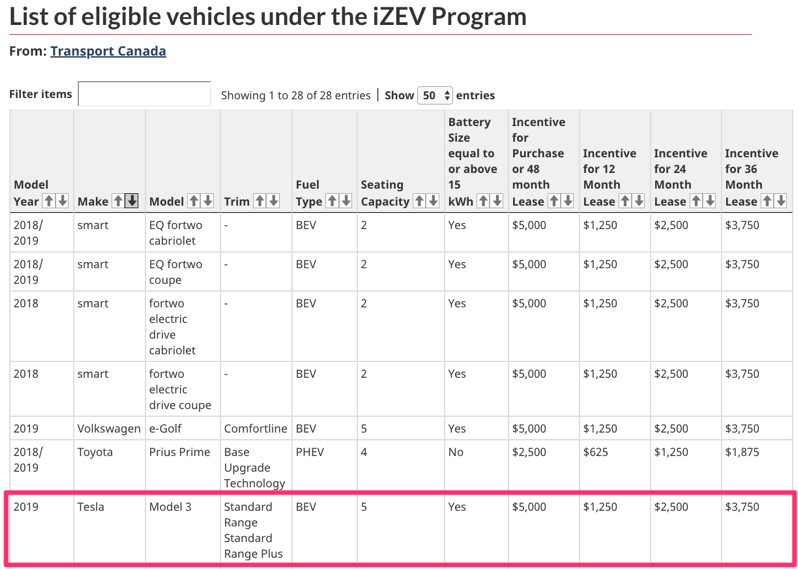

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

https://cdn.iphoneincanada.ca/wp-content/uploads/2019/05/Screenshot_2019-05-01_07_33_14.png

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

https://evadoption.com/wp-content/uploads/2017/07/Screen-Shot-2017-07-22-at-1.03.16-AM.png

Web WASHINGTON March 31 Reuters The U S Treasury Department unveiled stricter electric vehicle tax rules on Friday that will reduce or remove tax credits on some zero Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web 31 mars 2023 nbsp 0183 32 The US Treasury Department today announced its expected EV tax credit guidance on the battery component and critical mineral sourcing requirements of the Web 7 mars 2023 nbsp 0183 32 As amended by the IRA for vehicles placed in service after December 31 2022 and before January 1 2033 3 the amount of the EV Credit for a qualifying electric

2021 Electric Car Tax Credit Irs Galore Blogging Picture Show

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

El IRS Invita A Los Consumidores A Comentar Sobre La Elegibilidad Del

https://www.teslarati.com/wp-content/uploads/2023/01/Screen-Shot-2023-01-03-at-1.50.05-PM.png

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/clean-vehicle-tax-credits

Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for

EV Tax Credit Support Climate Nexus May 2019

2021 Electric Car Tax Credit Irs Galore Blogging Picture Show

2018 Form IRS 8862 Fill Online Printable Fillable Blank PdfFiller

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Ev Car Tax Rebate Calculator 2022 Carrebate

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

How The IRS Ignored The Inflation Reduction Act Snubbed The Most

Petition Raise Maximum MSRP For Small Truck Platform Only To Allow

How Do I Claim The Recovery Rebate Credit On My Ta

Irs Tax Rebate Ev - Web 3 ao 251 t 2023 nbsp 0183 32 The IRA remedies this Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price