Irs Tax Rebates Energy Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll

Irs Tax Rebates Energy

Irs Tax Rebates Energy

https://data.formsbank.com/pdf_docs_html/224/2246/224684/page_1_thumb_big.png

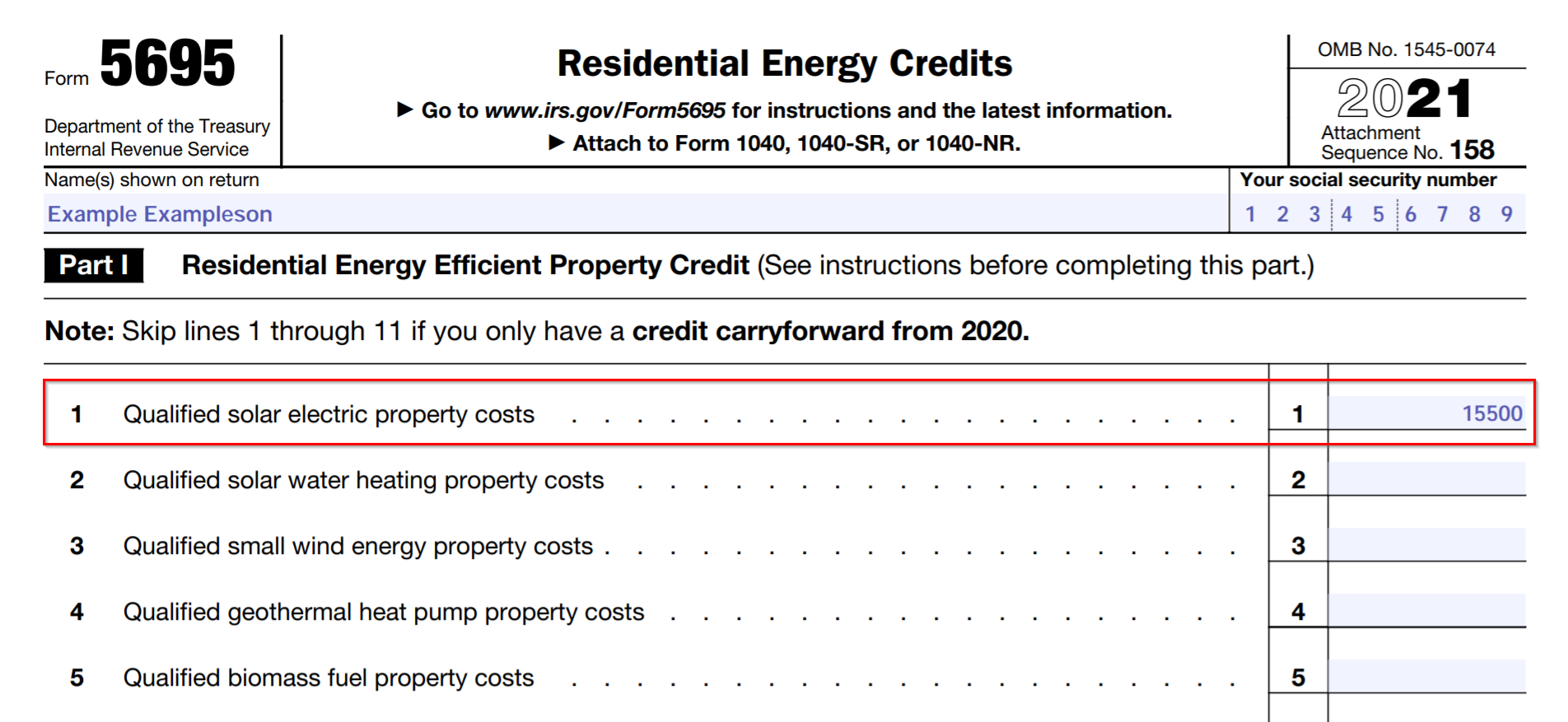

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

https://www.solarreviews.com/content/images/blog/irs_form2021.png

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat Web 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit How to Claim the Credit File Form 5695 Residential Energy Credits Part II with

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address

Download Irs Tax Rebates Energy

More picture related to Irs Tax Rebates Energy

.png)

Federal Solar Tax Credit Steps Down After 2019 Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/Pick My Solar LIVE (9).png

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

Filing For The Solar Tax Credit Wells Solar

https://wellssolar.com/wp-content/uploads/2020/01/IRS-solar-tax-credit-form-5695-sm.jpg

Web 21 nov 2022 nbsp 0183 32 the residential energy tax credit previously the energy efficient property credit IRC Section 25D which subsidizes investments in renewable energy production Web General Overview of the Energy Efficient Home Improvement Credit Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As

Web 9 f 233 vr 2023 nbsp 0183 32 Changes to the residential clean energy credit apply to this tax season You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind Web 21 d 233 c 2022 nbsp 0183 32 A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts Q Are there limits to what

IRS CP 11R Recovery Rebate Credit Balance Due

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

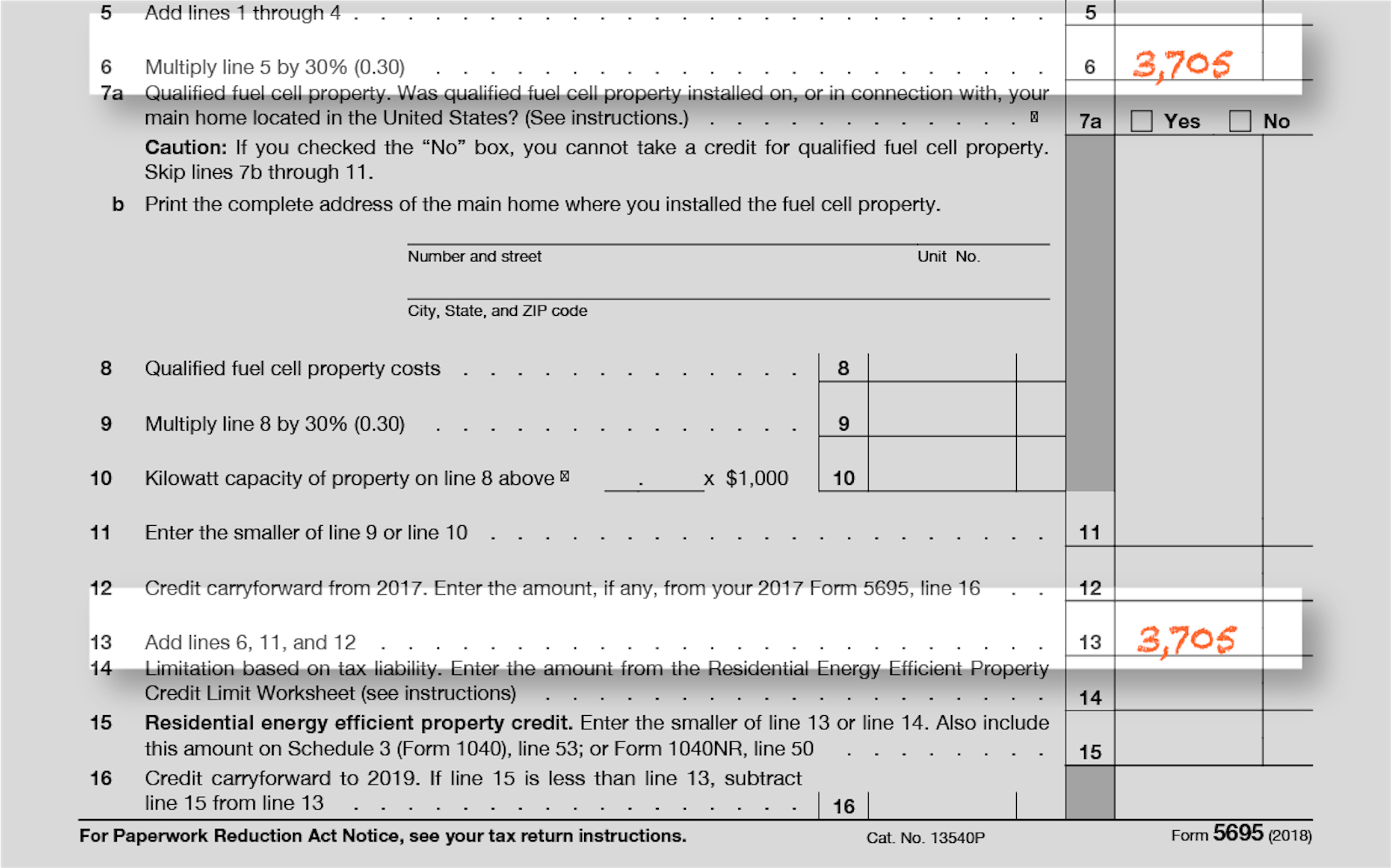

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

https://images.unboundsolar.com/media/5695-line-6-13.png?auto=compress%2Cformat&fit=scale&h=1278&ixlib=php-3.3.0&q=45&w=2048&wpsize=2048x2048&s=4c3c50e87ae7f70a91df763a7dd9aab4

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

IRS CP 11R Recovery Rebate Credit Balance Due

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Completed Form 5695 Residential Energy Credit Capital City Solar

Utility Company Rebates And Government Tax Incentives AEE

Utility Company Rebates And Government Tax Incentives AEE

Here s How To Claim The Federal 30 Tax Credit For Installing Solar

Solar Rebates And Tax Incentives Realsolar PowerRebate

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Irs Tax Rebates Energy - Web 19 ao 251 t 2022 nbsp 0183 32 The IRA s 4 28 billion High Efficiency Electric Home Rebate Program will provide an upfront rebate of up to 8 000 to install heat pumps that can both heat and