Is 1099 Ltc Taxable Income The bottom line The 1099 LTC form allows the IRS to track long term care or accelerated death benefit payments While some of this money may be taxable

Benefits paid to a chronically or terminally ill person and reported on Internal Revenue Service Form 1099 LTC are usually excluded from income and therefore not subject to income tax The exclusion isn t Form 1099 LTC reports payments of long term care benefits such as insurance or accelerated death benefits to the policyholder Learn who must file what benefits are

Is 1099 Ltc Taxable Income

Is 1099 Ltc Taxable Income

https://www.pdffiller.com/preview/539/448/539448886/big.png

Is 1099 K Income Taxable

https://financialsolutionadvisors.com/wp-content/uploads/FSA-Blog-Images-2-100.png

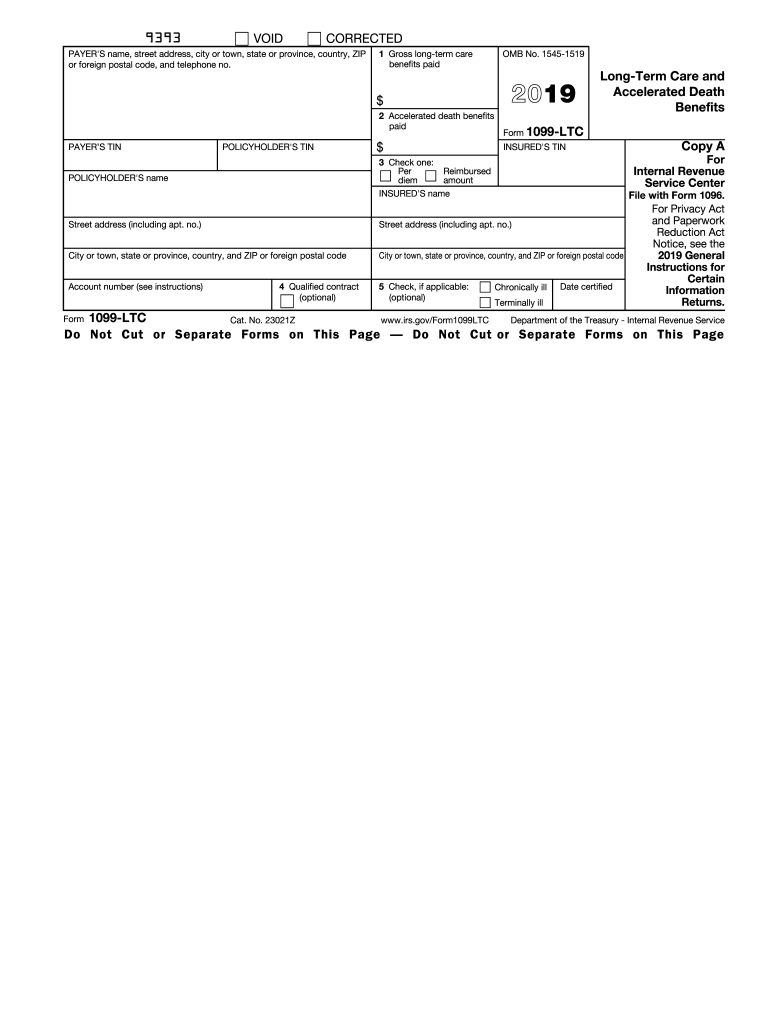

1099 LTC Software To Create Print E File IRS Form 1099 LTC

http://www.idmsinc.com/images/screenshots/1099LTC.png

Information about Form 1099 LTC Long Term Care and Accelerated Death Benefits including recent updates related forms and instructions on how to file File this form if For 2020 this limit is 380 It applies to the total of the accelerated death benefits and any periodic payments received from long term care insurance contracts

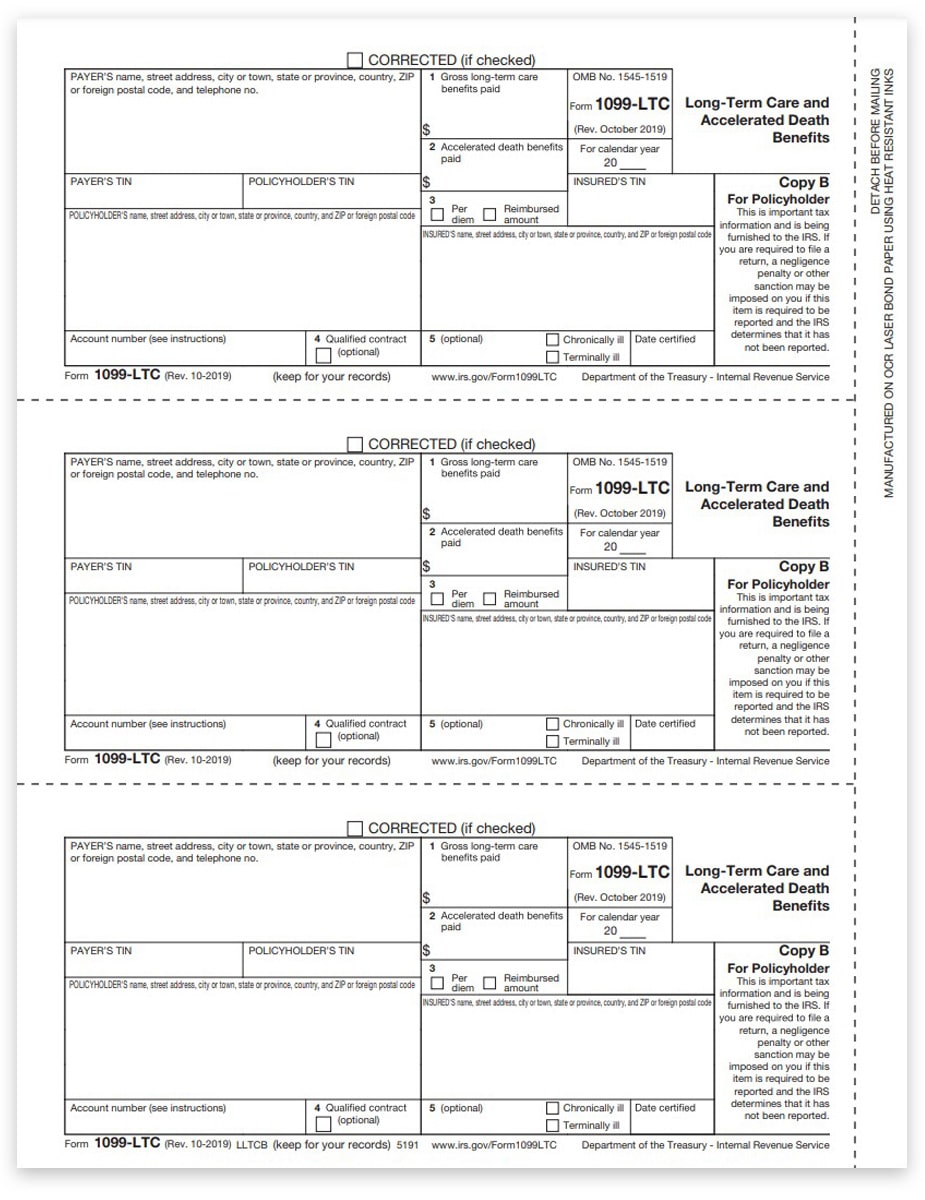

Your 1099 LTC taxable income amount from long term care and accelerated death benefits must be included as other income on Schedule 1 line 8z Schedule 1 for You may report benefits paid from each contract on a separate Form 1099 LTC At your option you may aggregate benefits paid under multiple contracts on one Form 1099

Download Is 1099 Ltc Taxable Income

More picture related to Is 1099 Ltc Taxable Income

IRS 1099 LTC 2019 2022 Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/454/879/454879714/large.png

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png)

Form 1099 LTC Long Term Care And Accelerated Death Benefits Definition

https://www.investopedia.com/thmb/w6ojMz00Bp4heSd2aam1H9LZei0=/1664x812/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png

Are Benefits From A Long Term Care Insurance Policy Taxable LTC News

https://ltcnews-cdn.s3.amazonaws.com/misc/irs-form-1099-ltc-medium.png

Did you receive a Form 1099 LTC What is a 1099 LTC and how do you use it to report long term care and AD benefits Learn more here The fact that you receive this form does not necessarily mean that the amounts reported are taxable income to you In addition benefits declared are often offset by expenses

Generally your LTC reimbursement is only taxable if they exceed your medical expenses Be sure to answer the TurboTax follow up questions in the 1099 LTC The payments received that are indicated by Form 1099 LTC are either long term care benefits or accelerated death benefits Payments that are from long term care insurance

1099 Tax Form Printable Printable Forms Free Online

https://www.american-equity.com/filesimages/Tax Forms PDFs/1099 R 2018.JPG

10 Days Leave Encashment In The LTC Cash Package Is Taxable Or Not

https://1.bp.blogspot.com/-Kn627ZobyaU/YE4focdCUkI/AAAAAAAAGIo/o_OK7hWSX9gnt4Bn6IIfULjlreVtFbNRACLcBGAsYHQ/s701/LTC%2B-TAX.png

https://blog.taxact.com/guide-to-1099-ltc-form

The bottom line The 1099 LTC form allows the IRS to track long term care or accelerated death benefit payments While some of this money may be taxable

https://www.sapling.com/8768833/1099…

Benefits paid to a chronically or terminally ill person and reported on Internal Revenue Service Form 1099 LTC are usually excluded from income and therefore not subject to income tax The exclusion isn t

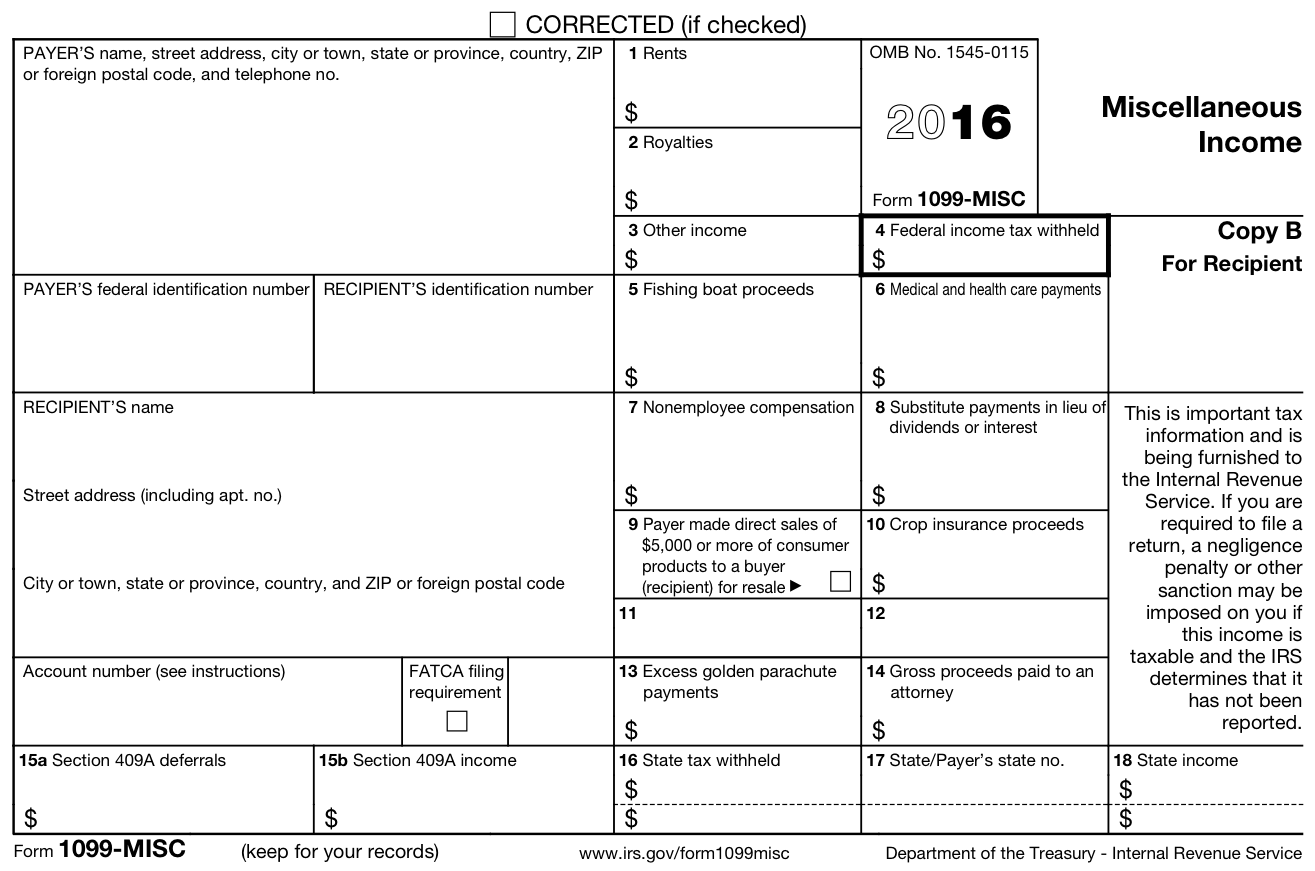

1099 MISC Tax Basics

1099 Tax Form Printable Printable Forms Free Online

Form 1099 LTC Long Term Care And Accelerated Death Benefits

1099LTC Forms For Long Term Care Benefits DiscountTaxForms

1099LTC Tax Forms For Long Term Care Benefits Copy B ZBPforms

E file Form 1099 LTC IRS Form 1099 LTC Long Term Care And

E file Form 1099 LTC IRS Form 1099 LTC Long Term Care And

What Is A 1099 MISC Personal Finance For PhDs

What Is A 1099 K Tax Form

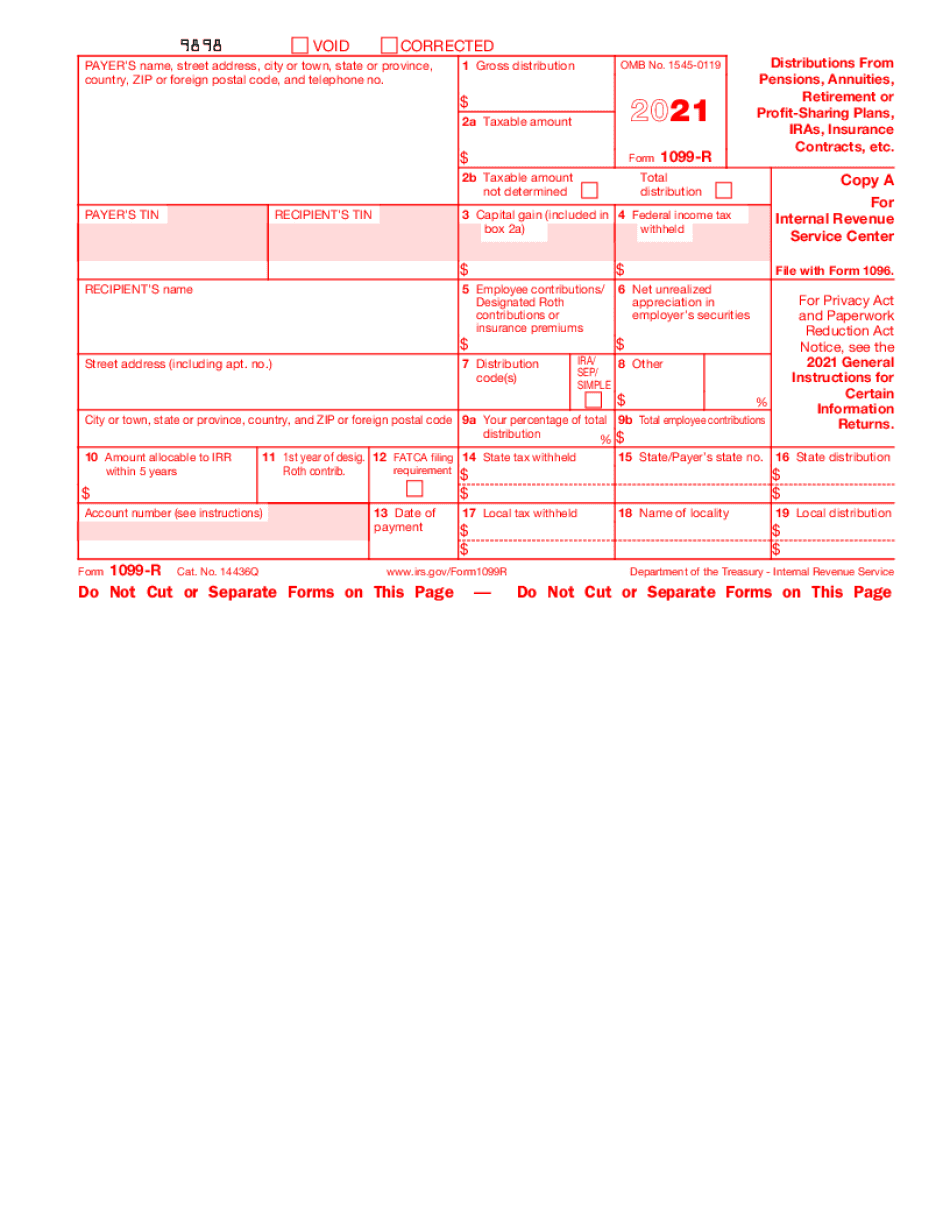

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Is 1099 Ltc Taxable Income - Information about Form 1099 LTC Long Term Care and Accelerated Death Benefits including recent updates related forms and instructions on how to file File this form if