Is 80c Deduction Allowed In New Tax Regime Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

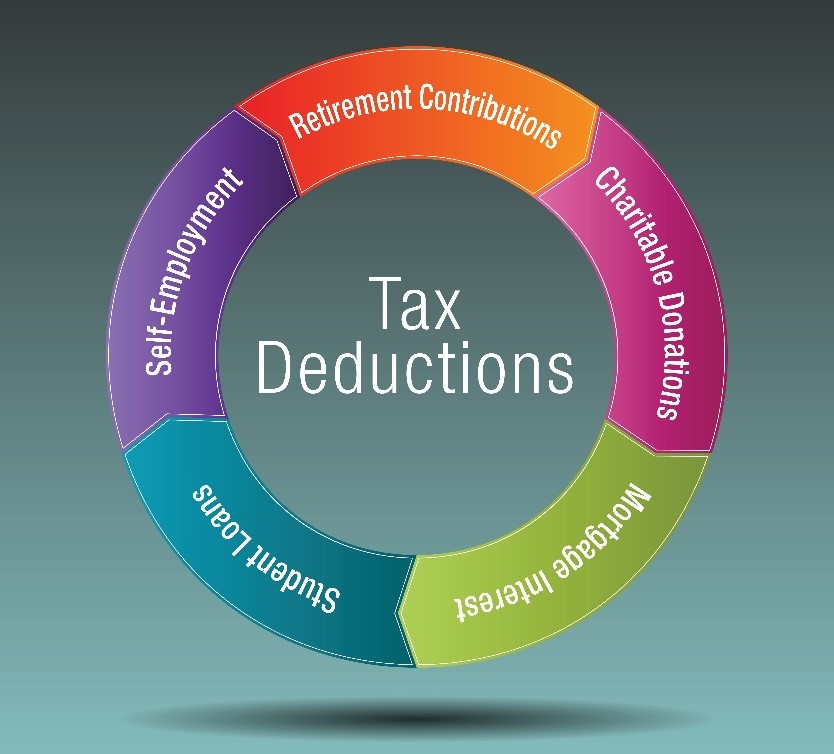

In new tax regime Chapter VIA deductions cannot be claimed except deduction u s 80CCD 2 80CCH 80JJAA as per the provision of Section 115BAC of the Income Tax The only deduction that is allowed under the new income regime in FY 2022 23 is Section 80CCD 2 This deduction is linked to the employer s contribution to the

Is 80c Deduction Allowed In New Tax Regime

Is 80c Deduction Allowed In New Tax Regime

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

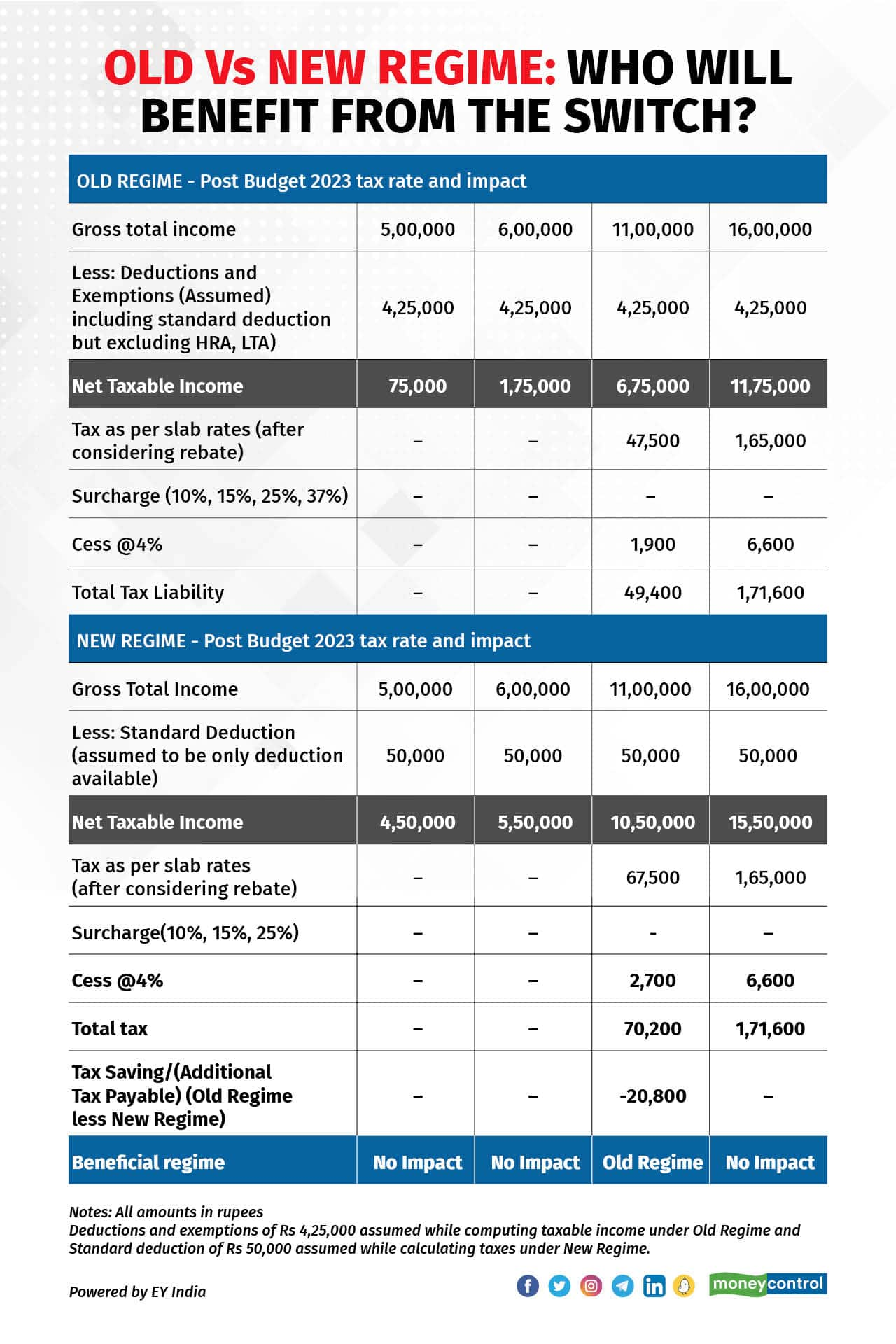

However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Can I claim 80C in the new tax regime No Section 80C deduction is not applicable in the new tax regime

What deductions are still not allowed in the revised new tax regime effective April 2023 Under the revised new tax regime the individual will forego 70 deductions Since the new tax regime began in FY 2020 21 a deduction under Section 80CCD 2 has been available for employer contributions to an employee s Tier I NPS account Private sector employees

Download Is 80c Deduction Allowed In New Tax Regime

More picture related to Is 80c Deduction Allowed In New Tax Regime

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

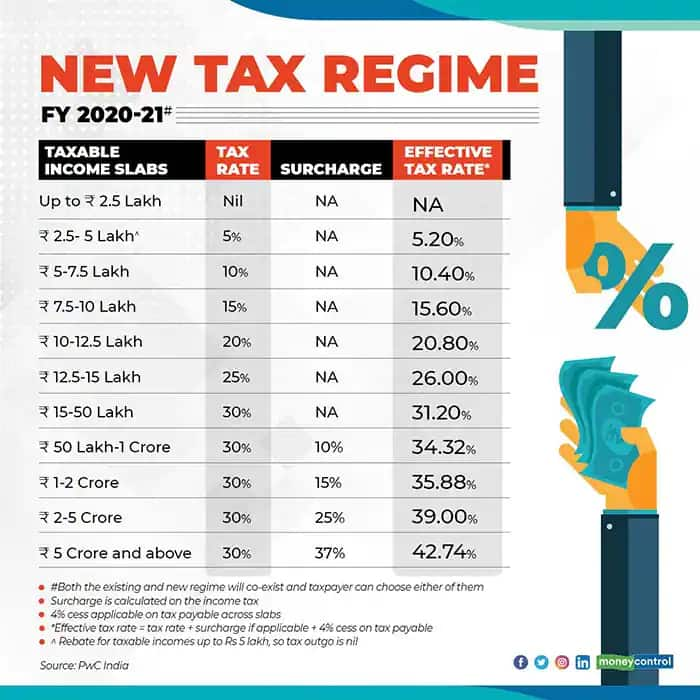

Under the new tax regime the tax rates are structured as follows income up to Rs 3 lakh attracts zero tax Rs 3 lakh to Rs 6 lakh is taxed at 5 with a rebate under section 87A Rs 6 lakh to Rs Ans From AY 2024 25 new tax regime has become the default tax regime where claiming of chapter VIA deductions are not allowed except section 80CCD 2 as per the

New Tax Regime A new tax regime was introduced in Budget 2020 wherein the tax slabs were altered and taxpayers were offered concessional tax rates A taxpayer can claim a few exemptions under the new tax regime apart from HRA LTA Section 80C and 80D of the Income Tax Act 1961 ClearTax Chronicles Standard

Rebate Limit New Income Slabs Standard Deduction Understanding What

https://feeds.abplive.com/onecms/images/uploaded-images/2023/02/01/a7b773f5d25d441b1f70bb4e5af7e14f1675251759563314_original.jpg

Brief Comparison Between New Tax Regime And Old Tax Regime FY 2023 24

https://studycafe.in/wp-content/uploads/2023/04/Brief-comparison-between-New-Tax-Regime-and-Old-Tax-Regime-1.jpg

https://taxguru.in/income-tax/exemptions-deduction...

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

https://www.incometax.gov.in/iec/foportal/sites...

In new tax regime Chapter VIA deductions cannot be claimed except deduction u s 80CCD 2 80CCH 80JJAA as per the provision of Section 115BAC of the Income Tax

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Rebate Limit New Income Slabs Standard Deduction Understanding What

Changes In New Tax Regime All You Need To Know

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Is 80c Deduction Allowed In New Tax Regime - Section 80CCD allows deductions for contributions to the National Pension Scheme NPS or Atal Pension Yojana Understanding these 80C subsections can help