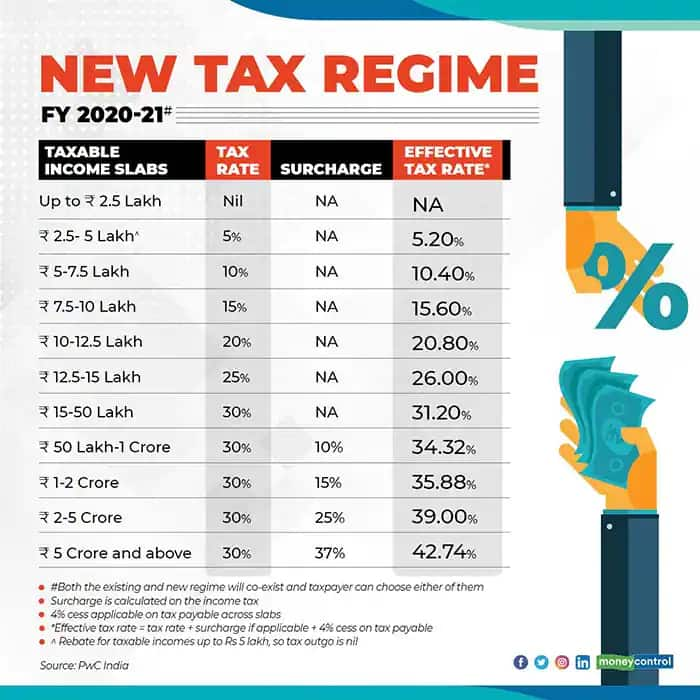

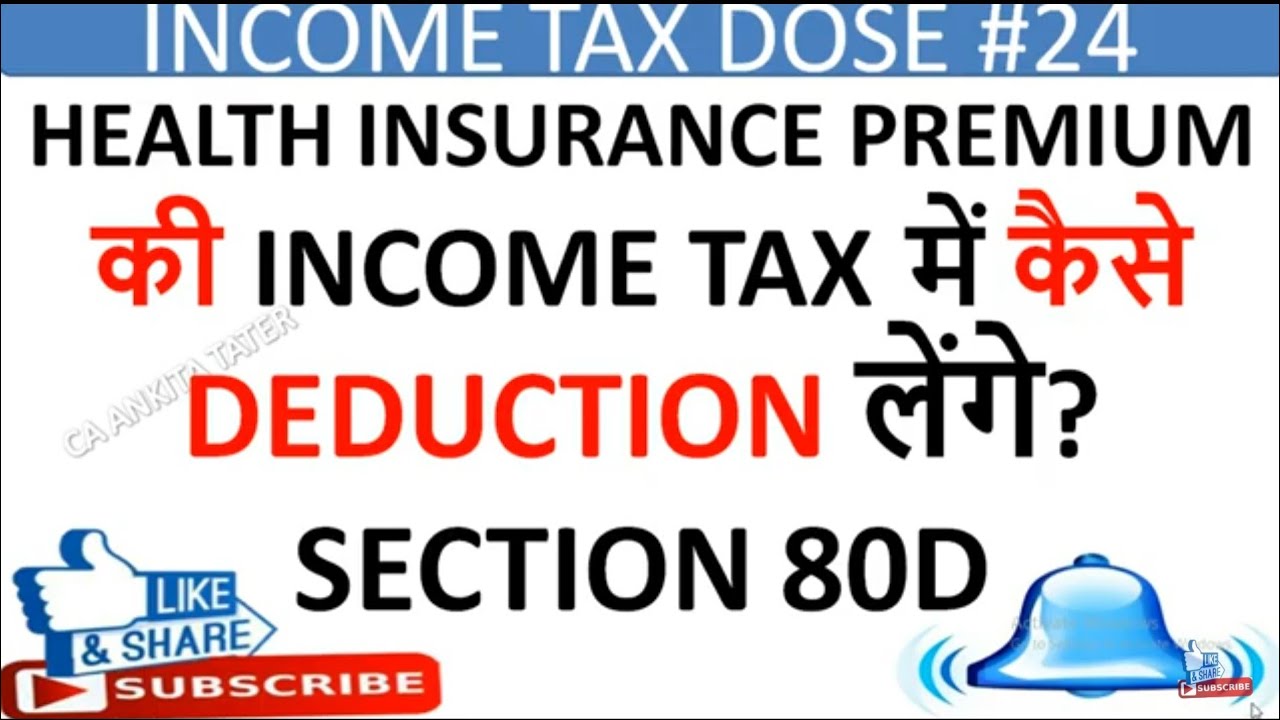

Is 80d Deduction Allowed In New Tax Regime What Deductions are Allowed Under Section 80D Though the Budget 2024 announced no change in income tax slabs Section 80D deductions are still available to taxpayers under the new tax regime Below is the list of

In new tax regime Chapter VIA deductions cannot be claimed except deduction u s 80CCD 2 80CCH 80JJAA as per the provision of Section 115BAC of the Income Tax Act Note that the new tax regime has removed nearly 70 tax deductions that were earlier allowed in the old regime For example you can not claim tax saving benefits on expenses related to

Is 80d Deduction Allowed In New Tax Regime

Is 80d Deduction Allowed In New Tax Regime

https://mkrk.co.in/wp-content/uploads/2021/03/Blog18-Old-Versus-New-Tax-Regime-33.png

Why The New Income Tax Regime Has Few Takers

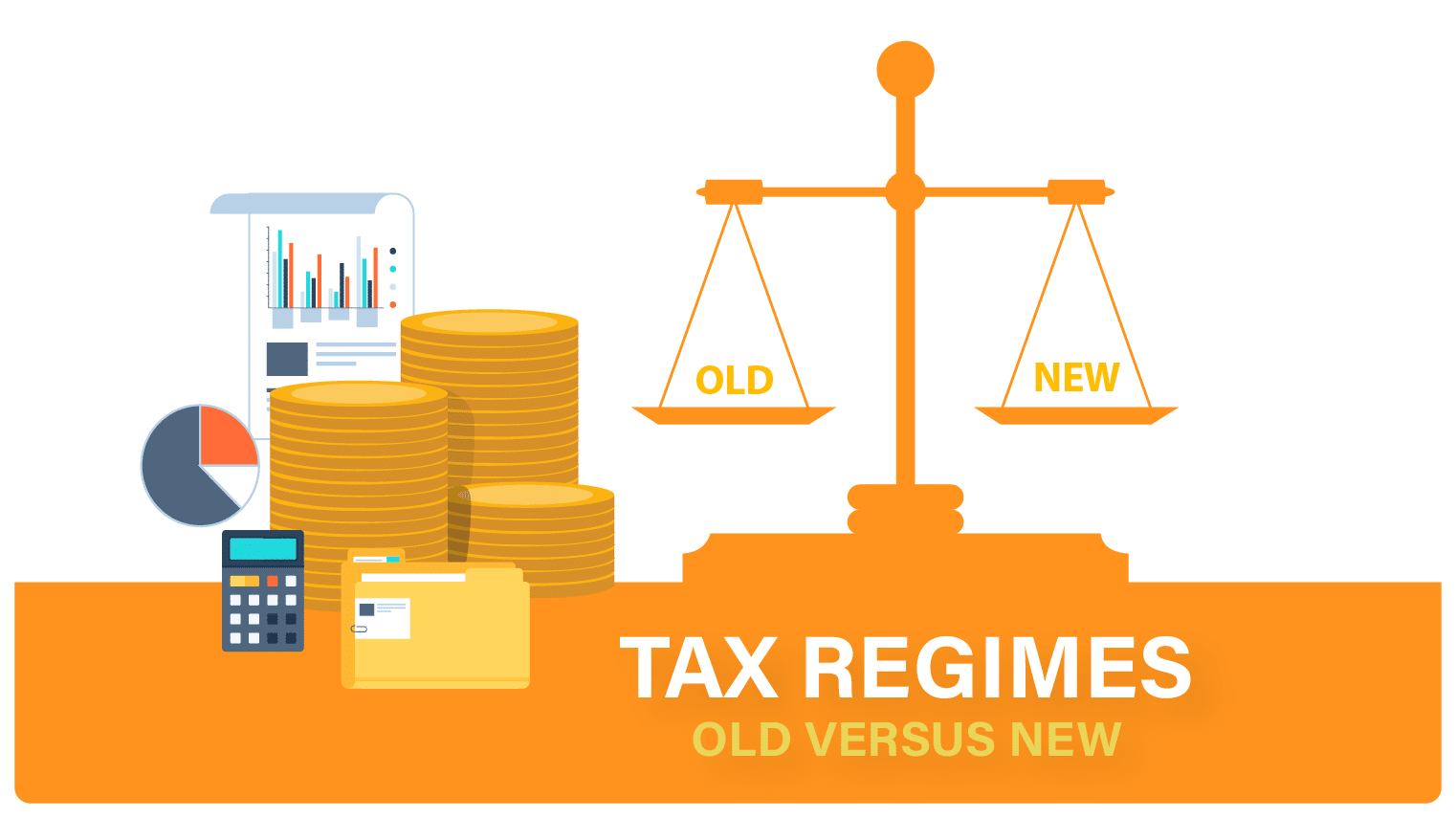

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

Tax saving via section 80D for FY 2023 24 Here s all you need to know about claiming deduction under Section 80D to save income tax This deduction is available under old tax regime only Individuals opting for new tax Taxpayers can deduct upto Rs 75 000 as a standard deduction from their salary Deductions and Exemptions The old tax regime offered a host of deductions and exemptions such as Section 80C 80D 80E 80G and so on

Although most of tax deductions and exemptions cannot be claimed under the new tax regime the following deductions are allowed under existing rules The employer s No deductions under Chapter VI A including popular ones like 80C for investments 80D for medical insurance premiums and 80E for education loan interest

Download Is 80d Deduction Allowed In New Tax Regime

More picture related to Is 80d Deduction Allowed In New Tax Regime

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://blog.quicko.com/wp-content/uploads/2020/02/New-Tax-Regime-coverage-scaled-1-1024x512.jpg

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

You can get a tax deduction of up to Rs 1 00 000 60 above self and 60 above parents under section 80D including a preventive health check of Rs 5000 self family It is an additional Deduction under Section 80CCD 2 The updated New Tax Regime now allows the taxpayers to avail the advantage of employer contribution to their National Pension Scheme NPS account as per Section 80CCD 2 of

Under the new tax regime the total income should meet the below mentioned conditions All deductions under Chapter VI A except those specified in section 80CCD Here we look at the tax deductions and exemptions under both tax regimes for FY2025 26 New Tax Regime 2025 26 FM Nirmala Sitharaman s tax relief proposals in

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

https://taxguru.in › income-tax

What Deductions are Allowed Under Section 80D Though the Budget 2024 announced no change in income tax slabs Section 80D deductions are still available to taxpayers under the new tax regime Below is the list of

https://www.incometax.gov.in › iec › foportal › sites...

In new tax regime Chapter VIA deductions cannot be claimed except deduction u s 80CCD 2 80CCH 80JJAA as per the provision of Section 115BAC of the Income Tax Act

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Rebate Limit New Income Slabs Standard Deduction Understanding What

Income Tax Slabs For FY 2022 2023 AY 2023 2024 Akrivia HCM

Changes In New Tax Regime All You Need To Know

Changes In New Tax Regime All You Need To Know

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

Is 80d Deduction Allowed In New Tax Regime - Section 80D This deduction is available for premium paid on medical insurance policy An individual can claim maximum deduction of Rs 25 000 for insurance premium paid