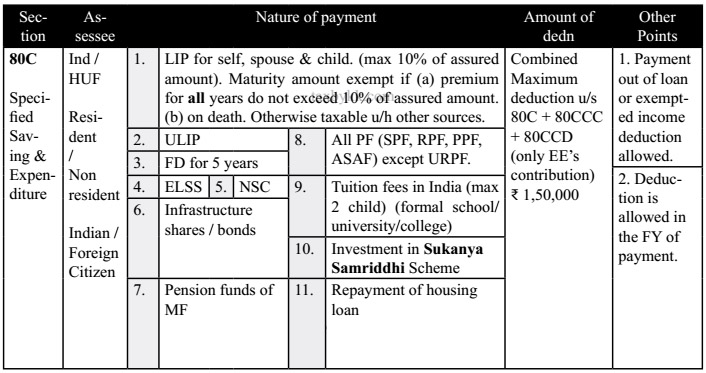

Is 80eeb Part Of 80c The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000

Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80EEB on Income Tax The benefit Section 80EEB can be claimed by individuals only An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 1 5 lacs u s 80EEB

Is 80eeb Part Of 80c

Is 80eeb Part Of 80c

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Section 80C To 80U Income Tax Deductions FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/10/section-80C-to-80U-1024x576.webp

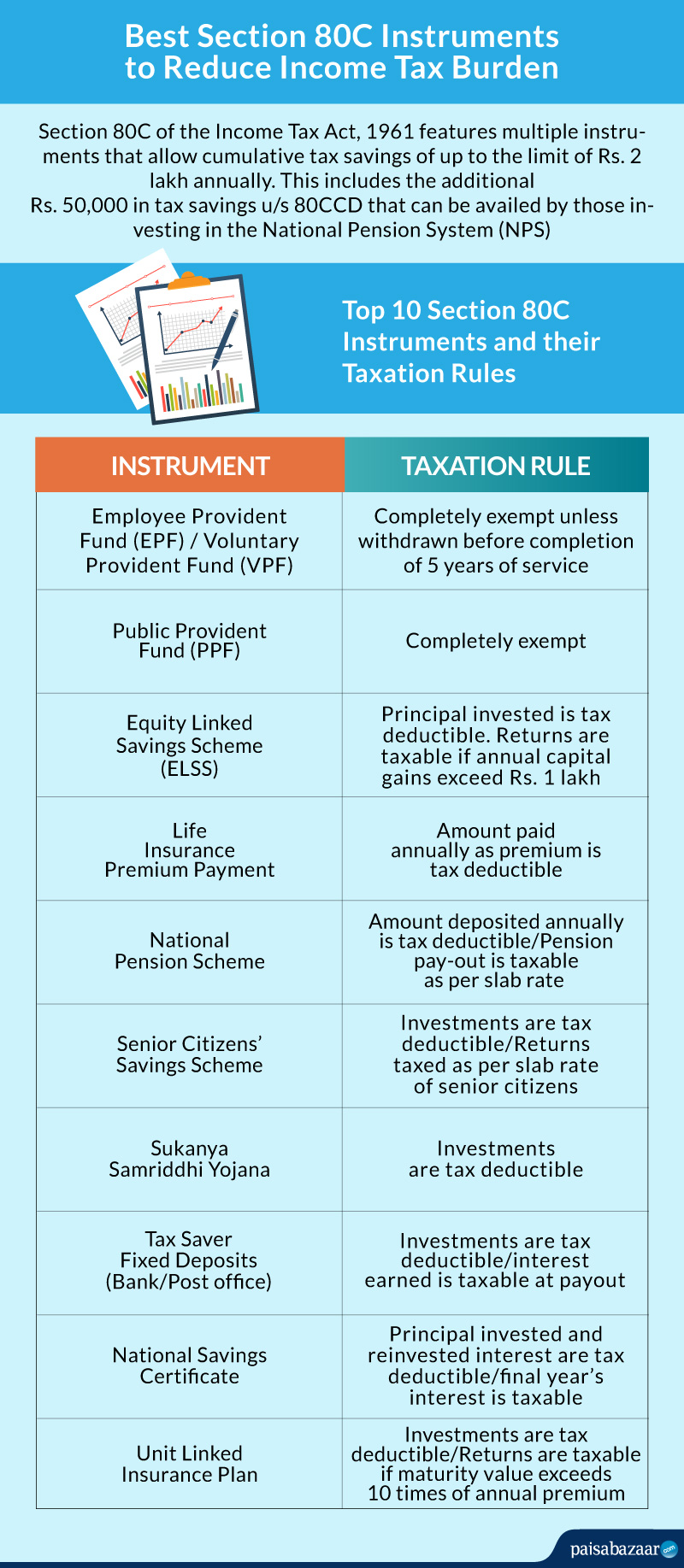

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of Is Section 80EEB a part of Section 80C of the Income Tax Act Section 80EEB does not fall under section 80C The latter offers tax deductions and rebates for

All eligible persons are allowed a deduction under section 80 EEB To claim an 80EEB deduction you should fulfil the following conditions The assessee should have an Discover how Section 80EEB of the Income Tax Act incentivized the purchase of electric vehicles in India with tax deductions on loan interest Learn about eligibility

Download Is 80eeb Part Of 80c

More picture related to Is 80eeb Part Of 80c

What Is 80c All You Need To Know About Section 80C Tata Capital Blog

https://www.tatacapital.com/blog/wp-content/uploads/2022/02/section-80C-768x399.jpg

Section 80EEB Deduction Tax Benefit Of Buying An Electric Vehicle

https://life.futuregenerali.in/media/uqtba5wf/section-80eeb-deduction.jpg

Deduction U s 80C To 80 U Part 12 In Tamil deductionu s80eeb

https://i.ytimg.com/vi/7rZcmLdXF_A/maxresdefault.jpg

Section 80EEB is applicable to an eligible taxpayer who has taken a loan for the purchase of an electric vehicle from any financial institution Interest payable on such From April 1 2019 March 31 2022 a total of Rs 10 000 crore would be spent on FAME India Phase II Section 80EEB allows a deduction for the interest paid on the loan taken

Deduction in respect of interest payable on loan taken for the purchase of Electric Vehicle is available under Section 80EEB of the Income Tax Act 1961 as introduced by the Finance Act 2019 The Section 80EEB of the Income Tax Act in India provides a deduction for interest paid on loans taken for the purchase of electric vehicles Know more on 80EEB

Deductions 80E 80EE 80EEA 80EEB 80QQB 80RRB Part 3 80C To 80U CMA

https://i.ytimg.com/vi/IMFGsMEL0x8/maxresdefault.jpg

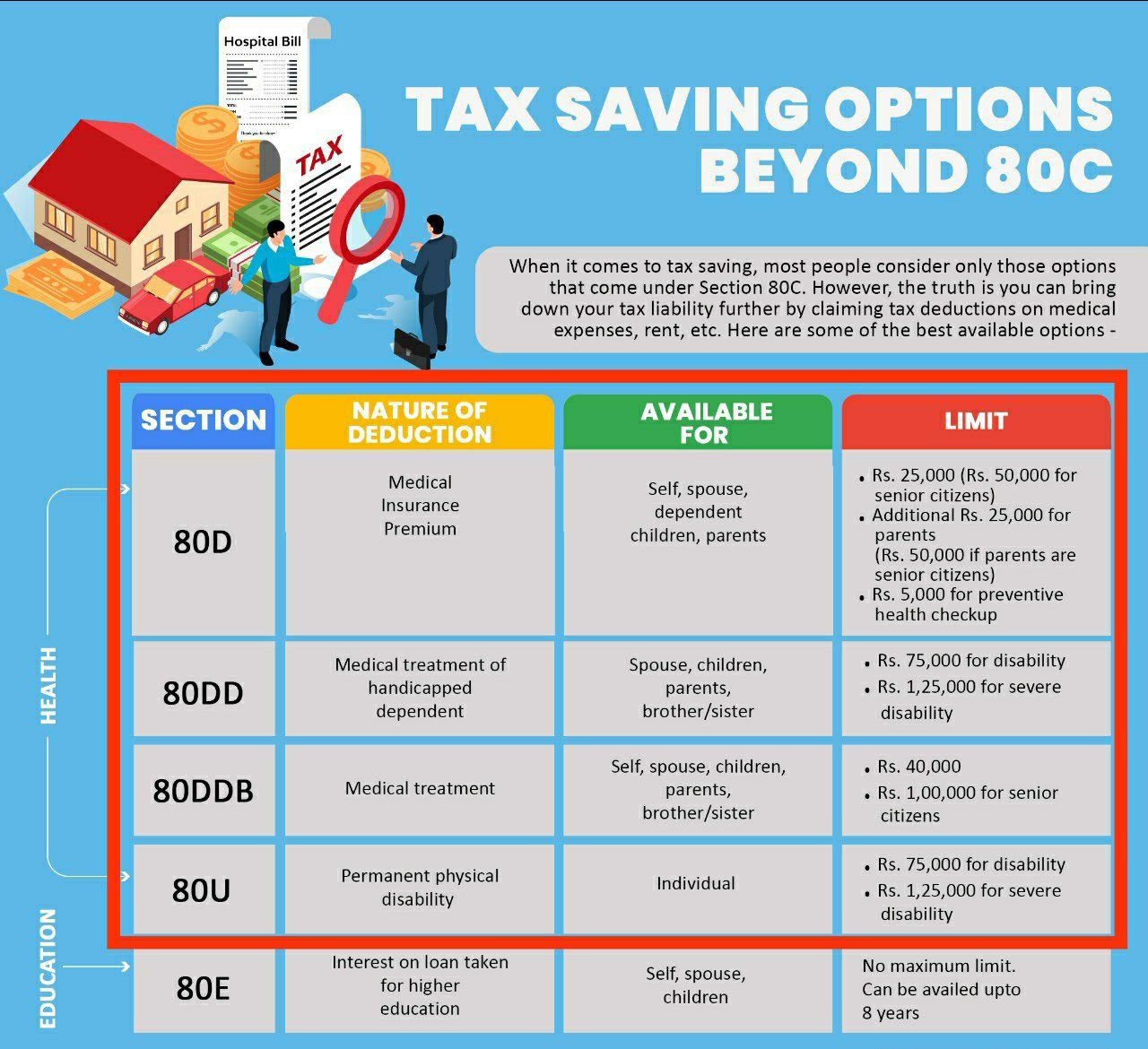

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

https://cleartax.in/s/80c-80-deductions

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000

https://tax2win.in/guide/section-80eeb-d…

Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80EEB on Income Tax

Size 70B 70C 75A 75B 75C 80A 80B 80C 85C 85B 90A 70D 75D 80D 85D

Deductions 80E 80EE 80EEA 80EEB 80QQB 80RRB Part 3 80C To 80U CMA

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

80c Cartoon Cartoons Love 80s Cartoons Animated Cartoons Cowabunga

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80EEB Of Income Tax Act Deduction Tax Benefits

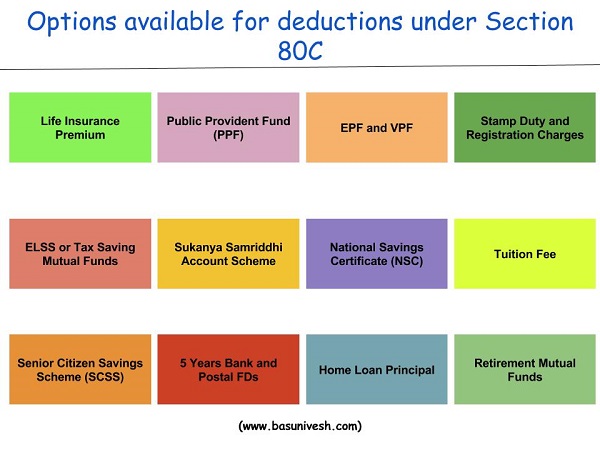

Deduction Under Section 80C A Complete List BasuNivesh

WHAT IS 80EEB SECTION INTREST DEDUCTION IN ELECTRIC VEHICLE LOAN

Is 80eeb Part Of 80c - Is Section 80EEB a part of Section 80C of the Income Tax Act Section 80EEB does not fall under section 80C The latter offers tax deductions and rebates for