Is 87a Rebate Available In New Tax Regime Verkko 3 helmik 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh

Verkko 4 kes 228 k 2023 nbsp 0183 32 Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Verkko 8 kes 228 k 2023 nbsp 0183 32 87A Rebate in New Tax Regime As per the Finance Act 2023 the threshold limit for total income eligible for rebate under Section 87A has been

Is 87a Rebate Available In New Tax Regime

Is 87a Rebate Available In New Tax Regime

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

87A Tax Rebate Benefits Are Lost If Non taxable MF LTCG Is Added In ITR

https://freefincal.com/wp-content/uploads/2022/07/87A-tax-rebate-benefits-are-lost-if-non-taxable-MF-LTCG-is-added-in-ITR.jpg

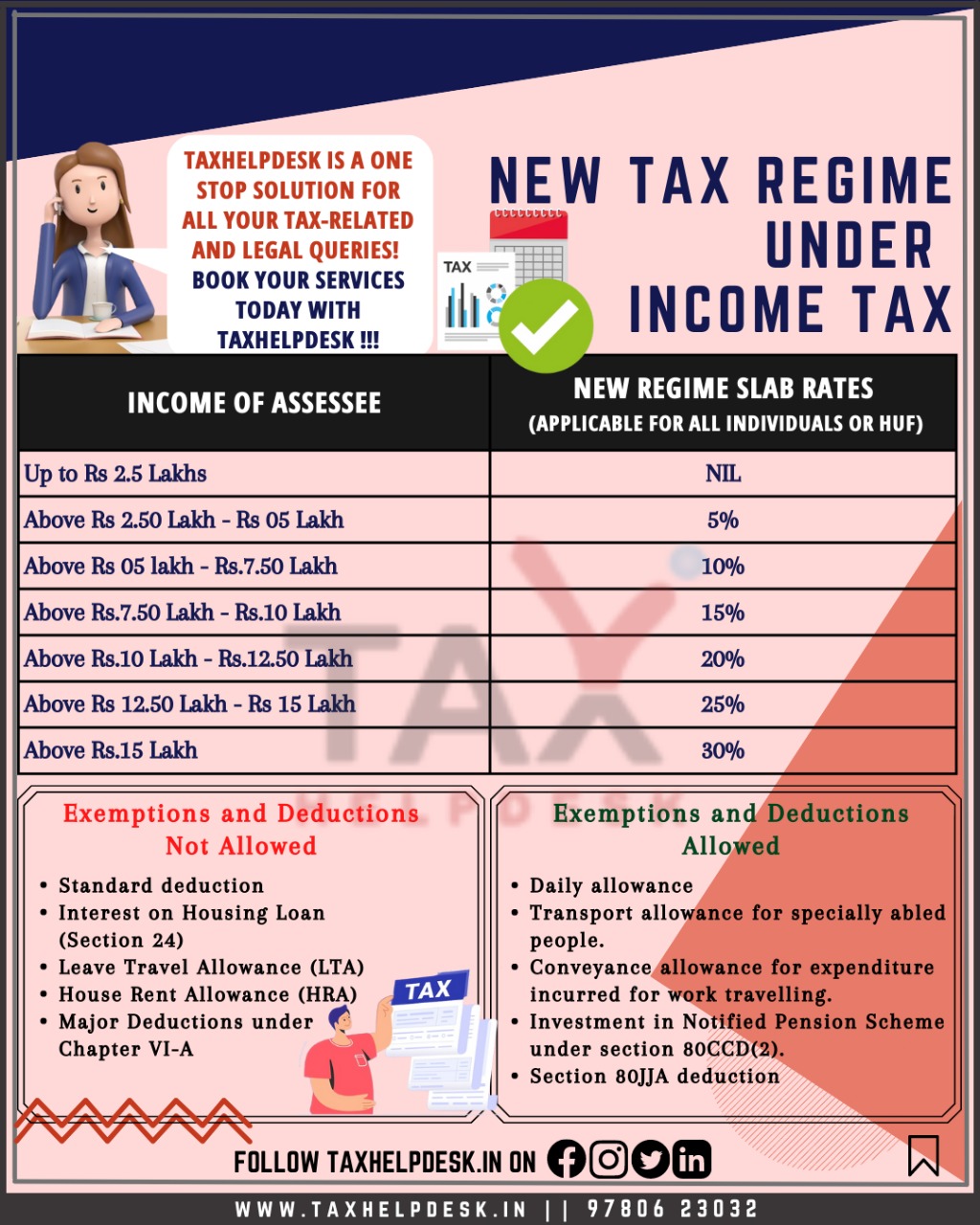

Verkko 3 helmik 2023 nbsp 0183 32 A income tax rebate under section 87 of Rs 25 000 is available u s 87A for the NEW tax regime for individuals whose taxable income is Rs 7 lakh or less in a year A rebate of Rs 12 500 is Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 The new tax regime was widened with six tax slab rates ranging from 0 to 30 Under this regime a full tax rebate on an income up to Rs 7 lakh was

Verkko 26 April 2022 Income Tax Taxpayers can reduce their tax liability through the rebate under Section 87A of the Income Tax Act Individuals can claim the rebate if the total Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 An adjustment in the new tax regime involves an increase in the rebate amount provided under section 87A The rebate amount has been raised by Rs

Download Is 87a Rebate Available In New Tax Regime

More picture related to Is 87a Rebate Available In New Tax Regime

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Increase in tax rebate Under Section 87A of the Income Tax Act the rebate limit has been increased from Rs 12 500 to Rs 25 000 in the new tax regime Verkko 10 huhtik 2023 nbsp 0183 32 Section 87A rebate is available under both the old and new tax regimes For FY 2023 24 the rebate limit of Rs 7 lakh in the new tax regime is

Verkko 4 elok 2023 nbsp 0183 32 Firstly note that Section 87A Tax rebate is available under both new and old tax regimes for Assessment Year 2024 25 Individuals having total taxable income Verkko What is Tax Rebate Under Section 87 A Steps to Claim Rebate Who is Eligible Things to Consider FAQs Understanding Rebate Under Section 87 A Income tax rules in India

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax.jpeg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Verkko 3 helmik 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh

https://taxguru.in/income-tax/marginal-relief-…

Verkko 4 kes 228 k 2023 nbsp 0183 32 Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Is 87 A Rebate Available In Case Of LTCG U s 112 A ltcg 87A

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Section 87A Income Tax Rebate

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax Rebate Under Section 87A

Here Is How To Claim Rebate Under Section 87A Of Income tax Act Zee

Section 87A Tax Rebate FY 2023 24 Under Old New Tax Regimes

Is 87a Rebate Available In New Tax Regime - Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 An adjustment in the new tax regime involves an increase in the rebate amount provided under section 87A The rebate amount has been raised by Rs