Is A Donation To A Nonprofit Tax Deductible Verkko 19 lokak 2023 nbsp 0183 32 Gifts to a non qualified charity or nonprofit As a society we give nearly 2 of our personal income to charities and nonprofit organizations However there is a common misconception that all nonprofits are qualifying charitable organizations but that isn t always the case For tax purposes the law classifies charities and

Verkko Where you donate Only certain types of organizations get the IRS s approval to declare that donations are tax deductible Most of these organizations have what s called 501 c 3 status All qualified organizations will be able to provide a National Taxonomy of Exempt Entities or NTEE code which is used to classify organizations based on the Verkko 5 jouluk 2023 nbsp 0183 32 A nonprofit cemetery company if the funds are irrevocably dedicated to the perpetual care of the cemetery as a whole and not a particular lot or mausoleum crypt Timing of Contributions Contributions must actually be paid in cash or other property before the close of your tax year to be deductible whether you use the cash or

Is A Donation To A Nonprofit Tax Deductible

Is A Donation To A Nonprofit Tax Deductible

https://simpleartifact.com/wp-content/uploads/2018/08/donor-thank-you-letter-sample-of-tax-donation-letter-template.png

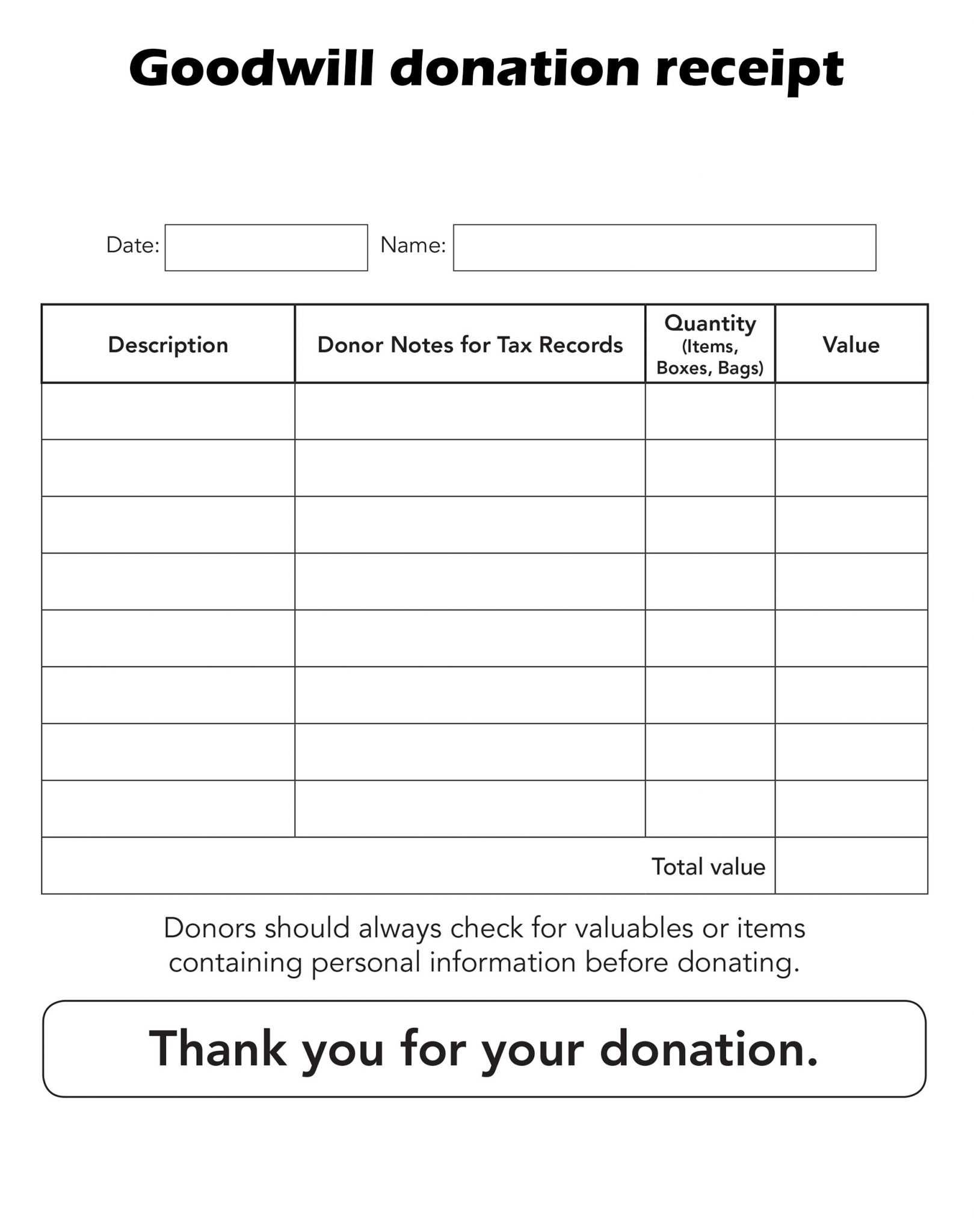

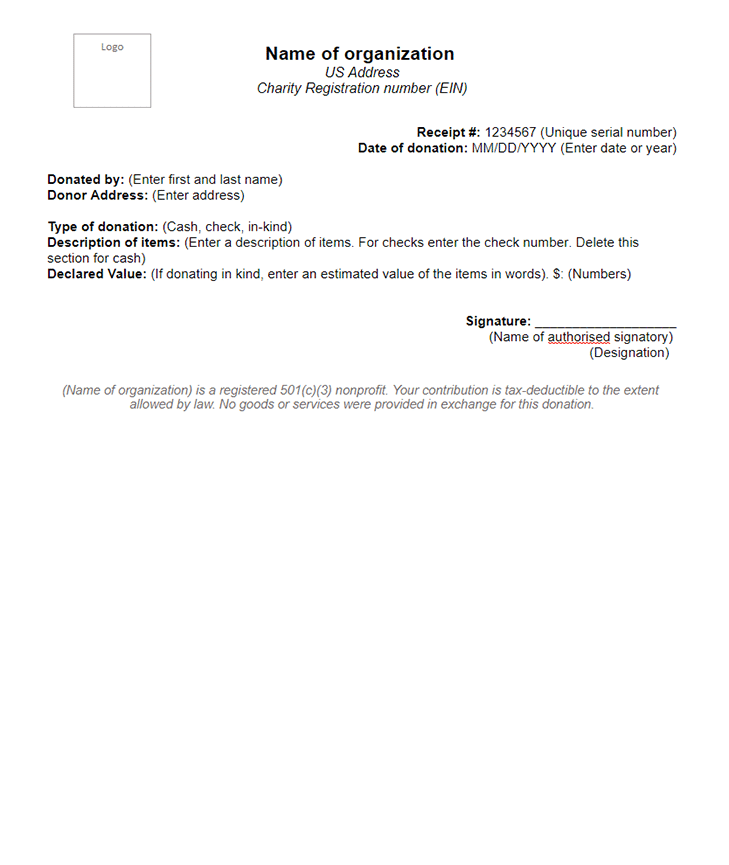

501c3 Donation Receipt Template Printable Pdf Word Receipt

https://i.pinimg.com/originals/c7/20/cf/c720cf928b1b541070d9f730bf9a736f.jpg

Uso Printable Donation Form Printable Forms Free Online

https://bestlettertemplate.com/wp-content/uploads/2020/08/Goodwill-donation-receipt-2-1619x2048.jpg

Verkko 25 marrask 2020 nbsp 0183 32 IRS Tax Tip 2020 161 November 25 2020 The arrival of the holiday season is when many people think about how they can give back Often taxpayers want to donate to a charity The IRS has a tool that can help people figure out if giving to their favorite cause will also give them the gift of a tax deduction Verkko 2 elok 2019 nbsp 0183 32 A tax deductible donation must meet certain criteria to qualify and count against your taxes See if a donation is deductible and if it will lower your tax bill Our flow charts and explanations make it easy to figure out If you re a US taxpayer giving to a nonprofit or charity you should be asking this question The

Verkko 15 jouluk 2022 nbsp 0183 32 Here s how your philanthropic giving can lower your tax bill Skip to content Money Credit Donations are deductible only if they go to a 501 That s because when you donate the stock Verkko 7 kes 228 k 2023 nbsp 0183 32 A searchable database of organizations eligible to receive tax deductible charitable contributions Web Based Mini Course Deducting Charitable Contributions Amount and types of deductible contributions what records to keep and how to report contributions Tax information on donated property

Download Is A Donation To A Nonprofit Tax Deductible

More picture related to Is A Donation To A Nonprofit Tax Deductible

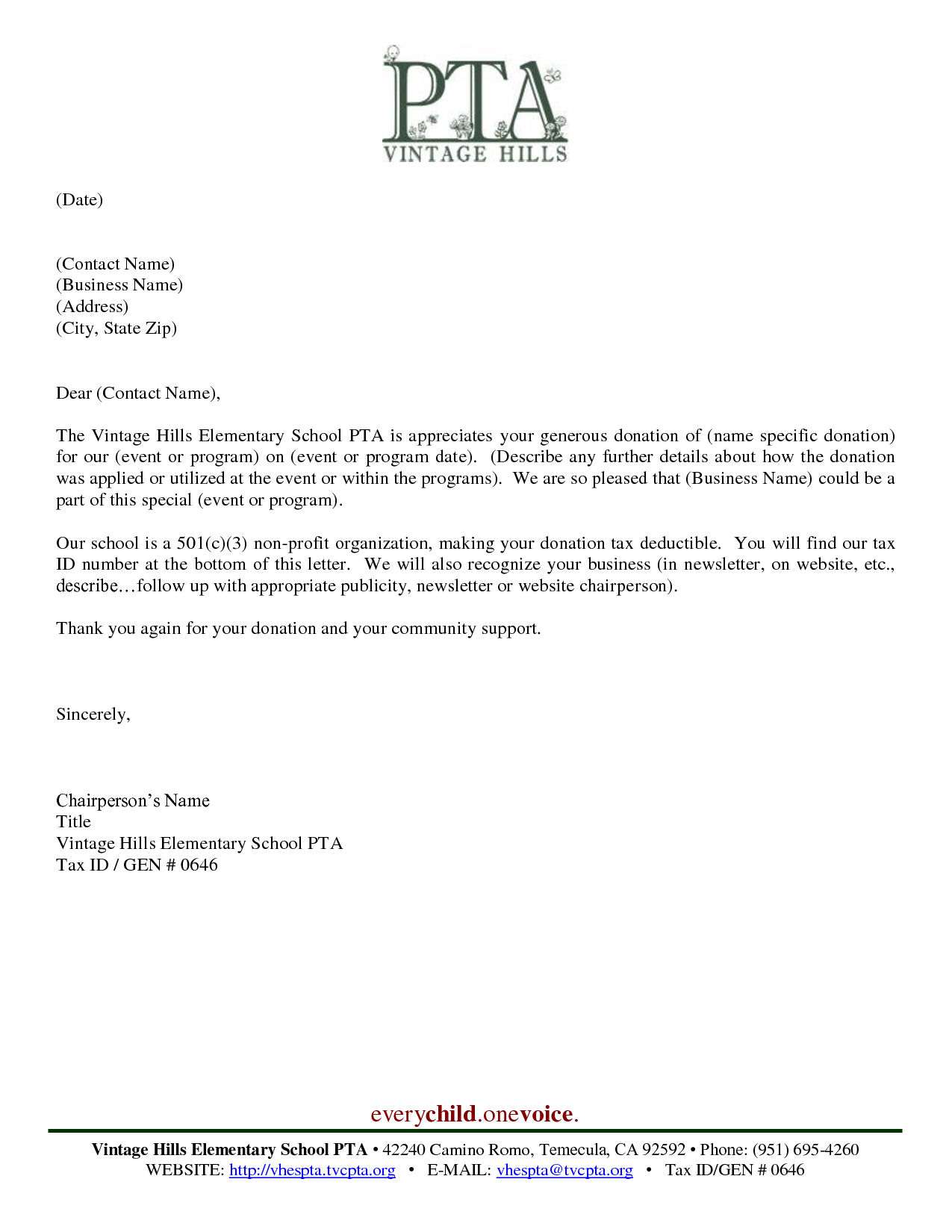

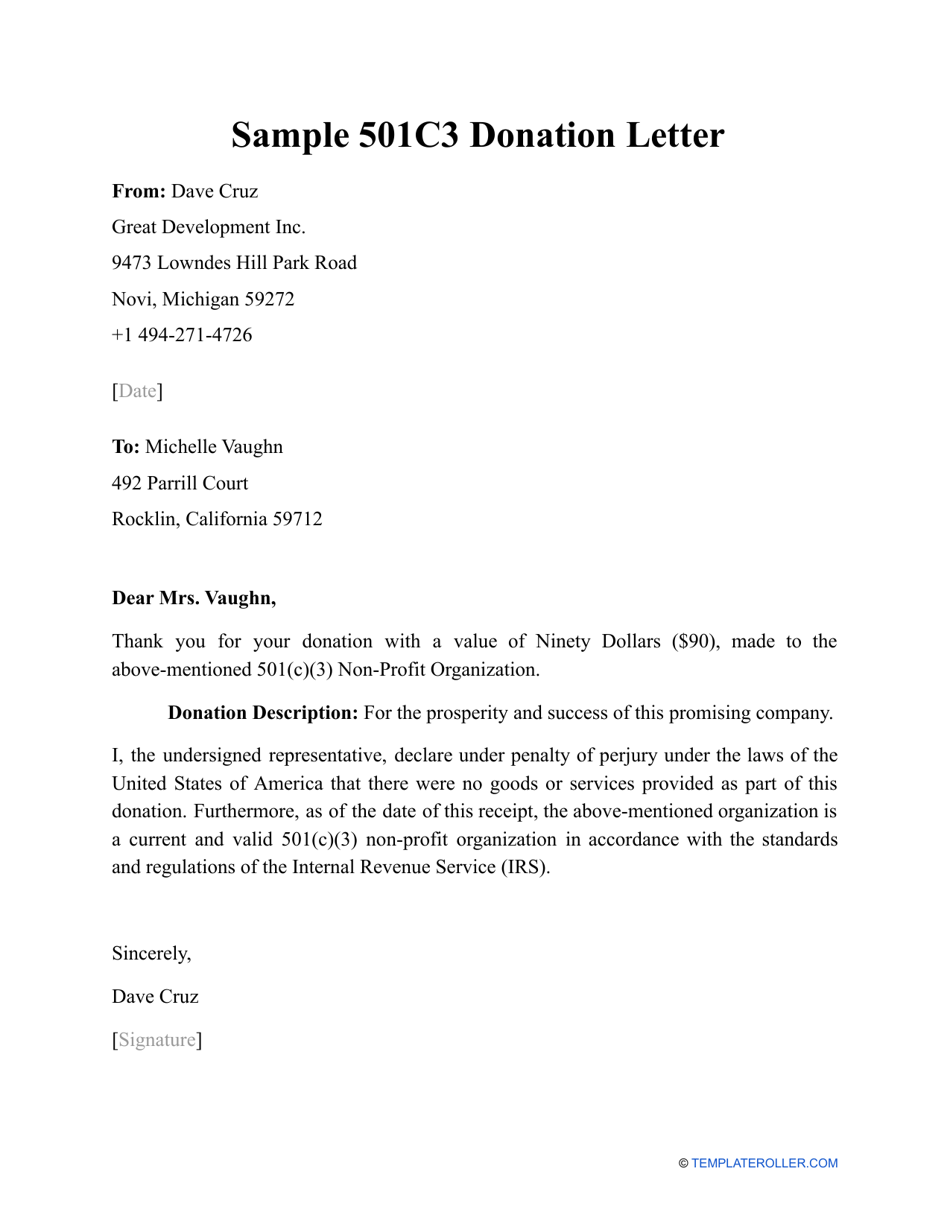

Tax Deductible Donation Thank You Letter Template Examples Letter

https://ntgj.org/wp-content/uploads/2018/08/tax-deductible-donation-form-template-of-tax-deductible-donation-thank-you-letter-template.jpg

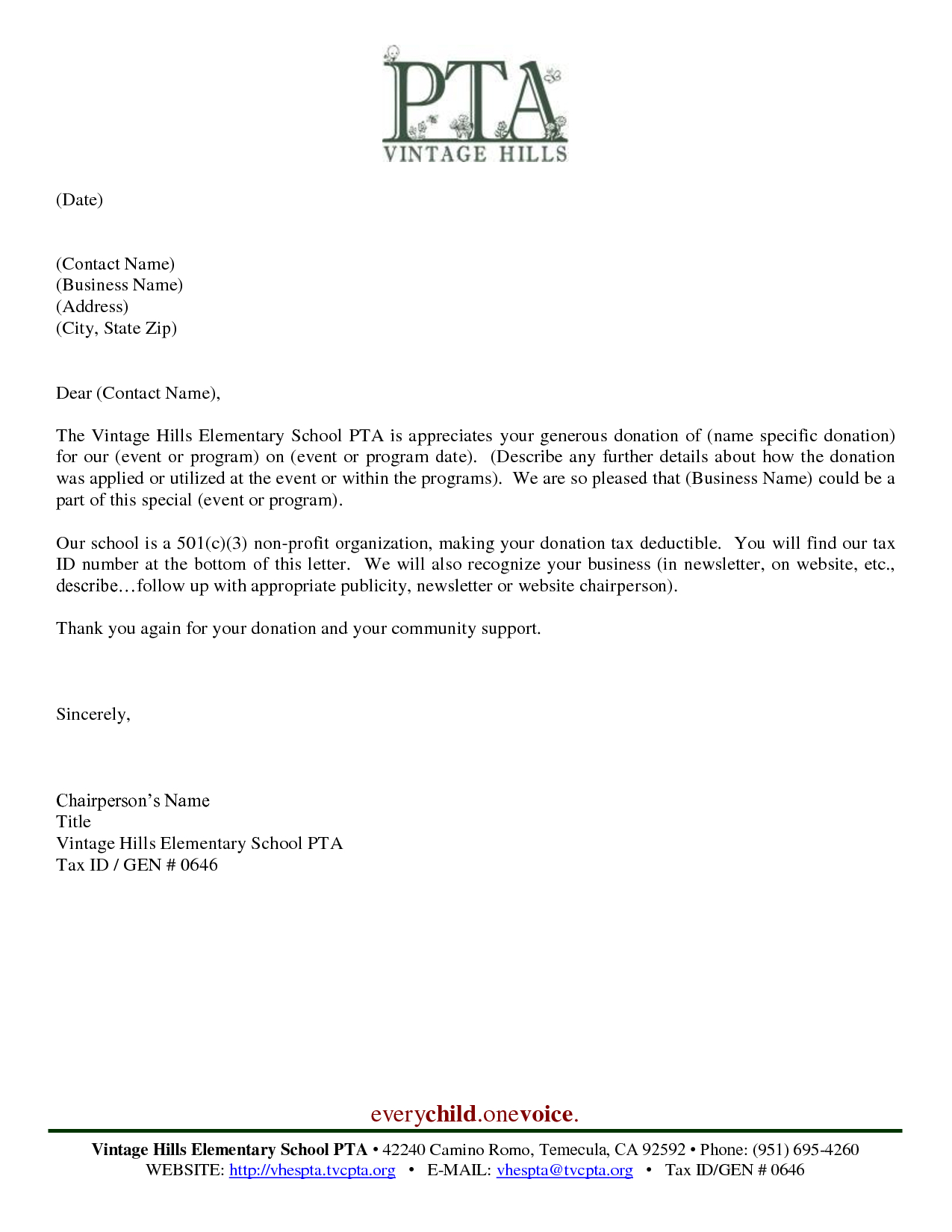

Non Profit Donation Request Letter Template Donation Request Letters

https://i.pinimg.com/originals/54/c1/2f/54c12ffefa3426ad96354dd0a47c32a1.png

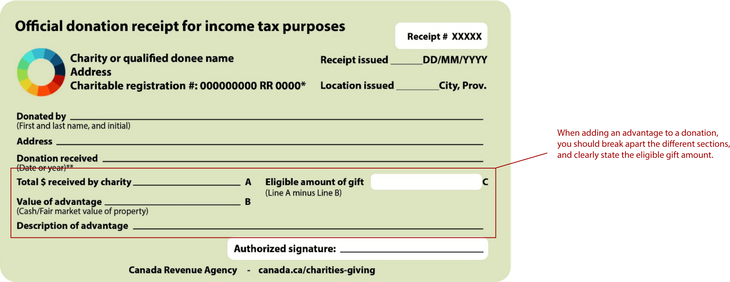

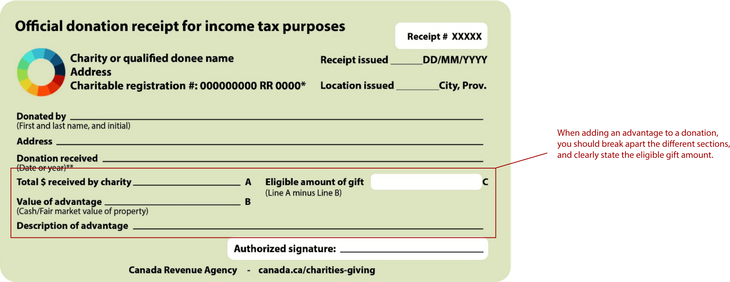

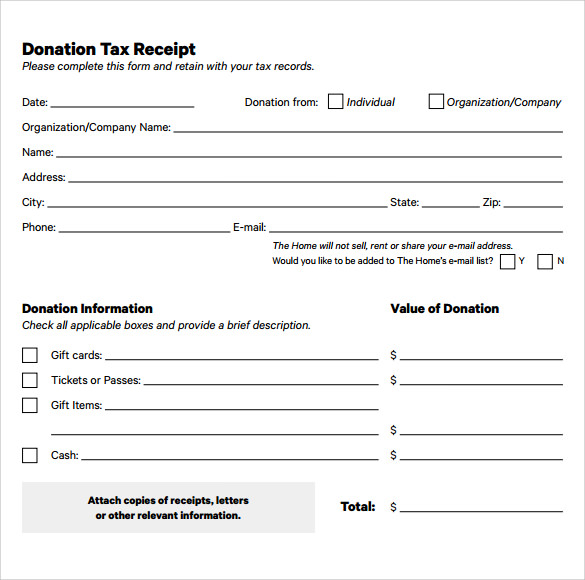

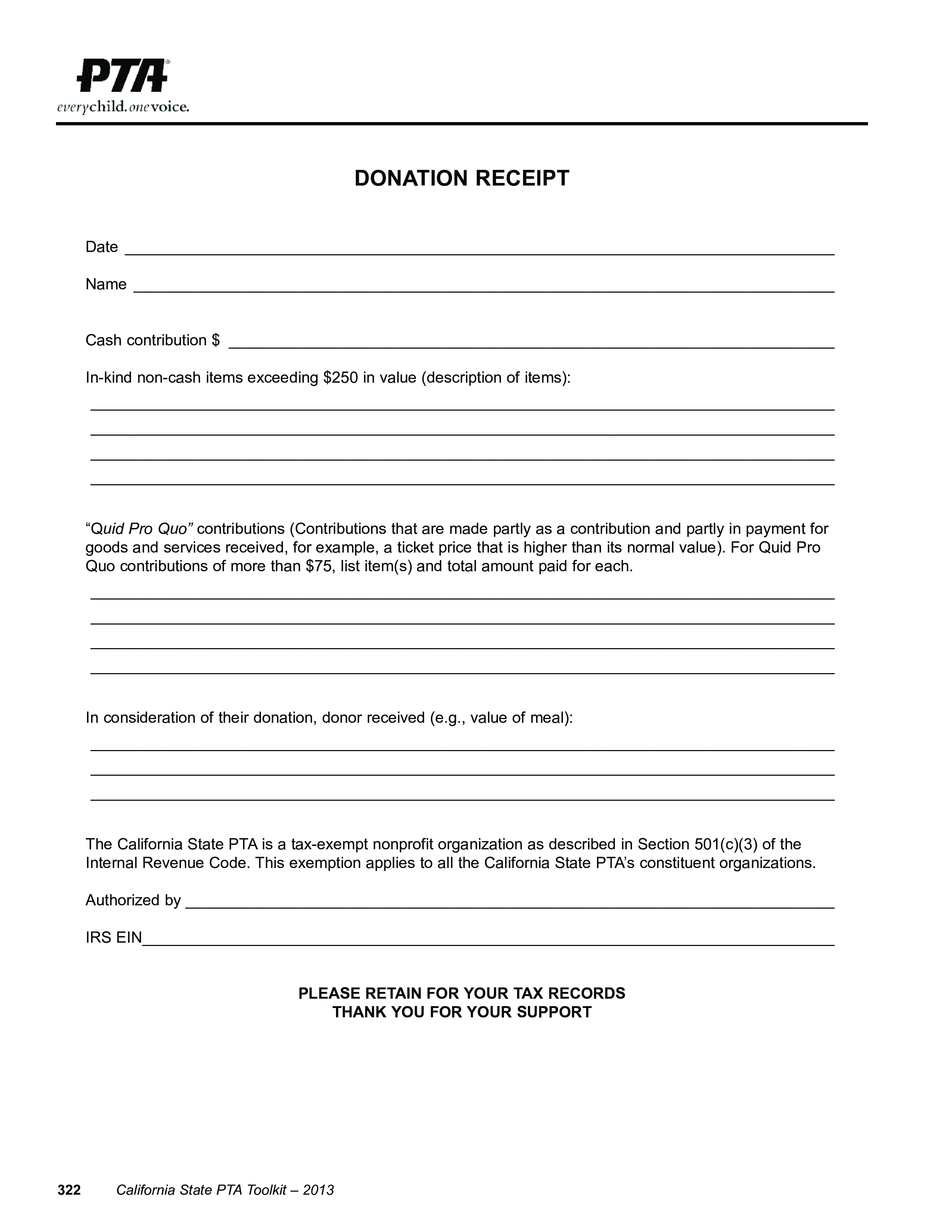

Free Donation Receipt Templates Sumac

https://www.sumac.com/wp-content/uploads/2021/02/501c3_donation_receipt_template_usa.png

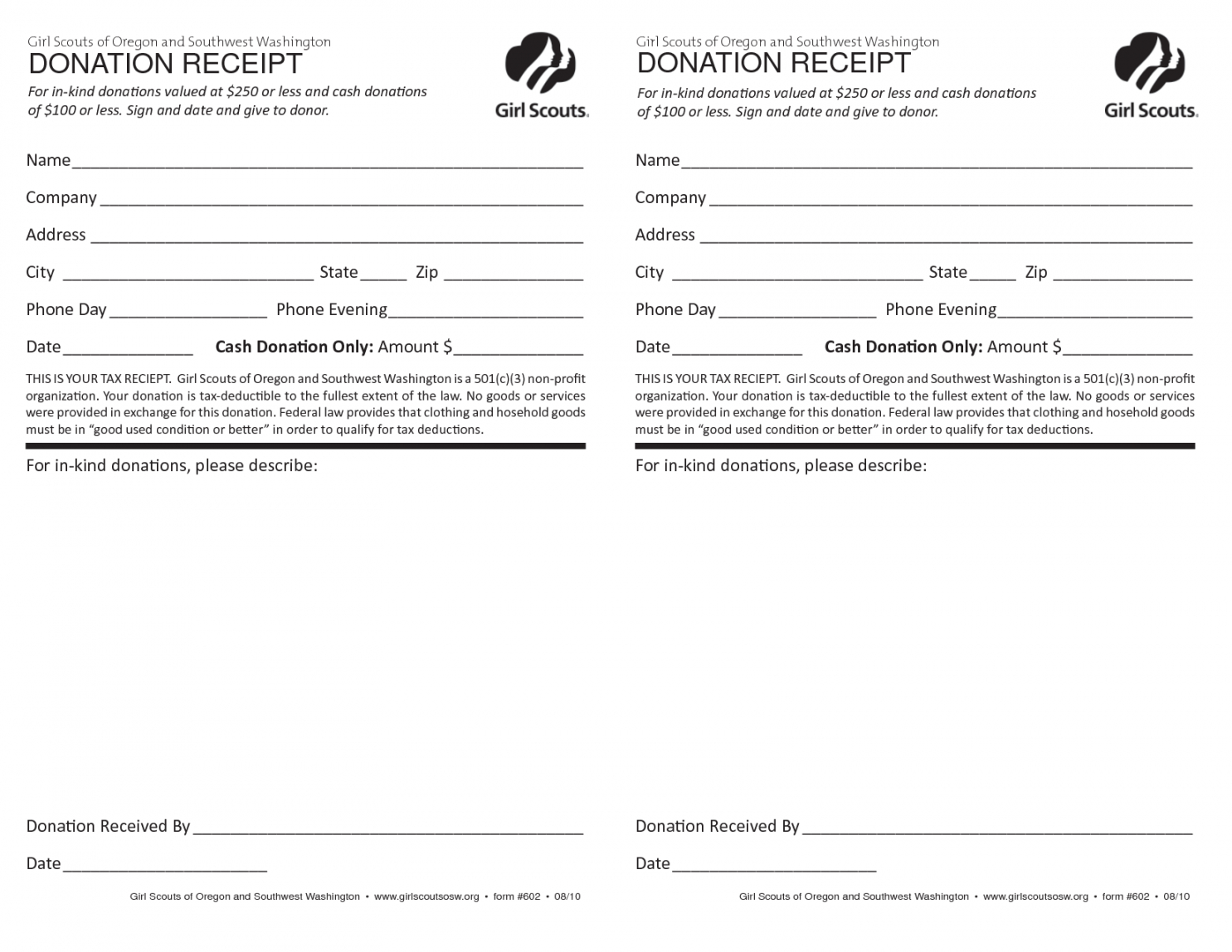

Verkko In the United States ever changing tax laws can make it difficult for donors to know which gifts are tax deductible and to what extent We recommend checking how any changes to the tax code or your situation may impact your charitable dedication eligibility Verkko Thus no matter what role you have at your nonprofit you should never give a donor specific legal or tax advice on donations You are not the donor s lawyer or tax adviser This is also why blanket statements in fundraising solicitations or thank you letters such as quot your contribution is tax deductible quot while they may be technically

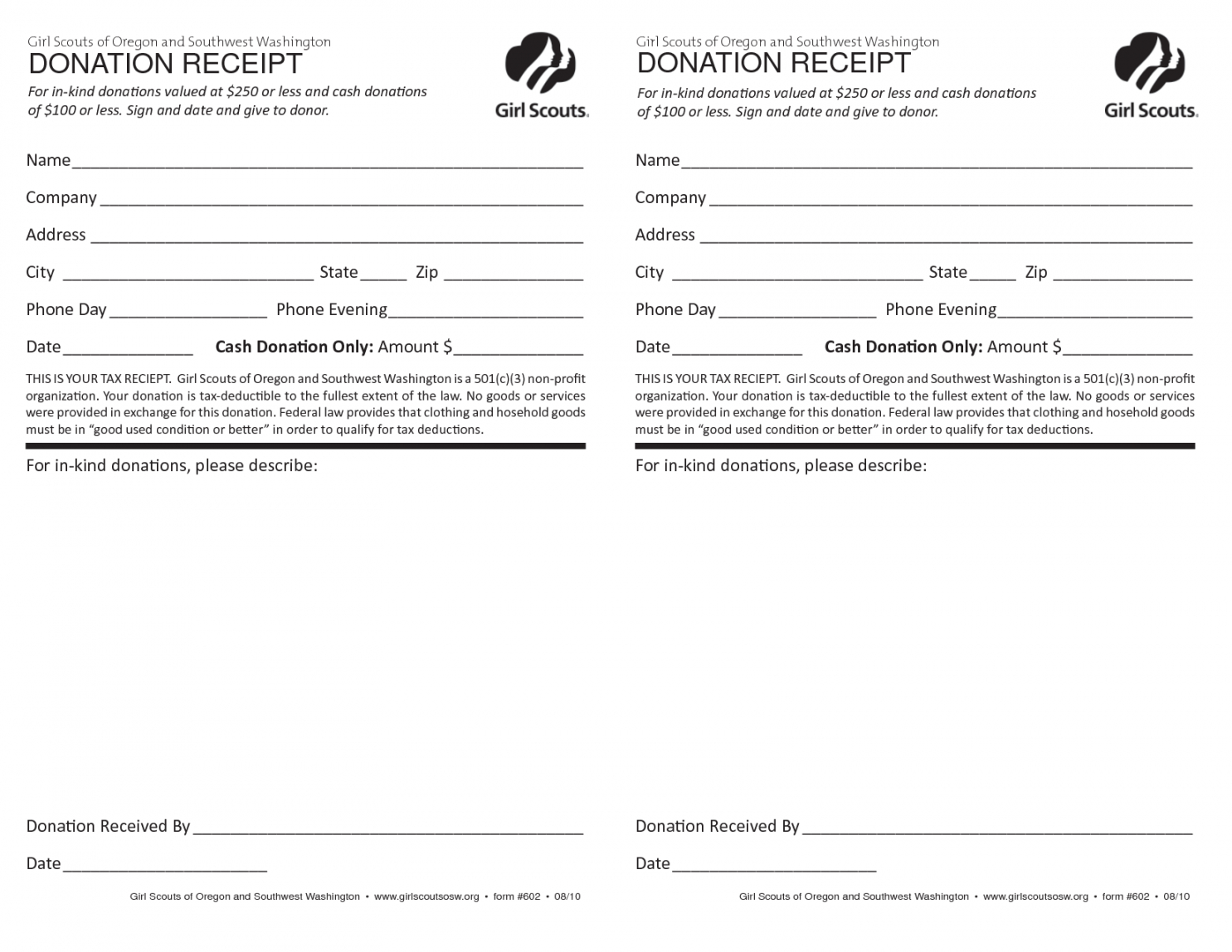

Verkko Tax deductible donation example In 2023 a single taxpayer with 100 000 in annual income donated 7 000 to their community church and 1 000 to the Girl Scouts of America for a total of 8 000 in Verkko 5 tammik 2024 nbsp 0183 32 Tax deductible donations must meet certain guidelines to get a tax break for your good deed Here s how to make your charitable donations a little sweeter

Printable Printable Church Donation Receipt Template For Religious

http://www.emetonlineblog.com/wp-content/uploads/2020/07/printable-printable-church-donation-receipt-template-for-religious-church-tax-donation-receipt-template-sample.png

Sample 501c3 Donation Letter Fill Out Sign Online And Download PDF

https://data.templateroller.com/pdf_docs_html/2209/22095/2209505/sample-501c3-donation-letter_print_big.png

https://turbotax.intuit.com/tax-tips/charitable-contributions/...

Verkko 19 lokak 2023 nbsp 0183 32 Gifts to a non qualified charity or nonprofit As a society we give nearly 2 of our personal income to charities and nonprofit organizations However there is a common misconception that all nonprofits are qualifying charitable organizations but that isn t always the case For tax purposes the law classifies charities and

https://givingcompass.org/article/is-my-donation-tax-deductible

Verkko Where you donate Only certain types of organizations get the IRS s approval to declare that donations are tax deductible Most of these organizations have what s called 501 c 3 status All qualified organizations will be able to provide a National Taxonomy of Exempt Entities or NTEE code which is used to classify organizations based on the

501c3 Donation Receipt Template Printable Pdf Word Receipt

Printable Printable Church Donation Receipt Template For Religious

Donation Letter Templates How To Write And Send An Effective One

Donation Letter for Taxes Best Letter Template

Donation Receipt Template Fill Out Sign Online And Download PDF

Sample Donation Receipt Godscolon

Sample Donation Receipt Godscolon

Nonprofit Tax Receipt Template Printable Receipt Template

.png)

Nonprofit Donation Receipt Template 6 Free Templates

Non Profit Templates

Is A Donation To A Nonprofit Tax Deductible - Verkko 7 kes 228 k 2023 nbsp 0183 32 A searchable database of organizations eligible to receive tax deductible charitable contributions Web Based Mini Course Deducting Charitable Contributions Amount and types of deductible contributions what records to keep and how to report contributions Tax information on donated property