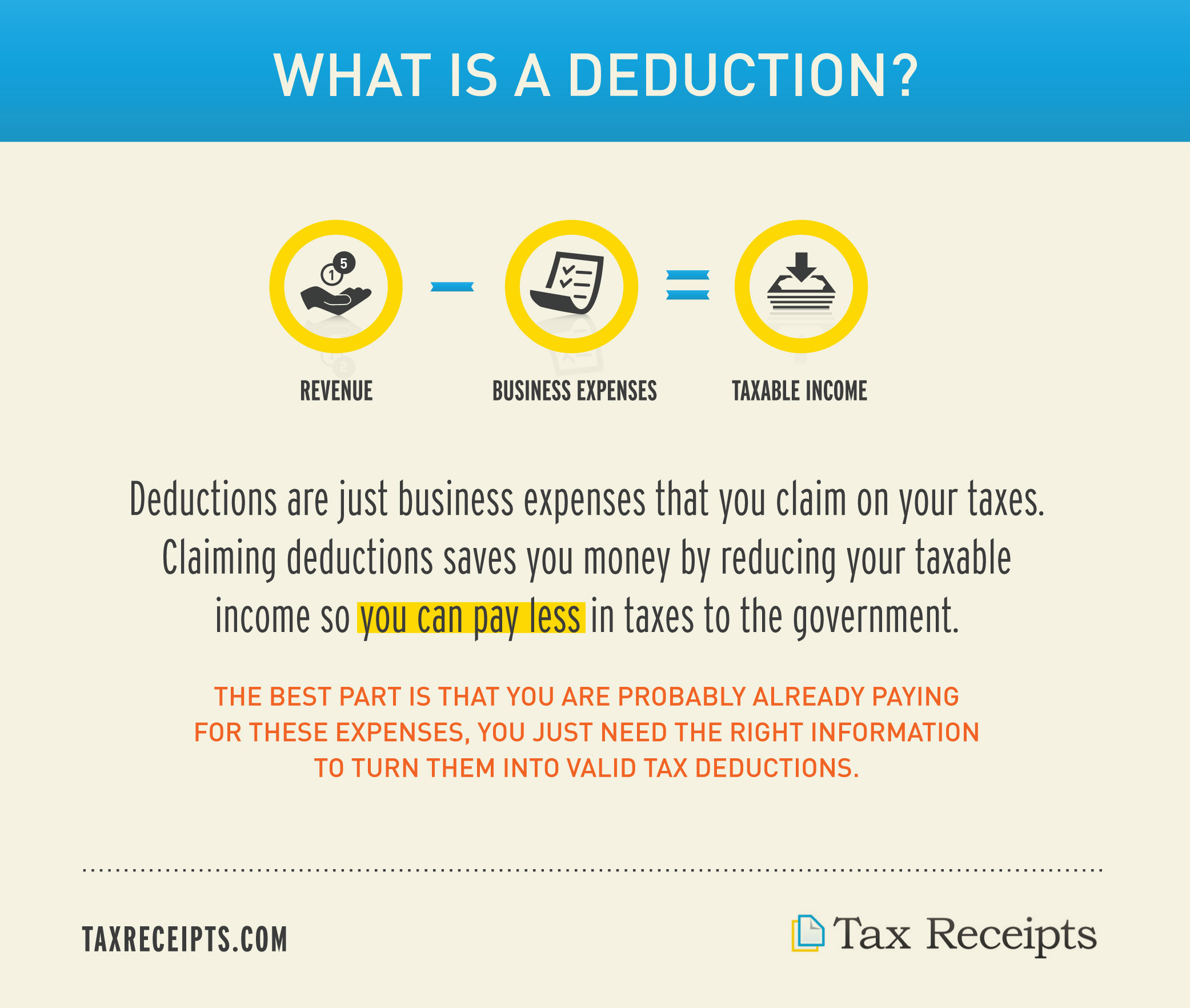

Is A Furnace Tax Deductible Web 19 Okt 2023 nbsp 0183 32 OVERVIEW Are you investing in energy efficient appliances Doing so may result in some useful tax breaks to lower the cost TABLE OF CONTENTS Click to

Web The federal government is offering tax incentives to homeowners and businesses who purchase brand new sustainable energy efficient Web 29 Dez 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take

Is A Furnace Tax Deductible

Is A Furnace Tax Deductible

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

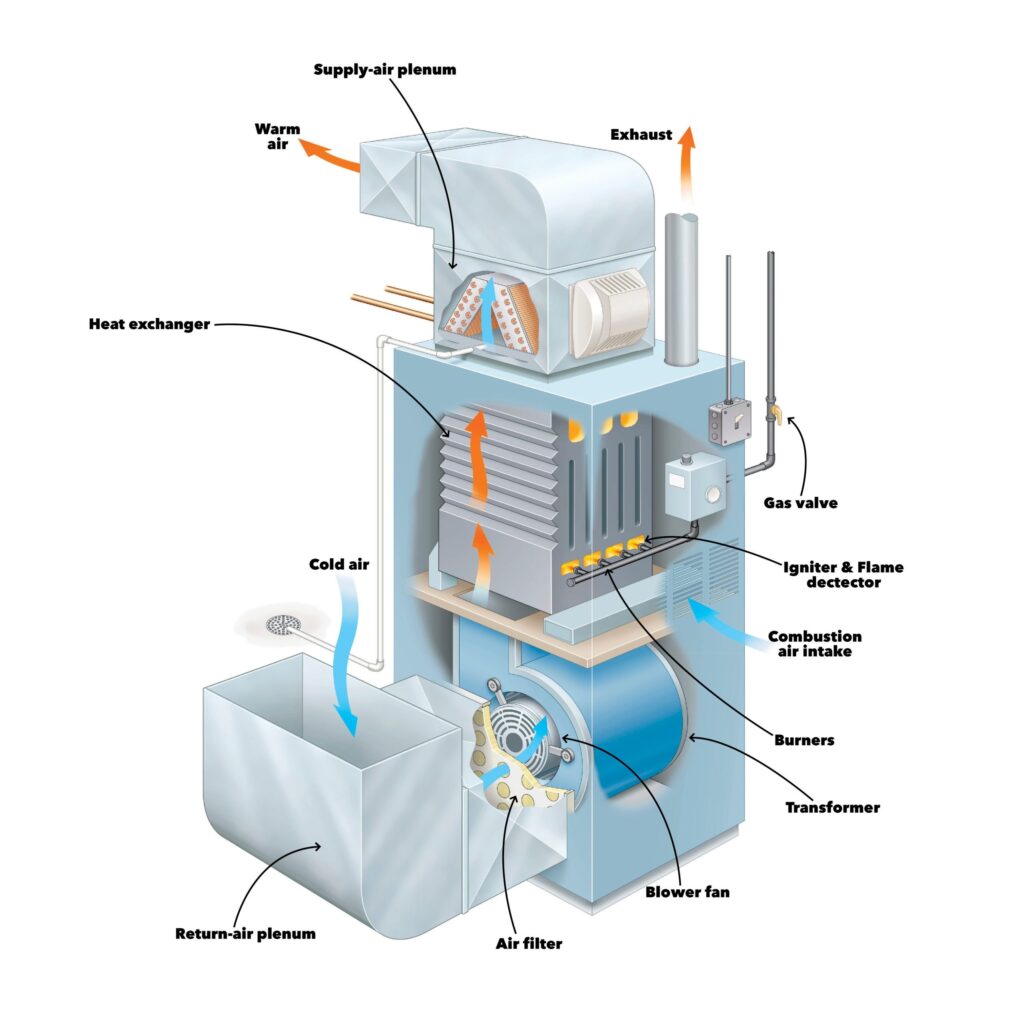

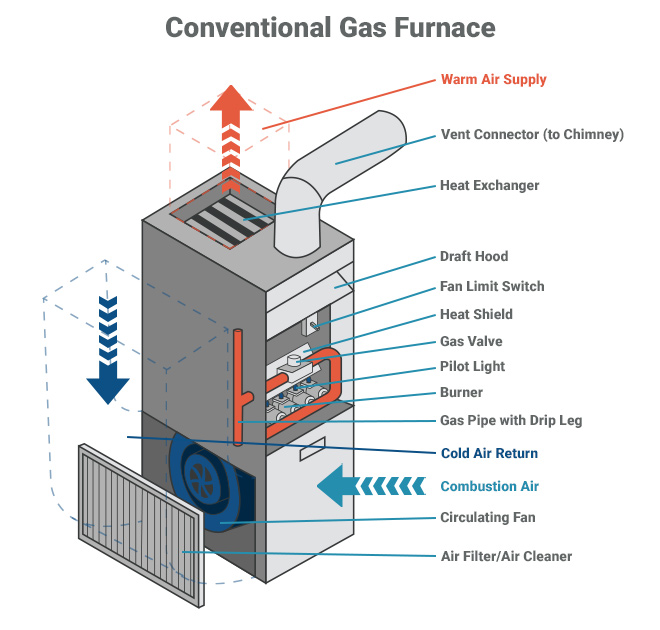

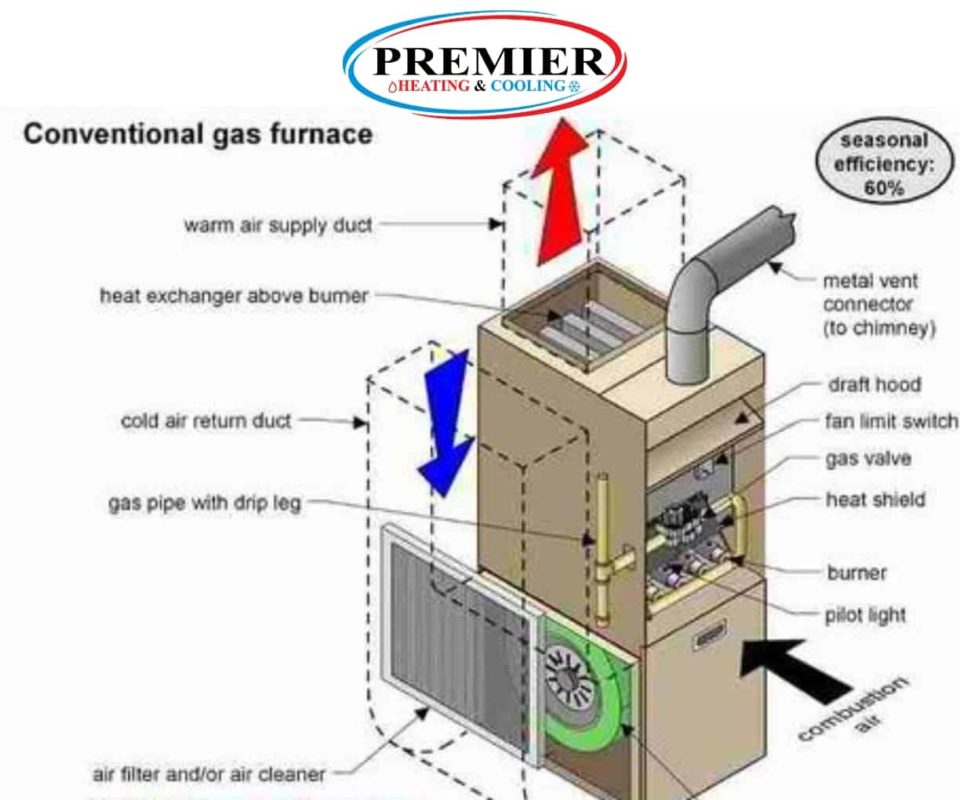

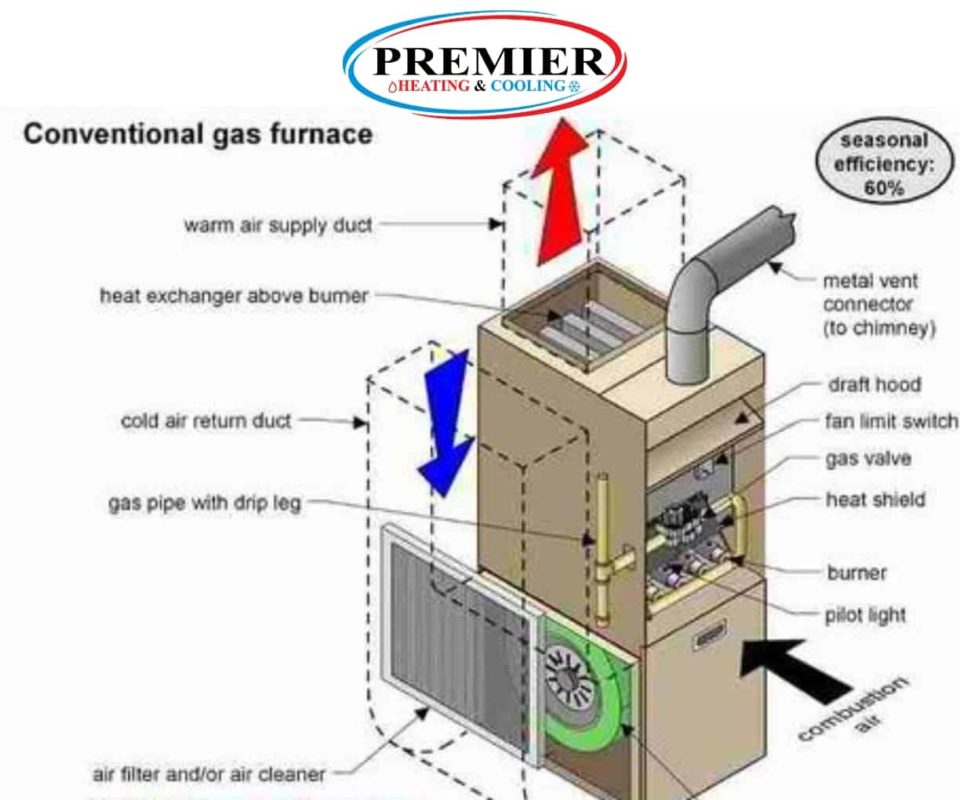

What Is A Furnace

https://media.angi.com/s3fs-public/furnace-illustration.png?impolicy=infographic

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png?ssl=1

Web 4 Juni 2019 nbsp 0183 32 1 Best answer dgslentz01 New Member You may be able to if the furnace and home office are in the same structure The thing to remember is that you only get to Web If you re asking Is a new furnace tax deductible you ll be happy to know that you can earn a tax credit for units that meet the following criteria Installed between January 1

Web 22 Dez 2022 nbsp 0183 32 IRS FAQ Page Last Reviewed or Updated 05 Dec 2023 IR 2022 225 December 22 2022 The Internal Revenue Service today released frequently asked Web 13 Apr 2023 nbsp 0183 32 The criteria your furnace must meet to qualify for a tax credit vary depending on the type of fuel it uses Gas furnaces must be Energy Star certified and

Download Is A Furnace Tax Deductible

More picture related to Is A Furnace Tax Deductible

Ultimate Guide To Furnace System Components Parts

https://www.totallycleanservices.com/wp-content/uploads/2023/05/furnace-components-1024x1024.jpg

Learn More About How Does A Furnace Work Furnace 101

https://enersure.ca/wp-content/uploads/2018/11/furnaces-101-1.jpg

Parts Of A Furnace

https://www.acwholesalers.com/images/1658-gas-furnaces.jpg

Web 15 Apr 2021 nbsp 0183 32 Guide to expensing HVAC costs Heating ventilation and air conditioning HVAC replacement costs can be significant expenses for businesses that own or lease Web The Internal Revenue Service offers a 150 tax credit against the cost of an Energy Star certified furnace burning natural gas oil or propane To qualify for the credit your

Web In most cases no you cannot write off your new furnace as a tax deduction If your new furnace was installed due to certain home improvements like energy efficiency or if Web 15 Feb 2023 nbsp 0183 32 If you re installing new appliances you may get 300 in credit for air source heat pumps non solar water heaters biomass stoves and central air 150 for oil gas

How Does A Furnace Work An Easy Guide

https://www.premierheating.ca/wp-content/uploads/2018/02/Premier-How-Furnace-Works-Blog-Image-960x800.jpg

Is There A Tax Deduction For A New Furnace Germany Wallpaper

https://coloradomechanical.com/wp-content/uploads/2018/08/Tax-break-table.png

https://turbotax.intuit.com/tax-tips/going-green/are-energy-efficient...

Web 19 Okt 2023 nbsp 0183 32 OVERVIEW Are you investing in energy efficient appliances Doing so may result in some useful tax breaks to lower the cost TABLE OF CONTENTS Click to

https://thelawdictionary.org/article/how-to-clai…

Web The federal government is offering tax incentives to homeowners and businesses who purchase brand new sustainable energy efficient

Infographic Is My Move Tax Deductible Wheaton

How Does A Furnace Work An Easy Guide

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

Tax Deductions You Can Deduct What Napkin Finance

Homeowner s Guide To The Parts Of A Furnace Technical Hot Cold Parts

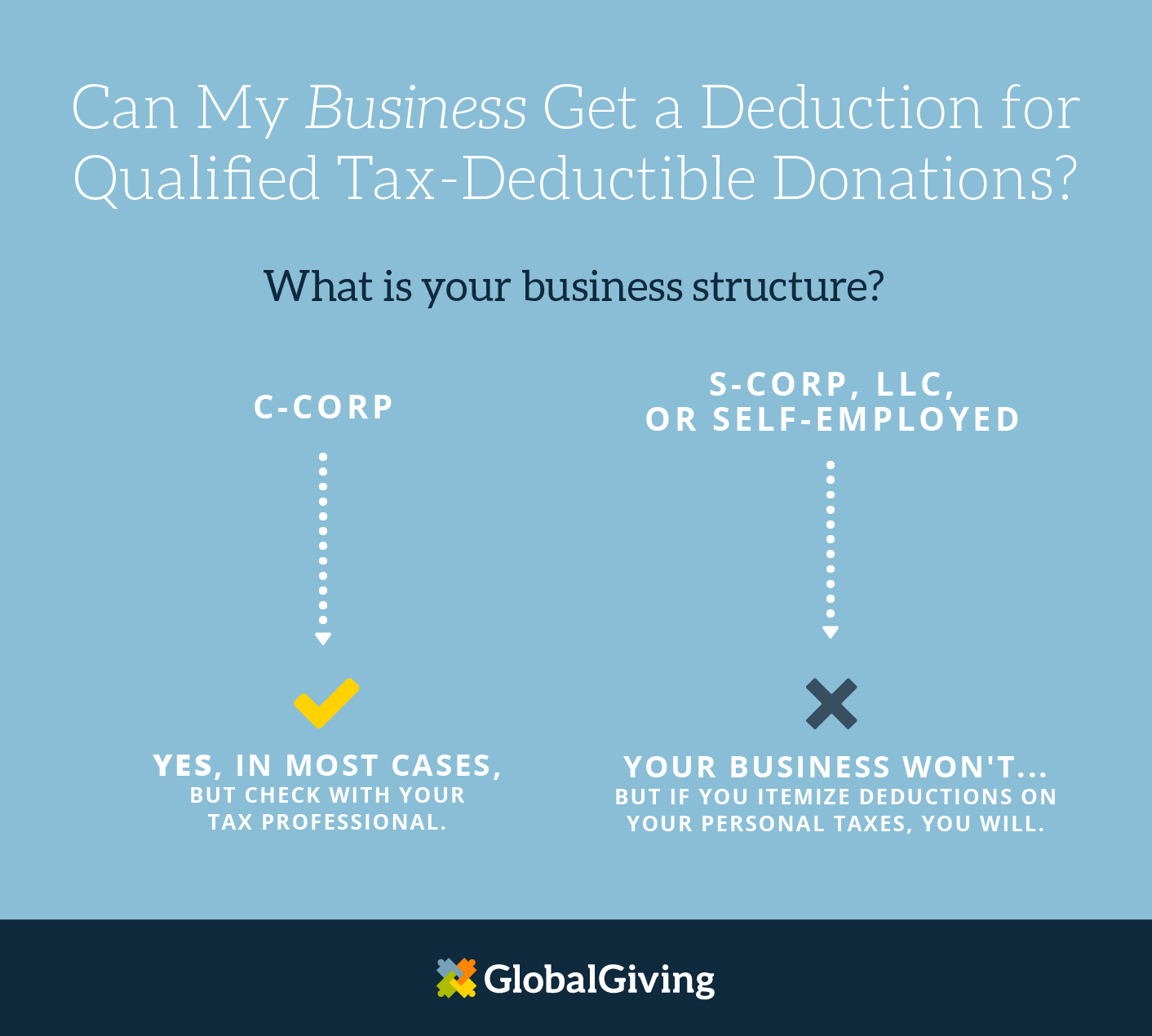

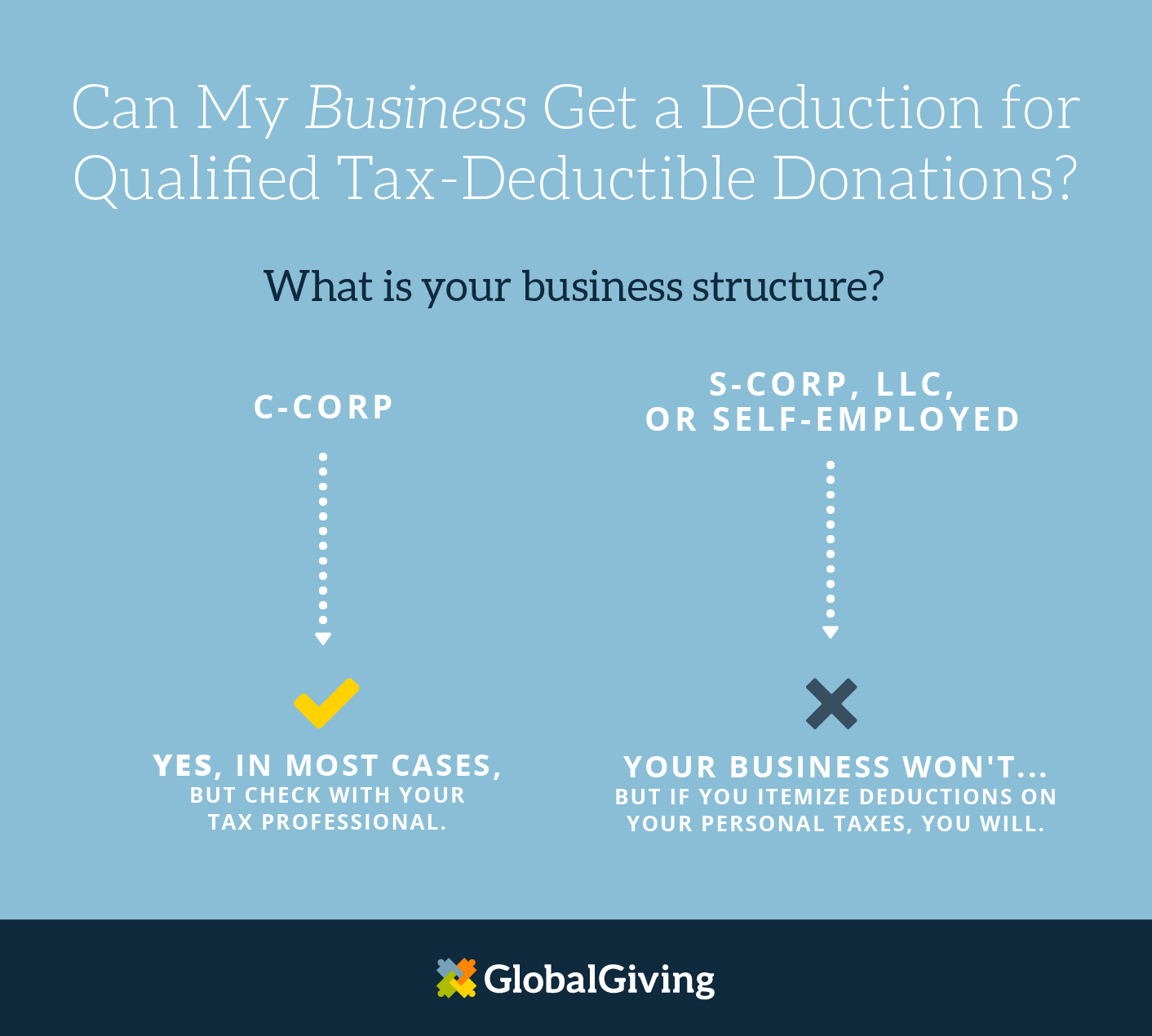

Everything You Need To Know About Your Tax Deductible Donation Learn

Everything You Need To Know About Your Tax Deductible Donation Learn

Tax Deduction Definition TaxEDU Tax Foundation

How Long Does A Furnace AC Unit Water Heater Last

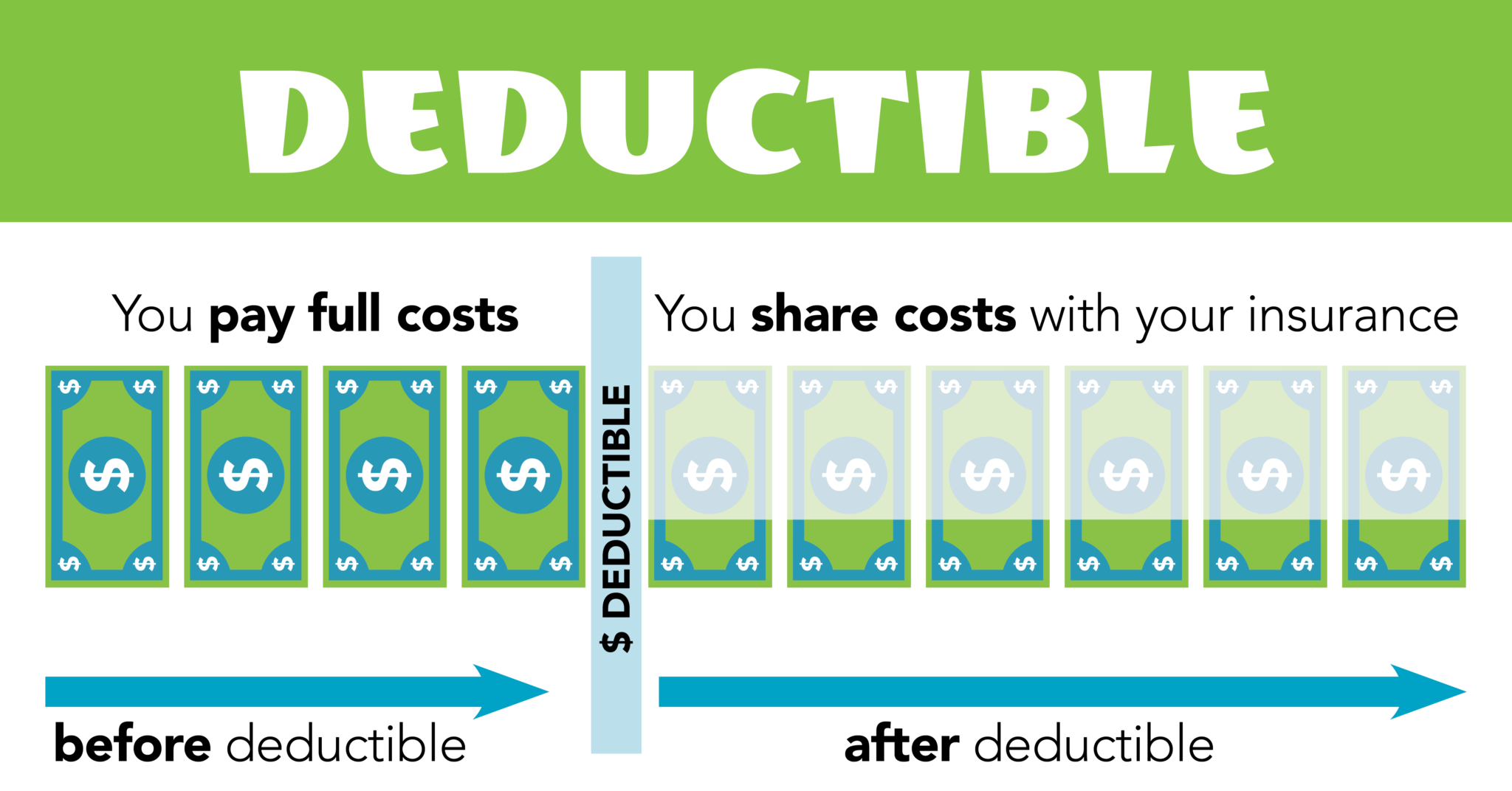

Deductibles Explained ETrustedAdvisor

Is A Furnace Tax Deductible - Web 4 Juni 2019 nbsp 0183 32 1 Best answer dgslentz01 New Member You may be able to if the furnace and home office are in the same structure The thing to remember is that you only get to