Is A Gift To My Child Taxable In general gifts to children and grandchildren are tax free if You hand out less than 3 000 total in a tax year The gifts are small less than 250 per person You give a certain amount of money tax free as a wedding gift You gift the money more than seven years before you die

For now the threshold is per person meaning a couple can give a combined gift of up to 36 000 to each of their children in 2024 for instance You most likely won t owe any gift taxes on a gift your parents make to you Depending on the amount your parents may need to file a gift tax return If they give you or any other individual more than 36 000 in 2024 18 000 per

Is A Gift To My Child Taxable

Is A Gift To My Child Taxable

https://kidsrkids.com/hamilton-mill/wp-content/uploads/sites/101/2020/12/Gift-Giving.jpg

Kids Giving Gift To Dad And Mom Royalty Free Vector Image

https://cdn4.vectorstock.com/i/1000x1000/28/28/kids-giving-gift-to-dad-and-mom-vector-5912828.jpg

Child Giving Mom A Gift Mother s Day Picture Give Mothers Day

https://img.lovepik.com/element/40127/0942.png_860.png

Unfortunately gifts to individuals are not tax deductible tax deductions can only be taken for gifts to organizations on the IRS list of approved charities In fact the IRS limits the amount of gifts you can make to any one person As of 2021 the maximum gift exclusion is 15 000 per child per parent This interview will help you determine if the gift you received is taxable Information you ll need The source of the gift e g employer opening a bank account

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return The tax applies whether or not the donor intends the transfer to be a gift The gift tax applies to If you gift your child 40 000 to help with wedding costs or offer to pay for an expensive honeymoon this could trigger a gift tax return

Download Is A Gift To My Child Taxable

More picture related to Is A Gift To My Child Taxable

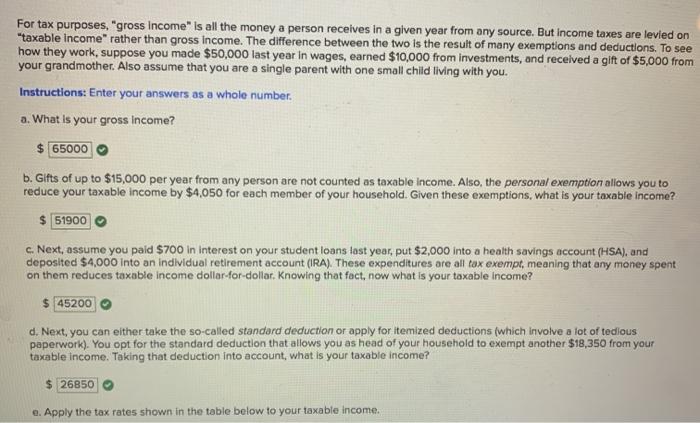

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

https://media.cheggcdn.com/study/ff0/ff01d6ed-b06c-472c-9507-0ae6a6d4109a/image

10 Tips To Make Your Kids Good Gift Givers Beth Kobliner

http://i.huffpost.com/gen/1523638/thumbs/o-CHILD-GIFT-facebook.jpg

Gift Vs Present What Is The Difference Mental Floss

https://images2.minutemediacdn.com/image/upload/c_crop,h_2164,w_3864,x_0,y_412/v1554737166/shape/mentalfloss/89961-istock-871610664.jpg?itok=AHyoyzcN

The parent would have no tax to pay on that gift nor would the child have any tax to pay upon receipt What the parent would have to do is file a gift tax return showing that the parent gave For 2024 the annual gift tax limit is 18 000 That s up 1 000 from last year s limit since the gift tax is one of many tax amounts adjusted annually for inflation For married couples

Gifts made to children may be subject to tax but typically only if they are large gifts As of 2023 any gift under 17 000 isn t typically subject to gift tax and doesn t need to be reported to the IRS The number rises to 18 000 for Generally the answer to do I have to pay taxes on a gift is this the person receiving a gift typically does not have to pay gift tax The giver however will generally file a gift tax return when the gift exceeds the annual gift tax exclusion amount which is 17 000 per recipient for 2023

25 DIY Gifts For Men Love Create Celebrate

http://lovecreatecelebrate.com/wp-content/uploads/2015/11/25-Totally-Do-Able-DIY-Gifts-for-Men.jpg

TRIBEWORK Giving The Gift Of Receiving

https://2.bp.blogspot.com/-el4MVWik0AM/Uo1ZZS2U0AI/AAAAAAAAQ4I/_zwgKwZdtbI/s1600/gift-giving.jpg

https://www. moneyexpert.com /life-insurance/gifting...

In general gifts to children and grandchildren are tax free if You hand out less than 3 000 total in a tax year The gifts are small less than 250 per person You give a certain amount of money tax free as a wedding gift You gift the money more than seven years before you die

https:// money.usnews.com /money/personal-finance/...

For now the threshold is per person meaning a couple can give a combined gift of up to 36 000 to each of their children in 2024 for instance

A Gift To My Father in law gone Wrong WatchCrunch

25 DIY Gifts For Men Love Create Celebrate

The Older I Get The More I Come To See The Importance Of Being Your

Giving Clipart 20 Free Cliparts Download Images On Clipground 2023

How To Teach Kids To Politely Receive A Gift POPSUGAR UK Parenting

The Season Of Giving Why Having An Estate Plan Is A Gift To Others

The Season Of Giving Why Having An Estate Plan Is A Gift To Others

In What Country It Is Embarrassing To Receive A Gift WorldAtlas

What Is Taxable Income Explanation Importance Calculation Bizness

A Child Of God A Gift To My Parents And My Community I Am A Person Of

Is A Gift To My Child Taxable - Key takeaways Know the pros and cons Gifting can help reduce the size of your taxable estate but it can have other potential tax implications and may result in at least some loss of control over gifted assets