Is A Home Equity Loan Taxes For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be

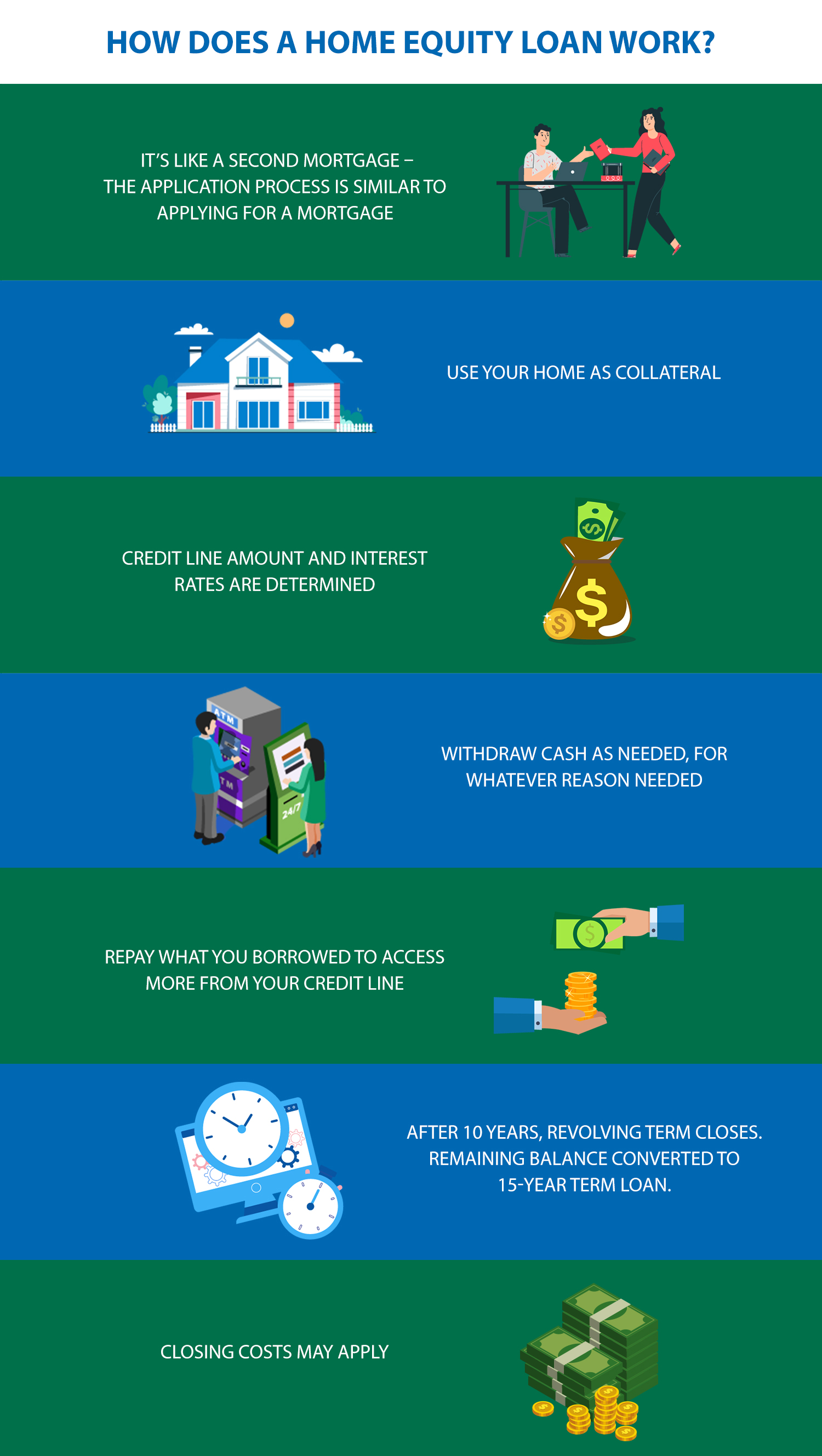

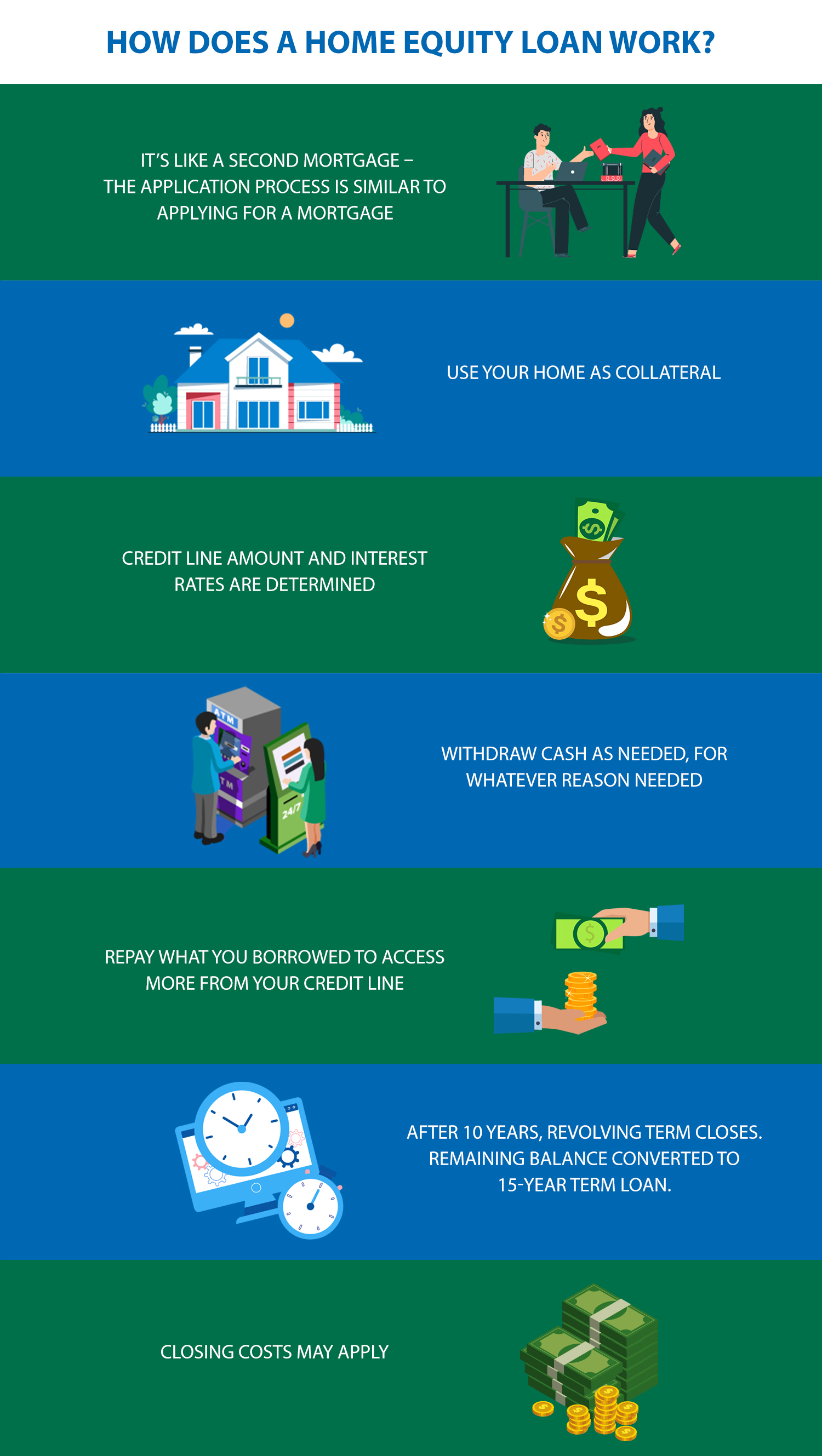

Interest on home equity loans has traditionally been fully tax deductible Is it possible to get a tax deduction on your home equity loan in 2024 and 2025 The answer is Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially improve

Is A Home Equity Loan Taxes

Is A Home Equity Loan Taxes

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

Home Equity Line Of Credit Creekhills Credit Union

https://www.palisadesfcu.org/files/palisades/1/image/Asana On Page Images/Palisades CU _ Home Equity Line of Credit Graphic.jpg

Home Equity Loans Toronto Ontario Home Equity Lines Of Credit

https://www.newhavenmortgage.com/borrower/wp-content/uploads/sites/3/2022/01/home-equity-loans.jpg

Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC just for the tax deduction Always consult with your accountant or other tax professional before deciding on a home equity loan based on tax ramifications or before claiming deductions on your tax returns

Home equity loan interest can be tax deductible as long as the loan is used to buy build or improve the home The TCJA also lowered the total mortgage loan amounts that you can deduct interest on These total loan amounts include Home equity loan interest is tax deductible when used for buying building or improving your home within IRS debt limits Having proper documentation including 1098 forms and receipts for home improvements is

Download Is A Home Equity Loan Taxes

More picture related to Is A Home Equity Loan Taxes

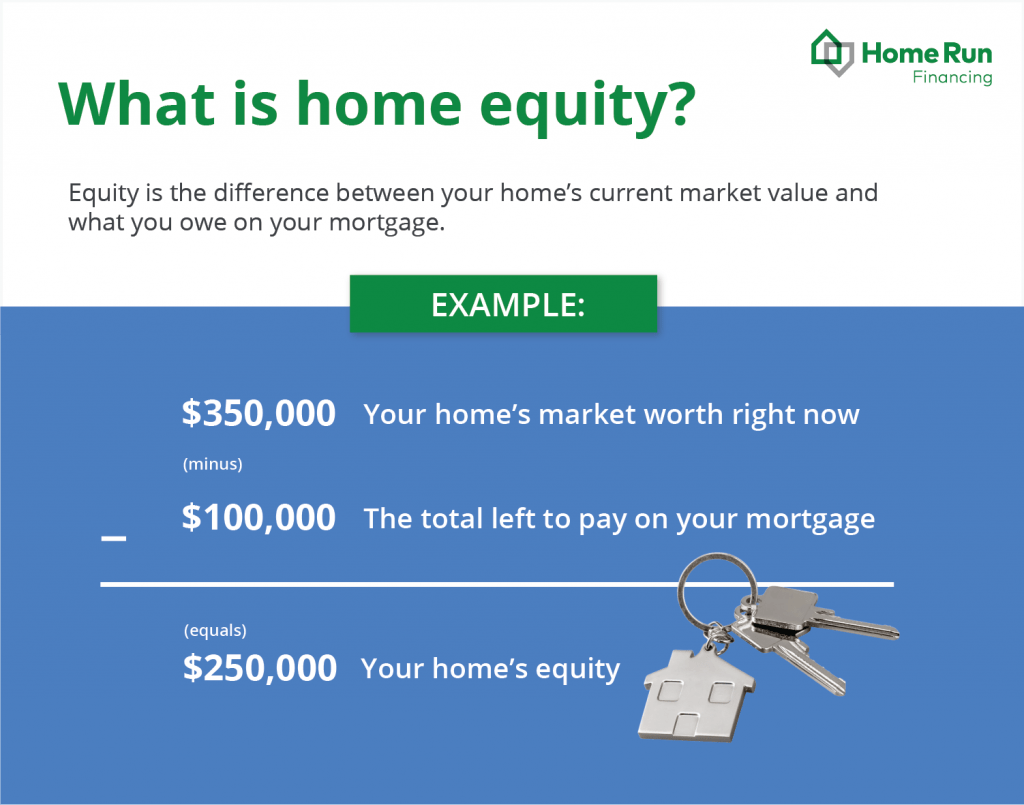

What Home Equity Is How To Use It Home Run Financing

https://www.homerunfinancing.com/wp-content/uploads/2021/07/how-to-calculate-home-equity-1024x805.png

What Is A Home Equity Loan Home Equity Solutions

https://jfh-assets.s3.amazonaws.com/BJxcPJs1e.jpg

How To Borrow Using Your Home Equity Loans Canada

https://loanscanada.ca/wp-content/uploads/2019/11/Home-equity-loan-canada.png

When you borrow against your home s equity the interest you pay every year is tax deductible up to a government imposed limit as long as the borrowed money goes toward improving your home According to the Internal Revenue Service IRS mortgage interest on a home equity loan is tax deductible as long as the borrower uses the money to buy build or improve a home For instance single or married homeowners filing

The question of whether and how much of the interest you pay on a home equity loan is tax deductible depends on when you closed the loan and how you used the The short answer is yes the interest you pay on home equity loans can be tax deductible But it depends on how you use your loan What Is a Home Equity Loan A home

How Home Equity Loans Affect Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

Home Equity Loan Vs Debt Consolidation Loan Which Is Better

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1aEnSt.img?w=1600&h=1600&m=4&q=74

https://www.irs.gov › faqs › itemized-deductions...

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be

https://americantaxservice.org › home-equity-loan-tax-deduction

Interest on home equity loans has traditionally been fully tax deductible Is it possible to get a tax deduction on your home equity loan in 2024 and 2025 The answer is

How To Get The Best Home Equity Loan Rate In Today s Economy

How Home Equity Loans Affect Taxes Optima Tax Relief

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

What Is Home Equity Line Of Credit HELOC Rates Definition And

Using A Home Equity Loan To Pay Off Debt Credible

Difference Between The Two Home Equity Loans Home Equity Home Equity

Difference Between The Two Home Equity Loans Home Equity Home Equity

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Mortgages Vs Home Equity Loans What s The Difference

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Home Equity Loan Vs HELOC What s The Difference Blog H ng

Home Equity Loan HELOC Or Cash Out Refinance What s Best Citizens

Is A Home Equity Loan Taxes - Home equity loan interest can be tax deductible as long as the loan is used to buy build or improve the home The TCJA also lowered the total mortgage loan amounts that you can deduct interest on These total loan amounts include