Is A Medical Bill Tax Deductible For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

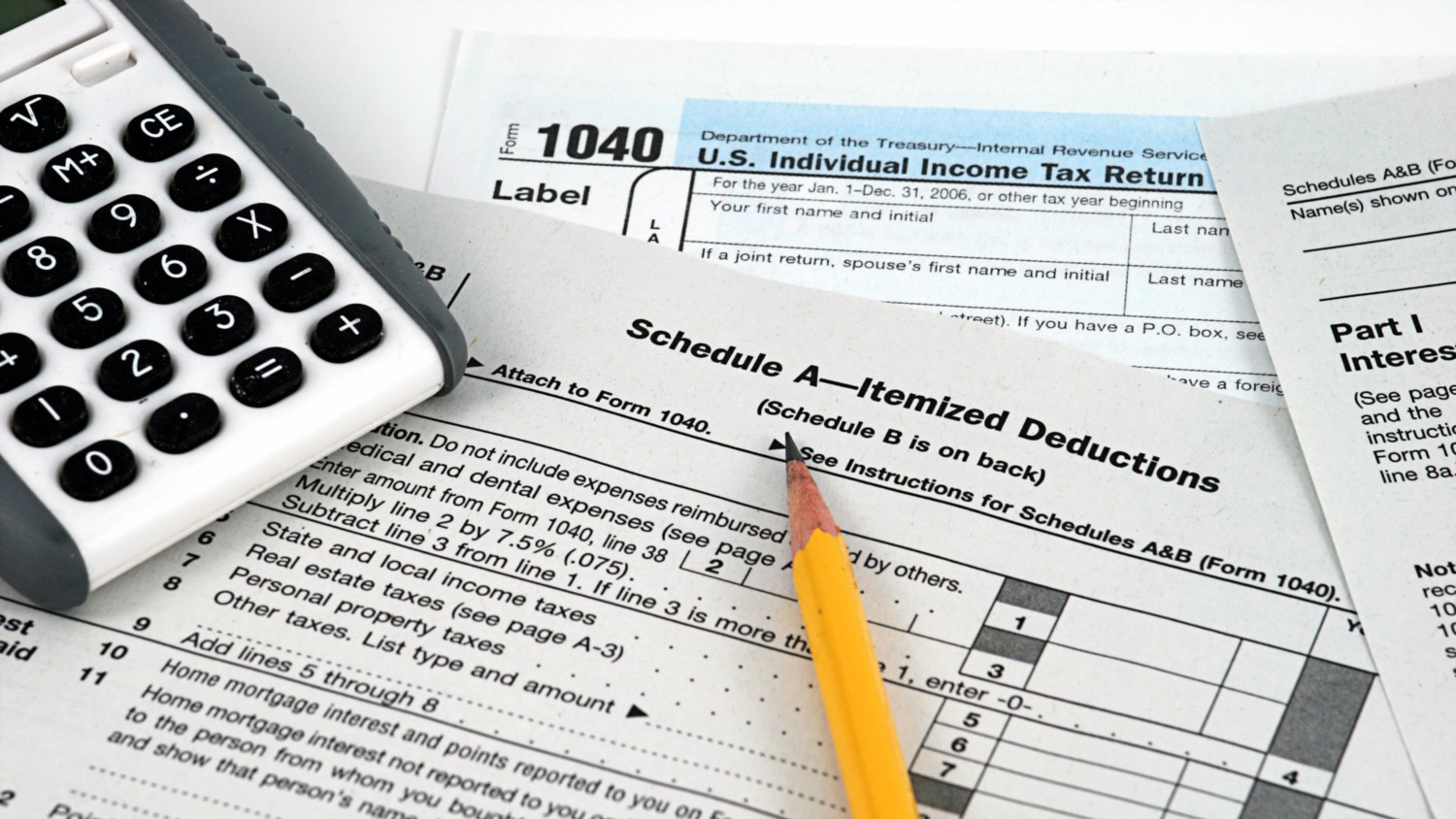

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat To be tax deductible a medical expense generally must be legal and meet IRS conditions which include Any medical services from physicians surgeons dentists and other medical professionals related

Is A Medical Bill Tax Deductible

Is A Medical Bill Tax Deductible

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

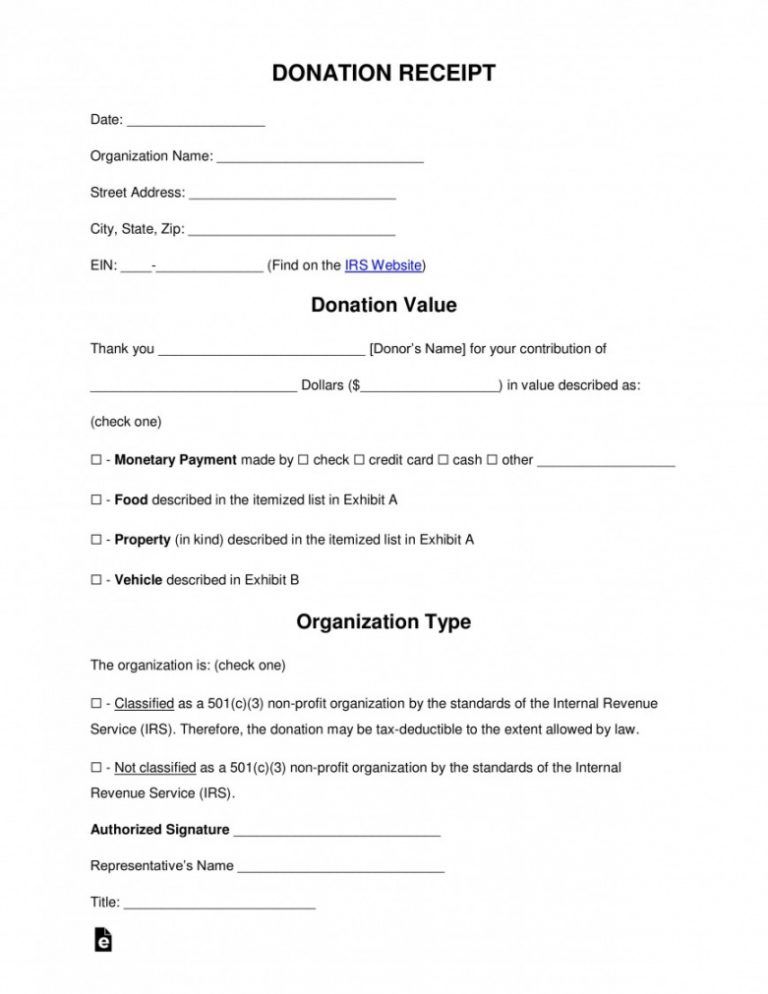

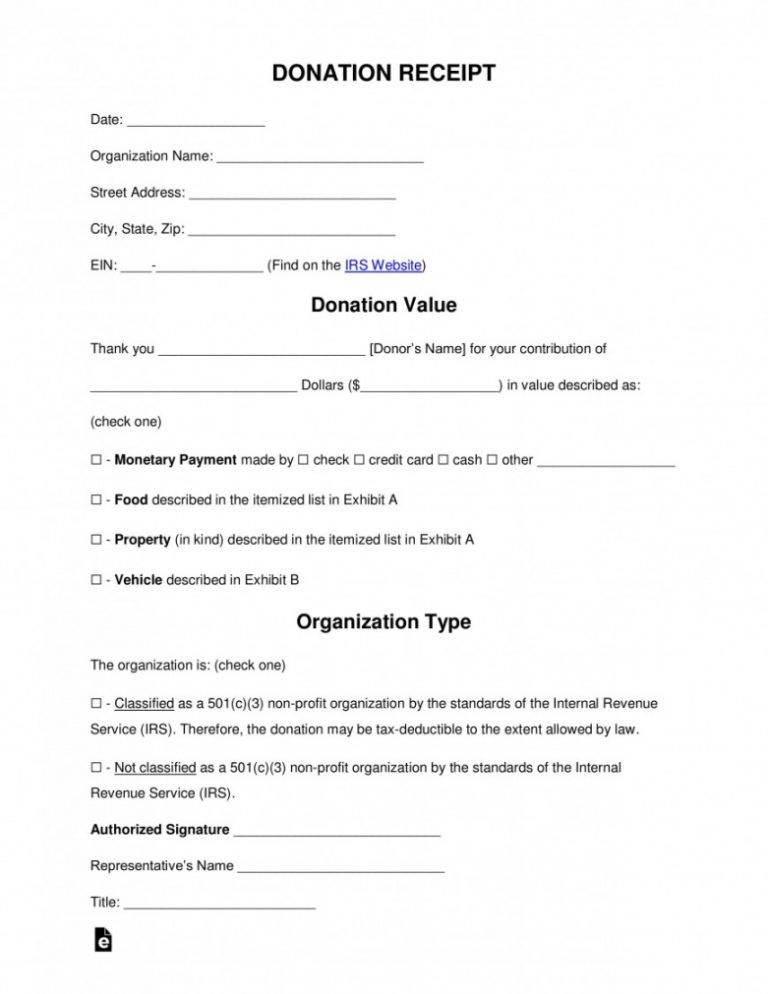

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

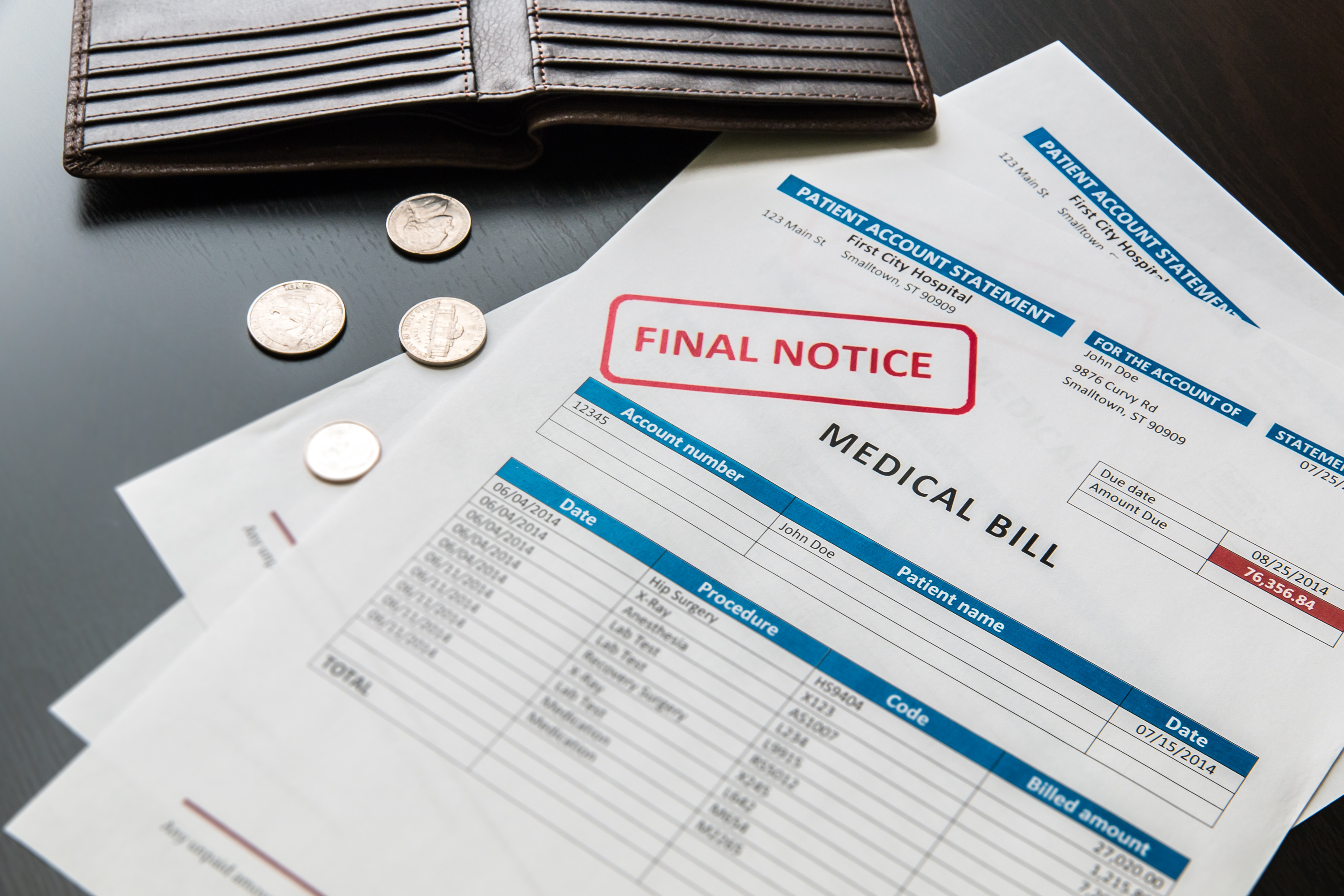

Are medical expenses tax deductible Your medical expenses may be tax deductible under certain circumstances If the medical bills you pay out of pocket in a year exceed 7 5 Expenses that are not deductible medical expenses include The portion of your insurance premiums treated as paid by your employer For example employer

A medical expense deduction could help offset the cost of some of your medical bills provided you qualify to take the deduction Learn about how to qualify for this deduction and how much you might be able to Aug 30 2021 at 9 57 a m Getty Images Tax deductible expenses must be unreimbursed and medically necessary Medical bills can put a dent in your budget but the silver lining is that

Download Is A Medical Bill Tax Deductible

More picture related to Is A Medical Bill Tax Deductible

Medical Bill Invoice Template Excel PDF Word XLStemplates

https://i.pinimg.com/736x/ff/cf/13/ffcf13ee8207e42037343489031ec076.jpg

Are Medical Expenses Tax Deductible Capital One

https://ecm.capitalone.com/WCM/learn-grow/card/lgc988_hero_are-medical-expenses-tax-deductible_v1.jpg

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

The Consolidated Appropriations Act of 2021 made the 7 5 threshold permanent You can get your deduction by taking your AGI and multiplying it by 7 5 If your AGI is 50 000 only qualifying medical Here s the low down you can deduct your medical and dental expenses those of your spouse or the expenses of your dependent s if you choose to itemize If

Basic rules and IRS clarifications You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can Itemizing deductions on your tax return can be a smart way to lower your tax bill If you meet the 7 5 AGI threshold you can deduct expenses like surgeries

Medical Bill Explainer 1

https://media-s3-us-east-1.ceros.com/business-insider-editorial/images/2021/04/08/4c3914734527307b97916ae302046c81/itemized.png

Are Closing Costs Tax Deductible Under The New Tax Law PNWR

https://assets.site-static.com/blogphotos/1399/1801-closing-costs-tax-deductible.jpg

https://www.nerdwallet.com/article/tax…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Deducting Medical Dental Expenses On Your Tax Return PPL CPA

Medical Bill Explainer 1

Medical Bills Bankruptcy Acworth GA Law Offices Of Roger Ghai

Medical Bills Tax Exemption For AY 2019 20 Rules How To Claim

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Bill Of The Month Share Your Story With NPR And KFF Health News

Bill Of The Month Share Your Story With NPR And KFF Health News

Are Health Insurance Premiums Tax Deductible Insurance Deductible

Investment Expenses What s Tax Deductible Charles Schwab

How Has Medical Debt Affected Your Life Shots Health News NPR

Is A Medical Bill Tax Deductible - Expenses that are not deductible medical expenses include The portion of your insurance premiums treated as paid by your employer For example employer