Is A New Air Conditioner Tax Deductible 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

However the 3 200 total credit is split as follows Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item Up to 2 000 for heat pump water heaters biomass fuel stoves and air source heat pumps Important Note This means that certain qualifying air conditioners and heat pumps installed through December 31 2022 are eligible for a 300 tax credit The tax credit also retroactively applies to new air conditioners installed in the 2018 2021 tax year The tax credit originally expired December 31 2017

Is A New Air Conditioner Tax Deductible 2022

Is A New Air Conditioner Tax Deductible 2022

https://timeforknowledge.com/wp-content/uploads/2021/10/air-conditioner.png

Although The Price Of A New Air Conditioner May Be High Getting A New

https://i.pinimg.com/originals/ac/e3/21/ace32133f098e8ce075a1717d1791524.jpg

Is A New HVAC Unit Tax Deductible Christiansonco

https://www.christiansonco.com/wp-content/uploads/2021/07/ac-air-appliance-change-checking-clean-condition.jpg

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 The IRS offers several ways for taxpayers to cut their tax bills through investing in certain energy efficient appliances and home improvements This can include upgrades like energy efficient water heaters furnaces air conditioners windows doors and similar investments but also clean vehicles and related equipment

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Download Is A New Air Conditioner Tax Deductible 2022

More picture related to Is A New Air Conditioner Tax Deductible 2022

5 Ways You Can Save On A New Air Conditioner Trane

https://www.trane.com/_next/image/?url=https:%2F%2Flive-trane-headless-cms.pantheonsite.io%2Fwp-content%2Fuploads%2F2019%2F05%2F5-ways-you-can-save-on-a-new-air-conditioner-1546x1024.jpg&w=1920&q=75

5 Best Central Air Conditioner Brands And Units For Your Home

https://www.familyhandyman.com/wp-content/uploads/2021/07/central-air-GettyImages-1017312386.jpg

Air Con Sunshine Coast Finding The Best Air Conditioner For Your House

https://www.airconsunshinecoast.com.au/wp-content/uploads/2019/03/air-conditioner-buying-guide.jpg

Get the details on the new federal tax credits for HVAC installations that will go into effect in 2022 Learn how you can use this information to increase your sales and grow your business Heating ventilation and air conditioning HVAC replacement costs can be significant expenses for businesses that own or lease real estate Find out about how to distinguish between deductible repairs and more extensive work that must be capitalized

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation Qualified air conditioners or furnaces may receive up to 600 each There is also a separate annual limit of 2 000 for qualified heat pumps which means a homeowner could claim up to 3 200 in credits annually

Buying A New Air Conditioner Hansberger Refrigeration And Electric

https://blog.hansbergerrefrig.com/wp-content/uploads/2017/04/newairconditioner_geralt_Pixabay.png

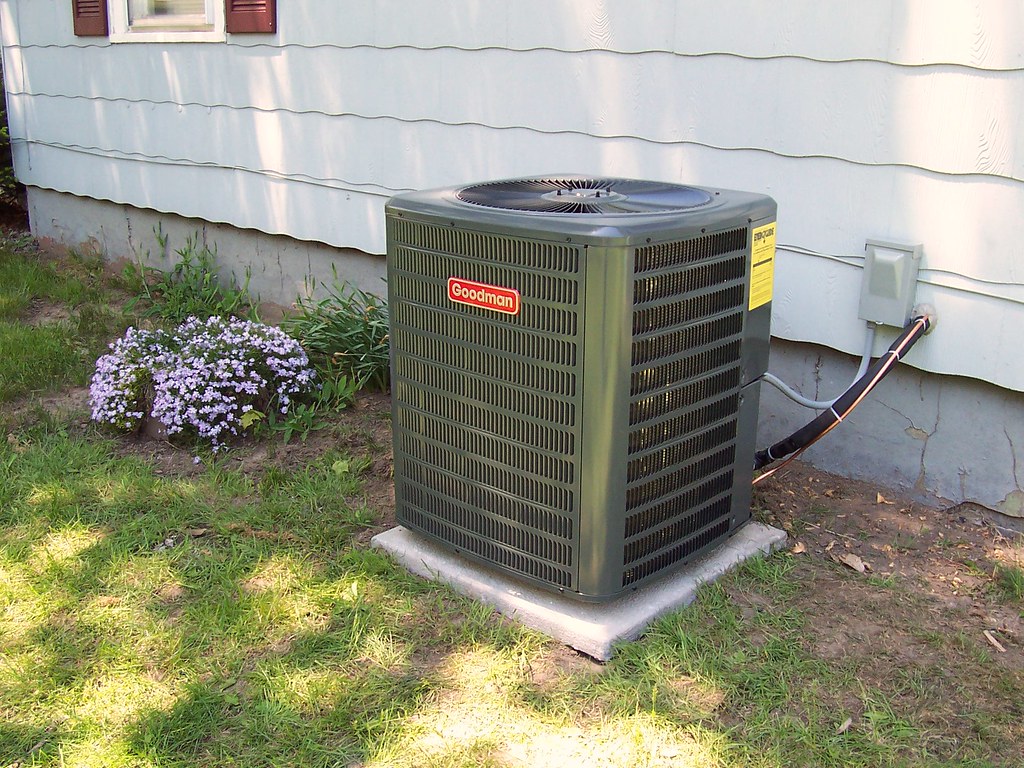

New Air Conditioner Unit Dayna Flickr

https://c1.staticflickr.com/3/2356/2497751040_28a45a5307_b.jpg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

https://airconditionerlab.com/what-hvac-systems...

However the 3 200 total credit is split as follows Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item Up to 2 000 for heat pump water heaters biomass fuel stoves and air source heat pumps Important Note

Tax Rates Absolute Accounting Services

Buying A New Air Conditioner Hansberger Refrigeration And Electric

Advantages Of Split Type Air Conditioners WriteUpCafe

New Air Conditioner Sun Tech Air Conditioning

Don t Let Air Conditioning Problems Ruin Your Day Ed s Heating And

Air Conditioner AC Repair Invoice Template Invoice Maker

Air Conditioner AC Repair Invoice Template Invoice Maker

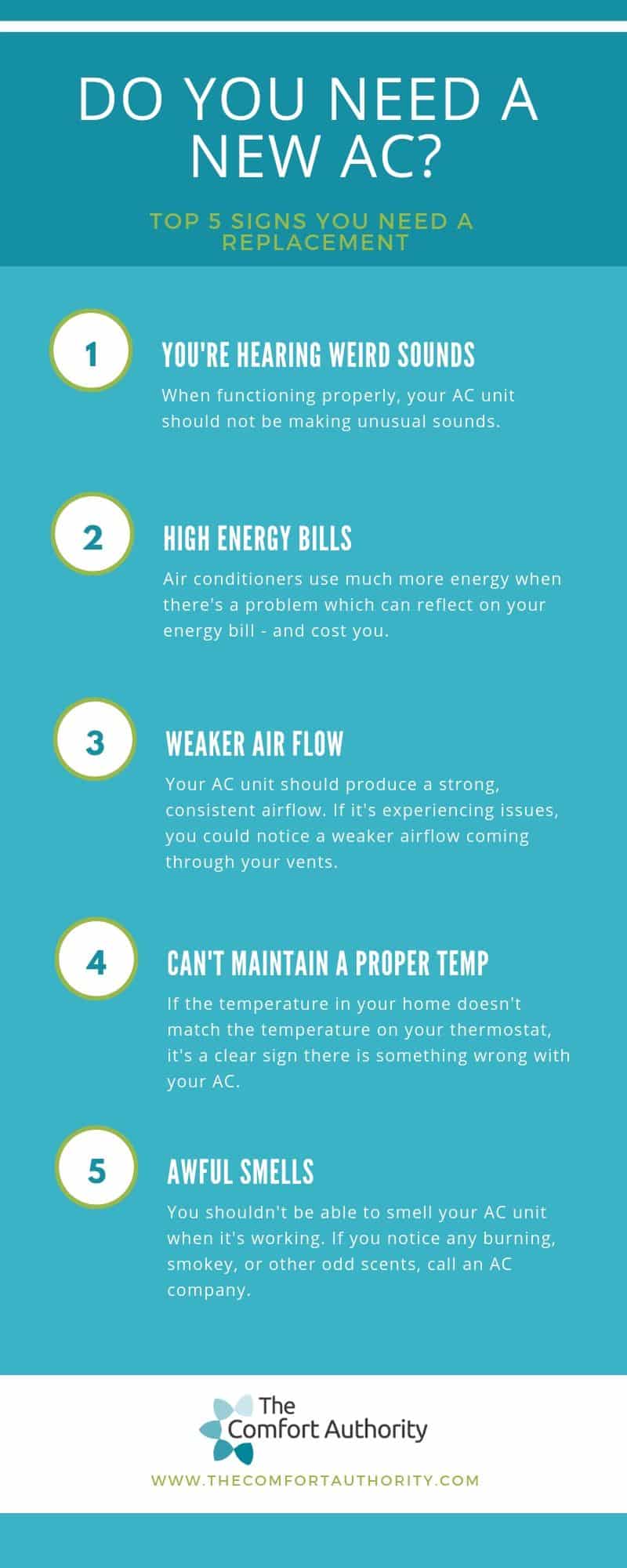

Do you need a new air conditioner The Comfort Authority

How Much Does A New Air Conditioner Cost Tri City Fuel Heating Co

Medicare Costs 2023 Chart Hot Sex Picture

Is A New Air Conditioner Tax Deductible 2022 - Did you invest in a new air conditioner or heat pump in 2022 or before If you haven t already done so you may be able to claim a tax credit under the Non Business Energy Property Credit