Is A New Furnace Tax Deductible If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

Is A New Furnace Tax Deductible

Is A New Furnace Tax Deductible

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png?ssl=1

Is Your HVAC Replacement Tax Deductible Champion Home Services

https://www.championac.com/wp-content/uploads/2018/07/reviews-1.png

What Is The Cost Of A New Furnace A Guide To Buying And Replacing A

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2021/03/Cost-of-a-New-Furnace.jpg

What home improvements provide tax savings for 2024 There are many renovation and improvement tax credits Some are applicable and some are not Here s a breakdown Furnaces Natural Gas Oil Tax Credits This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695

Kenya provides an annual Standard Deduction that is deducted from your total income to produce your taxable income in Kenya in 2022 In Kenya social security deductions specifically contributions to the National Social Security Fund NSSF are deductible when calculating taxable income How To Claim A New Home Furnace On Your Income Tax Form The federal government is offering tax incentives to homeowners and businesses who purchase brand new sustainable energy efficient appliances Homeowners who purchase a qualifying home furnace can deduct up to 150 from their taxes

Download Is A New Furnace Tax Deductible

More picture related to Is A New Furnace Tax Deductible

What Is The Cost Of A New Furnace A Guide To Buying And Replacing A

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2021/03/Cost-of-a-New-Furnace-DIY-vs.-Hiring-a-Professional.jpg

Learn More About How Does A Furnace Work Furnace 101

https://enersure.ca/wp-content/uploads/2018/11/furnaces-101-1.jpg

The California Furnace Tax Credit An FAQ For Homeowners Bell Brothers

https://bellbroshvac.com/wp-content/uploads/2020/10/bigstock-Tax-Credits-Claim-Return-Deduc-151305731.jpg

Natural gas propane or oil furnace 150 for ENERGY STAR certified gas furnaces except those certified for U S South only Gas and oil furnaces that have earned the ENERGY STAR label use fans that meet the requirements of the 150 fan tax credit The distinctions among betterments improvements routine maintenance and the effects of normal wear and tear are key to determining whether building expenditures are currently deductible or must be capitalized

[desc-10] [desc-11]

Infographic Is My Move Tax Deductible Wheaton

https://www.wheatonworldwide.com/wp-content/uploads/2015/04/Tax-Deductible-Graphic_Wheaton.jpg

New Gas Furnace Prices And Installation Costs In 2020 Home Remodeling

https://i2.wp.com/www.remodelingcosts.org/wp-content/uploads/2017/08/gas-furnace-installation.jpg?ssl=1

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified

https://turbotax.intuit.com/tax-tips/home...

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit

Are All New Furnaces High Efficiency Answereco

Infographic Is My Move Tax Deductible Wheaton

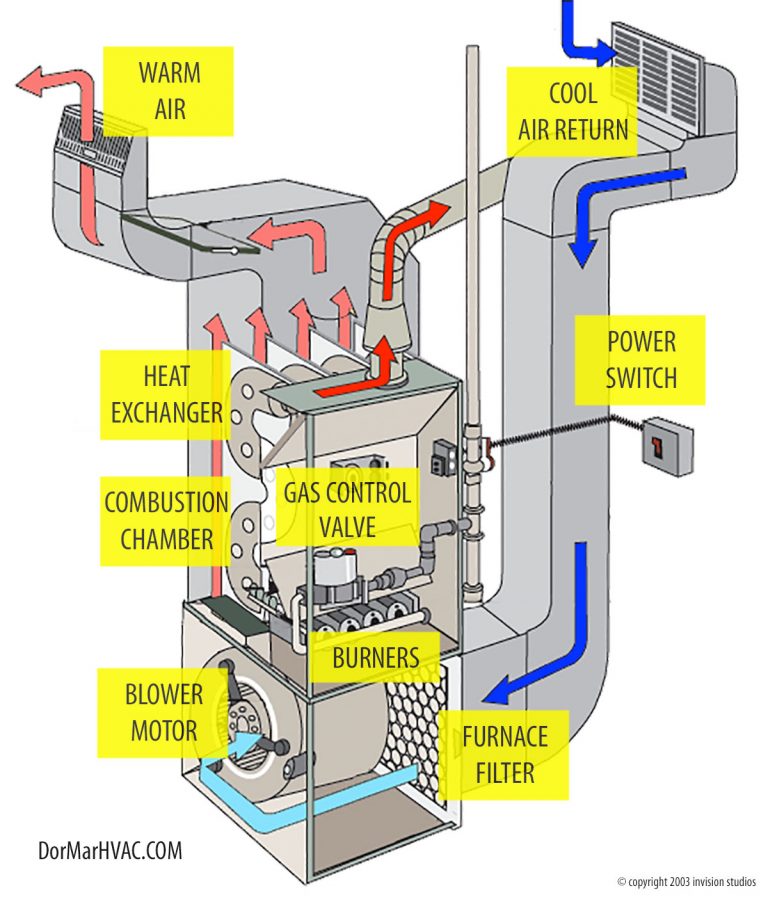

How Does A Furnace Work Dor Mar Heating Air Conditioning

How A New Furnace Can Save You Money

When Do I Need A New Furnace Furnace Installation Little Rock

Costs Involved In Installing A New Furnace Architurn

Costs Involved In Installing A New Furnace Architurn

Georgesworkshop Heat 4 The New Furnace

Carrier furnace install Furnace AC Experts Heating Cooling

10 Common Furnace Problems Furnace Maintenance Tips

Is A New Furnace Tax Deductible - What home improvements provide tax savings for 2024 There are many renovation and improvement tax credits Some are applicable and some are not Here s a breakdown