Is A New Oil Tank Tax Deductible Verkko 22 helmik 2012 nbsp 0183 32 An oil tank is a long lived asset exceeding ten years add the total cost of that improvement to the cost basis Upon renting the tax law requires you to

Verkko 5 kes 228 k 2019 nbsp 0183 32 It is not a deductible expense in your tax return However it should be added to the cost basis of the home you sold and would therefore reduce the gain or Verkko 11 tammik 2021 nbsp 0183 32 Is a new oil tank tax deductible It is not a deductible expense in your tax return However it should be added to the cost basis of the home you sold

Is A New Oil Tank Tax Deductible

Is A New Oil Tank Tax Deductible

https://www.dixonbros.com/wp-content/uploads/2020/11/signs-you-need-a-new-oil-tank.jpg

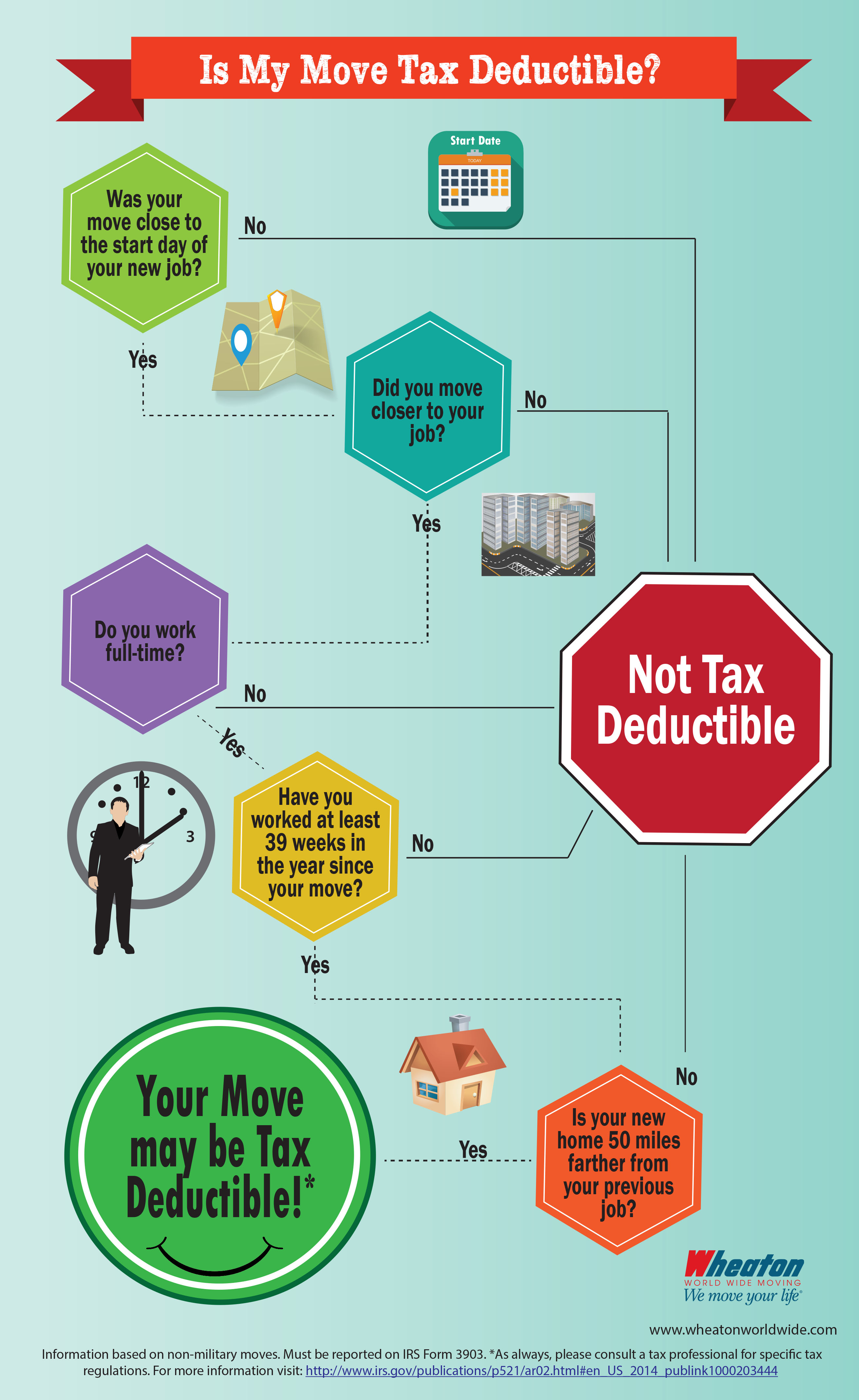

Infographic Is My Move Tax Deductible Wheaton

https://www.wheatonworldwide.com/wp-content/uploads/2015/04/Tax-Deductible-Graphic_Wheaton.jpg

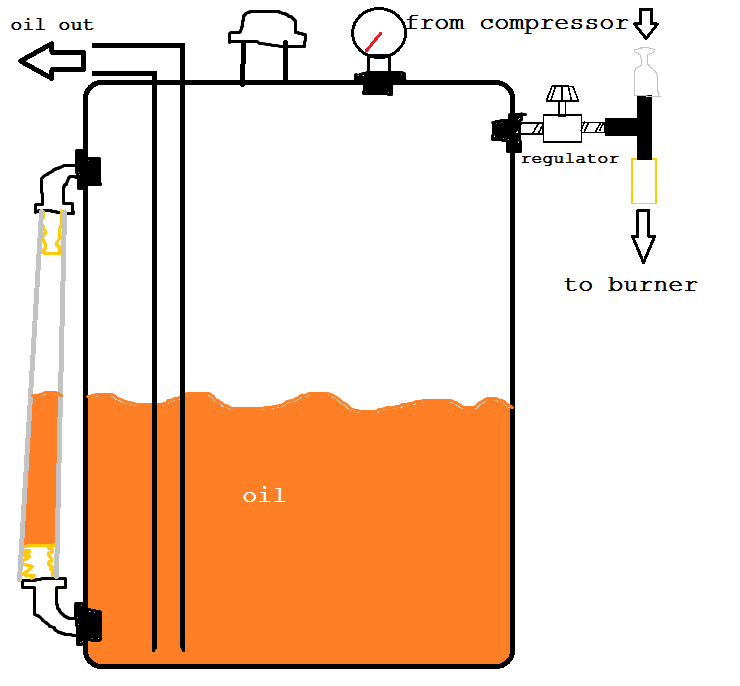

The Foundry It s Time To Build A New Oil Tank Greens And Machines

https://2.bp.blogspot.com/-ggQSlP-jodY/VMVI3EX80TI/AAAAAAAABmY/OzFz7EzsBDY/s1600/oil%2Btank.png

Verkko 6 helmik 2023 nbsp 0183 32 Are there tax deductions available for oil and gas companies Yes oil and gas investors will find numerous major tax benefits available These cannot be found anywhere else in the tax Verkko 10 jouluk 2023 nbsp 0183 32 Credits deductions and income reported on other forms or schedules More important offer details and disclosures Two tax credits for renewable energy

Verkko 2 tammik 2024 nbsp 0183 32 The article aims to explain road CO2 emissions including passenger car emissions in the EU member states with the rates of indirect taxes except VAT Verkko Specifically the production of oil and gas is an extraction activity that qualifies for the deduction The deduction is limited to the lesser of 6 of qualified production

Download Is A New Oil Tank Tax Deductible

More picture related to Is A New Oil Tank Tax Deductible

I Need A New Aboveground Heating Oil Tank What Are My Options

https://www.greentraxinc.com/wp-content/uploads/2020/01/275-Outside-6-50.jpg

PDF TAX NON COMPLIANCE OF THE SIX DEDUCTIBLE ITEMS UNDER THE NEW

https://i1.rgstatic.net/publication/355127736_TAX_NON-COMPLIANCE_OF_THE_SIX_DEDUCTIBLE_ITEMS_UNDER_THE_NEW_INDIVIDUAL_INCOME_TAX_LAW_IN_CHINA_-_Oil_Gas_Energy_Quarterly/links/61e5dfa25779d35951b6c3ca/largepreview.png

How To Prepare For An Oil Tank Installation Oil 4 Wales

https://www.oil4wales.co.uk/wp-content/uploads/2019/05/home-heating-option.jpeg

Verkko Oil and gas companies operating within the Norwegian jurisdiction are subject to a general corporate tax of 22 and a special tax of 56 The ordinary corporation tax Verkko 1 lokak 2021 nbsp 0183 32 Deductions Taxpayers generally must capitalize amounts paid to improve a unit of property A unit of property is improved if the cost is made for 1 a betterment

Verkko PIM2030 Deductions repairs is it capital One of the key considerations when deciding whether a repair is a deductible expense is whether it is revenue or capital Here we Verkko 30 jouluk 2022 nbsp 0183 32 600 maximum amount credited What products are eligible Gas storage water heaters ENERGY STAR certified models are eligible as follows gt 0 81

The Foundry It s Time To Build A New Oil Tank Greens And Machines

http://1.bp.blogspot.com/-zFchVpH-1xs/VMVI0SxaWTI/AAAAAAAABmw/YLGO_hR7HjE/s1600/002tanknew.jpg

Questions To Ask Yourself When Buying A New Oil Tank Http

https://i.pinimg.com/originals/f4/b1/0e/f4b10e8ddc39782ca171a25f7eb237d5.jpg

https://www.bogleheads.org/forum/viewtopic.php?t=91207

Verkko 22 helmik 2012 nbsp 0183 32 An oil tank is a long lived asset exceeding ten years add the total cost of that improvement to the cost basis Upon renting the tax law requires you to

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/...

Verkko 5 kes 228 k 2019 nbsp 0183 32 It is not a deductible expense in your tax return However it should be added to the cost basis of the home you sold and would therefore reduce the gain or

Oil Tank Installation And Replacement Energy Co op Of Vermont

The Foundry It s Time To Build A New Oil Tank Greens And Machines

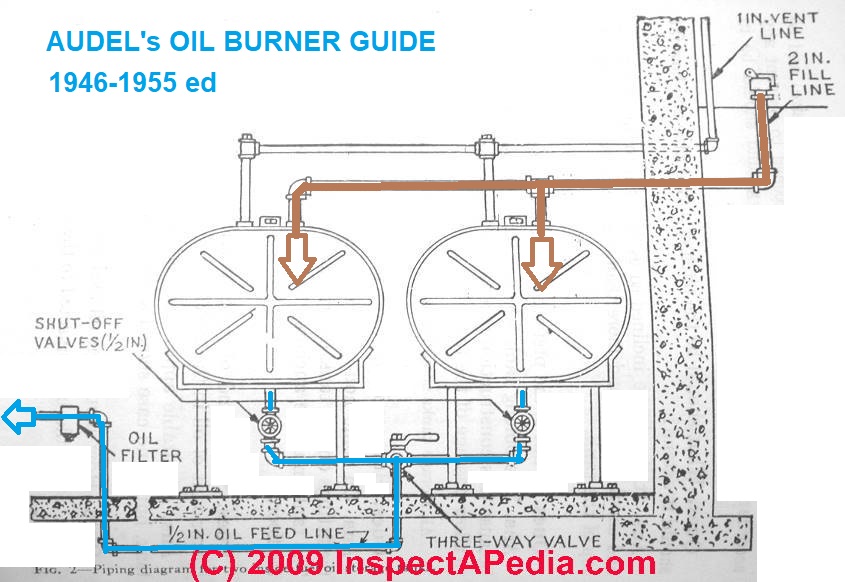

Oil Piping For Duplex Or Paired Oil Storage Tanks

Buy VEVOR Hydraulic Fluid Reservoir Tank 10 Gallon Hydraulic Oil

1000 Litre Slimline Bunded Oil Tank Oil And Fuel Tanks

Oil Tanks Scobie Heating General Contractor

Oil Tanks Scobie Heating General Contractor

Dry Sump Tank Heater Patterson NASCAR 5 Gallon Aluminum Dry Sump Oil

Oil Tank Bases Concrete Slab CT Tanks

Are Moving Expenses Tax Deductible Under The New Tax Bill

Is A New Oil Tank Tax Deductible - Verkko 10 jouluk 2023 nbsp 0183 32 Credits deductions and income reported on other forms or schedules More important offer details and disclosures Two tax credits for renewable energy