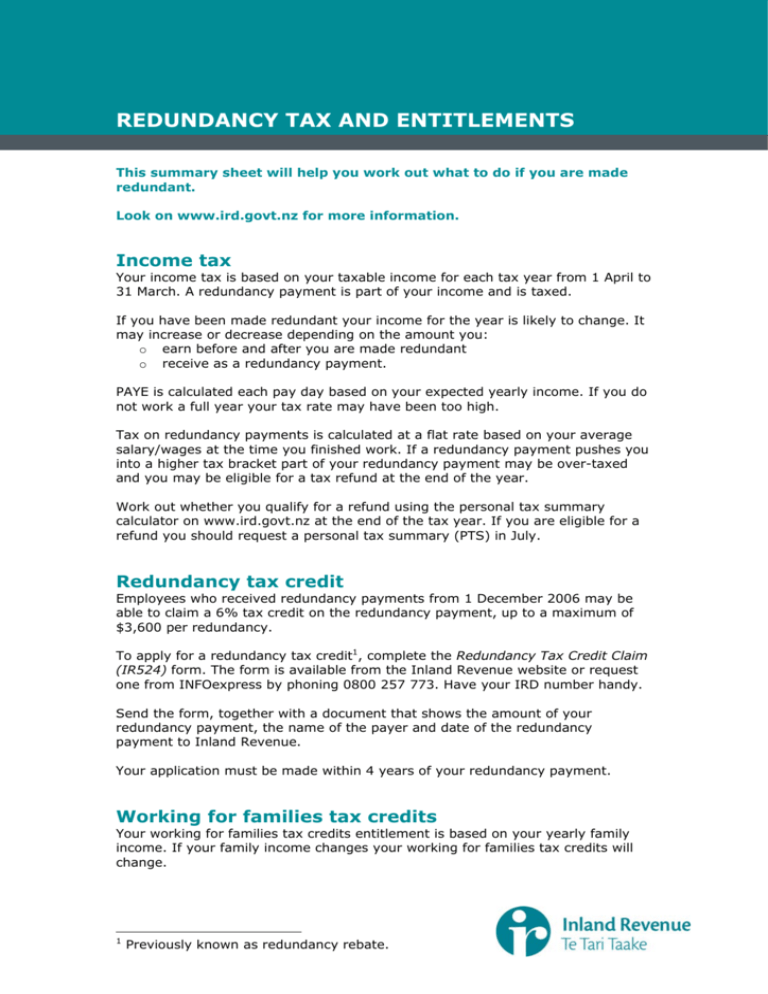

Is A Redundancy Payment Tax Free What may be tax free You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your employer gives you

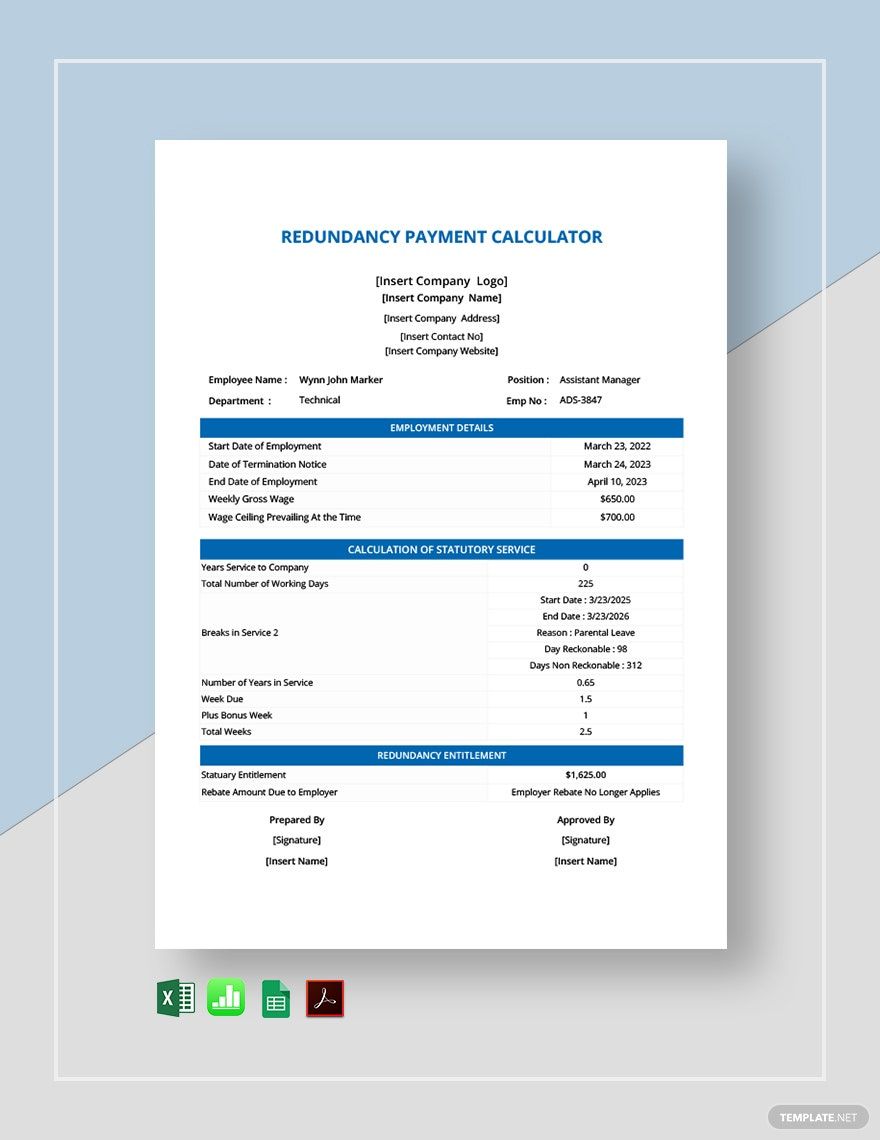

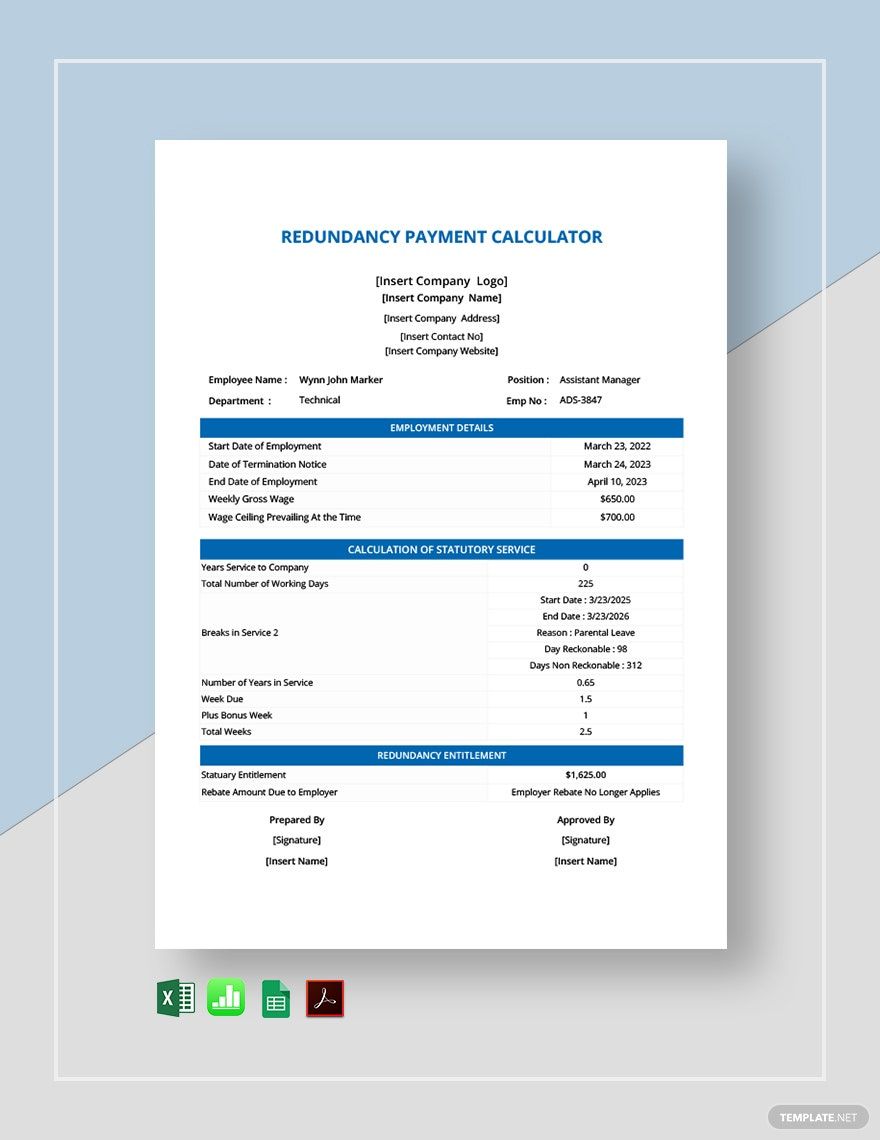

If employees are facing redundancy or considering voluntary redundancy they need to know exactly how much money they will receive within their redundancy payments Unfortunately the answer is not straightforward Some parts of a redundancy payment will be tax free while other parts will not Any payments that meet the conditions of a genuine redundancy are tax free up to a limit depending on your years of service with your employer The tax free limit is a whole dollar amount plus an amount for each year of service you complete in your period of employment with your employer

Is A Redundancy Payment Tax Free

Is A Redundancy Payment Tax Free

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

How Much Are You Entitled As Redundancy Pay Know Your Eligibility In UK

https://cdn.papershift.com/20221019210850/redundancy-pay-for-the-employees-in-UK-and-its-legal-obligations-explained-by-Papershift.jpeg

Termination Letter Redundancy Free Template Sample Lawpath

https://i.pinimg.com/originals/2a/a8/88/2aa8882f9424f9e3356dffa7784d6353.png

Whether statutory or enhanced this element of redundancy pay is free of tax and National Insurance Contributions NICs up to 30 000 Payments above the 30 000 threshold are treated as income and are subject to tax at your marginal rate but you won t pay NICs on the excess amount Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

Is redundancy pay taxed The first 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard rate You don t have to pay National Insurance on any of your redundancy pay The first 30 000 of the redundancy payment which is tax free doesn t count as relevant UK earnings Can a redundancy payment be used to boost my pension savings Potentially yes though only the part of a redundancy payment over the tax exempt threshold of 30 000 counts as relevant UK earnings

Download Is A Redundancy Payment Tax Free

More picture related to Is A Redundancy Payment Tax Free

Is My Redundancy Payment Tax Free

https://media.licdn.com/dms/image/C5612AQGXzjMkY2xlhA/article-cover_image-shrink_600_2000/0/1520202043609?e=2147483647&v=beta&t=Q6xM_FRcmsT9WVPmYTYrbawpxcT9VrPygrcLNXAyDXg

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Who Funds Redundancy Pay When A Business Is Insolvent And Fails

https://www.antonybatty.com/wp-content/uploads/2021/03/Redundancy-Rights_reduced.jpg

Up to 30 000 of redundancy pay is tax free You may not be eligible for statutory redundancy pay if your employer offers you a suitable alternative job and you turn it down Redundancy pay is based on Genuine redundancy payments are taxed at special rates and part of the redundancy payment can be paid tax free The tax free limit consists of two elements a base amount and an annual amount for each full year of service and both are indexed annually

[desc-10] [desc-11]

Free Redundancy Payment Calculator Template Download In Google Docs

https://images.template.net/44503/Redundancy-Payment-Calculator-1.jpg

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

https://www.gov.uk/termination-payments-and-tax...

What may be tax free You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your employer gives you

https://www.springhouselaw.com/knowledge-hub/...

If employees are facing redundancy or considering voluntary redundancy they need to know exactly how much money they will receive within their redundancy payments Unfortunately the answer is not straightforward Some parts of a redundancy payment will be tax free while other parts will not

Pin On Letter Template

Free Redundancy Payment Calculator Template Download In Google Docs

Tax On Redundancy Payments Davis Grant

What Tax Do I Pay On Redundancy Payments CruseBurke

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

Can I Receive A Tax free Redundancy Payment From My Ltd Company

Can I Receive A Tax free Redundancy Payment From My Ltd Company

How To Calculate Redundancy Pay In Australia 2022 Update

Redundancy Payment What To Do With It

Furlough To Redundancy What Are The Correct Procedures To Follow

Is A Redundancy Payment Tax Free - [desc-14]