Is Accrued Interest Taxable However if some of the tax exempt interest falls under the definition of accrued interest it must be taken into account by subtracting accrued interest from the total tax exempt interest to arrive at the amount of tax exempt interest that is attributable to the purchaser

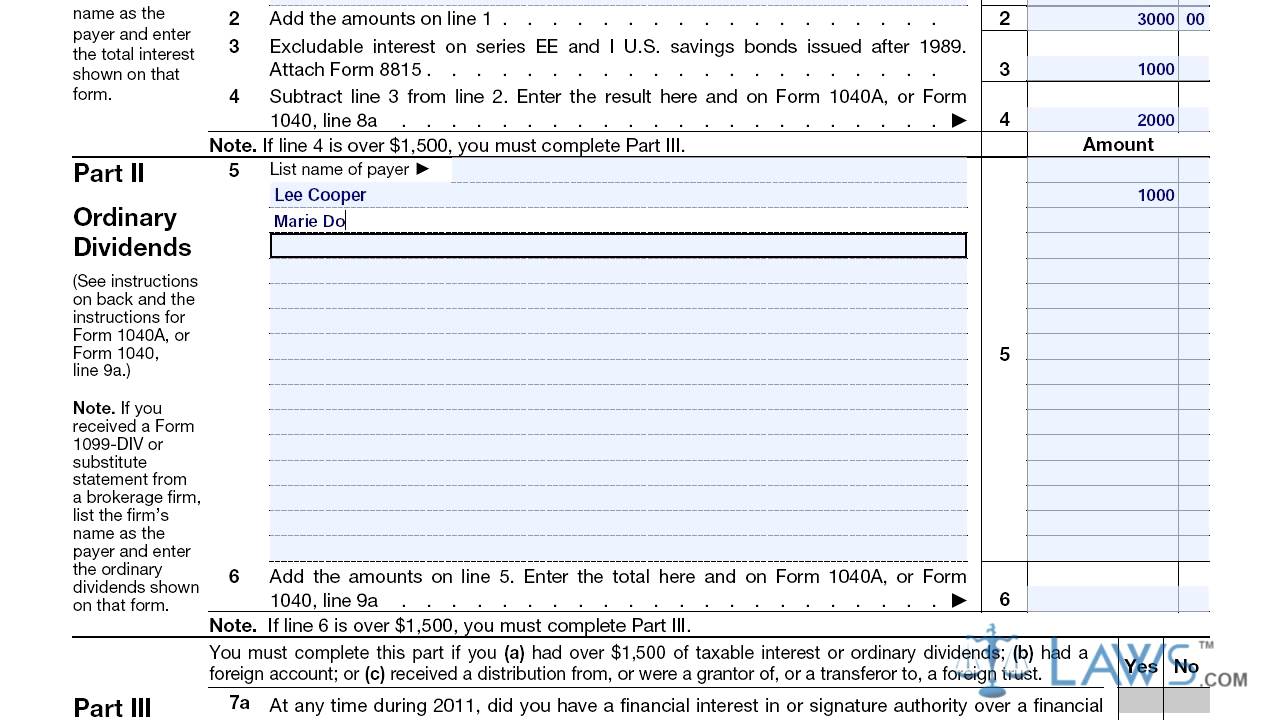

You need to report the accrued interest you paid at purchase because it is taxable to the seller not you Reporting Accrued Interest The first step in reporting accrued interest is Accrued Interest is Taxable Income As mentioned earlier any interest earned on a CD is considered taxable income even if you haven t received the payment yet This means that you ll need to report the interest on your tax return using Form 1099 INT

Is Accrued Interest Taxable

Is Accrued Interest Taxable

https://img.yumpu.com/35449117/1/500x640/schedule-b-on-form-1040.jpg

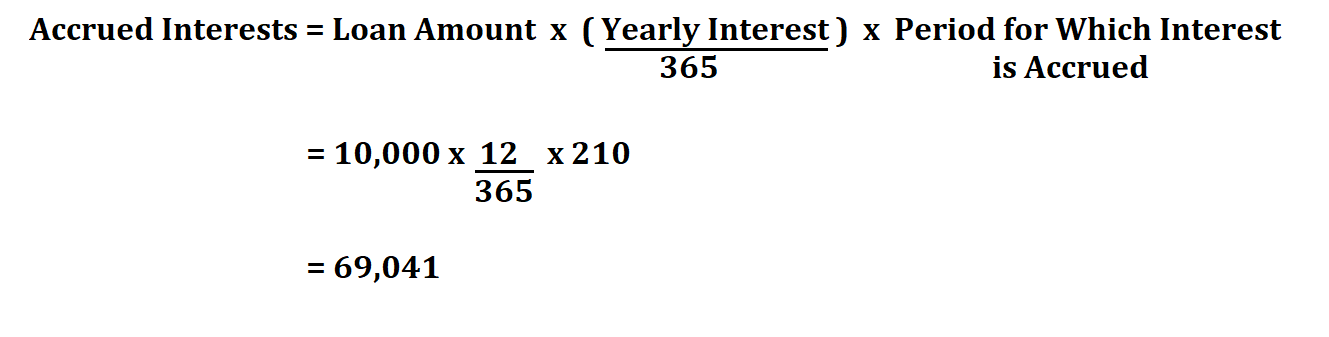

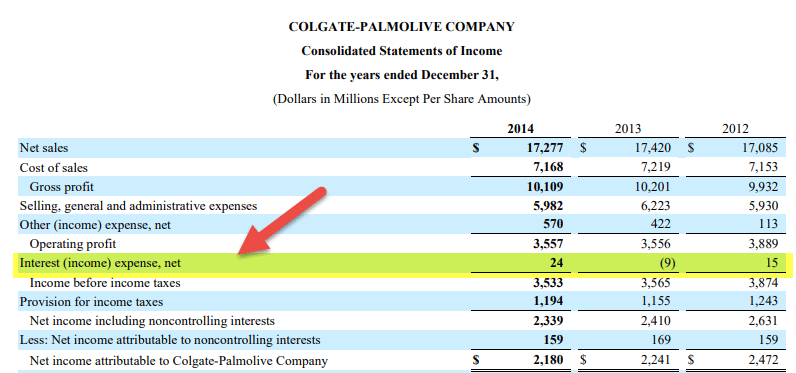

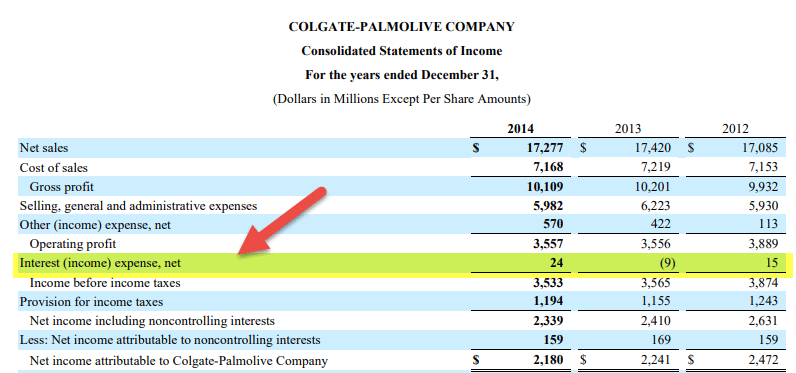

What Is Accrued Interest Formula Loan Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/29060808/Accrued-Interest-Formula.jpg

What Is Accrued Interest And How Does Its Calculation Work

https://www.compareclosing.com/blog/wp-content/uploads/2022/02/What-is-Accrued-Interest-and-How-Does-Its-Calculation-Work.jpg

The defaulted or unpaid interest is not income and is not taxable as interest if paid later When you receive a payment of that interest it is a return of capital that reduces the remaining cost basis of your bond Interest that accrues after the date of purchase however is taxable interest income for the year received or accrued Accrued interest adjustment lowers a fixed income security buyer s taxable interest income by reducing the extra interest amount that is paid to them Accrued

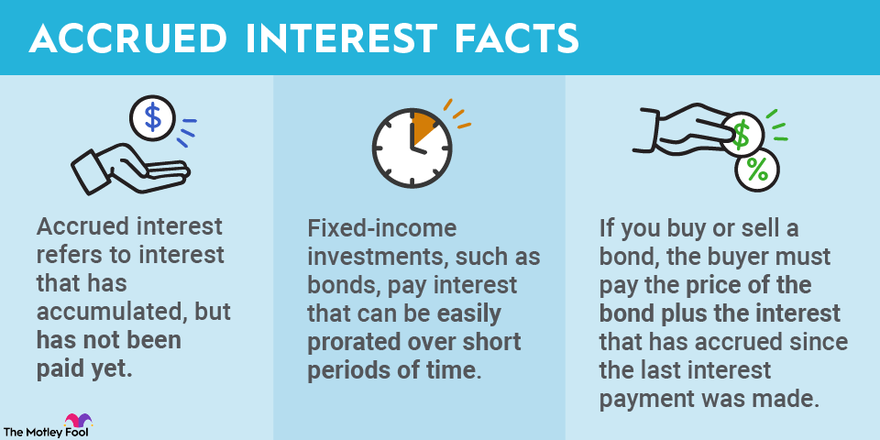

Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out While the vast majority of individuals are cash method taxpayers many businesses operate on the accrual method Accrual method businesses can deduct expenses as they are incurred but cash method individuals do not recognize income until actually received

Download Is Accrued Interest Taxable

More picture related to Is Accrued Interest Taxable

How To Report Accrued Interest On A Tax Return Finance Zacks

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/14/212/fotolia_4244187_XS.jpg

Interest And Ordinary Dividends Schedule B YouTube

https://i.ytimg.com/vi/2LUGatP0fXM/maxresdefault.jpg

How To Calculate Bond Accrued Interest 7 Steps with Pictures

http://www.wikihow.com/images/5/55/Calculate-Bond-Accrued-Interest-Step-7-Version-2.jpg

Accrued interest is the amount of interest earned on a debt such as a bond but not yet collected Interest accumulates from the date a loan is issued or when a bond s coupon is made but Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you However some interest you receive may be tax exempt

[desc-10] [desc-11]

KayshaAodhan

https://m.foolcdn.com/media/dubs/images/accrued-interest-infographic.width-880.png

:max_bytes(150000):strip_icc()/accuredinterest-e30eac418e8741a682dbb01b0087a6fb.png)

Accrued Interest Definition Example

https://www.investopedia.com/thmb/z1XYPm4y0_Mdf_BKuD_YchyFQqI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/accuredinterest-e30eac418e8741a682dbb01b0087a6fb.png

https://ttlc.intuit.com › community › taxes › discussion › ...

However if some of the tax exempt interest falls under the definition of accrued interest it must be taken into account by subtracting accrued interest from the total tax exempt interest to arrive at the amount of tax exempt interest that is attributable to the purchaser

https://finance.zacks.com

You need to report the accrued interest you paid at purchase because it is taxable to the seller not you Reporting Accrued Interest The first step in reporting accrued interest is

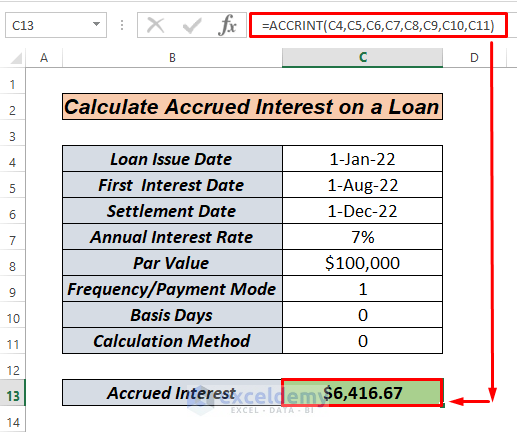

How To Calculate Accrued Interest

KayshaAodhan

What Is Accrued Interest How To Calculate Accrued Interest Market

What Is Accrued Interest Formula Loan Calculator

Accrued Interest Formula Calculator Examples With Excel Template

Accrued Interest What Is It Example Journal Entry

Accrued Interest What Is It Example Journal Entry

What Is Accrued Interest

How To Calculate Accrued Interest On A Loan In Excel 3 Ways ExcelDemy

What Is Accrued Interest Formula Loan Calculator

Is Accrued Interest Taxable - While the vast majority of individuals are cash method taxpayers many businesses operate on the accrual method Accrual method businesses can deduct expenses as they are incurred but cash method individuals do not recognize income until actually received