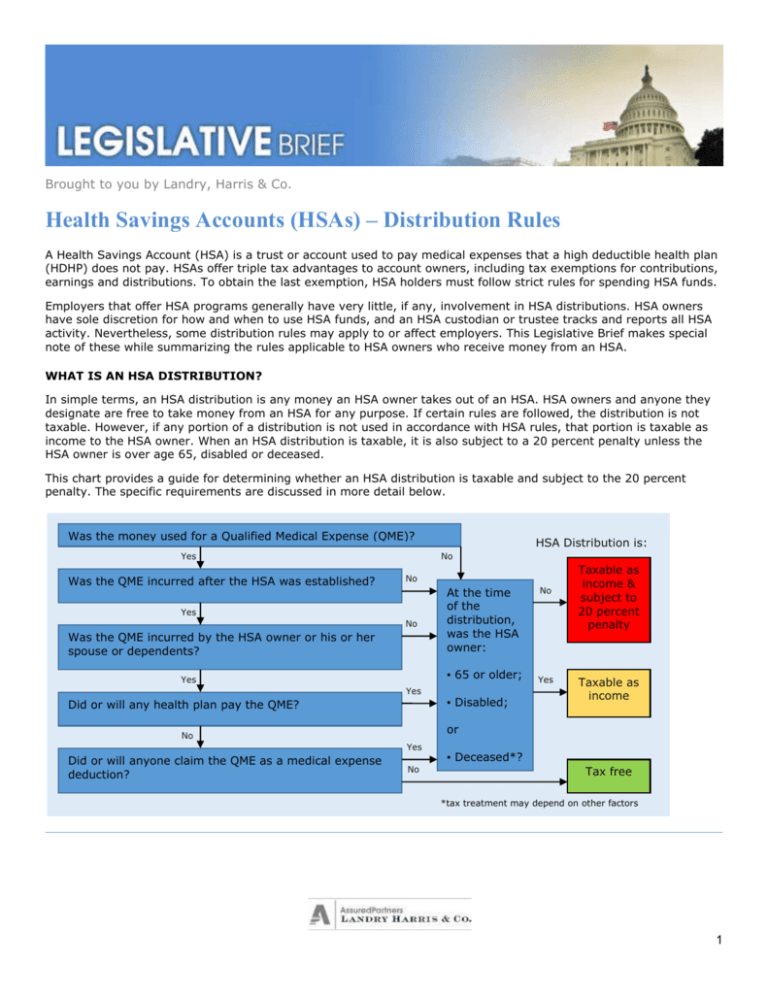

Is An Hsa Distribution Taxable HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

Contributions to HSAs and MSAs are tax deductible and the unspent balances can rollover indefinitely from year to year Distributions from HSAs and MSAs If you don t use a distribution from your HSA for qualified medical expenses you must pay tax on the distribution Report the amount on Form 8889 and file it with your Form

Is An Hsa Distribution Taxable

Is An Hsa Distribution Taxable

https://www.centralbank.net/uploadedfiles/images/infographics/central-bank/anatomy-of-an-hsa-infographic.jpg?v=1D7597EA897F000

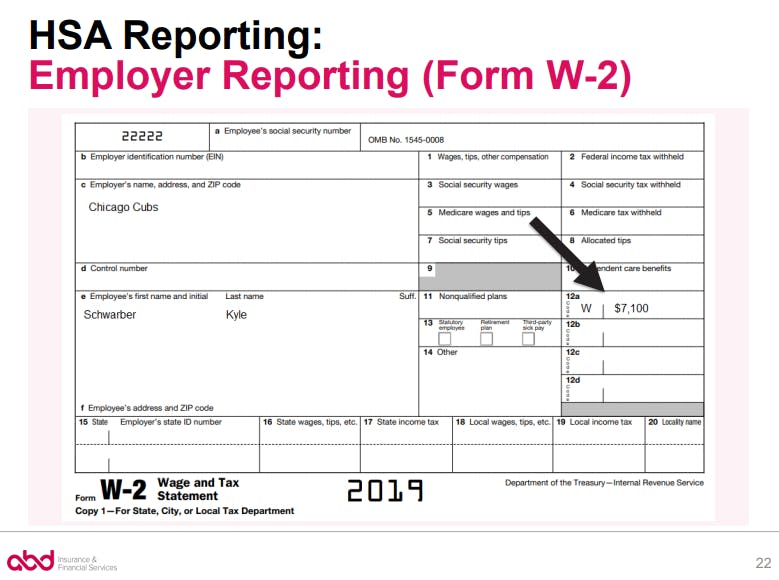

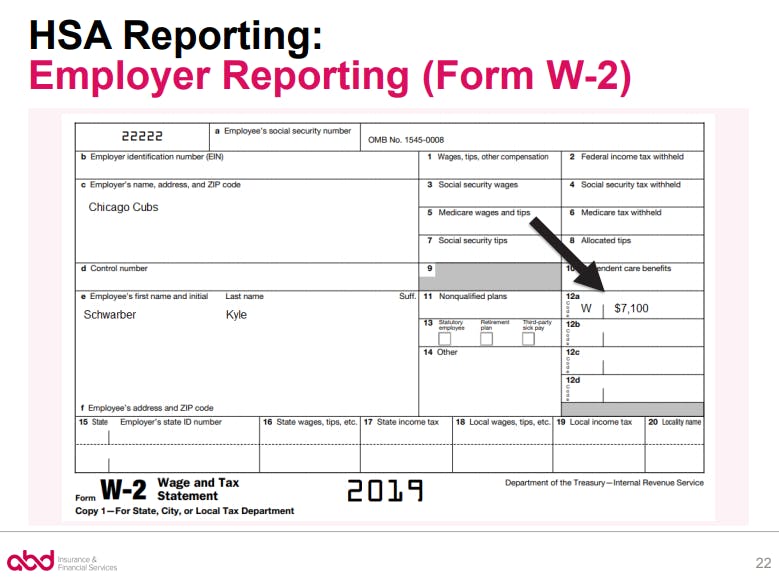

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make Information about Form 1099 SA Distributions From an HSA Archer MSA or Medicare Advantage MSA including recent updates related forms and instructions

The earnings are taxable in the year of distribution even if used for qualified medical expenses and are also included in Box 1 The taxable earnings are Key Takeaways A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs No tax is levied

Download Is An Hsa Distribution Taxable

More picture related to Is An Hsa Distribution Taxable

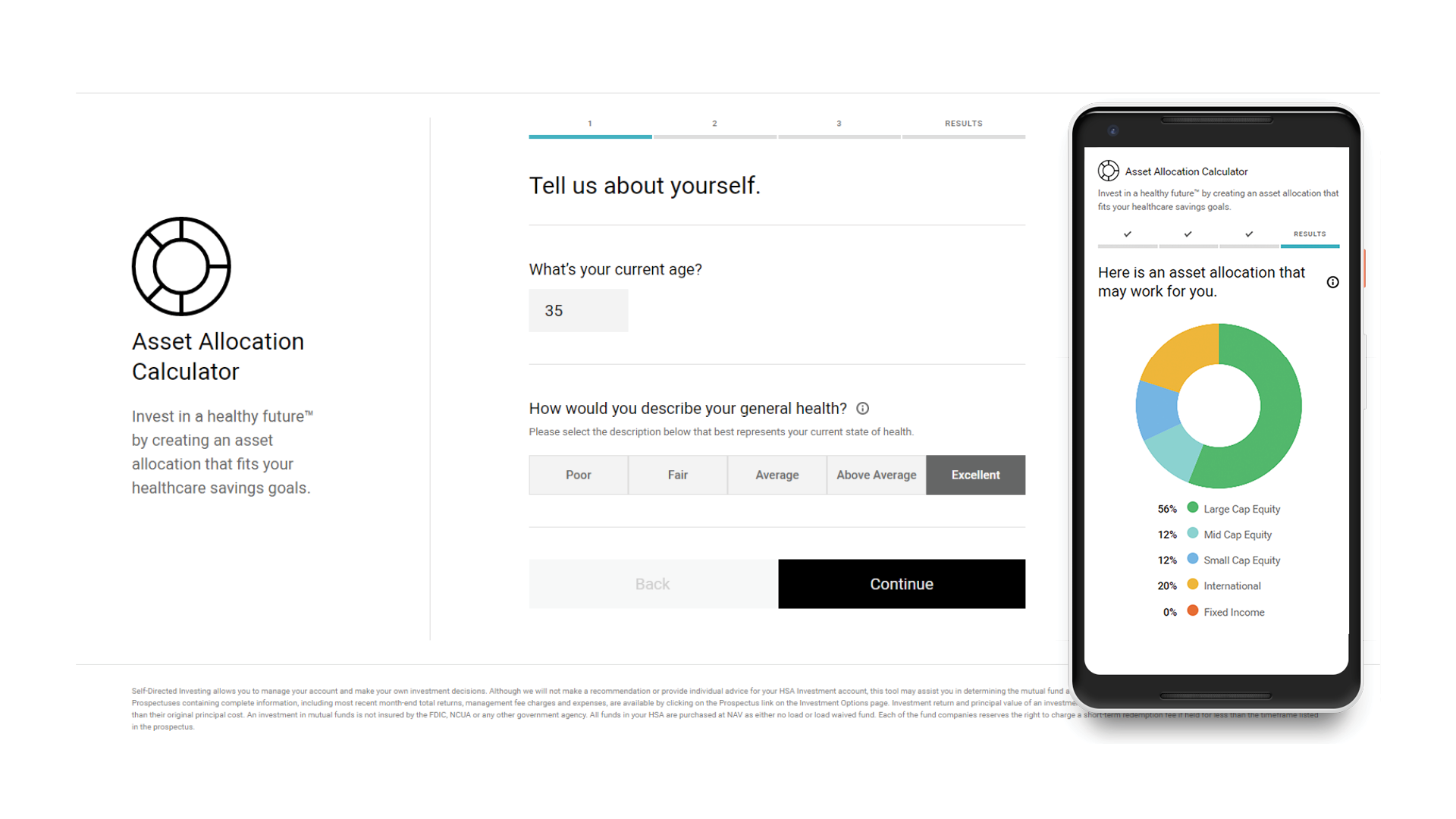

New HSA Asset Allocation Calculator Devenir

https://www.devenir.com/wp-content/uploads/AssetAllocation_Screenshots.png

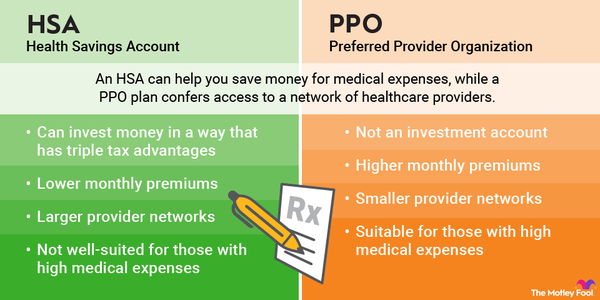

HSA Vs PPO Which Is Better The Motley Fool

https://m.foolcdn.com/media/dubs/images/HSA-vs-PPO-plans-infographic.width-600.png

Should I Get An HDHP Just To Use An HSA High Deductible Health Plan

https://i.pinimg.com/originals/46/27/45/46274528cb4759103deccd708888105f.png

You are not required to determine the taxable amount of a distribution Do not report a negative amount in box 1 Do not report the withdrawal of excess employer contributions An HSA is only available to people who have a high deductible health insurance plan The contributions to an HSA are tax deductible and the account s earnings if invested

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded Contributions by individuals to an HSA or if made on behalf of an individual to an HSA are not deductible to the extent they exceed the previously discussed limits

Graph Showing Resource Distribution Discrepancies On Craiyon

https://pics.craiyon.com/2023-11-12/y_Yr_jY_RgKFOojeX62ohg.webp

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

https://www.fool.com/retirement/plans/hsa/distributions

HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

https://turbotax.intuit.com/tax-tips/health-care/...

Contributions to HSAs and MSAs are tax deductible and the unspent balances can rollover indefinitely from year to year Distributions from HSAs and MSAs

What Is An HSA Distribution Sapling

Graph Showing Resource Distribution Discrepancies On Craiyon

What Is A Health Savings Account HSA HSA Search

HSA Distribution Taxes Forms Qualified Distributions The Motley Fool

What Is An Hsa Distribution

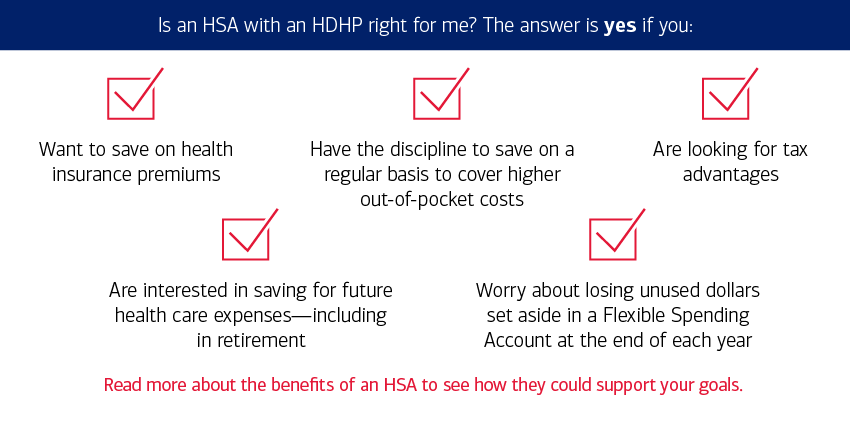

Is An HSA Right For Me

Is An HSA Right For Me

Pin On Hack

Taking A Distribution From HSA Participant Help Center

FAQ About Health Savings Accounts HSA

Is An Hsa Distribution Taxable - Information about Form 1099 SA Distributions From an HSA Archer MSA or Medicare Advantage MSA including recent updates related forms and instructions