Is Aotc A Refundable Credit To be eligible to claim the AOTC or the lifetime learning credit LLC the law requires a taxpayer or a dependent to have received Form 1098 T Tuition Statement from an eligible educational institution whether domestic or foreign Generally students receive a Form 1098 T PDFTuition Statement from their school by See more

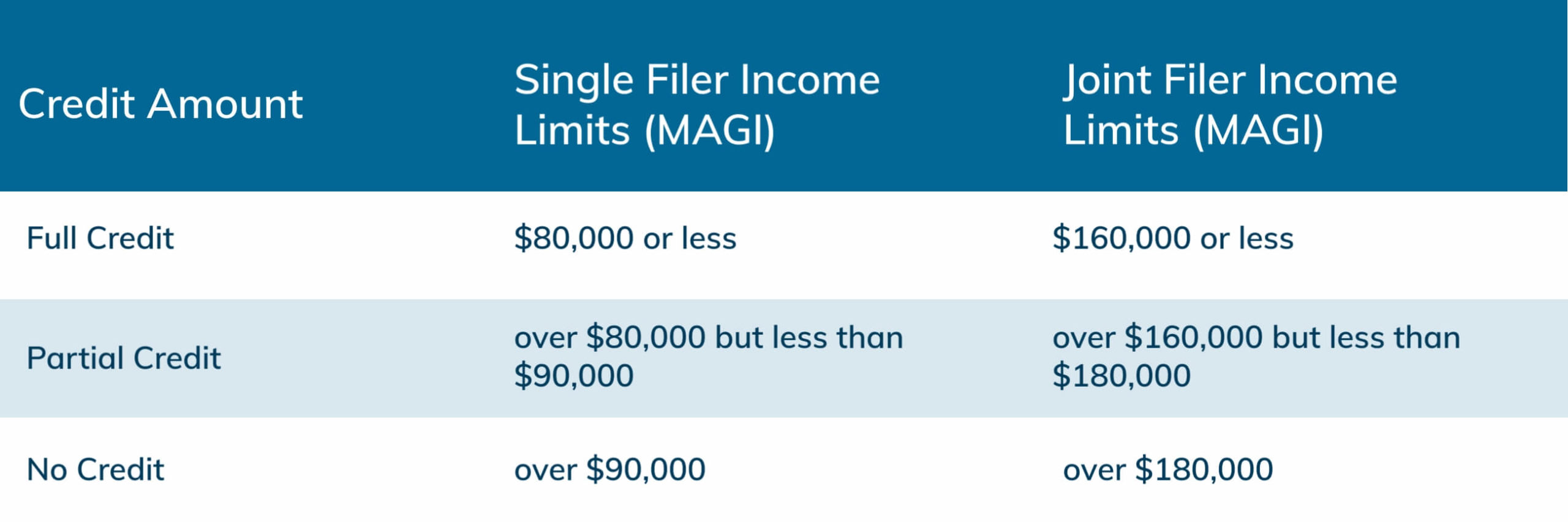

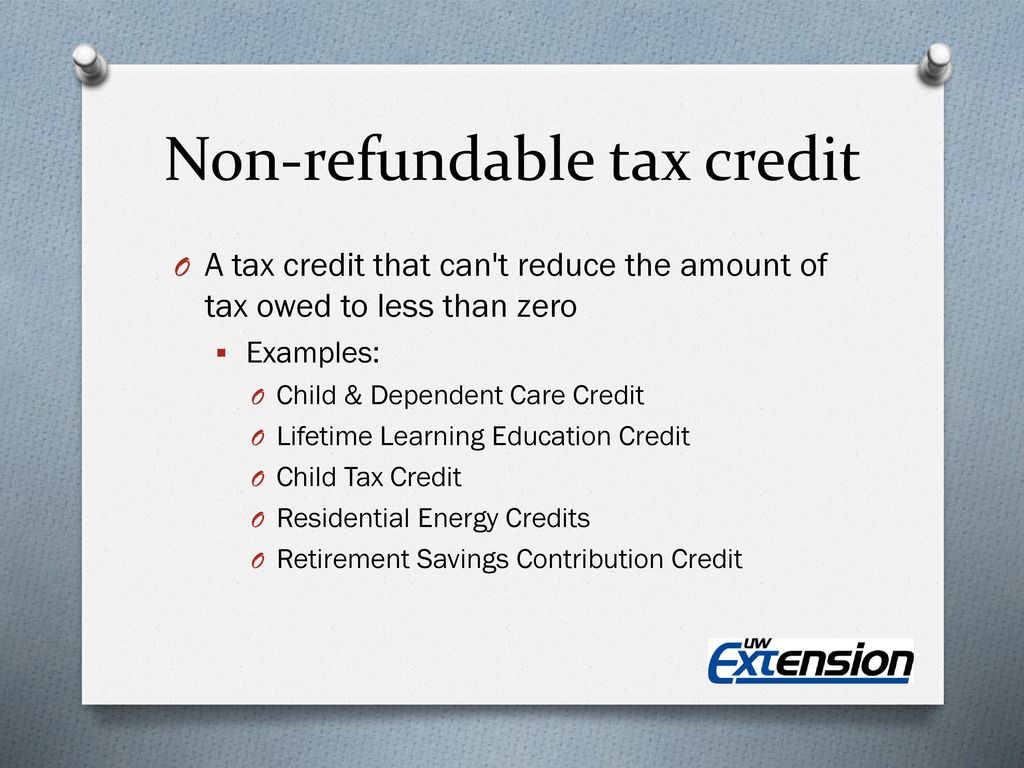

If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American opportunity tax credit AOTC and the lifetime learning credit In general tax credits are refundable nonrefundable or partially refundable Up to 1 000 40 of the AOTC is refundable making it a partially refundable tax credit

Is Aotc A Refundable Credit

Is Aotc A Refundable Credit

https://www.ckhgroup.com/wp-content/uploads/2022/02/Website-article-images-800x550.png

College Tax Credit 2022 What Is The Income Limit For AOTC Marca

https://phantom-marca.unidadeditorial.es/2b0e81507f8618e07b9e60f935924d2e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/03/21/16478518207053.jpg

AOTC Legacy Sprinkles Water On Fyrakk Eternal Kingdom

https://www.eternal-kingdom.com/wp-content/uploads/2023/12/Fyrakk_AOTC.jpg

Up to 40 of the AOTC is refundable The Internal Revenue Service IRS will refund up to 40 of what s left over up to a cap of 1 000 if claiming the credit reduces your tax bill to zero You can receive a refund of The AOTC is a partially refundable tax credit A refundable tax credit allows a taxpayer to receive a refund if the amount of the taxpayer s tax credit exceeds the taxpayer s

Is the American Opportunity Tax Credit refundable Since you have the opportunity to receive some of the AOTC in cash it s known as a partially refundable credit If Find the latest information for refundable credits on Refundable Credits News and Updates See the AOTC and LLC criteria side by side on our Compare Education Credits

Download Is Aotc A Refundable Credit

More picture related to Is Aotc A Refundable Credit

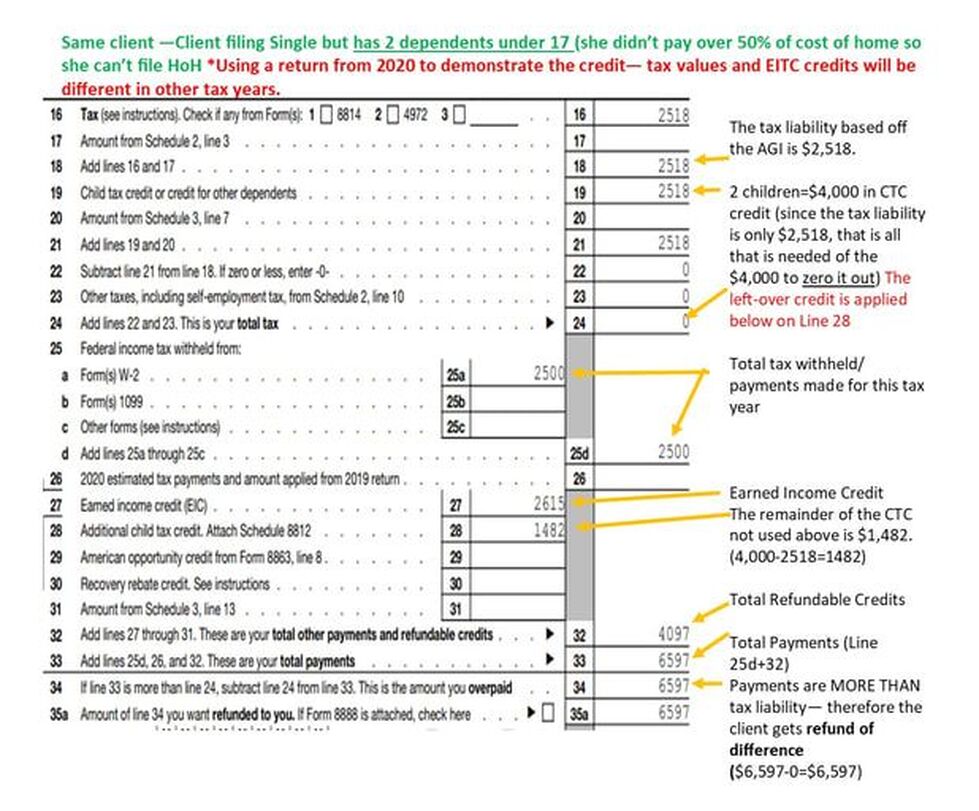

Refundable Credits

https://www.vitaresources.net/uploads/1/2/0/5/120565036/published/affect-of-ctc-on-a-return-page-2-pub.jpg?1660437991

College Students Body The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2022/11/College-Students-Body-scaled.jpg

Tax Credit Vs Tax Deduction What s The Difference Guide

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

Refundable tax credit that provides financial assistance to taxpayers or their children who are pursuing a higher education The credit worth up to 2 500 per student can What s more the American Opportunity Credit is a partially refundable education tax credit That means if you ve offset your applicable taxes and there s some of the credit left over you could receive money back as a refund

This tax credit is worth up to 2 500 per year and has a refundable portion of 40 meaning it can create a tax refund of up to 1 000 if you owe no taxes Use the tips below to help avoid common AOTC errors Claim a credit for a student that did not attend a college university or vocational school AOTC is for post secondary education only that includes colleges universities and

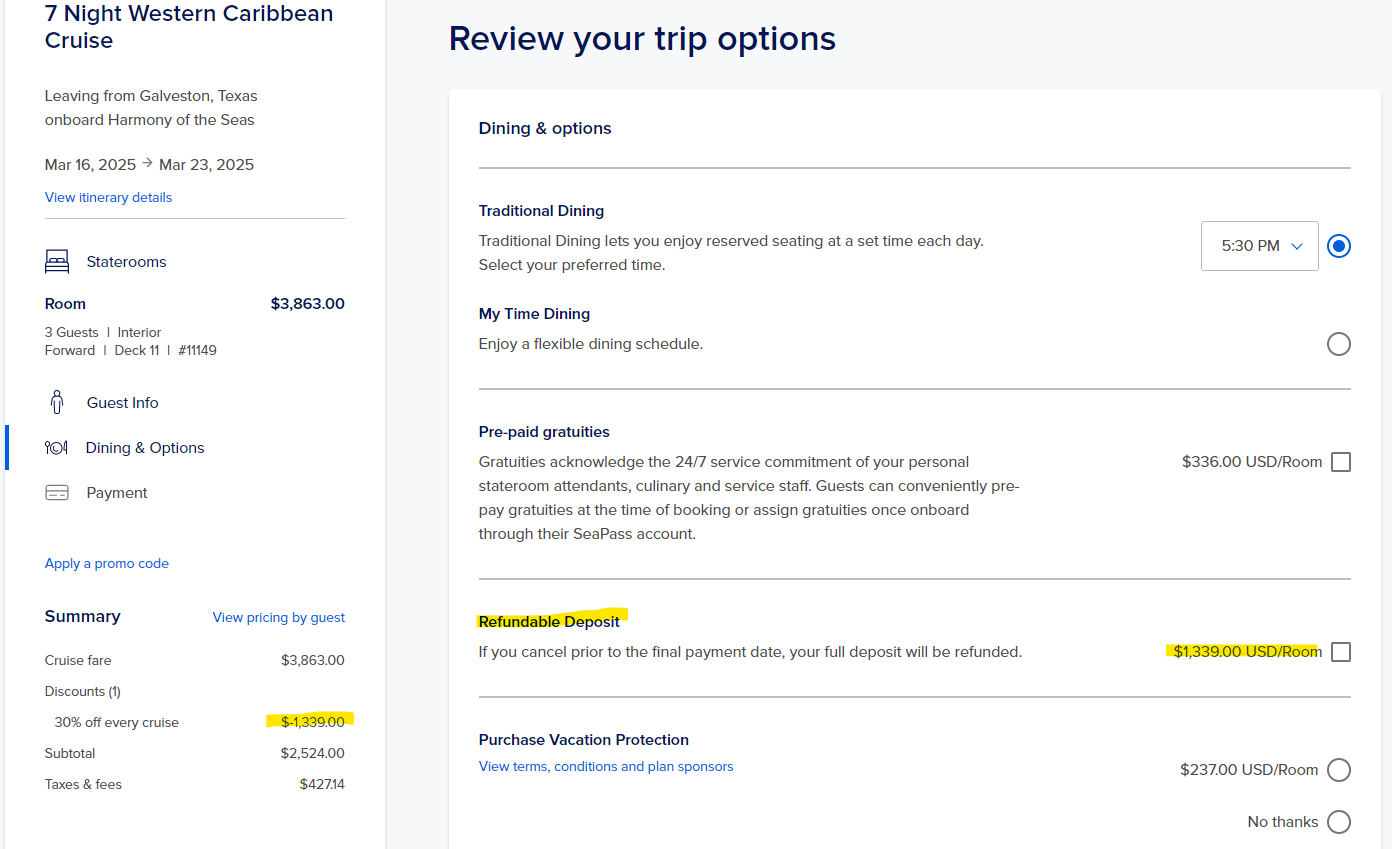

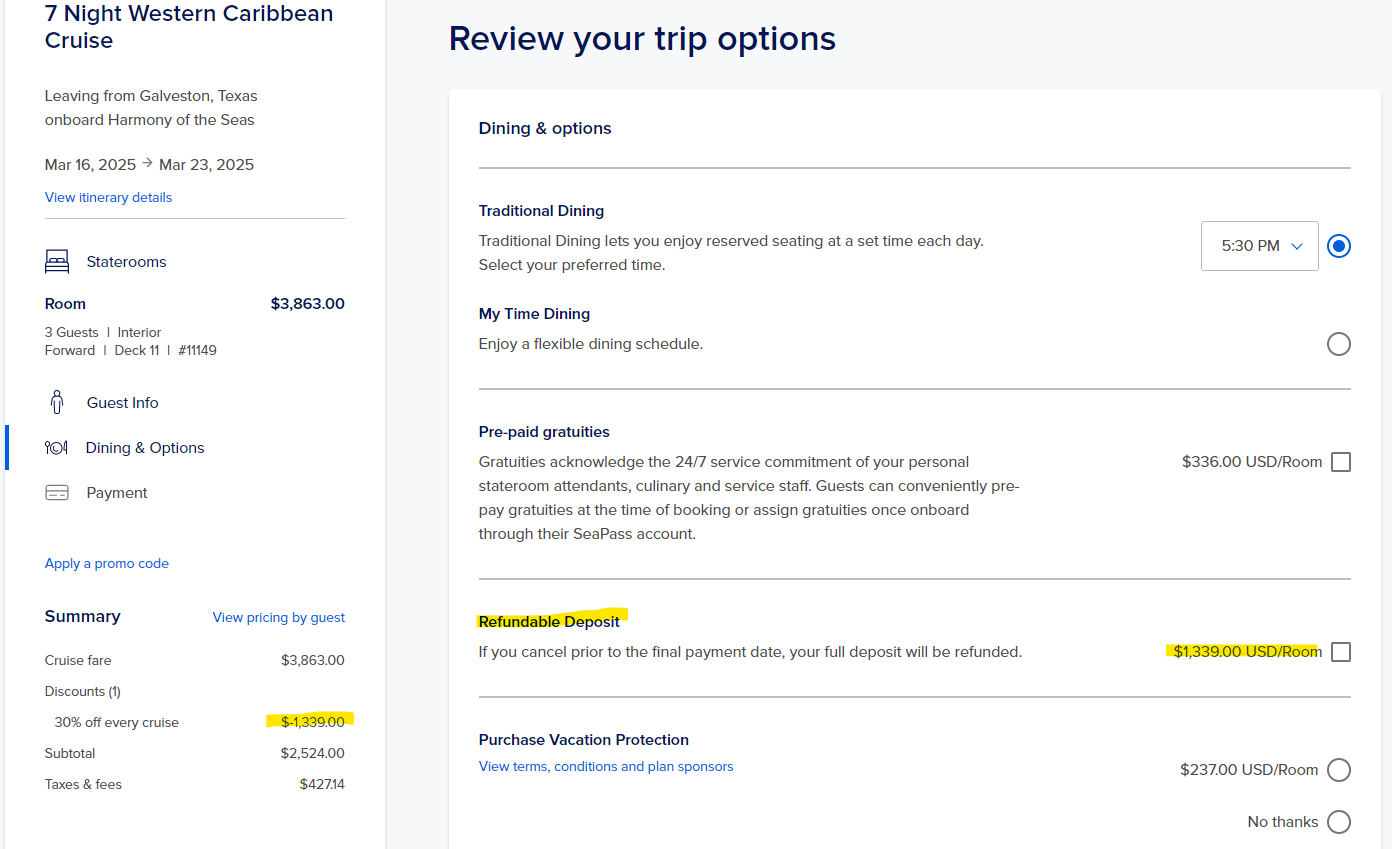

Refundable Deposits Removing Discounts Royal Caribbean Discussion

https://www.royalcaribbeanblog.com/boards/uploads/monthly_2022_12/image.png.1c4c57c083e143d92f32a06648accbbb.png

AOTC Boom Deployment Exercise YouTube

https://i.ytimg.com/vi/-nlBrWUSu9I/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGE0gVyhlMA8=&rs=AOn4CLD0s0q9H91px5CXXK2DTn9OxclLbg

https://www.irs.gov › credits-deductions › individuals › aotc

To be eligible to claim the AOTC or the lifetime learning credit LLC the law requires a taxpayer or a dependent to have received Form 1098 T Tuition Statement from an eligible educational institution whether domestic or foreign Generally students receive a Form 1098 T PDFTuition Statement from their school by See more

https://www.irs.gov › ... › education-credits-aotc-llc

If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American opportunity tax credit AOTC and the lifetime learning credit

Is LLC A Refundable Credit Leia Aqui Are The AOTC Or LLC Refundable

Refundable Deposits Removing Discounts Royal Caribbean Discussion

Tax Credits Refundable Non refundable Credits

2022 Education Tax Credits Where s My Refund Tax News Information

Advanced Oilfield Technology Company LLC On LinkedIn AOTC 52nd

Week 11 Heroic Sark Prog AoTC Next Week YouTube

Week 11 Heroic Sark Prog AoTC Next Week YouTube

Welcome AOTC Energy Mining 2023

What Is Refundable Vs Nonrefundable Child Tax Credit Leia Aqui What

A US Stormrage Recruiting For AOTC And Mythic Focused Teams Wowguilds

Is Aotc A Refundable Credit - Is the American Opportunity Tax Credit refundable Since you have the opportunity to receive some of the AOTC in cash it s known as a partially refundable credit If