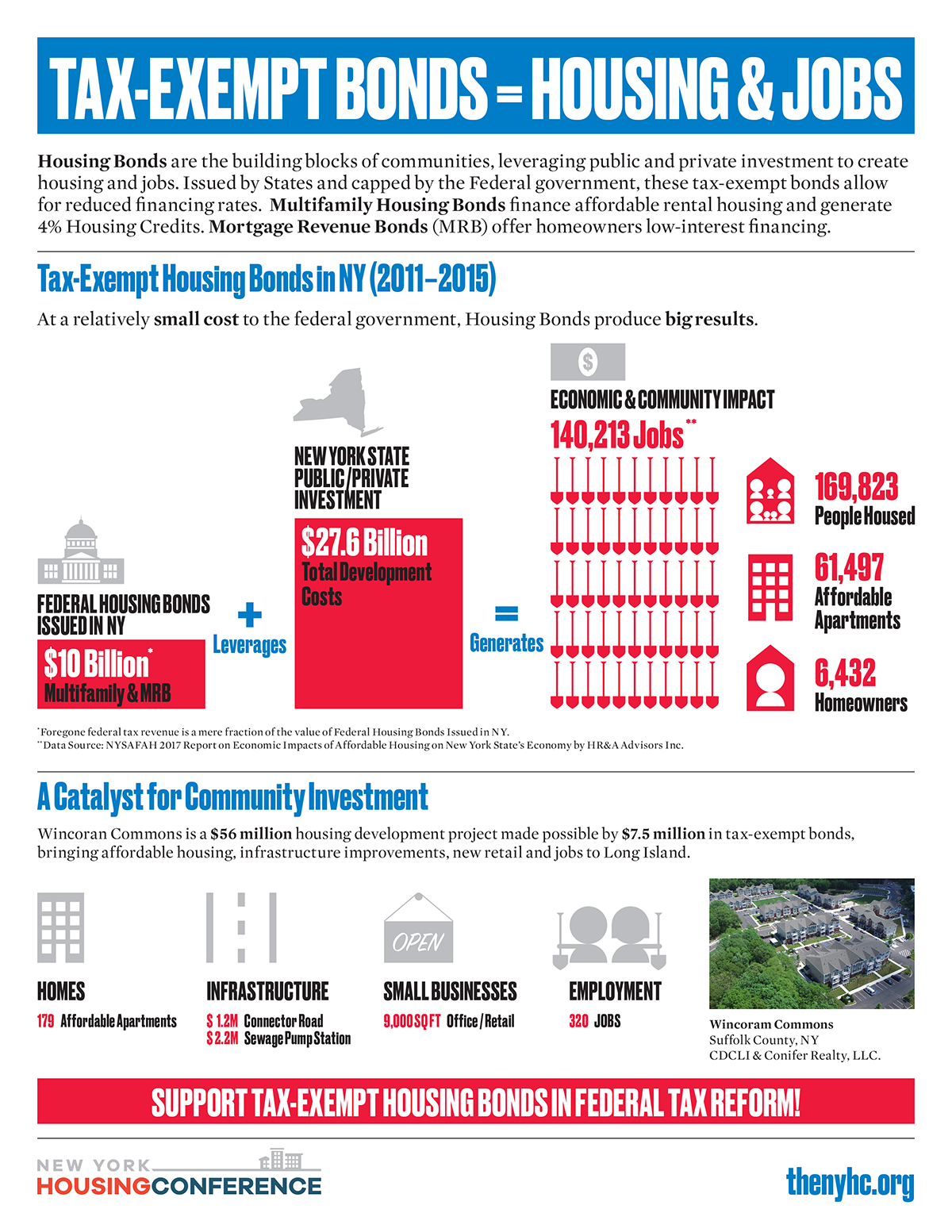

Is Bond Premium On Tax Exempt Bonds Taxable Amortizable bond premium If you elect to reduce your interest income on a taxable bond by the amount of taxable amortizable bond premium follow the rules earlier under

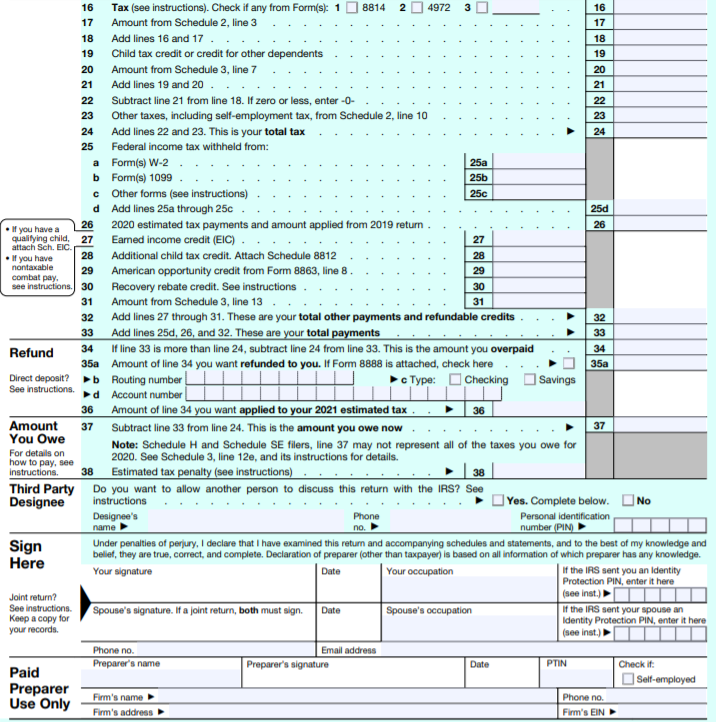

Generally no reduction for premium amortization is allowed since the interest is not taxable but if the bonds are taxable out of Market purchases of bonds adjustments to taxable income and forms 1099 For taxpayers who purchase bonds or other debt instruments Bonds the Tax Code1 may require

Is Bond Premium On Tax Exempt Bonds Taxable

Is Bond Premium On Tax Exempt Bonds Taxable

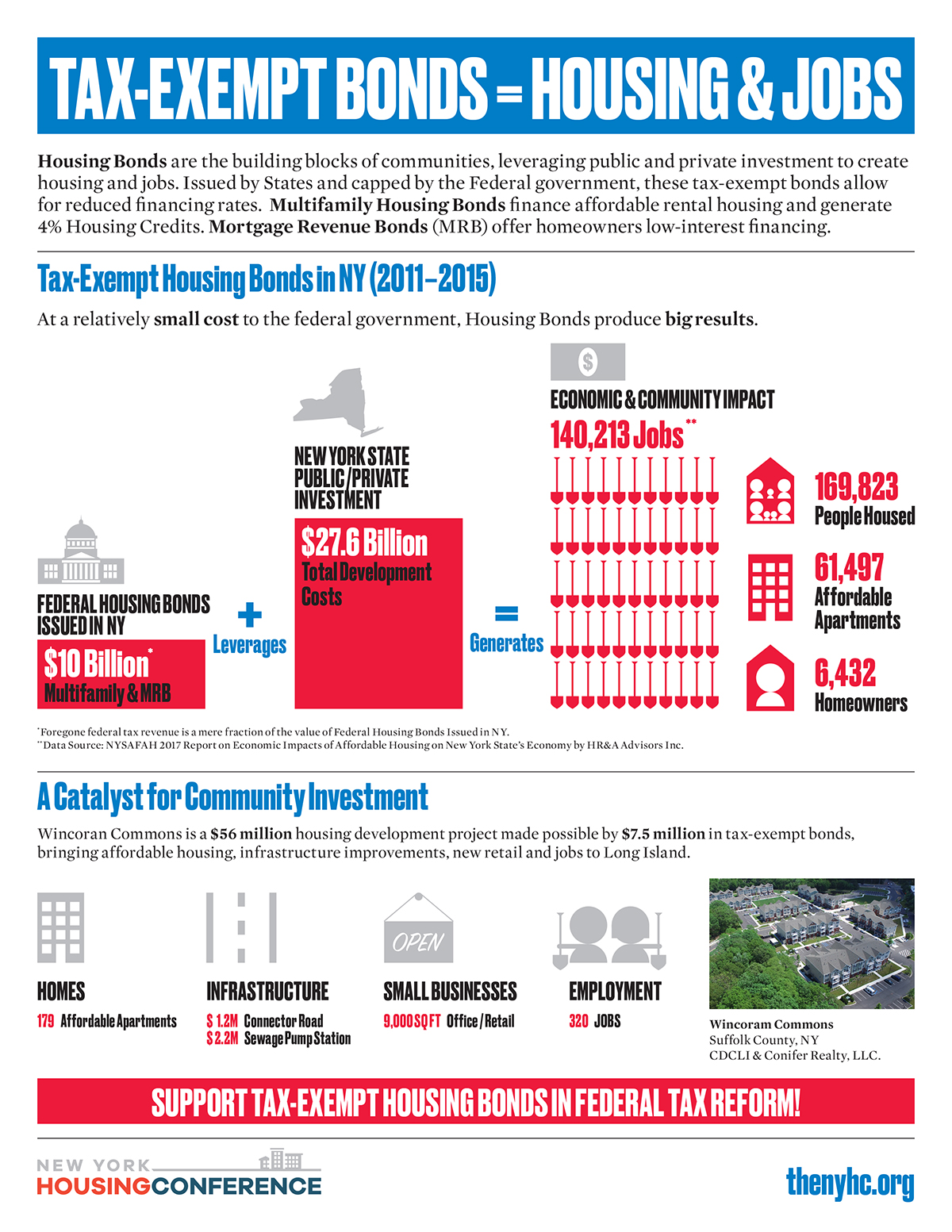

https://thenyhc.org/wp-content/uploads/Advocacy/Tax-Exempt-Bonds/Full-Tax-Exempt-Bond-Infographic.jpg

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

What Are Bonds And How Do They Work

https://www.thebalancemoney.com/thmb/SYr9iyMvIQ1XN-xAeiozFcwGHNw=/6000x4000/filters:fill(auto,1)/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png

Solved Timpanogos Inc Is An Accrual method Calendar year Corporation

https://www.coursehero.com/qa/attachment/16501720/

Interest from corporate bonds is generally taxable at both the federal and state levels Interest from Treasuries is generally taxable at the federal level but not at Market discount on a tax exempt bond is not tax exempt If you bought the bond after April 30 1993 you can choose to accrue the market discount over the period you own the

Tax exempt bonds Information about tax advantaged bonds including tax exempt tax credit and direct pay bonds Resources for issuers borrowers and bond professionals The premium paid represents part of the cost basis of the bond can be tax deductible and amortized over the lifespan of the bond Amortizing the premium can be

Download Is Bond Premium On Tax Exempt Bonds Taxable

More picture related to Is Bond Premium On Tax Exempt Bonds Taxable

Putting Taxable Bonds In A Tax aware Portfolio Vanguard

https://corporate.vanguard.com/content/dam/corp/articles/images/taxable-bonds-in-tax-aware-portfolios/taxable_bonds_tax_rates_1.svg

Solved Xonic Corporation Issued 7 8 Million Of 20 year 8 Percent

https://www.coursehero.com/qa/attachment/15317115/

Why The Surge In Taxable Municipal Bonds

https://i0.wp.com/www.brookings.edu/wp-content/uploads/2020/12/Taxable-and-tax-exempt-muni-bond-issuance_monthly.png?w=768&crop=0%2C0px%2C100%2C9999px&ssl=1

The rules for including OID in income generally do not apply to U S savings bonds tax exempt obligations and loans of 10 000 or less between individuals who are not in the business of Interest from corporate bonds and U S Treasury bonds interest is typically taxable at the federal level U S Treasuries are exempt from state and local income

While the interest income is usually tax exempt for municipal bonds capital gains realized from selling a bond are subject to federal and state taxes The short term Taxation of federal government bonds Income from bonds issued by the federal government and its agencies including Treasury securities is generally exempt from

7 Best Tax Free Municipal Bond Funds Bonds US News

https://www.usnews.com/dims4/USNEWS/7f302d5/2147483647/crop/2121x1414%2B0%2B0/resize/1200x1200>/quality/85/?url=http:%2F%2Fmedia.beam.usnews.com%2F41%2F35%2F2fd3cd874c7b97f6c307917ac576%2Fmunicipalbond.jpg

Municipal Bonds And Rising Rates 3 Considerations For Investors

https://www.lordabbett.com/content/dam/lordabbett-captivate/images/insights/investment-objectives/2021/charts/030122-Web-Municipal-Bonds-Have-Outperformed-Taxable-Counterparts-Over-Time.png

https://www.irs.gov/instructions/i1040sb

Amortizable bond premium If you elect to reduce your interest income on a taxable bond by the amount of taxable amortizable bond premium follow the rules earlier under

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png?w=186)

https://ttlc.intuit.com/community/invest…

Generally no reduction for premium amortization is allowed since the interest is not taxable but if the bonds are taxable out of

Tax Exempt Securities Vs Municipal Bonds Finance Zacks

7 Best Tax Free Municipal Bond Funds Bonds US News

Annual Tax Exempt Bond Issuance

2A Ray And Maria Gomez Have Been Married For 3 Chegg

Solved Exercise 14 24 Algo Convertible Bonds Chegg

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

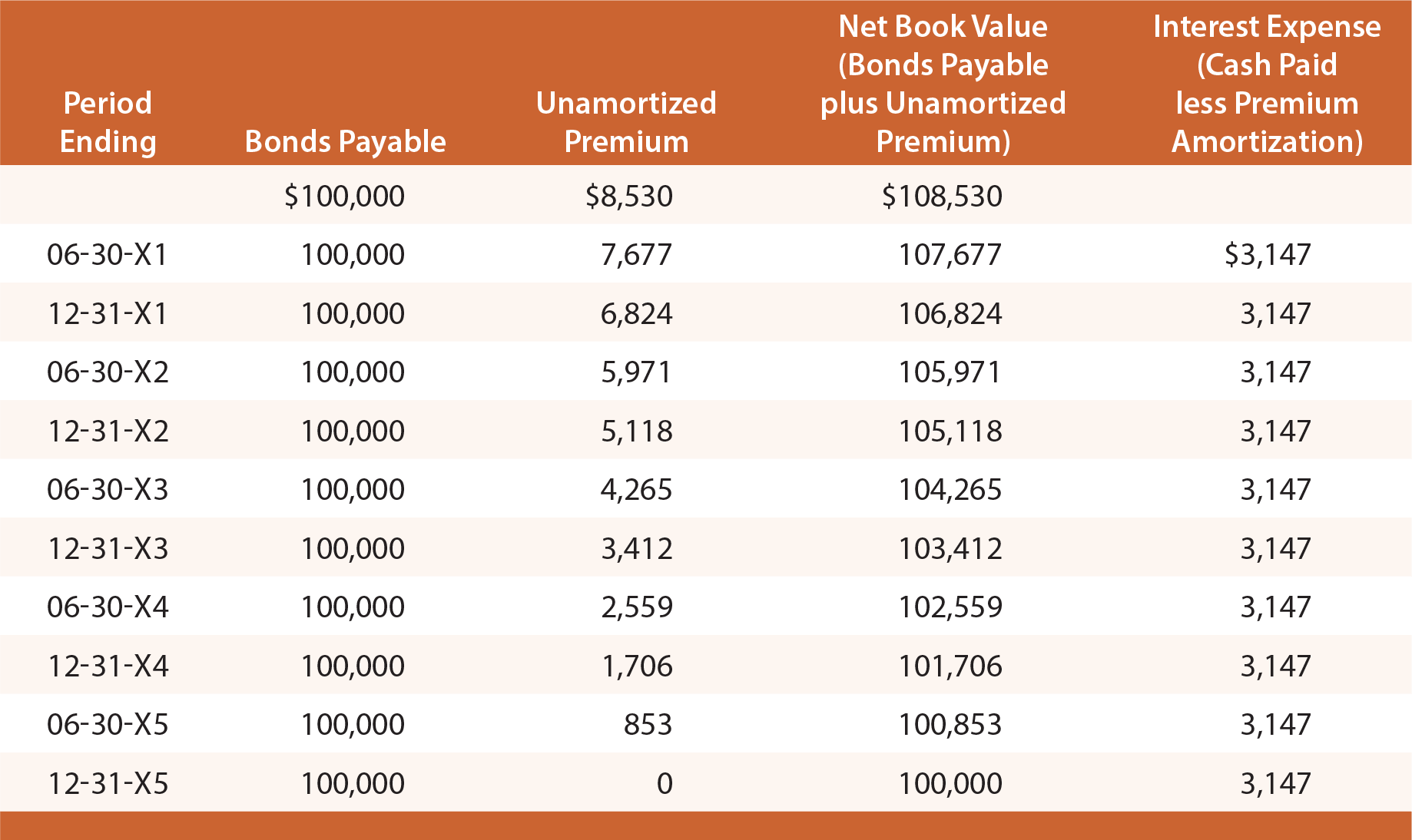

Amortization Of Bond Premium Step By Step Calculation With Examples

Series EE Savings Bonds Series EE Bonds Were Originally Offered On

Accounting For Bonds Payable Principlesofaccounting

Is Bond Premium On Tax Exempt Bonds Taxable - Market discount on a tax exempt bond is not tax exempt If you bought the bond after April 30 1993 you can choose to accrue the market discount over the period you own the