Is Business Line Of Credit Interest Tax Deductible Businesses may deduct interest on loans taken out for business purposes including mortgages on business property term loans and lines of credit The IRS says you may deduct interest on business

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies Interest paid on a personal line of credit is not tax deductible If it is found that even a minuscule portion of the business line of credit is used to

Is Business Line Of Credit Interest Tax Deductible

Is Business Line Of Credit Interest Tax Deductible

https://s.yimg.com/uu/api/res/1.2/evO7M0dUmFwjNGktKceIXQ--~B/aD0xNDYzO3c9MjA0OTtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/motleyfool.com/cbdf5e307d50f0dbe4cdc22816aa633e

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Is Line Of Credit Interest Tax Deductible In Canada PiggyBank

https://piggybank.ca/wp-content/uploads/Line-of-Credit-Interest.png

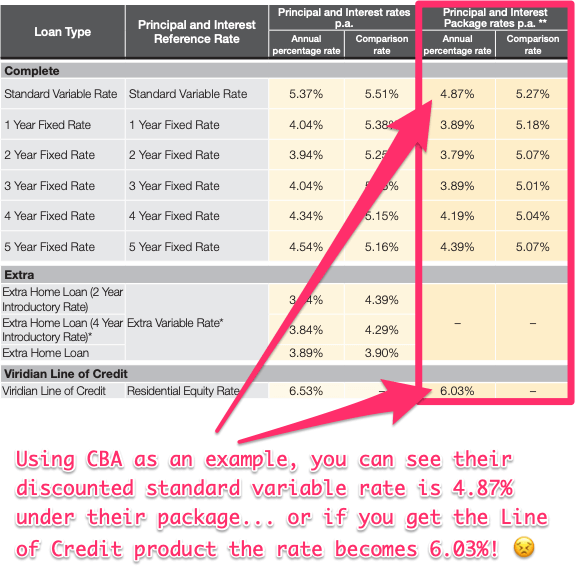

Not an Automatic Tax Deduction The interest on a business line of credit does not automatically qualify as a business tax deduction Several types of interest are tax deductible including mortgage interest on a primary or second home student loan interest and interest on some business loans including business

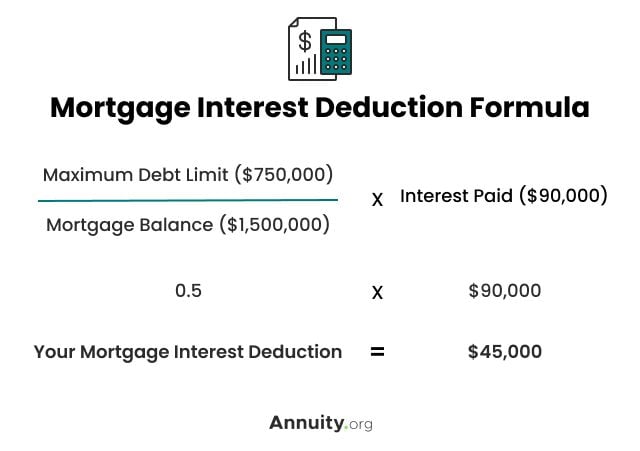

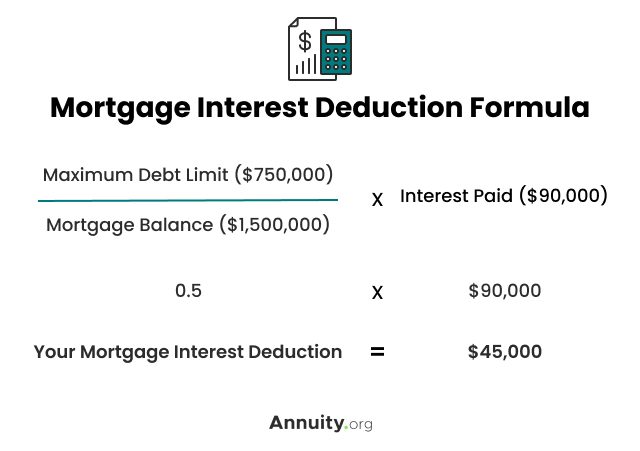

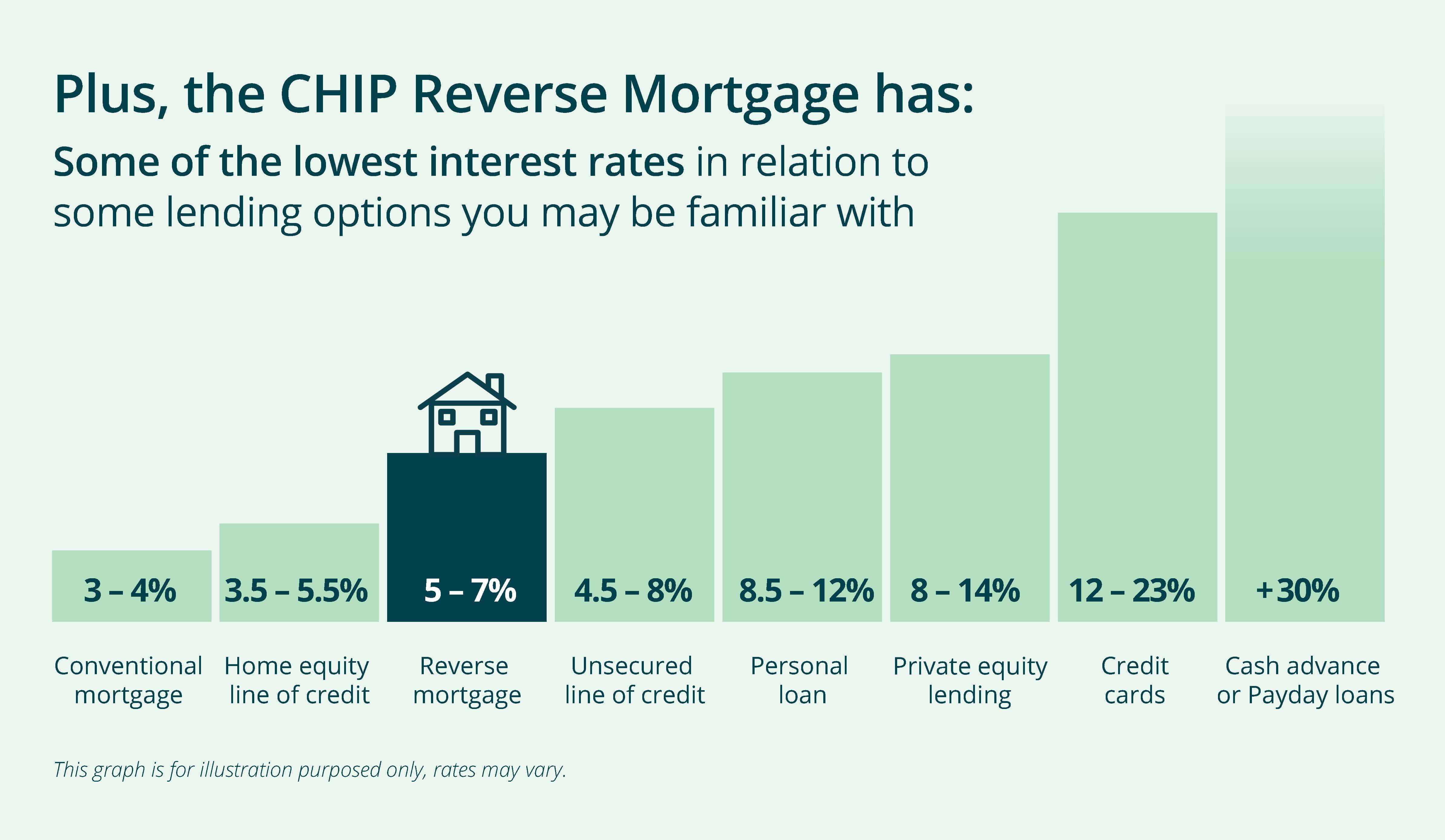

Lines of credit Many businesses use lines of credit from lenders to cover operating expenses The interest on this form of borrowing is tax deductible as well If you use your personal loan 100 to fund your business your interest payments are deductible If the loan is being used for mixed purposes you can only

Download Is Business Line Of Credit Interest Tax Deductible

More picture related to Is Business Line Of Credit Interest Tax Deductible

What Is A Business Line Of Credit LendVer Best Lender Reviews

https://www.lendver.com/wp-content/uploads/2019/04/AdobeStock_96422901_LineofCredit-2048x1360.jpeg

Compare The Best Savings Account Rates In Beaumont And Southeast Texas

https://www.dugood.org/hubfs/rates/Header-Rates-Savings01.jpg#keepProtocol

How To Calculate Interest Rate Line Of Credit Haiper

https://www.huntergalloway.com.au/wp-content/uploads/2019/02/cba-line-of-credit-interest-rate.png

That s right business loan interest can be tax deductible Here s what small business owners should know about interest deductions and small business loans But With a line of credit you only pay interest on withdrawals i e if you have a 30 000 line of credit and only withdrew 5 000 in one calendar year so it may be

If you ve been wondering whether or not business loan interest is tax deductible the short answer is yes If the loan is being used for business purposes Can I deduct line of credit repayments on my taxes No Any funds drawn against a business line of credit aren t considered a cost to your business and are not

How To Get The Best Line Of Credit Protect Now Blog

https://protectnowllc.com/wp-content/uploads/2020/08/What-You-Need-to-Know-About-Business-Credit-and-Covid-Relief.jpg

Is Mortgage Interest Tax Deductible In 2023 Orchard

https://assets-global.website-files.com/5fcff9094e6ad8e939c7fa3a/639ba11b8923dc39fc2c17c1_Is mortgage interest tax deductible_.png

https://www.thebalancemoney.com/deducting …

Businesses may deduct interest on loans taken out for business purposes including mortgages on business property term loans and lines of credit The IRS says you may deduct interest on business

https://www.irs.gov/taxtopics/tc505

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies

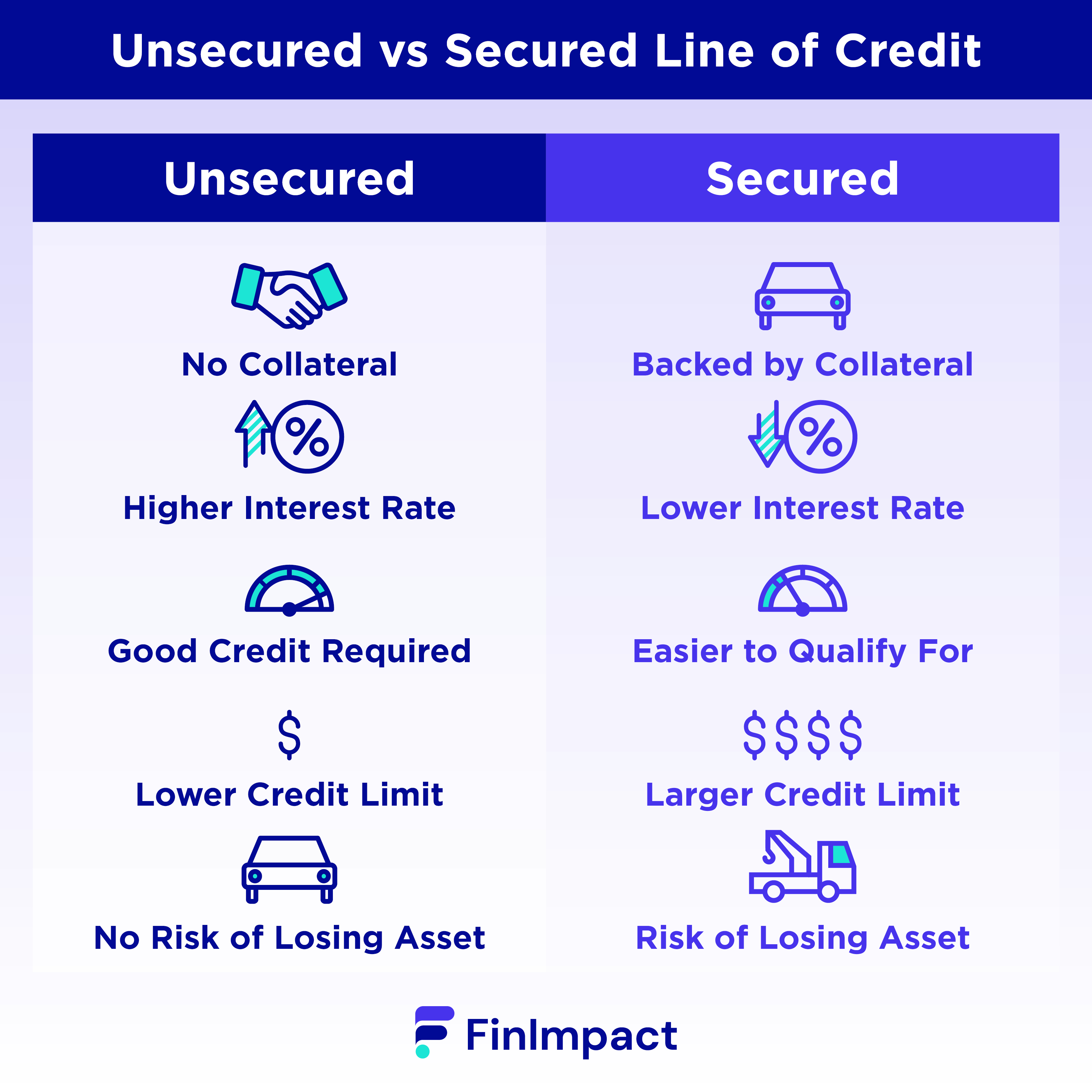

Unsecured Business Line Of Credit What Is It How It Works

How To Get The Best Line Of Credit Protect Now Blog

What Is A Line Of Credit Definition And Meaning Market Business News

Business Line Of Credit LOC The Right Solution For You Blursoft

HELOC Rates In Canada Home Equity Line Of Credit Rates

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Business Line Of Credit With No Revenue A Guide To Obtaining Financial

Consumers Credit Union Honored With Multiple Best And Brightest

Can You Claim Business Credit Card Interest As A Deductible Wealthy

Is Business Line Of Credit Interest Tax Deductible - From a taxation perspective the interest on a line of credit is generally tax deductible offering a fiscal advantage Nonetheless it s important to note that the principal