Is Car Insurance Tax Deductible When is your auto insurance premium tax deductible If you own a car you use exclusively for business purposes then all costs associated with it including gas

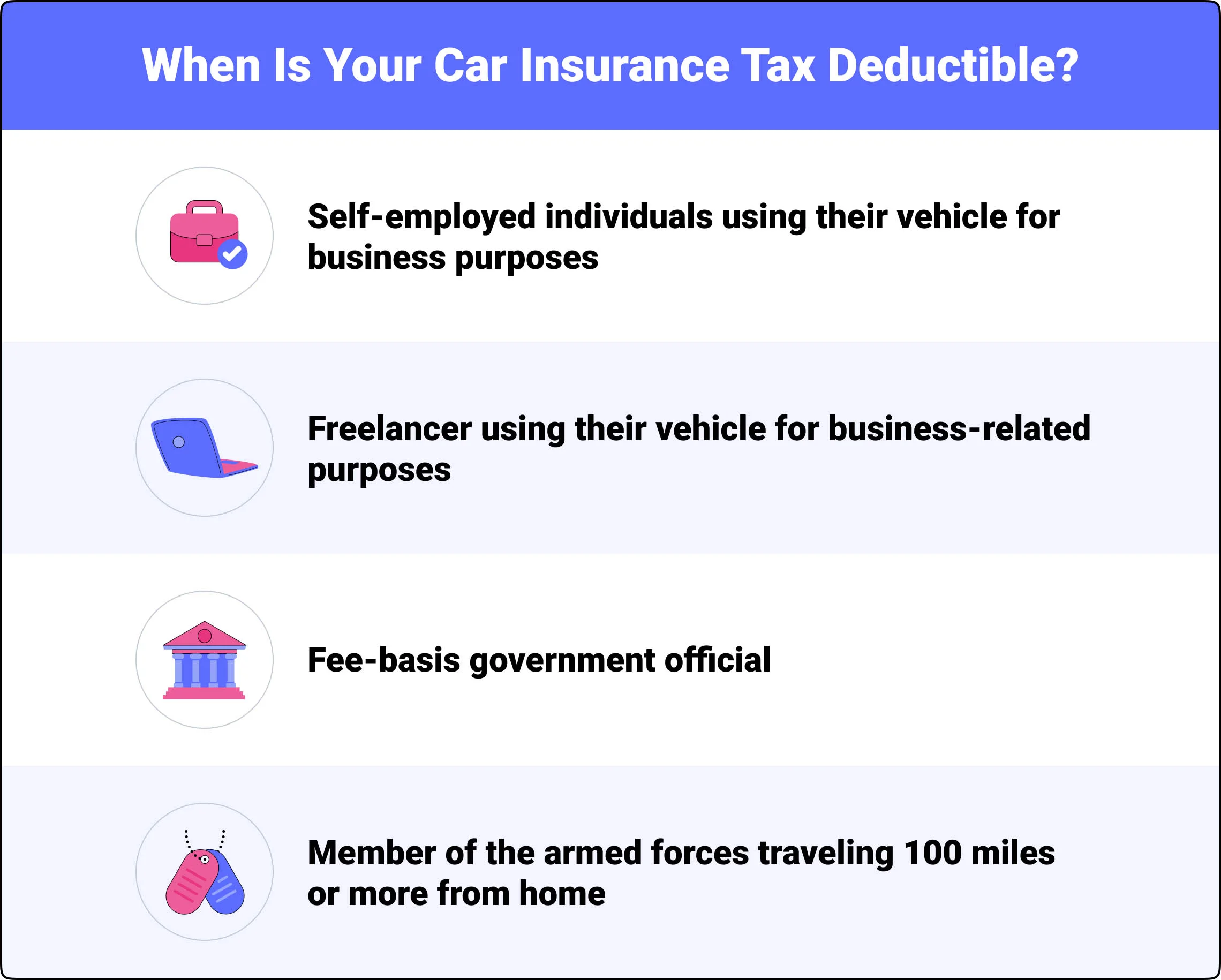

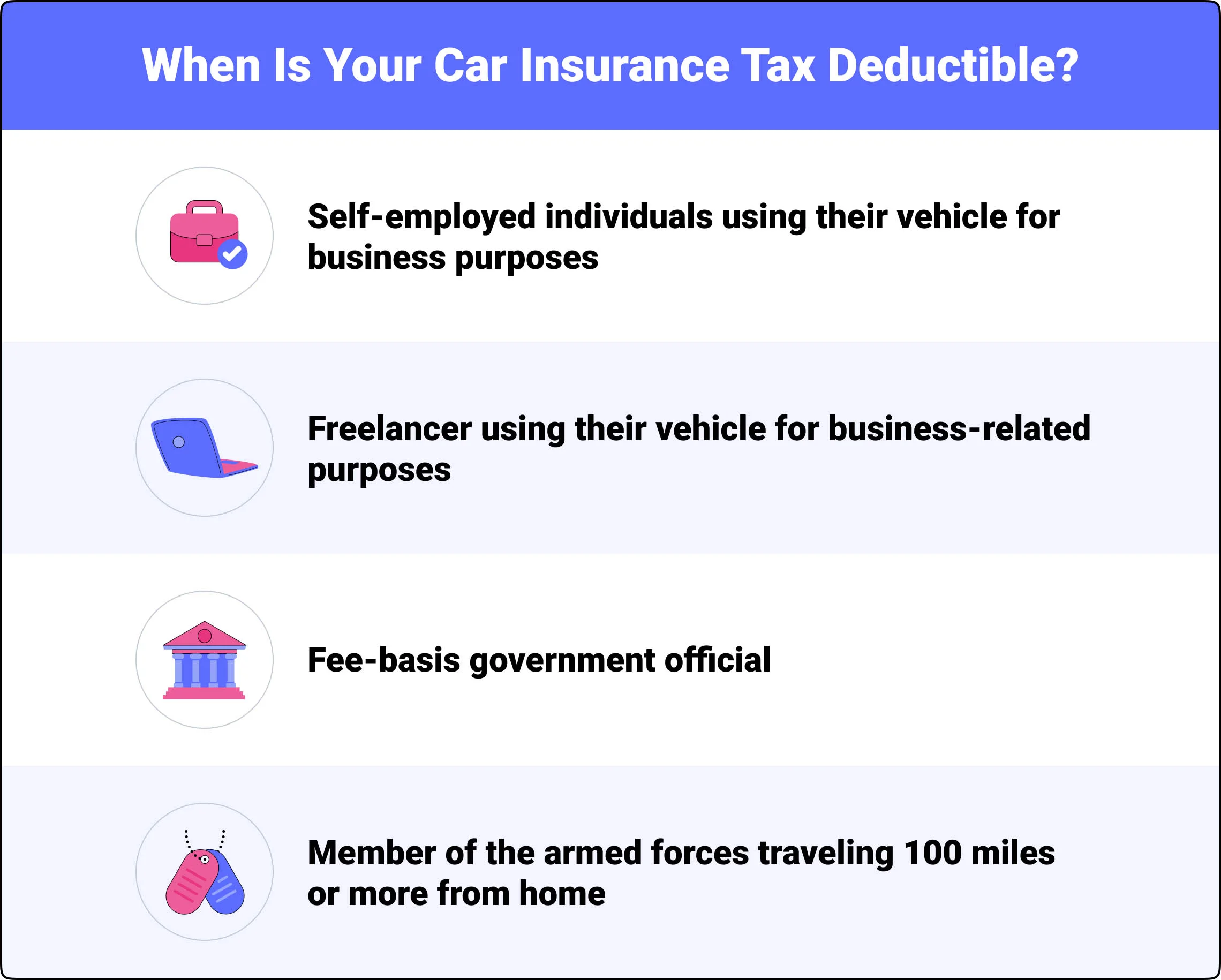

Car insurance can only be claimed as a tax deduction in specific circumstances It can t be deducted for personal vehicles but if your vehicle is used for business you might be The premium portion of your car insurance is tax exempt if you use your vehicle exclusively for business It can get a little more complicated when trying to write off your deductible though

Is Car Insurance Tax Deductible

Is Car Insurance Tax Deductible

https://www.einsurance.com/wp-content/uploads/is-car-insurance-tax-deductible.jpg

Is Car Insurance Tax Deductible W B White Insurance Ltd

http://www.wbwhite.com/wp-content/uploads/2017/11/Is-Car-Insurance-Tax-Deductible.jpg

When is Car Insurance Tax Deductible ValuePenguin

https://res.cloudinary.com/value-penguin/image/upload/f_auto,q_auto,c_limit/GettyImages-514731720_htg0vp.jpg

How can I deduct car insurance on my taxes If you qualify you can either 1 deduct all your business related vehicle expenses including your car insurance premiums or 2 deduct an Depending on how you use your car you may be able to deduct certain expenses related to your insurance premiums or even insurance deductible Here are a few things to know about

Auto insurance is tax deductible if you use your car for business charity medical or military moving purposes You may be able to deduct health insurance costs from your taxes if Whether or not you can deduct your car insurance depends on the details of your employment People who are self employed or freelancers may be able to deduct at least

Download Is Car Insurance Tax Deductible

More picture related to Is Car Insurance Tax Deductible

Is Car Insurance Tax Deductible The Ultimate Guide To Maximizing Your

https://insuranceblob.com/wp-content/uploads/2023/12/Is-Car-Insurance-Tax-Deductible.jpg

Is Car Insurance Tax Deductible YouTube

https://i.ytimg.com/vi/yX4IlIo_ZLY/maxresdefault.jpg

Is Car Insurance Tax Deductible CarInsurance

https://www.carinsurance.com/uploadedfiles/shutterstock_1199007088-1024x731.jpg

Car insurance premiums are tax deductible only if the vehicle is used for business not personal purposes Self employed individuals can deduct a percentage of their car If you use your car solely for personal reasons then your car insurance is not tax deductible However if you use your car for business purposes in some cases you can write

[desc-10] [desc-11]

Is Car Insurance Tax Deductible Everything You Need To Know

https://hips.hearstapps.com/hmg-prod/images/close-up-of-toy-car-and-coins-by-insurance-agent-on-royalty-free-image-1584476695.jpg?resize=1200:*

Is Car Insurance Tax Deductible Explore All Insights

https://images.ctfassets.net/uwf0n1j71a7j/27w4OpRBdDZmZQqBnKYakA/42a2771a177093256274121fc77cb43a/is-car-insurance-tax-deductible.png?w=3840&q=75

https://www.valuepenguin.com › is-car-insurance-tax-deductible

When is your auto insurance premium tax deductible If you own a car you use exclusively for business purposes then all costs associated with it including gas

https://www.bankrate.com › insurance › car › is-car...

Car insurance can only be claimed as a tax deduction in specific circumstances It can t be deducted for personal vehicles but if your vehicle is used for business you might be

Is Car Insurance Tax Deductible Nj

Is Car Insurance Tax Deductible Everything You Need To Know

Is Car Insurance Tax Deductible Strock Insurance

Is Car Insurance Tax Deductible Know The Fact

Is Car Insurance Tax Deductible The Basics Explained

Is Car Insurance Tax Deductible

Is Car Insurance Tax Deductible

Is Car Insurance Tax Deductible

Is Life Insurance Tax Deductible The Insurance Bulletin

Is Car Insurance Tax Deductible SmartFinancial

Is Car Insurance Tax Deductible - Auto insurance is tax deductible if you use your car for business charity medical or military moving purposes You may be able to deduct health insurance costs from your taxes if