Is Car Interest Tax Deductible Interest expenses for taxes labour market contributions special pension savings and customs and excise duties If you have not paid your interest expenses for previous years you will not be able to deduct the interest until you have paid the amount owing

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies Some interest is not tax deductible such as that you pay on personal car loans and credit card balances

Is Car Interest Tax Deductible

Is Car Interest Tax Deductible

https://res.cloudinary.com/moneygeek/image/upload/v1595025112/yt1xhevxyiyck9ozyamg.jpg

Is Credit Card Interest Tax Deductible For A Business TMD Accounting

https://tmdaccounting.com/wp-content/uploads/2017/05/Is-Credit-Card-Interest-Tax-Deductible-for-a-Business-.png

Is Buying A Car Tax Deductible 2020

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f338b908fa5cb21cc78c3e8_ildar-garifullin-FPMYMPre6Y4-unsplash.jpg

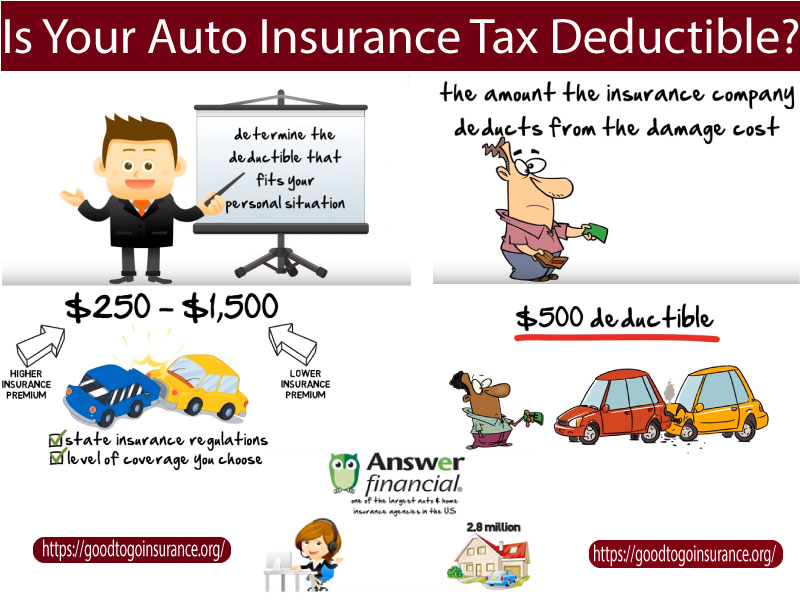

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense Deducting car loan interest on your tax returns can be a valuable write off if you re a small business owner or you re self employed But before you claim this deduction be sure you qualify

Interest on car loans If you are an employee you can t deduct any interest paid on a car loan This interest is treated as personal interest and isn t deductible If you are self employed and use your car in that business see Interest earlier under You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest may be tax deductible The amount you can deduct will depend on how many miles you drive for business vs personal use

Download Is Car Interest Tax Deductible

More picture related to Is Car Interest Tax Deductible

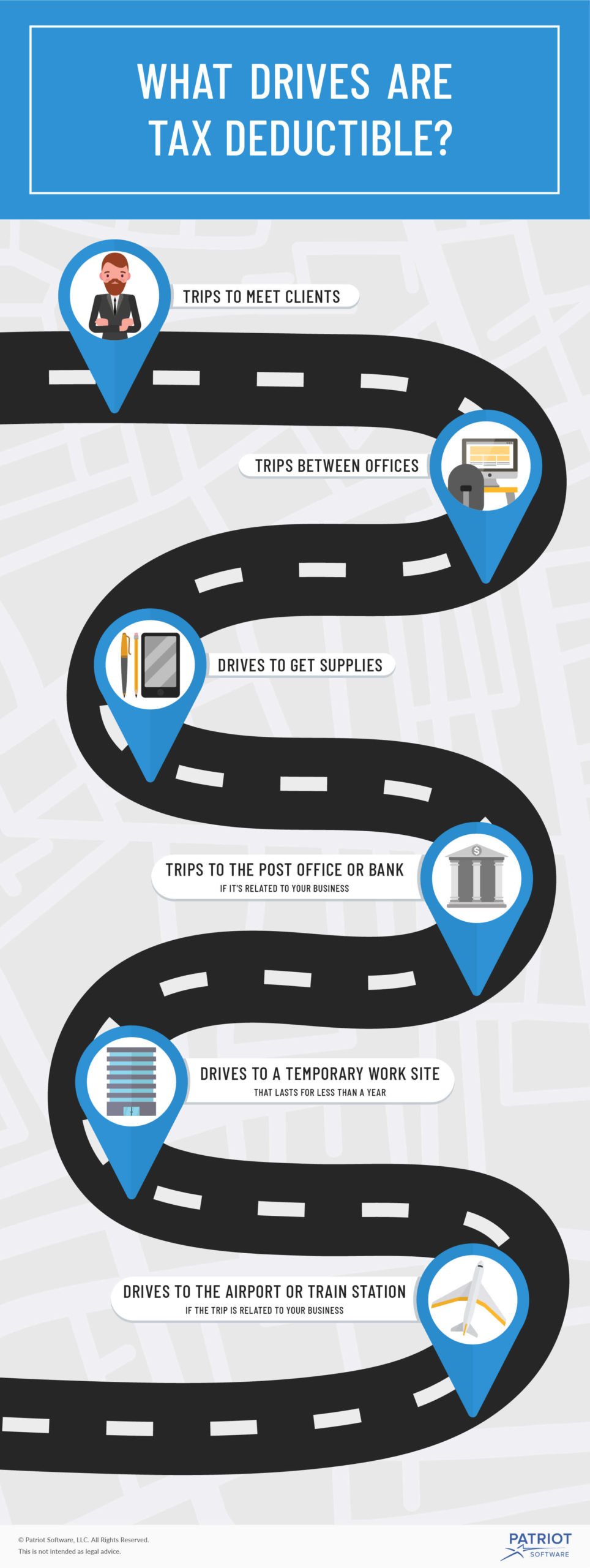

What Drives Are Tax Deductible Claiming Tax Deductions For Mileage

https://www.patriotsoftware.com/wp-content/uploads/2020/01/tax_deductable_drives_69080-01__1_-scaled.jpg

Is Buying A Car Tax Deductible

https://www.einsure.com/blog/wp-content/uploads/2020/09/is-buying-a-car-tax-deductible-672x372.jpeg

Insurance Deductible Tax Deductible Is Car Insurance Tax Deductible H

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05.jpg

You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes But writing off car loan interest as a business expense isn t as easy as just deciding you want to start itemizing your tax return when you file The answer to is car loan interest tax deductible is normally no But you can deduct these costs from your income tax if it s a business car It can also be a vehicle you use for both personal and business purposes but you need to account for the usage

[desc-10] [desc-11]

Is Credit Card Interest Tax Deductible Corporate Valley

https://www.corporatevalley.com/wp-content/uploads/2020/03/IS-CREDIT-CARD-INTEREST-TAX-DEDUCTIBLE.jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/qsB1dLdpQ/640x335/is-car-loan-interest-tax-deductible-1645731550732.jpg?position=top

https://skat.dk/.../deduction-for-interest-expenses

Interest expenses for taxes labour market contributions special pension savings and customs and excise duties If you have not paid your interest expenses for previous years you will not be able to deduct the interest until you have paid the amount owing

https://www.irs.gov/taxtopics/tc505

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Is Credit Card Interest Tax Deductible For A Business Do s And Don ts

Is Credit Card Interest Tax Deductible Corporate Valley

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

Is Sales Tax On A Car Tax Deductible Classic Car Walls

Is Sales Tax On A Car Tax Deductible Classic Car Walls

What Is A Car Insurance Deductible YouTube

Conceptual Photo About Tax Deductible Interest With Handwritten Text

Is A Car Lease Tax Deductible

Is Car Interest Tax Deductible - [desc-12]